Today’s artists express their vision by stretching far beyond the boundaries of canvas and paint. Through unorthodox juxtapositions of light, color, video, sound, and nature, artists such as Bill Fontana and the artist couple Christo and Jeanne-Claude create immersive experiences that require the input of a complex and highly adaptable network of collaborators—including the spectators themselves, each of whom comes away with a highly personalized experience. To succeed, this type of ambitious endeavor requires radical connectivity, an open mind, and a wide range of players. The collaboration itself and the interplay of different elements create artistic value.

The same is true for the complex ecosystems now emerging throughout the business landscape and across industries—and for the new ways they deliver value. As the Internet of Things (IoT) makes our homes, phones, and cars “smart,” companies must work with a far wider range of partners to pull together the underlying technologies, applications, software platforms, and services needed for an integrated solution. The need for partnerships is further amplified by rapidly changing technologies and consumers’ growing demand for a highly customized user experience.

The members of today's industry ecosystems collaborate in ways that are fundamentally different from collaborations of the past.

Some large networks, such as the digital ecosystems of smartphones, comprise a million or more platform partnerships through their integrated app stores. And it’s not just the tech industry that’s undergoing these changes. All industries—including incumbents such as banking, health care, consumer products, logistics, and automotive—are seeing an evolution of their products and services and a need to collaborate differently.

This new reality can be especially challenging for incumbent players, many of which are used to going it alone—either by trying out new things in-house or by buying a company in order to enter a new space. And when they do set up partnerships or make acquisitions, they often end up with an ecosystem more by accident than by virtue of long-term strategic planning.

A better approach is to actively participate in shaping the new landscape. To this end, many leading companies are building their own collaborative networks and/or joining existing ones. The challenge is how to effectively set up and manage these ecosystems and use them strategically to maximize value—and gain a competitive edge. Companies that can meet this challenge will reap enormous benefits, while those that don’t risk falling behind or becoming irrelevant.

In this article we’ll explore a number of key strategic questions, including:

- How collaboration within an ecosystem is different from traditional collaboration

- What types of ecosystems are available and which are best suited for incumbents

- How incumbents can gain a competitive advantage through the strategic use of digital ecosystems

The New Collaboration Model

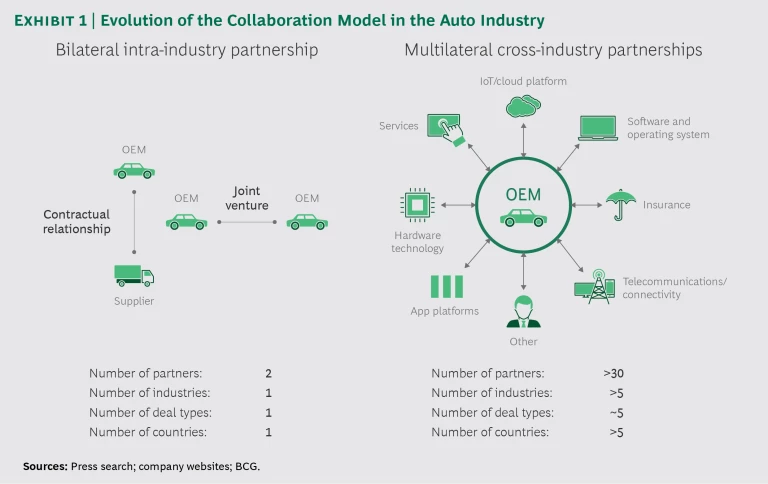

Just as contemporary art installations are completely unlike traditional paintings, the members of today’s digital ecosystems collaborate in ways that are fundamentally different from collaborations of the past. Case in point: the auto industry, which is currently undergoing radical changes. In the past, automakers either formed a joint venture or alliance with an OEM to enter a new market (such as China) or formed contractual relationships with hundreds of suppliers to secure parts. These traditional partnerships still exist, but today a typical European auto company will draw on an ecosystem of more than 30 partners across five different industries and several countries to make cars that are connected, electric, and autonomous. (See Exhibit 1.) The auto company acts as the “orchestrator,” whose role is to organize and manage the ecosystem, define the strategy, and identify potential participants.

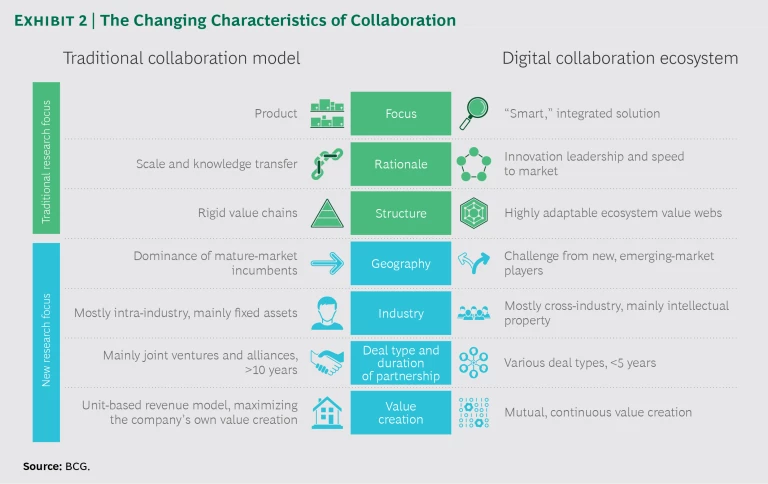

Today’s collaborations have a different purpose, structure, and outcome than those of the past—and industry lines are becoming increasingly blurred. Articles in academic and business journals have explored only limited aspects of these differences, such as the new focus on smart, integrated solutions;

Our extensive research into 40 ecosystems revealed four additional aspects of the new digital ecosystems that are changing how companies collaborate: geographic diversity of participants; cross-industry focus; shorter, more flexible deal structures; and mutual, continuous value creation. (See Exhibit 2.)

Geographic Diversity of Participants. Digital-age partnerships involve diverse players from many places, which means collaboration often occurs remotely across geographic, language, and cultural barriers. Our proprietary analysis showed that 90% of ecosystems involve participants from more than five countries and 77% of ecosystems involve both developed- and emerging–market players.

For instance, Ant Financial, a technology company that grew out of Alibaba’s e-commerce business, recognized that Chinese customers wanted access to its payment services when traveling abroad. To make that happen, the company forged alliances with a variety of international partners, such as US coffee chain Starbucks, Scandinavian airline Finnair, and the Singapore tourism board.

Because companies in an ecosystem need to share expertise, data, technology, and intellectual property with partners that may be subject to less stringent regulations and rules, IP protection mechanisms—such as limiting access to IP and building a local IP organization—are critical. Similarly, contractual commitments regarding data sharing agreements and IP contributions must be set up carefully.

Ecosystems push companies to rethink how they interact with their partners and ensure that benefits are shared by all.

Cross-Industry Focus. Many ecosystems are set up to bring in expertise from other industries. Our research showed that 83% of digital ecosystems involve partners from more than three industries and 53% from more than five industries. For instance, to bring an advanced vacuum robot to market, a household electronics manufacturer might partner with sensor and camera manufacturers and an AI software provider, as well as with technology research facilities.

Collaborating across industries may also mean working with partners that have clashing company cultures and different expectations regarding timing and quality. As a result, processes that affect the partnership may need to be aligned with the respective partners’ needs. This could result in “two speed” IT—a faster, customer-centric system running alongside a slower legacy system. Similarly, two parallel functions may be needed in other areas, such as R&D, innovation, marketing.

More Flexible Deal Structures. Rather than longer-term joint ventures or alliances between two parties, ecosystems are likely to use more flexible deal structures, such as contractual relationships, platform partnerships, and minority shares in venture capital investments. These arrangements ensure that the ecosystem will be able to respond quickly to changing customer preferences, new technologies, emerging competitive threats, and regulatory changes. Moreover, their relatively easy setup and dissolution allow companies to quickly form new partnerships or exit existing ones. Our research showed that 90% of digital ecosystems include three or more different deal types.

For instance, Caterpillar’s smart-mining ecosystem involves four types of collaboration, with a strong focus on flexible deal structures like partnerships and minority investments, along with joint ventures and M&A. CAT has forged partnerships to improve its proprietary industrial IoT platform’s technology and has made minority investments to expand the platform’s automation, optimization, and analytics capabilities. For most companies, these flexible deal types require a different approval process than traditional contracting and M&A—one that is faster, leaner, and closer to the business.

Mutual, Continuous Value Creation. A strong ecosystem is beneficial to all participants and focuses on continuous value creation. For instance, Amazon’s Alexa offers its Software Developer Kits and related application programming interface and tools (to support connected devices) to a large network of developers for free. So far, more than 50,000 skills/applications have been developed by companies ranging from Domino’s (pizza delivery) to American Express (banking services). The rich trove of skills makes the Alexa smart speaker more useful and appealing to customers—which, in turn, attracts new skills developers in a self-reinforcing cycle. The growing number of skills and customers generates more user data, which Amazon uses to refine its AI algorithm and improve the user experience across its various e-businesses. Another mutual benefit: developers can apply their Alexa skills to more and more products, building up their own business portfolios while further increasing the appeal of Amazon’s Alexa.

In traditional supplier relationships, companies often focus on maximizing their own profits while squeezing the margins of their vendors. Ecosystems push companies to rethink how they interact with their partners and ensure that benefits are shared by all. Tools such as a combined margin system, profit pooling, revenue sharing, and stakes in a venture can help all partners meet their goals.

How to Choose the Right Ecosystem

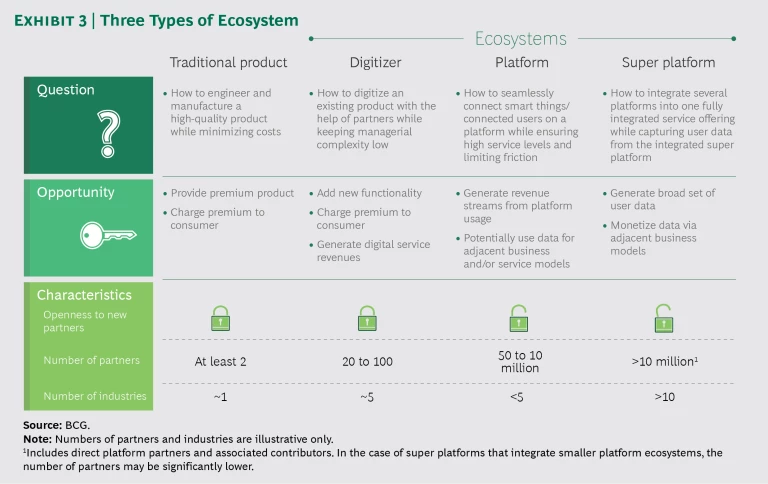

CEOs must decide which type of ecosystem is best suited to their strategic objectives and their company’s capabilities. Our analysis of ecosystems across eight industry verticals revealed three primary types: digitizer network, platform, and super platform. (See Exhibit 3.)

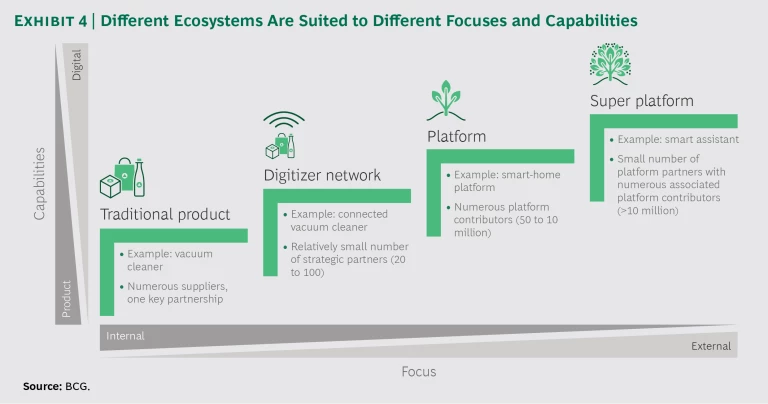

The right choice depends on your company’s main strategic focus as well as its existing capabilities. (See Exhibit 4.)

- If your main strategic question is how to digitize an existing product with the help of partners while keeping managerial complexity low, you should choose the digitizer network. It is best suited to companies with strong product capabilities and a limited focus on external partners.

- If your main strategic question is how to seamlessly connect smart things/connected users on a platform while ensuring high service levels and minimal friction between contributors and users, you should choose the platform. It is best suited to companies with strong digital capabilities and a largely external focus regarding expertise.

- If your main strategic question is how to integrate several platforms into one fully integrated service offering while capturing user data from the integrated super platform, you should choose the super platform. It is best suited to companies with advanced digital capabilities, an openness to working with outside partners, and a well-established platform to start with.

Many companies use more than one type of ecosystem at the same time. Amazon Alexa uses all three: a digitizer network to improve the hardware and voice recognition functionality of its smart speaker; a platform for adding applications and skills that increase Alexa’s service offering; and a super platform that integrates other platforms, such as Sonos smart home, to increase Alexa Voice Service’s breadth or usage.

Let’s look at the three ecosystem types more closely, exploring the characteristics, management principles, value creation model, and key success factors of each. (See “Ten Principles of Ecosystem Management” for some overarching guiding principles that increase the odds of success.)

TEN PRINCIPLES OF ECOSYSTEM MANAGEMENT

TEN PRINCIPLES OF ECOSYSTEM MANAGEMENT

Drawing on our research into more than 40 ecosystems across eight industries, we’ve distilled ten guiding principles that increase the odds of success.

- Choose the right type of ecosystem. Our research revealed three main types of ecosystem: digitizer network, platform, and super platform. The right choice depends on your company’s starting point, strategic objective(s), and capabilities. You may need more than one type for different purposes.

- Set up a governance model. Every ecosystem must have an “orchestrator”—the lead company that organizes and manages the ecosystem, defines the strategy, identifies potential participants, and clearly defines all roles, responsibilities, contributions, and interactions upfront, so that all partners know what to expect. The most effective governance model will depend on the type of ecosystem you choose.

- Develop a monetization strategy. Consider how the ecosystem will create value and generate income from the outset. For instance, a smart, connected product commands a higher price and can generate income streams from services; platforms may take a portion of transaction value, earn ad revenue, or charge usage or subscriptions fees; and super platforms usually make money from adjacent, data-based businesses.

- Focus on mutual value creation. A strong, attractive ecosystem is beneficial to all participants and focuses on sharing the value that accrues. A combined margin system, profit pooling, revenue sharing, stakes in the venture, or an open API for developers are commonly used tools to ensure that all partners’ goals are met.

- Make high-value partnerships a priority. Given their many roles and responsibilities, orchestrators should focus whenever possible on partners with the greatest commercial potential and/or strategic importance to maximize value creation within the ecosystem.

- Maintain fluidity and flexibility. Set up agile, flexible partnership arrangements so the ecosystem can respond quickly to changes in the business landscape—and form new partnerships or exit existing ones more quickly.

- Build trust among partners. IP protection mechanisms—such as limiting access to IP and building a local IP organization—are critical. Similarly, contractual commitments regarding data-sharing agreements and IP contributions must be carefully established. Setting up local data storage facilities and adding advanced privacy settings are other steps than can build trust among partners.

- Build a sense of community. Organize meetings or conferences with partners to obtain feedback, co-innovate, discuss planned changes, and create a sense of community and cohesiveness. Some companies host annual conferences to bring together partners, users, and developers.

- Set and track clear performance targets. Set performance metrics related to revenue, profitability, and service levels for each partner and for the ecosystem as a whole. Review these with partners during monthly or quarterly business meetings and adjust as needed.

- Separate ecosystems from legacy businesses. To ensure that ecosystems remain agile and aren’t restricted by the policies and procedures of the legacy corporate environment, set them up within separate entities or have them report directly to top management.

Digitizer Network: Capitalizing on an Offering’s Digital Potential

Most incumbents use a digitizer network to make a well-established product or service smart and connected. The digitizer network is most suitable for companies with strong product capabilities, limited digital capabilities, and a largely internal focus. A typical example is an automaker that partners to access the technology and IP needed for connected cars and related digital services.

Most incumbents use a digitizer network to make a well-established product or service smart and connected.

Number and Type of Partners. The digitizer network usually has anywhere from 20 to 100 partners across a handful of industry verticals. The network’s architecture is quite closed, and the orchestrator should be careful to choose partners that are skilled enough and have the IP needed to ensure that the digitized product or service has the desired functionality. Limiting the network in this way will reduce redundancy among partners, maximize their individual value, and keep managerial complexity low.

Role of Orchestrator. The orchestrator’s role is a time-consuming one since the partners must work closely together to develop the digitized solutions and seamlessly integrate them into the product or service. Adding to the challenge is the fact that the partnership agreements tend to be nonstandardized and must be heavily customized. To improve efficiency, the orchestrator should try to standardize the agreements wherever possible.

Value Creation. The digitizer network benefits the orchestrator by delivering sought-after, value-added products—such as connected cars or smartphones—that can increase sales revenues by commanding a premium price and generating additional income from integrated services. Partner remuneration is typically linked to quantity sold and/or share of additional service revenues.

Key Success Factors. Our research showed that the most successful digitizer networks have an advanced product or service to start with, are able to integrate advanced hardware and software into the product, and lock customers into the product by offering desirable features that build “stickiness” and loyalty.

Platform: Seamlessly Connecting Smart “Things” or Users

A more advanced ecosystem, the platform seamlessly connects smart “things” or users on a digital platform that provides high service levels and limits friction between contributors and users. Although some nontech companies have begun to join this type of ecosystem, established tech players and tech startups are more likely to set up a platform as their core business model, given their digital capabilities and openness to collaborating with external partners that have the necessary skills. A good example is Xiaomi’s smart-home platform, whose many “contributors”—the device makers—add a variety of smart, connected products, such as air purifiers, scales, and rice cookers.

The platform seamlessly connects smart "things" or users on a digital platform that provides high service levels and limits friction between contributors and users.

Number and Type of Partners. Platforms tend to have more partners than digitizer networks, but the number varies by platform type. Industrial IoT platforms, such as a smart-city or smart-mining platform, can have hundreds of partners. E-commerce, streaming, social media, and sharing-economy platforms tend to have thousands or millions of collaborators. The value of this network tends to increase with the size of its community, since only a large number of contributors and users can create an efficient and consumer-centric exchange. For these reasons, platform ecosystems are usually more open than digitizer networks, and the screening process for partners is standardized and often limited.

Role of Orchestrator. Because a platform has so many contributors, the orchestrator must set up a standard and often an automated model of governance, interaction, and financial exchange. And since personal interaction among orchestrator, contributors, and users is limited, partners often use self-service portals to get answers and resolve issues.

With so many partners and limited governance, the platform orchestrator must establish trust among contributors and users. To that end, platforms such as Airbnb gather two-way feedback—from both hosts and guests—to promote good behavior. Violators can be flagged and sanctioned by the platform through account blocks or, in extreme cases, involvement by law enforcement. Airbnb has 600 employees who focus on tracking and monitoring issues related to trust.

Digital platforms are even more challenging when the service offered involves a physical product. These ecosystems have to keep supply and demand balanced to ensure that both contributors and users are satisfied with the service level. For instance, Lyft adjusts ride prices based on current demand levels, which helps balance demand and supply throughout the day.

Value Creation. Different platforms make money in different ways. E-commerce platforms usually take a percentage of the transaction value, as do asset- and labor- sharing platforms. Social media platforms collect ad revenue or use other data-driven business models. In these cases, increasing the time users spend on the platform is critical. Interesting content, videos, games, online communities, and an appealing user interface tend to lengthen user visits, driving data generation and ad revenues. Streaming platforms take a different approach, typically charging a rental or subscription fee, while industrial IoT platforms, such as smart cities, commercialize the platform itself and collect a fixed or usage-based fee.

Key Success Factors. The most successful platforms have an appealing user interface, a large and engaged user base, a high degree of trust among partners, and a well-managed balance of contributors and users—especially when the platform involves the exchange of physical goods, as is the case with eBay.

Super Platforms: Integrating Several Platforms into One Fully Integrated Offering

Some platforms integrate a wide range of complementary platforms into a single, fully integrated super platform. A good example is a digital assistant that integrates transportation, payment, shopping, and communication services into a single user-friendly solution. This type of ecosystem requires advanced digital capabilities, an openness to outside partners, and a well-established platform to start with. For these reasons, it tends to be preferred by well-established tech companies.

Some platforms integrate a wide range of complementary platforms into a single, fully integrated super platform.

Number and Type of Partners. This type of ecosystem depends on a high volume of users driven by a limited number of well-established partner platforms and their contributors, which number in the millions. As a result, super platforms are open—even to competitors, if they can add unique features. For instance, Amazon’s Alexa integrated the Sonos smart-speaker platform to attract high-end users. Rather than standardizing partner screening, super platforms focus on strategic considerations, such as what impact potential partners will have on the overall market opportunity, product cannibalization, and user lock-in.

Role of Orchestrator. Since super platforms have a relatively small number of partners (i.e., the partner platforms), the orchestrator can focus on negotiating the strategic aspects of the ecosystem, such as data sharing, exclusivity, and any changes to the platform that affect services or functionality. The orchestrator’s negotiating strength depends on the power of the super platform, which is a direct function of the number of engaged users and the products and services that are already integrated. The orchestrator also sets technical requirements for the partner platforms.

Another key focus is on providing a best-in-class customer interface and user experience to drive user engagement, grow the user base, and attract other partner platforms. Both Amazon Alexa and WeChat, two well-established super platforms, offer highly intuitive user interfaces that draw upon extensive user preference data from the companies’ other businesses. The two super platforms also integrated their own adjacent services and platforms before adding key partners. This allowed them to experiment with integration, prove the viability of the combined offering, and build up their user base—all of which made the platforms more attractive to potential partners.

A strong financial backbone is needed to grow a super platform. For instance, Amazon launched an extensive marketing campaign to promote Alexa and discounted speaker prices to bring in users. It also provides financial support (via the Alexa Fund) and gives programmers financial incentives to develop skills that continually increase Alexa’s usability and appeal.

Value Creation. A super platform makes money largely through adjacent, mostly data-based businesses, such as ads, e-commerce payments, and new service offerings. A good example is WeChat, which started as a social messenger and now allows users to buy and sell products, send money to friends, order food and groceries, and check news. Customizing service offerings and building adjacent businesses that users want and need require a broad set of user data. Super platforms therefore focus partner negotiations on trying to safeguard their own data and get access to the data of other integrated platforms.

Key Success Factors. Our research suggests that a successful super platform needs a well-established technology foundation, a superior user interface and experience, and strong financial backing.

Looking Ahead

In today’s connected world, industry and geographic boundaries are becoming meaningless, and unexpected change has become a constant. Adaptable ecosystems are designed to respond more quickly to evolving demand patterns, customer preferences, and the competitive landscape.

The new art of setting up and managing these broad collaborative networks—and leveraging their potential—is still uncharted territory for most businesses. The insights described above provide a starting point. Forward-looking companies that can capitalize on the potential power of ecosystems will reap enormous benefits and be well positioned for an uncertain future.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights .