Some 1.7 billion people around the world lack access to basic financial services such as a bank or mobile money account. Digital financial services have the potential to bring this population, concentrated in developing countries, into the financial system—giving them greater financial security and resilience to economic setbacks. But for that to happen, people need a mechanism for depositing and withdrawing their physical cash; that is, cash-in/cash-out services. Agent networks, a distribution channel that relies on individual entrepreneurs under a franchise-like model, have been shown to be an effective way to provide those services.

In 2018, BCG conducted a study on the economics of financial services agent networks, with a particular focus on those that support mobile money platforms. The work demonstrates that agent networks can flourish in areas that support healthy numbers of transactions. In those locales, the transaction fees earned by agents more than compensate for the financial costs and operational burdens of the business. Traditionally, financial services providers have made decisions about where to invest in agent networks mainly according to population size and density, creating an urban versus rural segmentation. This study defines the limits of network reach on the basis of agent and provider economics and identifies a new approach that will help identify overlooked profitable locations and drive potential interventions to support agent network growth.

The Promise of Digital Financial Services

In a small village in Kajiado County, Kenya—80 kilometers from Nairobi—M-Pesa agent William is helping to transform daily life. From a counter in his uncle’s small grocery shop, William collects about $300 in cash deposits every day from local villagers and dispenses upwards of $500 in cash, processing these financial transactions through the M-Pesa mobile payments account on his mobile phone.

William has developed a loyal set of customers, typically day laborers, farmers, and other local members of his Maasai community, who rely on him to deposit their earnings, purchase mobile airtime, and pay important utility bills. He offers informal credit to some customers and also runs a small side business recharging mobile phones for those who lack access to electricity. Twice per week, he pays a neighbor to drive him 20 kilometers by motorbike to the nearest bank. There, he adjusts both the amount of cash he has on hand and the balance, or “float,” in his M-Pesa account.

Digital financial services, including mobile wallets and digital payment systems offered by platforms like M-Pesa, have the potential to usher into the financial system many of the 1.7 billion people the World Bank estimates lack access to a bank account or mobile money service. But there’s a catch. For digital financial services to take off in developing markets, where virtually all transactions are still conducted in cash, people need access to physical infrastructure to safely and seamlessly deposit and withdraw cash. Banks have traditionally offered these cash-in/cash-out services via ATMs and bank branches. But these solutions are often too expensive to make economic sense in markets that have low-income, low-density populations.

Mobile money agents can put banking within reach for 1.7 billion people globally.

That’s where mobile money agents like William can make the difference. The mobile money agent model has experienced rapid growth in developing markets over the past 15 years, particularly in sub-Saharan Africa and South Asia. Yet, despite this momentum, many unbanked populations, particularly in rural areas, are beyond the reach of these networks. In light of that, BCG has partnered with the Bill & Melinda Gates Foundation to study the economics of mobile money agent networks and their role in advancing financial inclusion. The key questions: What are the economics of mobile money networks for both individual agents and the providers, such as banks and mobile network operators (MNOs), that develop them? Where is this model sustainable—and what factors limit its reach?

Our work begins to shed light on the kinds of action that the private sector, governments, and philanthropies can take to cultivate and support these agent networks. Such efforts can dramatically expand access to financial services —and that, in turn, can transform lives, giving consumers a safe and low-cost way to store and transfer money and ultimately helping to lift people out of poverty.

The Power of Agent Networks

The 1.7 billion adults who lack a bank or mobile money account—roughly 35% of the world’s adult population—rely largely on cash transactions in their daily life. According to research by the World Bank and Mastercard, in developing countries, more than 90% of transactions are executed with cash. Absent a way for people to move that physical cash into and out of an account, this population will remain excluded from the financial system. Agent networks—particularly those that use mobile technology—can provide that critical link.

The Role of a Cash-In/Cash-Out Infrastructure

Cash-in/cash-out services provide a bridge between a cash-only world and the use of both digital and traditional bank accounts. Such accounts can set consumers on a path to the adoption and sustained use of more-complex financial products . In fact, even in an advanced financial system such as the US, more than 30% of transactions are still conducted in cash, making cash-in/cash-out services a continued necessity.

In most developed economies, cash-in/cash-out services are delivered via bank branches and ATMs. Countries with nearly universal financial access have large numbers of these access points. South Korea, for example, has more than 200 ATMs per 100,000 adults and over 30 branches per 100,000 adults, according to the World Bank. This system is less robust in developing nations, however. That’s because bank branches are expensive to set up and operate. World Bank Data suggests there are an average of just 5 banks per 100,000 adults across countries in Africa. And ATMs require high capital investments as well as costly ongoing maintenance and cash replenishment.

How Traditional Bank Agents Helped Fill the Gap

Given the limited reach of traditional cash-in/cash-out infrastructure, another model has been required to ensure broad global access to financial services. In some markets, the answer was the deployment of local bank agents.

These agents, who help banks acquire and serve customers, have worked under what is essentially a franchise model. (See “The Traditional Agency Banking Model.”) Bank agents are typically required to invest significant upfront capital in the business and are encouraged to leverage their personal connections and credibility within the local community to stoke demand. This model provides substantial cost benefits to the provider, as the agent incurs the majority of startup costs, and most ongoing costs are variable and commission-based. The agent model also features some important non-financial benefits. As the retail face of the business, agents can provide customer assistance in a way that most ATMs cannot. This is especially valuable in communities with low rates of overall and technological literacy.

THE TRADITIONAL AGENCY BANKING MODEL

THE TRADITIONAL AGENCY BANKING MODEL

Traditional banking agents operate in many ways like a miniature bank branch, giving them a crucial role in expanding financial inclusion. They not only provide transaction services such as cash deposits and withdrawals, balance inquiries, and fund transfers to customers with a formal bank account but may offer other products including savings accounts, small loans, and insurance. In addition, governments increasingly use banking agents as a distribution channel for public programs such as social cash transfers and commodity subsidies.

Under this model, banks earn most of their revenue through the net interest earned on deposits or the interest charged on loans. They typically charge only minimal fees for cash-in/cash-out transactions. And in many countries, consumer protection laws mandate that a certain number of those transactions must be free of charge to the account holder.

On the cost side, while traditional agency banking is a leaner model than a bank branch, it comes with many of the same operational requirements, including branding and marketing, agent training and monitoring, and compliance oversight. In addition, banks typically pay agents a fixed commission based on the transactions they execute—even if the bank does not generate fee revenue from consumers for those transactions.

In Latin America and South Asia, the agent model has played a critical role for traditional banks that are seeking a low-cost approach to network expansion. Brazil offers an inspiring case study in which dramatic increases in financial access can be attributed to a vast network of bank agents that exceeds 400,000 according to the country’s central bank. In India, both public- and private-sector banks have relied heavily on the agent model to comply with the government’s financial-inclusion mandates. Based on an analysis of data from the Federal Reserve Bank of India, BCG estimates that from 2012 through 2016, the number of agents (known as business correspondents, or BCs) in the country grew 40% on a compound annual basis, significantly outpacing the growth of ATMs and branches (8% and 20%, respectively, during the same period).

In markets with high levels of deposits and demand for loans, banks can generate healthy earnings via the agency banking channel. The model, however, has its limitations.

In low-income communities with relatively small deposit balances, agent operations are more likely to be a cost center for the bank. That’s because the bulk of the activity is cash-in/cash-out transactions on which the bank pays the agent a fee but often earns nothing. In such cases, investment in the agent channel can still make sense for nonfinancial reasons, such as helping to reduce congestion at bank branches, keeping the bank in compliance with government mandates, or supporting the long-term development of promising markets. But in light of the economics, banks are generally selective in their expansion of traditional agent networks in low-income, sparsely populated areas.

The Rise of the Mobile Money Model

Mobile technology has been a game changer in helping to expand access to financial services. Over the past decade, banks, MNOs, and other players have invested in the development of mobile money platforms, which typically include a mobile wallet and an integrated payment system. These platforms allow customers to store, send, and receive money via their mobile device, serving as a convenient and low-cost alternative to a conventional bank account and a gateway to broader financial inclusion. (See “Mobile Money Agents 101.”)

MOBILE MONEY AGENTS 101

MOBILE MONEY AGENTS 101

The mobile money agent is the provider’s retail arm, supporting cash-in/cash-out transactions as well as person-to-person fund transfers, mobile phone airtime purchases, and bill payments. Like the traditional bank agent, the mobile money agent operates like a franchisee. But that’s where most similarities between the models end. The provider generates a majority of its revenue not from deposits or loans but from fees charged to the consumer for each transaction, with fees varying according to the market’s level of competition and stage of development. For each transaction, the provider pays the agent a commission, typically a percentage of the transaction amount. In our study, the average agent commission rate was 0.7%, or approximately $0.20 for a $30 transaction.

The agent’s core operating challenge is to maintain sufficient liquidity to support customer transaction needs. This liquidity comes in two forms: cash on hand and the float in the agent’s mobile money account. This allows the agent to either accept deposits (taking cash from a customer and transferring some of the float to the depositor’s account) or allow withdrawals (giving the customer cash and transferring float from the customer’s account to the agent’s account).

While those basics hold for all mobile money agents, the model does have some variations. In many models, providers offer initial training and onboarding, after which agents manage their ongoing operations independently. In such cases, agents are responsible for their own liquidity management activities. This typically involves traveling to a bank or an agent manager—known as a superagent—in order to rebalance by converting more of the float to cash or vice versa. In certain models with a higher level of provider support, agents are visited frequently (often daily) by a sales representative or dealer who provides follow-up training and assists with liquidity management or working-capital shortages.

At the same time, the individual agent’s business model also has some variations. Some agents are dedicated (meaning the mobile money operation is their sole operation), while others are non-dedicated (operating another business such as a retail shop in addition to the mobile money business). Non-dedicated agents are particularly common in rural areas. In many markets, providers encourage retailers to add mobile money services to their existing business offerings, with the assumption that agents benefit from multiple sources of revenue and the ability to share fixed costs across multiple businesses.

In addition, agents can be either exclusive (providing services on behalf of one provider such as an MNO or bank) or non-exclusive (providing services for more than one provider).

The power of that model has fueled a rapid expansion. From 2011 through 2017, the ranks of mobile money agents worldwide swelled from about 500,000 to 5.3 million, according to the GSM Association. That has supported widespread consumer adoption of mobile money services, with roughly 600 million new mobile money accounts registered during that period. Most of those accounts have been opened in sub-Saharan Africa (more than 300 million) and South Asia (more than 200 million).

Today, the market is poised to expand even further. For one thing, about two-thirds of the world’s unbanked individuals own a mobile device. Banks in developing markets are increasingly investing in mobile money platforms in addition to traditional branch-based services, with the goal of expanding their reach among underserved and lower-income customers. Countries are also continuing to revise regulatory guidelines to remove barriers that can block nonbank players such as MNOs, fintechs, and e-commerce companies from introducing mobile money services. For example, in 2015, the Reserve Bank of India issued licenses for a new payments bank model, a shift that prompted a variety of nonbank companies to enter the market with mobile money offerings.

The Economics of Mobile Money Agents

Given the potential of mobile money agent networks to expand financial inclusion, it is critical to understand what factors determine profitability—and what can undermine the viability of the model. To gain insight into these issues, BCG and the Bill & Melinda Gates Foundation studied the mobile money agent business in four established markets in East Africa and South Asia (Kenya, Tanzania, Bangladesh, and India), an effort that included interviews with more than 130 agents.

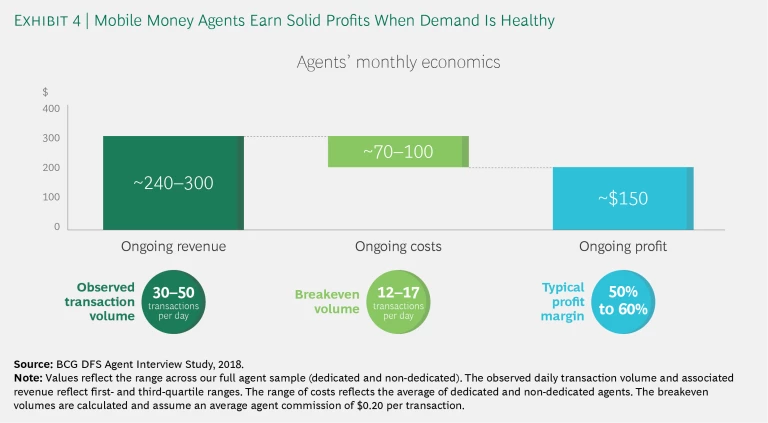

A couple of findings stand out. First, where demand is high, mobile money can be an attractive business for dedicated agents, with an average profit well in excess of $100 a month according to our sample. This is a meaningful income in the countries we studied, where gross national income ranges from $75 to $150 per month, and compares favorably with alternative employment options such as retail salesperson, taxi driver, or mechanic. Second, given that most costs are fixed, the higher the transaction volume (and therefore revenue), the higher an agent’s profit.

The mobile money business can provide a meaningful income in developing countries.

Transaction Volume Drives Revenue

Although providers have introduced a variety of mobile money services—including the purchase of airtime for mobile phones, facilitation of person-to-person transfers, and bill payments—the bulk of agent transactions, 81% in our sample group, were cash deposits or withdrawals. In most geographic areas, transactions were distributed fairly evenly between cash-in and cash-out; however, our research found a higher rate of cash withdrawals in rural areas (roughly 60% cash-out versus 40% cash-in). For most agents, the business ramps up quickly, hitting a steady transaction volume within three to six months.

Agents’ Costs Are Largely Fixed

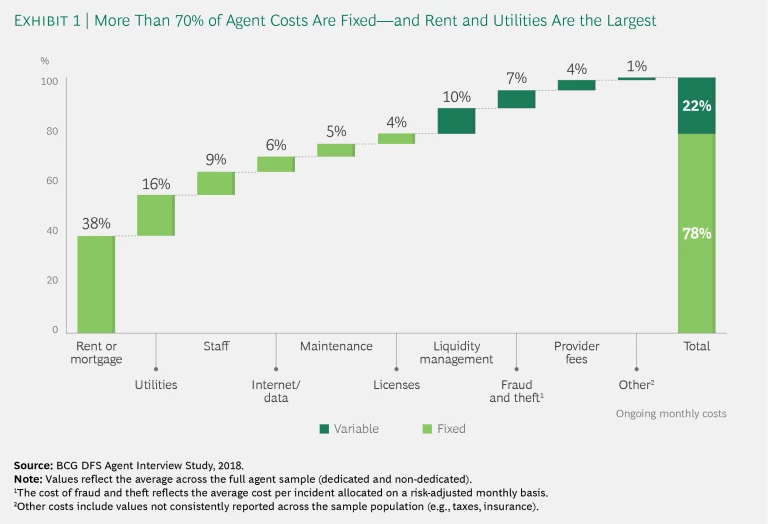

The business has a number of ongoing operating costs, with the single largest component being rent and utilities (see Exhibit 1):

- Rent and Utilities. These costs usually account for more than 50% of monthly expenses for agents—although there is quite a bit of variation. Operating from a kiosk on a small road, for example, may come with lower rent than locating in a busy market. In addition, rent expenses that must be allocated to the mobile money business can be lower if the agent works from home or shares space with another business.

-

Liquidity Management. These costs include transportation expenses (to travel to a bank or a nearby superagent to rebalance), transaction fees paid to the superagent or bank, ATM fees, and mobile phone charges for business-related calls. Ongoing liquidity management expenses are the most significant variable cost and equal about $10 per month on average, or up to 10% of total ongoing costs. This does not include opportunity costs such as lost income during rebalancing trips and lost fees related to transactions the agent can’t execute owing to insufficient liquidity.

Operational issues related to the tangible liquidity management costs are more difficult to quantify. Urban agents rebalance more than eight times per week, an onerous task given the long lines at the bank and security concerns related to traveling with significant sums of cash. Rural agents, meanwhile, rebalance with less frequency—on average two to three times a week—but travel substantial distances (about 20 kilometers roundtrip) to do so.

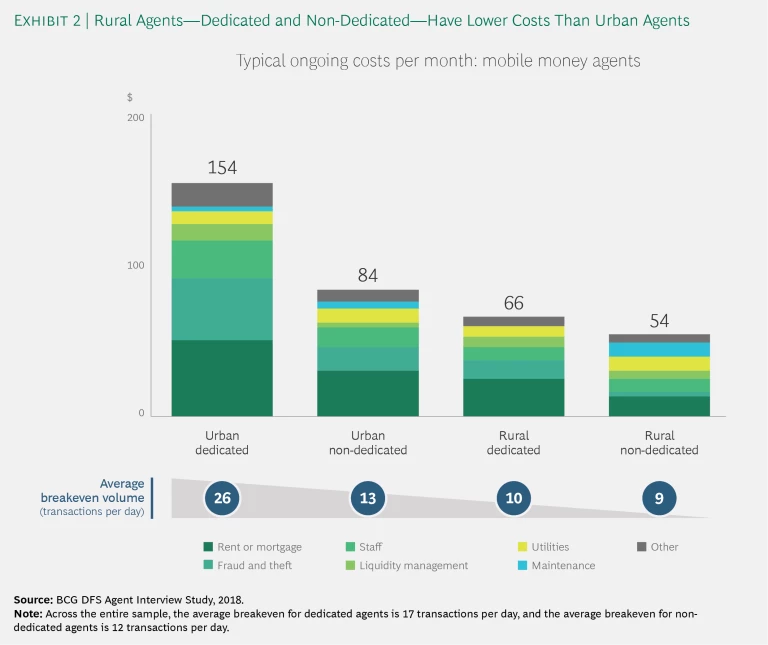

Taking all ongoing costs together, a typical dedicated agent has monthly expenses of about $100. Non-dedicated agents, who can spread their rent and utilities overhead across multiple businesses, tend to have fewer of these costs allocated to the mobile money business. In our sample, non-dedicated agents reported that monthly expenses for the mobile money operation totaled roughly $70 per month.

The pattern of lower allocated costs for non-dedicated agents versus dedicated agents holds in both rural and urban markets. And rural agents—whether they are dedicated or non-dedicated—have lower costs than urban agents. (See Exhibit 2.)

Agents’ Bottom Line Varies Depending on Their Approach

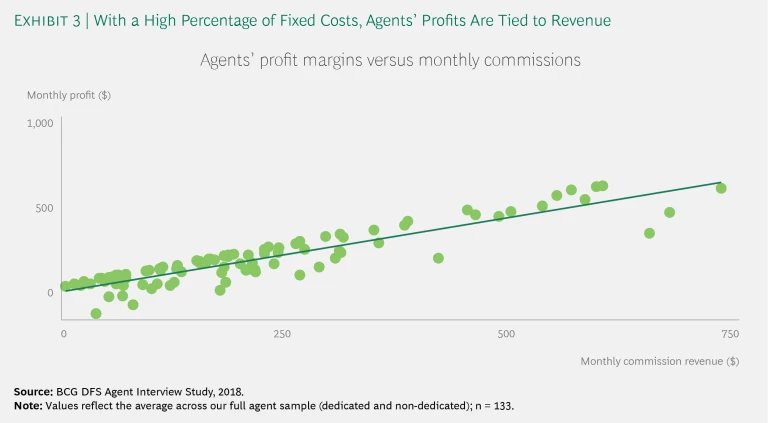

For all agents, commission revenue is the key to profitability. (See Exhibit 3.) But the economics can vary significantly depending on the individual agent’s approach. For example, urban, dedicated agents need to execute about 26 transactions per day to break even.

Meanwhile, urban, non-dedicated agents have a lower breakeven point—about 13 transactions per day—because they spread costs across multiple businesses. This pattern holds for rural agents as well, with dedicated and non-dedicated agents requiring 10 and 9 transactions per day, respectively, to break even.

Of course, for the mobile money model to thrive, agents need to do more than break even—they need to earn a decent living. And agents in our study clear these hurdles easily. The majority in our sample conducted 30 to 50 transactions per day, earning an average of $150 in profits per month. (See Exhibit 4.) The equation is more favorable for non-exclusive agents, who represent multiple providers. Profits for non-exclusive agents (both dedicated and non-dedicated) exceed those for exclusive agents by more than 40% in countries such as Kenya and Bangladesh.

It is worth noting that our study focused on agents who executed at least one transaction per day and have been in business for at least one year—so the average skews toward an agent with higher transaction volumes than the national statistical average for a given population. For example, in Kenya, our sample reflected a median volume of 51 transactions per day, compared with 45 transactions per day in the 2014 Helix Institute of Digital Finance’s Agent Network Accelerator (ANA) survey.

In the broader agent population, there are certainly agents who have significantly lower volumes than our average, as well as a long tail of inactive agents who hold an agent account but conduct an average of less than 1 transaction per day. In our interviews, it was clear that active agents expected a minimum transaction volume to justify the effort and capital investment required to run their mobile money operation. For agents in our sample, those who conducted fewer than 15 to 20 transactions per day reported significantly lower satisfaction with the business. Agents with fewer than 7 to 10 transactions per day were more likely to consider closing the business to pursue other opportunities with greater potential return on investment.

Agents Bear Financial Risk

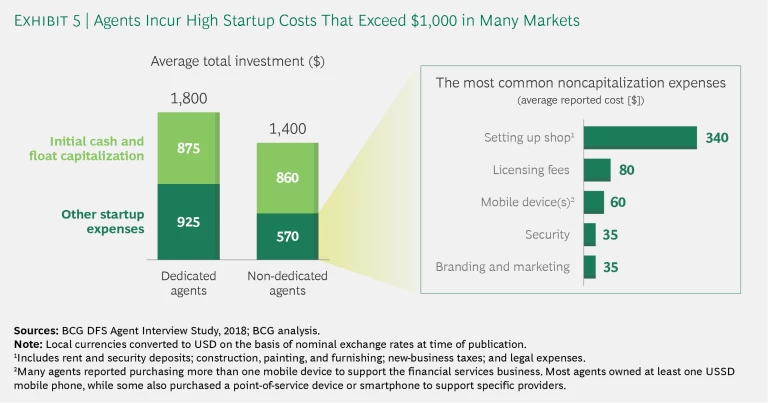

Mobile money agents take on significant financial risk in starting their business. For an individual starting a mobile money business, upfront costs—which include the initial cash and float required as well as shop setup expenses such as furnishings, technology devices, licensing, and security—can top $1,000. (See Exhibit 5.) That’s a substantial sum that equals more than one year of average rural income in a number of the countries we studied. On average, the typical agent recoups that investment in about ten months.

Most agents rely on personal savings and gifts from family members for the upfront costs. Few providers offer startup financing. And even when financing is available, agents are typically reluctant to take out loans given the pressure that interest charges would put on their profit margins.

Agents also confront fraud and theft. These issues are common in most of the markets we studied in depth and are often a major blow to agent profitability when they occur. Among the agents we surveyed, roughly 40% had experienced at least one incident of fraud or theft—and each incident cost them on average more than $200. The one exception in our research: agents in India experienced fraud and theft infrequently and did not cite it as a major problem for the industry at large.

Providers Enjoy a Healthy Bottom Line

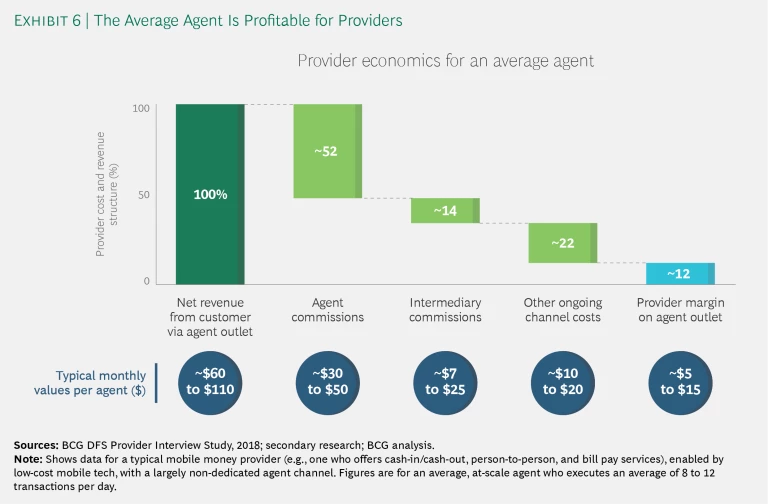

The franchise-like model of mobile money agent networks—wherein agents bear most of the financial risk—limits the downside for providers. The bulk of the costs for providers, 70% or so, are variable expenses including commissions paid to agents and other intermediaries such as individuals who help support and manage a group of agents. Fixed costs, for things like agent training, monitoring, and ongoing support, as well as marketing materials, are a smaller slice.

Most providers in our sample are running fully scaled agent networks. After commissions and other costs, these providers earn margins of 12% on the average agent. (See Exhibit 6.) (Growth-stage providers, who are still ramping up the scale of their agent networks, typically see lower margins.) And the costs for adding another agent to the network are low, about $15 to $50 per agent—making the payback period approximately nine months.

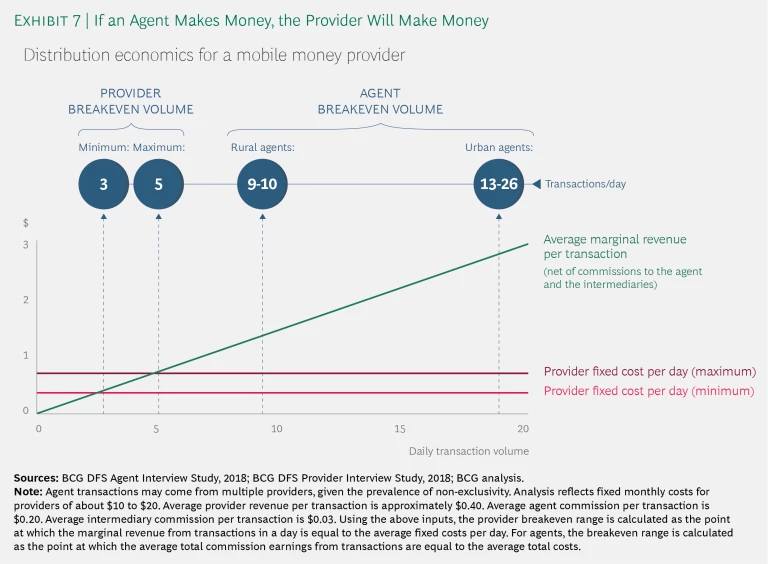

For mobile money models, the general rule of thumb is that if an agent can turn a profit, the provider will earn money as well. (See Exhibit 7.) Our study revealed a significant difference between the number of transactions providers require to break even versus the number of transactions needed by agents. Providers break even if agents are executing 3 to 5 transaction per day. But agents need higher numbers—9 to 10 transactions in rural markets and 13 to 26 in urban locations. Of course, it’s important to note that productivity is not uniform across the network. Our research found that 20% to 30% of agents generate 80% of the provider’s business. The remaining agents see much lower volumes (often less than 10 transactions per day). And providers reported that they typically have a significant number of agents who are completely inactive, reflecting overall churn in the agent base. According to the Helix Institute of Digital Finance, at least 30% of agents in several countries studied had not executed a single transaction during the past 90-day period.

Where the Mobile Money Agent Model Works—and Doesn’t

Given the economics at play, how will mobile money networks expand to reach more customers in developing markets?

In places that have sufficient transaction volume—areas with significant population density that can drive decent volumes—agent networks will grow organically. To understand what regions meet those qualifications, we have developed a new segmentation approach. Financial inclusion research commonly segments populations in terms of rural versus urban. But our approach expands that view, focusing not on a region’s population density but rather on its level of economic activity. We have identified three different zones of viability:

Our new segmentation approach focuses on a region’s level of economic activity.

- Dense Urban Locations. Urban markets are densely populated areas with high rates of economic activity. Most urban agents in our sample were located near places of interest such as a mosque or a local market. Typical market forces are at play in these urban areas—so where there is demand, competition increases. In some markets, an agent may have to contend with five other agents within 50 meters of his or her location. In the face of this strong competition, agents differentiate themselves on the basis of factors such as their liquidity level, reliability, and customer service.

- Rural Oases. About 85% of successful rural agents are located in hubs of economic activity far from an urban center, such as a highway intersection, regional market, or fuel station. We refer to these areas as oases in locations that are otherwise economic deserts. In these markets, agents generate profits that are higher than in traditional rural settings, thanks to healthy volumes of 30 to 40 transactions per day.

- Frontiers. Like a rural-oasis market, these locations are far from an urban center and have low population size and density. But where rural oases have significant levels of economic activity, frontiers do not. Agents in these areas are unlikely to execute more than ten transactions per day and potentially as few as one per day—far fewer than agents in rural-oasis contexts. In the countries we studied, a substantial share of the unbanked population lives in frontier locations. For example, in the Indian state of Uttar Pradesh, 80% of the rural population (125 million people) lives in villages with fewer than 5,000 people; of those, almost 65 million people live more than 5 kilometers from the nearest highway, and almost 9 million live more than 5 kilometers from a bank or ATM. In these markets, the economics for an agent are daunting: low projected transaction volumes and profitability, prohibitive startup costs relative to incomes in the area, and higher costs and complexity for liquidity management due to the remote location.

Whether an agent is located in an urban or frontier region, of course, is not the sole determinant of success. In all markets, additional factors can limit the development of agent networks. These include the lack of banking infrastructure required for rebalancing, regulatory requirements that make it challenging and time intensive to recruit agents, unreliable telecommunications networks and power grids, and poor roads and other physical infrastructure.

Takeaways from the Study of Mobile Money Agent Networks

New approaches are required to extend the reach of mobile money agents and expand financial inclusion. These new methods must encompass the system of economic incentives for providers and individual agents, the adoption of technological and business model innovations, and the development of supportive policies.

We see three primary areas for action:

-

Pursue the viable zones of demand. Providers should continue to take steps to identify viable markets for network expansion, including underserved urban centers and rural-oasis locations. Geo-spatial analysis, for example, could be used to identify rural-oasis spots with sufficient demand to support profitable mobile money agents.

In many cases, however, the data to enable that analysis is not readily available today. Cross-industry collaboration could help bridge the gap. MNOs, banks, and fast-moving consumer goods distributors, for example, could work together to aggregate data that would identify existing hubs of economic activity such as fuel stations, grocery stores, or micro-merchants, locations that could be profitably served by a mobile money agent.

-

Drive expansion to the frontier. Recognizing that agents and providers face meaningful barriers to profitability in frontier zones, industry stakeholders and governments should explore strategies that target these specific geographic areas. Providers, for example, could prioritize a non-dedicated-agent model in the frontier, recruiting existing small businesses to expand into mobile money. Or they could consider differentiated commission structures in frontier zones that enable agents to survive on lower transaction volumes.

Governments, meanwhile, could develop policies and regulations that support frontier expansion. Digitization of direct benefit transfer payments could accelerate the takeoff of digital financial services in the frontier. And incentives such as subsidies or revenue guarantees could encourage providers to extend agent networks into these areas. Some countries might also benefit from revising banking regulations that discourage or prohibit the use of non-dedicated-agent models.

- Embrace innovation. Financial services providers should pursue innovations in business models, operations, and technology to help agents diversify their revenue, reduce the burden created by liquidity management, and lower agent network management costs. Providers should look for ways to improve their operations in all markets—including established urban locations. But they should put a particular focus on initiatives for rural markets. For example, providers could introduce new payments products tailored to rural customers or provide rural agents with the tools to launch additional ancillary businesses. Providers could also seek partnerships with companies in other industries, including agricultural suppliers, fuel companies, and fast-moving consumer goods players that have more-established rural footprints. Such partnerships could not only help providers identify and recruit potential agents but might also provide assistance in managing agent networks. Finally, all innovations should be developed and piloted with an eye toward their ability to scale.

It is critical for all groups, including the private sector and government, to understand how such actions can unlock further growth in mobile money agent networks. With a clear understanding of the economics of mobile money, and the factors that support or inhibit its development, smart investments can be made to drive progress—and put financial services within reach for citizens around the globe.