For the fast-moving consumer goods (FMCG) industry , it’s both a buyer’s and a seller’s market right now. M&A activity, at historically high levels, is up 30% since 2013. This accelerating activity is expected to continue, owing to a confluence of factors that include slowing growth prospects, aggressive private equity buyers, and changes in US tax law.

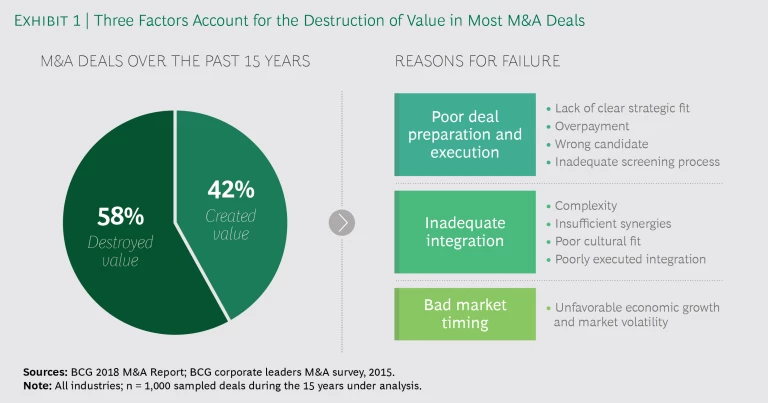

The urge to engage in M&A is understandable in the current market—with companies seeking to reorient their portfolios, reinforce strengths, and sell underperforming assets—but the long-term data on such deals is decidedly mixed. Business acquisition and integration can be challenging, and success is far from guaranteed. In fact, most deals destroy value. (See Exhibit 1.)

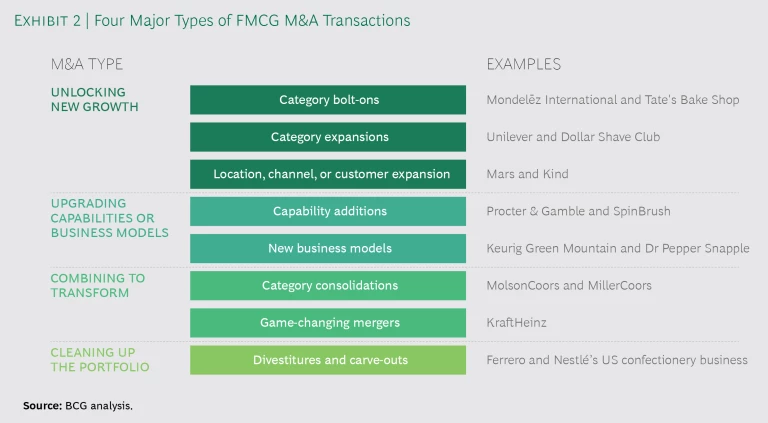

As the competitive landscape evolves and competitors reshape their portfolios, few FMCG companies will avoid the impact of the current wave of M&A. Every deal must therefore be carefully assessed to ensure that it will lead to real value. There is no playbook for success. The approach to every acquisition and the subsequent process of integration must be tailored to the profile of the deal. Each of the four deal types we have observed in the marketplace brings its unique array of opportunities and set of imperatives.

Three Factors That Lead to More Deals

A review of the long-term track record of M&A deals should give executives pause. Over the past 15 years, most M&A deals worldwide have destroyed value—the result, in most cases, of poor preparation and execution, inadequate integration, or bad timing. Still, M&A deals are certainly on the agenda of FMCG leadership teams. For decades, FMCG has been among the most reliable value creators in the business world, but in today’s world, things have changed. (See “ Why Consumer Goods Companies Need to Build, Buy, and Broker ,” BCG article, December 2017.) Three clear challenges in particular point to increased M&A activity for the FMCG industry.

- Industry Headwinds. The first challenge is that the growth rates of FMCG companies are slowing in both developed and developing markets. Annual growth in the global food and beverage business has declined from 5.2% in 2011 to 2.7% in 2017; and in home and personal care, it dropped from 8.3% to 4.4%, according to Euromonitor. In addition, the scale advantages that once led to huge efficiency gains among large companies—and significant negotiating clout with retailers—have run their course. Changes in distribution, marketing, and even manufacturing make it far easier for smaller brands—often more popular among younger buyers—to establish a foothold with a more targeted offering, taking market share from bigger brands.

- The Ongoing Interest of Private Equity. Another factor is aggressive private equity buyers’ continued interest in the industry. These firms have been active investors in FMCG companies, looking to build “platform” companies to consolidate various industries. Private equity funds will seek additional deals to continue creating value, and the threat they pose will continue to cause defensive M&A activity by other players in the market.

- New Tax Laws. Changes in US tax law have created a favorable M&A environment. The new laws will trigger a big increase in corporate liquidity, freeing up as much as $4 trillion from higher corporate earnings and overseas cash that companies bring back to the US. There are more favorable provisions for companies that sell nonstrategic assets, and after-tax proceeds on such divestitures are up to 22% higher. (See “

The Impact of US Tax Reform on Corporate Strategy and M&A

,” BCG article, February 2018.) The advantages are significant enough that some acquirers may opt to buy entire companies and then sell off the pieces they don’t want to keep.

In the aggregate, these trends point to continued acceleration of M&A activity in the industry. Given the shifting landscape and that many industry leaders are doing deals, companies must not simply maintain their status quo. However, just making deals is not sufficient. Value-creating M&A requires a strategic approach.

Four Deal Strategies

On the basis of our proprietary research and experience with clients, we have identified four major types of FMCG transactions: unlocking new growth, upgrading capabilities or business models, combining to transform, and cleaning up the portfolio. Each of them has a distinct value creation objective. (See Exhibit 2.)

Unlocking New Growth. The first type of transaction aims to find new sources of growth. Typically, a large company acquires a small or midsize player that has demonstrated a strong growth trajectory either in existing or new product categories or in markets, channels, or customer bases with high growth potential. Because headwinds have slowed organic growth for most FMCG players, this type of acquisition has become more common. For transactions focused on growth, the following imperatives characterize successful deals:

- Take a balanced approach to integrating commercial functions. When a company buys small, growth-oriented companies, it should keep its dedicated sales, marketing, and new-product-development capabilities isolated from those of the acquisitions to avoid disrupting revenue growth. At the same time, the buyer must seek ways to collaborate and leverage the scale and distribution strength of the combined company to achieve full value.

- Increase scale in operations and look for targeted integration opportunities in the back office. Many small, fast-growing companies lack the scale and expertise for the best-practice operations that can help them advance to the next stage of growth. Sharing operational and support processes such as procurement and finance can quickly boost an acquired company’s growth with minimal risk of disruption.

- Understand cultural and operating model differences and protect the target’s unique attributes. To retain the best talent and sustain the target company’s growth trajectory, it is critical to overcome major cultural differences and ways of doing business—to, in other words, understand the target company’s “special sauce.” The differences are more likely to cause friction in growth-based deals in which the target is a smaller and faster-growing company with leaner and more agile ways of working. (See Breaking the Culture Barrier in Postmerger Integrations , BCG Focus, January 2016.)

- Seek opportunities to cross-pollinate. When lines of communication are open across the two businesses—with knowledge-sharing sessions, cross-staffing opportunities, and other collaboration channels—both the acquirer and the acquired benefit. When a leading food and beverage company acquired a small industry player, core aspects of the latter’s consumer trend insights were gradually diffused across the broader portfolio of the parent company, which was then able to anticipate such big shifts in the food industry as the move to non-GMO ingredients.

These “reverse influence” measures should be adopted thoughtfully and at a pace that does not disrupt the target company’s operations. In addition, an acquiring company can foster collaboration by customizing its strategic plan and budget to avoid overburdening the target.

Upgrading Capabilities or Business Models. Significant imperatives for deals based on upgrading capabilities or business models include the following:

- Ensure retention of the key talent that enables targeted capabilities. When the acquiring company adds a new capability or business model, retaining talent at the target company becomes disproportionately important—and difficult. If being acquired prompts the best employees of a target company to leave, the deal will likely fall short of its objectives. For this reason, increased focus on retention and a tightly organized communication strategy are core to success. Even if that approach is more expensive in the short term, buyers need to understand how the integration will affect key people, processes, and decisions in areas such as performance evaluations, compensation, and staff titles.

-

Maintain operational continuity for the acquired business model or capability. When the acquirer is not familiar with the capabilities being acquired, an arm’s-length integration can work best: the target company maintains operational control over parts of the business that are foreign to the acquirer. During the learning period of the next one to two years, the acquiring company can identify opportunities for further integration and scale.

For example, a leading consumer packaged-goods company followed this approach, integrating back-office and distribution capabilities in the six months following a 2017 acquisition. It then integrated operations in the year or so after closing the deal, keeping sales and new-product development separate. In addition, the acquirer brought in a new president, who prioritized blending the two company cultures to preserve the best aspects of both.

- Provide leaders with autonomy and align on incentives. In order to maintain the successful model of the acquisition, the leadership team of the acquired company must be granted the latitude to run its business independently and free of the bureaucracy, reporting, and other barriers that can exist in an acquiring organization. Also, compensation and other incentives need to be aligned to the goals and metrics of the acquired business.

Combining to Transform. The third deal type is, perhaps, the most visible in the M&A landscape: a company acquires a large player to create value through consolidation or by changing the direction of the business through a dramatic, game-changing merger. Success factors for these kinds of transformative combinations include the following imperatives:

-

Establish a rigorous program management approach and manage the integration as a discrete process, separate from the day-to-day business. Game-changing deals can be the most complex integrations, involving the management of more interdependencies, significant demands on resources, and an extended timeline. These transactions require dedicated integration teams aligned with the new operating model and sources of value. Buyers should set explicit milestones and timelines for key integration initiatives. They should also establish strong governance and effective decision-making processes along with a rigorous tracking mechanism to ensure that synergy, organization, operations, and system milestones are achieved, monitoring leading indicators that prompt course corrections when they are needed.

For example, when two global food companies merged in 2015, their leadership teams set out clear cost synergy ambitions and established a detailed path toward achieving those goals. The integrated company saw its profit margins begin to improve just a few months into the program and ultimately exceed its savings targets.

- Proactively engage customers to ensure retention and avoid revenue disruptions. Big integrations, which are frequently in the news, can create uncertainty for key customers and accounts. Just as change management is important internally, it is critical that companies proactively engage their customers and allay concerns during this period of turmoil.

- Aggressively pursue cost synergies. In mergers of large companies with overlapping functional and business structures, cost synergies are typically a core value driver. Merging companies should seek to optimize G&A across shared functions and aggressively consolidate operational activities such as procurement. Large and transformative integrations can also serve as good opportunities for assessing and pursuing cost reduction levers in addition to eliminating overlapping roles. Examples include the aggressive leveraging of shared services and location of resources, network redesign, and use of new technologies for support functions.

- Capitalize on the complementary market presence and footprint to generate commercial synergies. Although many transformative types of deals involve companies in the same industry, incremental locations, channels, and customers can lead to revenue synergies. Expanded distribution networks, investment capabilities, and go-to-market scale can be key drivers of value, far exceeding standard cost savings.

Expanded distribution networks, investment capabilities, and go-to-market scale can be key drivers of value, far exceeding standard cost savings.

Cleaning Up the Portfolio. Acquirers can sell off less-attractive assets to streamline their portfolio and focus on more profitable and high-growth businesses. Changes in US tax law have created favorable conditions for such deals. For example, in early 2018, a global food and beverage company announced the sale of one of its units at a favorable price, and the valuation multiple was materially higher than average historical transaction prices. The seller benefited from the combination of a higher valuation and a lower tax rate.

Key imperatives for portfolio clean-ups and divestitures include the following:

- Conduct periodic and candid reviews to determine whether your company is the best owner for a given business. One of the most difficult truths to acknowledge is that another company might be a better owner of a certain business and that, as a result, that company will attach greater value to it in a transaction. When a global pharmaceutical company sold its consumer health unit in 2018, the decision was a result of an extensive portfolio review in which the seller’s management determined that consumer health was no longer a fit for the company’s strategy.

- Focus efforts on credible, motivated buyers. Companies waste significant time and effort preparing for deals that never materialize. Determining how much the business is worth to the company and whether it would make more sense for a potential buyer is key to knowing where to invest efforts with a potential counterparty.

- Define a post-transaction operating model that reduces complexity and minimizes stranded costs. Rather than examining stranded costs once the deal is done, companies should evaluate decisions throughout the transaction and while designing the operating model that will affect the seller’s ability to shed costs later on. Several years ago, when a multinational clothing company sold one of its subsidiaries, a cross-functional team was assigned to quickly define a viable standalone operating model, identifying and breaking up interdependencies among businesses and legal entities.

The FMCG industry shows the potential for high levels of M&A activity for the foreseeable future. Management teams can resist this trend, or they can capitalize on it. By understanding the four types of transactions discussed here—and the key imperatives for each type—companies can ride the M&A wave to a more successful and profitable future.