When the dot-com era commenced in the early 1990s, companies weren’t quite sure what to make of the internet, only that it represented something big. Investor interest was enormous, but questions remained: How do you monetize applications for markets that don’t yet exist? Will there be one dominant player? One “killer app” or thousands? All investors really knew was that the internet was something profoundly different, both a platform and a springboard for as-yet-unproven applications that could take advantage of cheap, fast, and vast data-sharing capabilities.

In many ways, blockchain represents a similar phenomenon, an emerging technology with enormous potential that serves up the same head-scratching dilemmas. Will there be a dominant platform or protocol? Which needs can blockchain best fill? Which applications will be the most valuable? Which companies in my portfolio are threatened? And can anyone make money?

One thing investors do know is that timing matters. There’s a danger in jumping in too quickly and getting too far ahead of an unproven market, and a danger in lingering too long while others secure valuable stakes and partnerships. To help investors navigate blockchain, especially against the backdrop of heavy venture capital spending, we offer some context and a few guide rails for assessing this exciting but still emerging technology.

A Source of Gold or Just a Shiny Object?

Blockchain is a distributed, shareable database that consists of three layers: the blockchain engine or protocol, a platform layer that enables information sharing, and an application layer that allows for the development of specific use cases. Unlike traditional databases that are managed by one party, whose say-so regarding a dataset’s timeliness and veracity others are obliged to trust, blockchain distributes ownership across the network to all authorized participants. Everyone with access to the blockchain can view not only a given data record (or block), but the entire history (or chain of blocks) associated with that record. In addition, while participants can add new information, such as when a part arrived or left a manufacturing site, they cannot alter the chain itself. In other words, what goes on the blockchain stays on the blockchain. Should a system go down in one part of the network, it’s not a problem. Much like genetic code, each node (or computer server) on the network maintains a complete copy of the blockchain, replicating it automatically using consensus algorithms that confer with other nodes along the network and “vote” on the validity of each update.

There's a danger in jumping in too quickly and a danger in lingering too long while others secure valuable stakes and partnerships.

If the internet is all about providing connectivity, blockchain is all about enabling trust. Because the data is immutable and because the distributed nature of the database makes the information in it easily shareable and virtually tamperproof, blockchain platforms serve as a single source of truth for stakeholders. Specific differentiators of blockchain include the following:

- Anytime, Anywhere Traceability. Blockchain platforms give stakeholders the ability to track and trace an item at any point along the value chain, 24/7. Superior tracking and visibility could aid industries as diverse as food service, shipping, manufacturing, pharmaceuticals, and retail. Stakeholders can see when a good was shipped or a transaction completed, improving speed and cost performance.

- Data Reliability and Security. The inherent immutability of data on the blockchain can help companies, customers, and regulators establish an item’s provenance and authenticity and provide an auditable history that compliance personnel and others can use—ensuring, for instance, that medical records and other valuable assets remain unaltered. The ability to authenticate assets can reduce costs and losses from fraud and counterfeiting, improve record keeping, procurement, and supply chain management, and eliminate the need for intermediaries. The ability to guarantee the quality of an item or the security of a transaction could also allow some businesses to charge a price premium, creating new sources of revenue.

- Straight-Through Processing. Blockchain can enable instant payments and transactions without the need for human intervention. Today a merchant in Asia may wait days for a buyer halfway around the world to confirm receipt and remit payment, but with blockchain the entire transaction can be completed within minutes. Smart contracts—algorithms that use preconfigured agreements—allow businesses to automate many routine business functions, such as settlements and reconciliation, customs clearance, and property title transfers. Banks and others with heavy payments, invoicing, documentation, and transactional demands can use blockchain-enabled processing to boost operational efficiency and cost performance.

- Autonomous Trading. Bitcoin may have been many people’s first exposure to blockchain, but cryptocurrencies are just one type of trading economy that a next-generation database can enable. The precise path to monetization for tokens and coins remains unclear, and because the market is volatile and lacks a clear leader, wagering too heavily in any one currency creates unnecessary risk. That said, innovative trading models continue to emerge. In the energy sector, for instance, blockchain platforms can help individuals and entities trade excess energy stores autonomously and in near real-time over the grid.

Blockchain’s unique capabilities have the potential to displace those whose business models depend on current ways of doing business. For instance, it can do cheaply and in seconds what many transaction middlemen do today, threatening payment processing intermediaries as well as those who capitalize on information asymmetry. Yet most of these upside and downside scenarios remain hypothetical. While venture capital interest is surging and many industries are exploring blockchain applications, we’re still in the early stages of testing proof of concept, teasing out use cases, and understanding where the greatest potential and profitability from blockchain lie. But for investors interested in understanding if and where to place their bets, we offer the following suggestions.

Focus on Value

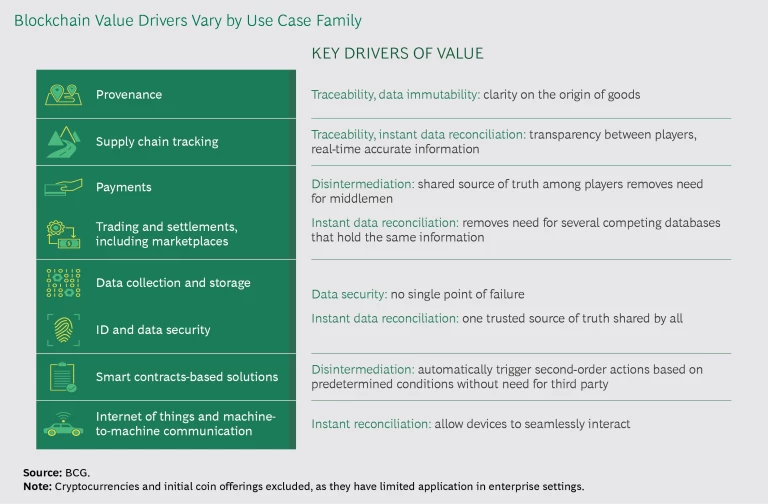

It’s clear that blockchain can do some things very well. The goal is understanding where it can help individuals and organizations do things cheaper, faster, or better than alternative solutions can. Use cases are still evolving. The ones likely to succeed in the near term are those that deliver concrete financial returns, allowing businesses to gain significant cost or loss reductions, improve organizational efficiency by an order of magnitude, and reduce time and uncertainty in manufacturing, sales, and service. Benefits that are easy to visualize within current business and operating norms are more likely to attract market momentum—and raise the collective learning curve. (See the exhibit.)

Blockchain initiatives can encompass many different categories, each with a different value profile. To assess the upside and downside risk, investors need to know where a company is planning to focus, be it the core platform, a niche solution built on top of a given platform, or a solution-specific extension that can add new features and capabilities.

Opportunities where the value seems more proven include the use of blockchain in financial services to transfer and settle significant amounts of capital. HSBC, one of the largest banks in the world, has settled more than 3 million foreign-exchange transactions and made more than 150,000 payments worth $250 billion using distributed ledger technology. The solution, called HSBC FX Everywhere , has been used for the past year to orchestrate payments across HSBC’s internal balance sheets and bring greater efficiency to the bank’s foreign-exchange processes.

Certifying provenance is another area that is showing early promise. In the diamond industry, Tracr is a new collaborative blockchain platform that provides end-to-end tracking capabilities, giving parties all along the value chain, from the mine to the end customer, the means to ensure a diamond’s authenticity and sourcing.

It’s important to note, however, that if ventures fail to build critical mass or demonstrate real value to participants, the idea can fizzle out. The blockchain journalism startup Civil learned this the hard way after its initial coin offering failed to reach its minimum cap.

Opportunities where the value seems more proven include the use of blockchain in financial services to transfer and settle significant amounts of capital.

Yet that doesn’t mean longer-term plays should be avoided. Bold blockchain strategies that introduce new sources of revenue, create new markets and ecosystems, and render other processes and players obsolete could generate higher returns over time. These innovations are usually more complex and take longer to prove and refine. Investing in the underlying blockchain ecosystem today could enable promising use cases down the line, ones that we can only begin to conceive of right now. Many blockchain infrastructure investments require minimal near-term monetization and could help position investors to avail themselves of these longer-term opportunities.

In time, for instance, Tracr could enable new business models, such as the use of a diamond (and its proven provenance) as collateral to secure a loan. Similarly, Walmart is developing a blockchain platform to improve supply chain cost performance and information sharing. In the future, the platform could spawn new services, such as Internet of Things-enabled “smart labels,” digital tags that track and trace products and goods to thwart fraud and the mislabeling of fish and other items. Sensor data that is automatically recorded onto the blockchain could ensure that goods are made and stored at the right temperature, lighting, and humidity levels.

Look for Network Effects

The value of a blockchain platform depends on attracting a core base of adopters with the right mix of capabilities; this will allow it to gain sufficient scale and, ideally, become the de facto platform for a given industry, function, or group. Blockchain can also address persistent negative externalities in existing networks, especially when it comes to processing times and efficiency. For platforms that can deliver these network effects, value grows exponentially higher and faster with increased adoption.

One obstacle to building such networks is cultivating the needed critical mass. In contrast to the dot-com era, when a good idea could flourish even with the limited resources of a garage-based entrepreneur, blockchain usually requires the leadership of a large incumbent or industry consortium that can bring the resources and clout needed to build stakeholder participation in an enterprise setting. The shipping company Maersk, for instance, partnered with IBM on TradeLens, a blockchain-enabled shipping solution designed to support information sharing and lower global supply chain costs. The leadership clout that IBM and Maersk provided prompted others, including DuPont, Dow Chemical, Tetra Pak, and the US Customs and Border Protection agency, to join the pilot.

Another challenge is the coopetition paradox. Building a mutually beneficial platform requires industry peers to set aside their competitive differences and work together. JPMorgan Chase succeeded in getting around these constraints to create a new, private blockchain platform, Quorum, with the goal of streamlining origination, settlement, interest rate payments, and other processes. Participants in the experiment included the National Bank of Canada, Goldman Sachs, Pfizer, and Legg Mason.

Potential backers need to probe the investment thesis and press companies to be concrete about how they intend to address these challenges. They need to know who the key stakeholders are and their roles. Is there a clear leader with sufficient clout to drive the effort? Is there enough potential value to gain their committed engagement? And are the right incentives in place to attract other important stakeholders? Walmart’s first attempt at a supply chain platform was a proprietary system, and the company had a hard time persuading suppliers to get onboard because the platform represented yet another set of books for them to manage, one for Walmart and several more for their other customers. Recognizing the issue, Walmart repositioned the platform as a single, industry-wide model, giving suppliers and customers greater incentive to join.

The value of a blockchain platform depends on attracting a core base of adopters with the right mix of capabilities.

In addition to convening stakeholders, companies and investors need to gauge whether they or their partners have the ability to manage the collaboration effectively over time—resourcing and resolving inevitable conflicts, for example, among other issues. This is not a trivial matter and can make or break a platform’s success.

Understand the Risks of Early-Stage Technology

As with any nascent technology, there are risks to consider. The leading blockchain protocols today are Ethereum and Hyperledger Fabric, which continue to be refined. New versions with different configurations will likely be needed to support different industry and use case solutions. The same is true of the platforms and decentralized applications built on top of the protocols. Given the trilemma among speed, security, and decentralization, no single platform is likely to meet all needs. But these issues will probably not be structural barriers in the long term.

Over the next few years, we will see three major sources of evolution. One will be existing leaders. For instance, Ethereum 2.0 will feature an improved consensus algorithm that promises significantly higher throughput speed with no sacrifice in security. Another source of evolution will be companies and consortia that create bespoke versions of existing platforms with the specific mix of features that they need most—a closed network based on Ethereum to enable near real-time transactions, for instance, such as JPMorgan’s Quorum. Finally, we’ll see new companies, such as Dfinity, develop radically different approaches to consensus algorithms and find other creative ways to use blockchain. Their innovations could result in superior offerings with higher long-term value.

Beyond the technology itself, regulation could become a major issue, especially in use cases related to heavily regulated sectors like financial services and health care, or in cases where multiple countries and jurisdictions are involved. How hard or easy it is to resolve these issues in a given use case or scenario will have an impact on the investment value.

Assess How Blockchain Could Affect Your Portfolio Companies

Blockchain is often thought of as a standalone investment idea: Should one invest in blockchain company A versus blockchain company B? But the evaluation should be more nuanced. Investors need to examine their current and prospective portfolio and identify which assets stand to gain or lose from blockchain.

Questions investors should ask themselves when evaluating their portfolio include:

- Is blockchain’s impact on a given investment or prospect likely to be positive or negative from a value engineering standpoint?

- Which businesses are exposed to disintermediation risk—that is, which currently serve as an intermediary or rely on information asymmetry or processing inefficiencies to create value?

- How would blockchain strengthen the company’s business model—that is, in what ways would trusted networks, real-time information, and secure provenance data better help you serve your clients?

- What set of assets and investments would create a cohesive, synergistic portfolio?

Finally, investors need to be wary of any ideas predicated on “token economics,” since monetization strategies for coins and tokens remain unproven and require comprehensive, ongoing due diligence to vet the proposed approach and validate the investment thesis.

While blockchain is an emerging technology, its reach is likely to be pervasive. No portfolio will be completely immune. Therefore, investors should continue to monitor their current and prospective holdings to see where their businesses can gain or hedge against potential disruptions. By focusing on where blockchain can relieve persistent pain points, understanding what it takes to achieve scale, and avoiding excessive concentration in still-evolving models, investors will be in the strongest position to profit from this exciting and disruptive technology.