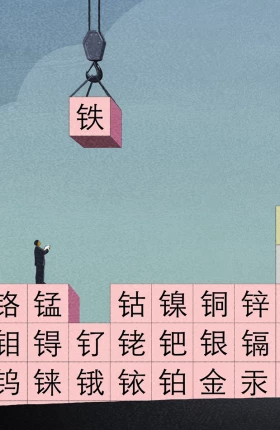

There has been a perceptible rise in concern in the executive suites of many chemical companies over the past year. The concern was not just over falling share prices, though that was certainly on executives’ minds as 2018 wore on. Something more fundamental happened. Demand weakened.

Chemical production in the European Union slipped 1% in the third quarter of 2018 and another 4% in the fourth quarter, the region’s biggest quarterly decline in a decade. Chemical production in China fell almost as much in last year’s fourth quarter—3%.

The production declines for chemical companies in Europe and China coincided with the biggest selloff in global stock markets since 2008. As a result, chemical companies had their first decline in total shareholder returns (TSRs) since 2015 and their worst TSR performance since 2012, according to Boston Consulting Group. Although stock markets have since rebounded, giving shareholders some relief, it’s still useful to look at what happened to chemical company returns in 2018 and see what can be learned from companies that bucked the negative trend.

Chemical companies had their first decline in total shareholder returns since 2015 and their worst TSR performance since 2012.

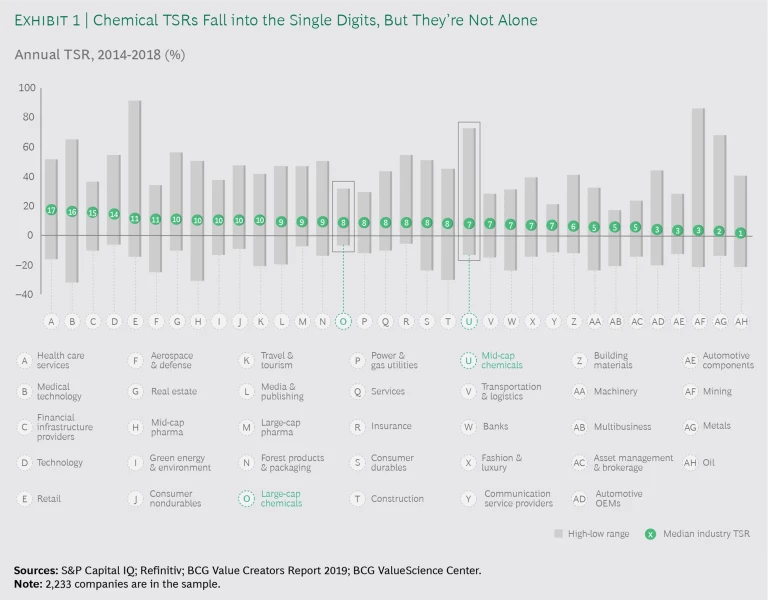

There’s no sugar-coating the situation: 2018 was a bad year for chemical shareholders, with the industry losing $263 billion in market value globally. The value destruction in 2018 wasn’t limited to chemical companies, of course; it happened in every industry. (See Exhibit 1.) In the case of chemicals, however, the decimation essentially halved companies’ five-year returns. The TSRs of large-cap chemical companies—the average compounded return an investor would have gotten in each year—fell from 16% between 2013 and 2017 to 8% between 2014 and 2018.

BCG looks at TSRs on a rolling five-year basis to spot trends and see how companies are performing over the longer term. This explains why the TSRs in this report are still in positive territory despite the wipeout in chemical-share values in 2018. (See the sidebar, “How We Calculate and Report TSR.”)

How We Calculate and Report TSR

How We Calculate and Report TSR

Total shareholder return, which accounts for the change in share price and any other effects on shareholders’ net wealth in a given period, is the product of multiple factors. Readers of BCG’s Value Creators series are likely familiar with our methodology for quantifying the relative contributions of the various components of TSR. (See the exhibit.) The methodology uses the combination of revenue (that is, sales) growth and change in margins as an indicator of a company’s improvement in fundamental value. It then uses the change in the company’s valuation multiple to calculate the impact of investor expectations on TSR. Together, those two factors determine the change in a company’s market capitalization. Finally, the model also tracks the distribution of free cash flow to investors and debt holders—in the form of dividends, share repurchases, and repayments of debt—in order to determine the contribution of free-cash-flow payouts to a company’s TSR.

All those factors interact—sometimes in unexpected ways. A company may increase its earnings per share through an acquisition but create no TSR if the acquisition erodes its gross margins. In addition, some forms of cash contribution (like dividends) can impact a company’s valuation multiple in different ways than others (like a share buyback); the effects are complex.

In this report, the TSRs used for groups and for comparative purposes are generally medians. The TSRs associated with individual companies are straight calculations of those companies’ capital gains and cash flows, rounded to the nearest percent.

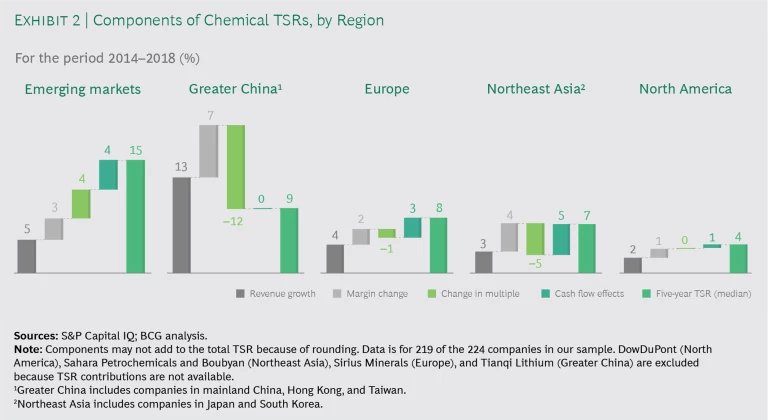

A Decline That Dragged Down Every Region

Chemical TSRs declined from the previous period in all five of the regions we study. They held up best in emerging markets, including India, where chemical companies continue to excel from a TSR perspective. In general, chemical sales in emerging markets haven’t contracted the way they have in more developed markets.

That was certainly true of Greater China, despite the production declines that affected the region last year.

One of the interesting developments in the latest period is the reversal of fortunes between Europe and North America, the two biggest chemical regions from the standpoint of public-company market values. Not that either region avoided the 2018 downdraft. There were plenty of poor TSR performers in Europe, especially in Germany and in the multispecialty subsegment. But there were also some big winners in Europe’s large-cap cohort, including the pharma ingredients and additives company Lonza (five-year TSR: 28%), the food ingredients company Chr. Hansen (24%), and the flavor and fragrance producer Givaudan (16%). These companies helped European chemical TSRs (at 8%) surpass North American TSRs (4%, a worldwide worst) for the first time since 2008-2012. (See Exhibit 3.)

No region had anywhere close to the number—or proportion—of low chemical TSRs that North America had. There were no US chemical companies in the top TSR decile globally and only a handful in the top quartile. Many US chemical companies have been saddled with slow growth, in the low single digits. One exception is the specialty company Entegris, which had a TSR of 20%—five times the North American average. (See below for an analysis of the company’s performance.) Hampered by increases in raw material costs, North American chemical companies also struggled in other components of TSR, including profitability.

Northeast Asian chemical companies, which had the best TSRs for 2013-2017, dropped to second-worst in the latest period. TSRs held up better in Japan, which accounts for four-fifths of the region’s players, than in South Korea, which accounts for the other fifth. Chemical companies in both countries showed improved margins, and the region would have done better from a TSR perspective if multiples had not fallen. Japan has a disproportionate share of the chemical industry’s multispecialty companies. Though multispecialty companies have lost some favor in the West, they dominate Japan’s chemical industry, where names like Toray and Teijin are very familiar to customers who rely on the companies’ Torayca and Twaron products.

Where the Returns Are Flowing, by Chemical Subsector

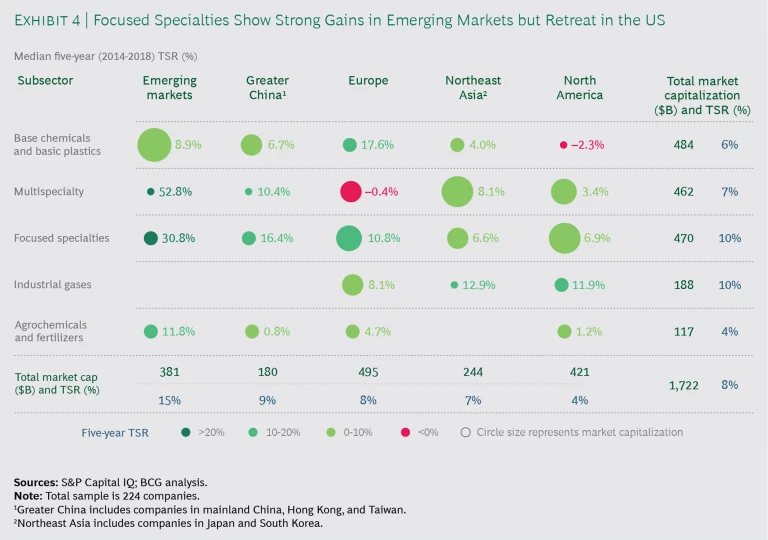

In 2014, focused specialties moved into the top TSR slot among subsectors, and by now it’s clear that their ascent has not been a fluke. The business model of focused specialty companies—developing highly targeted products, generally for a specific set of customer industries, with a highly tailored application range—has pushed them ahead of all other chemical subsectors on fundamental measures of business performance, including return on capital employed and return on net assets. This surge has helped keep them at the top of the TSR rankings.

The differential between focused specialty and multispecialty TSRs is especially pronounced in Europe. Indeed, Europe’s multispecialty subsegment is one of the two red bubbles (indicating a negative average TSR) on our performance map. (See Exhibit 4.) If not everywhere, then certainly in Europe, multispecialty companies are finding answers elusive.

Certain chemical specialties were associated with particularly strong returns in the latest five-year period. For instance, of the 20 focused-specialty companies with the highest TSRs, 13 participate in the fields of electronic chemicals, food ingredients, or paints and coatings.

On the other hand, having too much exposure in an industry with softening sales can be a drawback. This is apparent from the companies that are most dependent on the automotive industry, whose record stretch of growth appears to be nearing an end . The companies so exposed—about one-fifth of all the chemical companies in our study—had TSRs of 6%, two percentage points below the chemical industry’s overall average.

The record stretch of growth for companies most dependent on the auto industry appears to be nearing an end.

From a TSR perspective, agrochemical and fertilizer companies again came in last. The only way an investor could have made a return in this subsector would have been by betting on very small-cap companies outside of the US and Western Europe (like Russia’s Acron Group and China’s Zhejiang Huge Leaf, which both produced stellar returns). The agrochemical and fertilizer subsector has been wrestling both with its usual challenges—currency issues, weather, crop prices, increasing regulatory burden—and with some new ones. One new challenge is the US-China trade war, which is weighing on the agricultural subsector and on those supplying chemicals to farms. Together, these challenges have led to consolidation in the agricultural chemicals, seeds, and fertilizer product categories—in turn raising hopes of a rebound in the subsector.

Lessons from Four Winners

In every industry, it’s instructive to examine the companies that are outperforming to see if there’s anything one can learn from their examples. The companies we profile this year reflect the industry’s geographic diversity and subsector variety.

A Strategy of Bolt-On Acquisitions. The Swiss company Sika (TSR: 21%) has used a succession of mostly small acquisitions to get a bigger piece of the global market for adhesives and construction chemicals. Sika made two dozen acquisitions over the five years of our latest study period, paying less than $50 million each, on average, for the companies it acquired. (At the beginning of 2019, just months after successfully fending off a takeover threat of its own, Sika entered its biggest deal ever, paying $2.6 billion for the French company Parex.)

Its acquisitions—which have generally been done to give Sika access to complementary technologies or new geographic markets—have contributed to the company’s above-average growth. One-third of Sika’s 6% average annual growth in the past five years has come from acquisitions; the rest has come from organic expansion.

Sika now does business in more than 100 countries. The company’s additives are in the high-performance concrete of New York’s giant Hudson Yards development project. And its concrete fibers are preventing cracks in the floors of parking garages at Suzhou Central Plaza in Beijing, which houses the world’s largest shopping mall.

The lesson from Sika: Acquiring smaller, related, “hidden jewel” targets can rapidly accelerate revenue growth and strengthen competitive advantages.

An Integrated Value Chain. Indorama Ventures Limited (IVL) has also been a skillful acquirer—doing more than 20 deals over our most recent five-year study period—and this has contributed to the company’s EBIDTA growth. Formerly known mostly as a PET producer, IVL has integrated both backward, to protect itself against the high cyclicality of the PET feedstock markets, and forward, to participate in markets offering higher margins. Today, IVL’s portfolio comprises integrated PET, integrated olefins, specialty chemicals, fibers, and packaging.

Along the way, the Bangkok-based company has established a global footprint, with production capacity and sales distributed across Asia, Europe, and the Americas. Its wide presence means IVL operates with the advantages of a local player in key geographic markets.

Indeed, another reason that IVL (TSR: 24%) is worth looking at is its location in an emerging market—the geographic segment in our study that has the most winners in this year’s rankings. (See Exhibit 5.)

The company’s $2.1 billion acquisition of Huntsman’s intermediates and surfactants manufacturing assets (its biggest transaction ever, announced in the summer of 2019) exemplifies its strategic use of M&A. With Huntsman’s assets in hand, IVL’s upcoming Louisiana steam cracker will be fully captive, eliminating a previous exposure to merchants of roughly 25 percent. The deal also makes IVL the second-largest producer of ethylene oxide in the US—a crucial benchmark given the company’s determination to operate only in segments where it has a chance of being a leader. (IVL holds a 25% market share in PET and has more than twice the capacity of its nearest competitor.) The Huntsman acquisition also gives IVL an entrée into specialty surfactants, polyurethane materials, fuel additives, and other performance products, all of which enjoy comparatively fast-growing demand and attractive margins.

The lesson from Indorama: Integration can provide protection against the inherent cyclicality in the chemicals value chain, while also providing advantaged access to higher-value segments further downstream.

Integration can provide protection against the inherent cyclicality in the chemicals value chain, while also providing advantaged access to higher-value segments.

A Vital Position in a Growth Sector. In North America, there weren’t a lot of TSR bright spots for the most recent study period. Entegris—which had revenue growth of 15% last year alone--was one of the exceptions.

Entegris makes materials that help semiconductor companies overcome challenges in the areas of precision, purity, integrity, and safety. Even when the chip products that use Entegris chemicals are in a period of slow growth, Entegris’ top line can increase more rapidly thanks to higher use of its chemicals in each successive chip generation. This dynamic allows Entegris to sidestep some of the chip industry’s cyclicality.

In effect, the Entegris model is one of selling pickaxes to miners. In good markets and in bad, a pickaxe manufacturer’s business is steady because all of the competitors need pickaxes if they are to make a breakthrough. So it is with Entegris, whose products—including liquid and gas filtration and handling solutions—are mission-critical inputs for those producing digital devices. The nature of the products and the customers can make switching impractical, which gives Entegris a regular stream of revenues and a relatively high degree of predictability.

The lesson from Entegris: High-value products that are a small part of customers’ costs are a winning play, even more so if the market is expanding.

Geographical Diversification. In 2014, recognizing how mature the domestic market was, Japan’s Nippon Paint turned its attention to geographic expansion. That strategy has paid off, especially in China. A decades-old Chinese joint venture, now operating as a subsidiary, provided Nippon Paint with connections, and with an understanding of the Chinese market that many non-Chinese companies haven’t managed to develop. Rising household incomes in China have prompted consumers to buy new apartments and repaint their homes. With the ecofriendliness of some of its product lines, Nippon Paint is well positioned to meet the health expectations of these consumers, as well as the expectations of China’s government, which is becoming stricter in its regulations and more insistent on sustainable practices.

Nippon Paint—which enjoyed faster revenue growth than any company on our top-ten TSR list—hasn’t limited its geographic expansion to China and other parts of Asia. The company’s 2017 acquisition of Dunn-Edwards gave it a strong position in the US. And newer acquisitions, of the Australian company DuluxGroup and the Turkish company Betek in 2019, show Nippon Paint’s determination to establish itself in other geographies where it wasn’t previously an important player. Besides its strong five-year TSR (18%; 11th-best among the large-cap companies in our study), Nippon Paint is also a top-ten performer on our 10- and 20-year large-cap chemical TSR lists. It is one of only five chemical companies with that kind of unbroken success. (The others are Asian Paints, Braskem, Nissan Chemicals, and Sika.)

The lesson from Nippon Paint: Geographic expansion can be a winning play—especially in product segments with a strong local component.

Sustainability’s Growing Impact on TSR

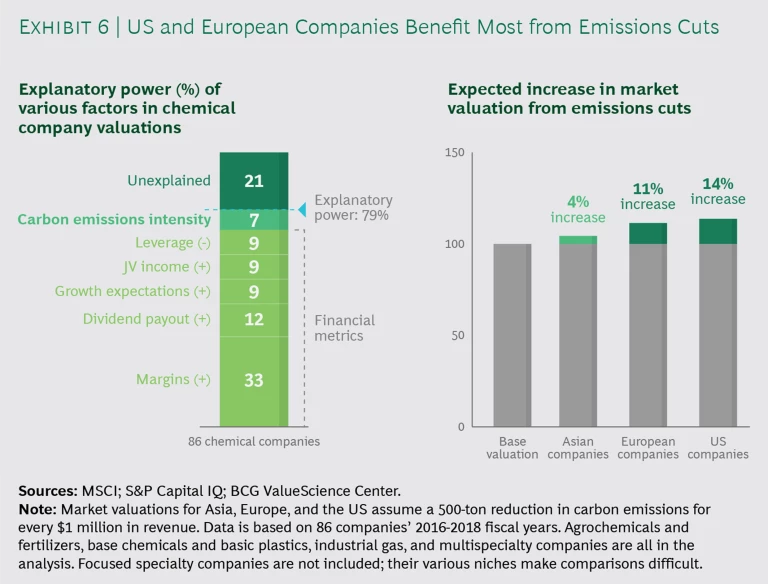

The topic of sustainability has become integral to any TSR discussion. In the early part of this decade, there was no clear relationship between chemical companies’ TSRs and their sustainability performance. That started to change a few years ago. Now—with tightening regulations, heightened consumer pressure, and increasingly dire predictions about the consequences of climate change—the relationship is unmistakable.

In particular, an inverse correlation between carbon emissions and chemical company valuations has emerged in the past two years. Carbon emissions aren’t the biggest factor in valuations—they’re well behind profit margins and other financial metrics that investors consider—and it’s not clear if emissions directly cause valuation changes, but they are certainly something that investors are thinking about. It seems reasonable to assume that, before long, other aspects of sustainability will also come under investor scrutiny.

An inverse correlation between carbon emissions and chemical company valuations has emerged in the past two years.

The change in the valuation equation for chemical companies, early though it is, shouldn’t be downplayed. It’s clear that something has changed when a group as well-connected as the Business Roundtable issues a statement—as this US entity did in August 2019—saying that shareholder interests must be in balance with other outcomes, including environmental protection. Chemical companies are already devoting more attention to sustainability, whether through new groups like the Alliance to End Plastic Waste or through increased investment in recycling technologies. The question is whether some of these sustainability efforts can also work in support of companies’ TSR strategies.

Especially for companies with large carbon footprints, there appears to be an opportunity to obtain better valuations in capital markets if they take steps to reduce their emissions. For now, the opportunity is greatest in Europe and the US. In these regions, where awareness of sustainability issues is most deeply engrained, our research shows that valuations can get more than a 10% boost for every 500-ton emissions reduction per $1 million in revenue. The effects in Asia are nowhere near this level. (See Exhibit 6.)

Reducing carbon emissions by 500 tons for every $1 million of revenue isn’t going to be easy for every chemical company. But some subsectors—in particular, fertilizer companies and base chemical companies—may well have a chance to do this. The average carbon intensity of these two subsectors is roughly 1,400 tons/$1 million and 900 tons/$1 million in revenue, respectively—in other words, quite high.

It seems certain that, in the future, carbon emissions won’t be the only sustainability measure that investors look at. While our analysis showed no correlation with other environmental, social, or governance topics, some of those topics (for example, air quality, waste management, and recycling) are natural points of focus in a chemical industry context.

Some parts of the industry already recognize that the old model of maximizing volumes is outmoded. Agrochemical companies that once focused on selling as much fertilizer or pesticides to farms as possible are taking advantage of precision digital readouts and promising that they can provide similar outcomes with substantially lower chemical volumes. Top adhesives manufacturers are developing products that have the same fixative properties but use far less material. There are many such examples.

As a whole, however, the industry has a long way to go. Consider that one-third of the companies in our sample don’t even report the size of their carbon footprints. And almost no chemical companies have set a quantitative ambition for carbon reduction beyond 2030. Companies must realize that sustainability initiatives often take years to produce results. They should take steps now, both to reduce their emissions and to become leaders in other areas of sustainable chemistry.

Imperatives for Chemical Industry Leaders

The contraction in chemicals production that hit Europe and China in the second half of 2018 remains a reality in some markets. The most widely followed forecasters of chemical production, including the European Chemical Industry Council and the American Chemistry Council, have said that they expect volumes to fall in 2019 versus 2018. And there are other problems, too, including the China-US trade battle, which has depressed investment levels throughout the industrial economy. But even in a challenging economic environment, there are attributes that chemical companies can develop and strengthen to increase their chances of improved performance and increased shareholder returns. Here are five of the most important:

- Growth foundation. Commercial excellence and channel management excellence, including digitally enabled sales, are essential capabilities for any chemical company that wants to grow. So is some degree of presence in regions, such as Greater China, that will inevitably expand in the long term. Another growth imperative is to be positioned in end-use markets that have unmistakably bright futures. This means having a portfolio of leading products in the appropriate application areas.

- Customer focus. In every business, and certainly in a mature one like chemicals, the innovations that matter most generally come from listening to customers. This makes it imperative for chemical companies to have multiple ways of capturing end-user feedback and for everyone in the organization to have a stake in enhancing customer responsiveness.

- Differentiated business models. The succession of years in which focused specialty companies have won the TSR “sweepstakes” is a clear sign that these companies are doing something right. Not every chemical company has the profile of a focused chemical company, and no company can magically turn itself into one. But most companies can adopt some of these companies’ tactics—whether it’s allocating resources for each business as though it were a standalone company or allowing different business models to flourish in the same portfolio.

- A facility for digital. Every chemical company should already be using digital technologies across its business. Digital technologies can bring huge efficiency gains to operations. They also give chemical companies a way of interacting with customers that customers may prefer, and they enable new business models.

- A staked-out position in sustainability. We have already noted the impact that carbon emissions are having on chemical-company valuations. But there’s more to it than that. Sustainability awareness, though it has different meanings across chemical subsegments, is fast becoming a license to operate—a must-have attribute rather than a nice-to-have attribute.

The day is not far off when sustainability changes from a largely defensive concept to an offensive one. New industry segments, new business models, a circular economy that emphasizes alternative feedstocks, reduced material input, and recyclability—these are among the opportunities that are appearing under the broad heading of sustainability. Every chemical company that’s in it for the long term will have to pivot in the direction of these opportunities. We’re not saying that products that leave the world safer and healthier are a big part of chemical industry revenues today; they’re not. But this will change. The speed at which sustainability products grow in the chemical industry might eventually resemble the speed at which cloud products grew in software. From under 1% of all revenues today, to 5% of revenues in 2024, to 35% of revenues in 2030? That isn’t exactly a prediction, but we wouldn’t bet against it.