There can be a huge difference in the digital experience offered by different retail banks. To understand how big, let’s look over the shoulders of two customers, Zuzanna and Oliver, as they use their mobile-banking apps.

It’s 10 a.m. in Warsaw, and with a few quick taps on her phone, Zuzanna is repaying a friend for last night’s dinner. As she sends the money, Zuzanna sees a reminder to activate her new credit card. The bank will give her 5% cash back if she uses her card five times in the coming week, and it’s offering a discount at her regular coffee shop if she uses her card to pay there. She taps the “activate” button, which automatically loads the card digitally into her e-wallet, orders herself a discounted coffee, and heads out for the day. The convenience and speed of this and other mobile-banking experiences have turned Zuzanna into something close to a purely digital customer; she rarely steps into a branch office anymore.

In another European city, Oliver is having a different experience. While attempting to open a new savings account, he gets frustrated when the application form in the banking app doesn’t prefill with his profile information. This means he has to provide—yet again—data that he’s given to the bank many times before. He gets stuck somewhere in the middle of the process and is forced to go to his local branch to complete the application.

For banks, digital sales are a crucial new benchmark —and a logical next step in the race to digitization. For every one time that customers visit a branch, they now access their banking apps between 50 and 80 times. And this doesn’t take into account visits to bank websites, which make the ratio of digital to physical interactions even more lopsided. Yet despite this mammoth behavioral shift, most banks’ proportion of digital sales hasn’t increased by much. It remains an opportunity that banks haven’t seized.

For every one time that customers visit a branch, they now access their bank apps between 50 and 80 times.

In their next phase of hiring, technology buying, and strategy formulation, banks need to create a foundation for digital sales. The ones that do so will gain a lasting advantage.

Retail Banks’ Preparedness for Digital Sales

To determine the extent to which customers are willing and able to buy bank products digitally (by using a bank’s mobile app or online site, rather than by visiting a branch), we sat down with actual customers of more than 140 banks globally—our “mystery shoppers”—while they worked with more than 210 sales-related features on their digital-banking apps and websites. We looked at the following features and scored their effectiveness:

- Marketing and Engagement. The best banks display and time their digital messages according to where and when they are most likely to be relevant to the individual customer. Messages appear in multiple places across the mobile app, starting on the home screen or notification center and continuing across product pages. They come in a range of formats (including carousels and videos within banners) to increase the chances of success. The objective is to personalize the message so that the customer sees it as having been created “just for me.”

- Product Research. Here we gave the highest scores to banks that use their digital apps to provide relevant information about products and services—and that optimize the displayed information to the size and format of customers’ devices. In addition, the most advanced banks, rather than limiting themselves to static displays, use formats such as explanatory videos and interactive comparison and solution wizards.

- Third-Party Products. The digital economy creates an opportunity for banks to put themselves at the center of consumer ecosystems by providing access to other financial and nonfinancial products. To date, not many banks have expanded their offerings in this way, although a few do offer insurance, merchant discounts, and even marketplaces that help steer customers to the best deals on utilities, real estate, and travel.

- Usability and Delight. Many apps provide a little kick that makes users want to return: the celebratory music that plays upon completion of a crossword puzzle, the voice options on the Waze navigation app, Shazam’s infallible name-that-tune music service. Banks could approximate this experience with great graphics and animation, easy-to-use interfaces, and the economical use of words. It’s about instant gratification and delivering a delightful experience.

- Product Application and Fulfillment. It only takes a few minutes to join mobile services like Uber and Lyft, and a few seconds (sometimes a single click) to buy products from Amazon. Even brand-new users don’t get lost. Banks should strive for something similar—and the best ones have, by simplifying the sales process, providing trackers and prefilled forms, validating information on the fly, and giving customers the ability to save an application and pick it up later.

- Assisted Sales and Support. The best banks also understand that when self-service is falling short for a customer, it’s sometimes useful to provide immediate direct support in the form of a knowledgeable human advisor, whether through a chat, a phone call, a video, or a quick screen-sharing session. These features offer guidance at precisely the moment it’s needed and dramatically increase the odds that the customer will complete the digital purchase.

Not many banks are doing a good job in all these areas simultaneously. In observing our mystery shoppers, we found that very few banks are delivering personalized marketing to their customers’ mobile devices. (The Polish bank used by Zuzanna is the rare exception.) Many banks provide product information over their digital channels, but the presentation often doesn’t take advantage of the medium’s interactivity or, in the case of mobile, is not suited to the small screen. It’s almost never easy to buy a bank product digitally; most such attempts result in the shopper’s having to re-enter personal data, be redirected to a separate bank website, or visit a branch. And heaven help the shopper who wants support while making a purchase: the options, whether phone, chat, or video, are usually rudimentary—if they are available at all.

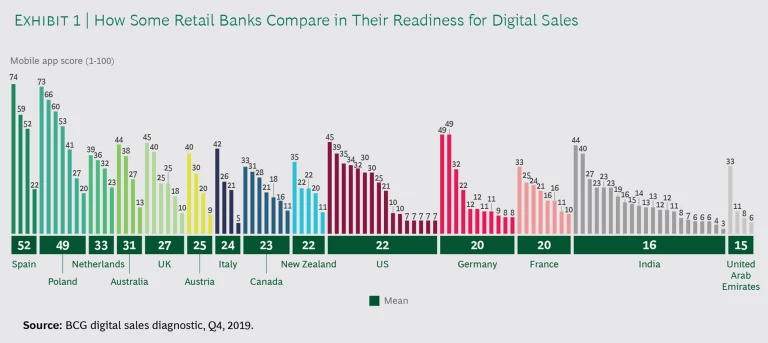

As a result, most of the banks we looked at score low on our digital-sales diagnostic; the median score of the banks’ mobile apps is 22 out of 100. This is a stunningly low number given the billions of dollars that banks collectively have poured into their digital initiatives in recent years.

Very few banks are delivering personalized marketing to their customers’ mobile devices.

Of course, not every bank performs badly. At the more advanced end of the continuum, some banks in Poland and Spain have scores up to three times the global average. (See Exhibit 1.) While we have not yet compared banks’ digital scores with their actual digital sales—which we estimate at 10% to 15% of total sales at banks globally—there is plenty of empirical evidence that the two move in tandem.

The Digital-Sales Stack

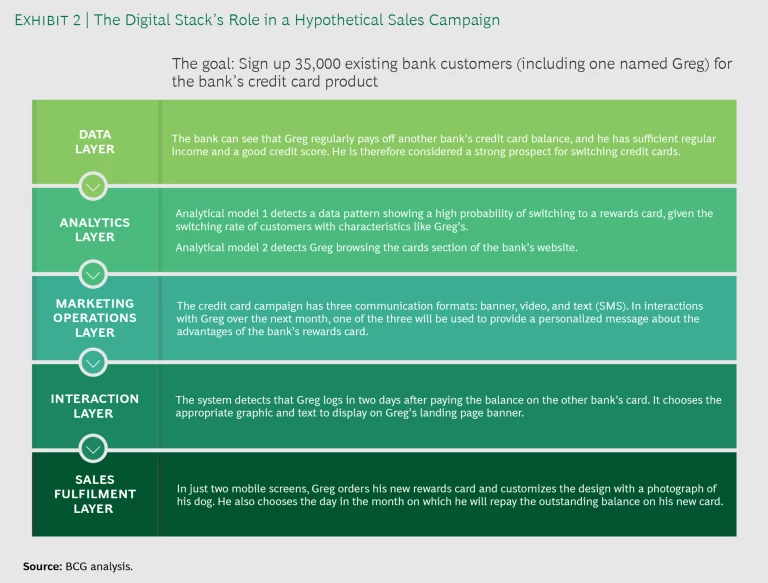

Performing well in the categories described above isn’t solely a function of a bank’s excelling at data and analytics—there’s much more to it than that. In our view, most banks are going to have to rethink their digital-sales “stacks”: the technology, processes, talent, operating model, and coordinating mechanisms needed to increase sales through digital channels. (See Exhibit 2.)

At banks, the stack has five distinct layers, most of them requiring new capabilities and infrastructure:

- Data Layer. This is where the collection, storage, and management of internal and third-party data occurs. The data layer allows for a holistic view of each customer’s behaviors, including product and channel usage. All these pieces of information get linked to a single customer ID.

- Analytics Layer. The job here is to figure out the best way for a specific marketing or engagement campaign to approach each customer. The objective is to match offers with real events in the customer’s life. To do this, banks deploy a variety of technologies, including machine learning.

- Marketing Operations Layer. The team that handles this part of the stack is responsible for coordinating the marketing approach. This includes selecting communication formats, preparing messaging content and creative elements, defining the communications policy, and prioritizing among different campaigns and customer interactions.

- Interaction Layer. This is the function that takes care of the interface with the customer, whether that means delivering marketing communications, product comparisons, or order forms. The interaction layer doesn’t limit its activities to digital channels; it uses branches and call centers as additional touchpoints. In effect, it sets the stage for customers who are ready to make a purchase.

- Sales Fulfillment Layer. This is where the last step—the actual sale—is handled, with the help of a seamless end-to-end fulfillment process. A crucial part of this layer is a workflow system that orchestrates data collection, request processing, and storage across all relevant applications.

Each layer of the digital stack comes with its own technology set, business processes, and organizational imperatives. At the best banks, these are set up and orchestrated in much the same way as at a digitally native company. And the method of achieving outcomes is similar, too. Just as Amazon seamlessly fulfills orders and Google stimulates consumer demand by ensuring that its messages are relevant, best-practice banks do the same.

A Deeper Look at One Layer of the Stack

To understand the challenges, let’s look at what a single layer—marketing operations—might be trying to accomplish at a given point in time. We’ll use just one campaign as an example: an effort to get customers to increase their savings balances.

Such a campaign is relatively common, and it makes sense to pursue it digitally as well as through traditional marketing. In managing the digital parts of a savings account campaign, however, most banks don’t make effective use of marketing operations. Common mistakes include underestimating the scale and breadth of the required effort or assuming that it can be handled by old-school CRM systems originally built to support branches or contact centers. Sometimes banks allow different teams to create their own messages, using systems that overlap and are poorly coordinated. And then there are the structural pitfalls, such as when a marketing operations team sits in the wrong place in an organization or doesn’t have the decision rights it needs.

At a bank with a more effective approach to digital, marketing operations would be very selective about the customer IDs it targets for the savings campaign. And it would pick a marketing approach that makes sense for each individual prospect, based on a unique combination of customer preferences and behaviors. For example, the notification would say “Hello Zuzanna” if Zuzanna had indicated that she prefers that greeting to the more formal “Good afternoon, Ms. Kowalski.” And if the bank knows that Zuzanna tends to do some mobile banking on her commute to work, it might display the campaign message at 8 a.m. on a weekday morning on the mobile app. Or suppose Zuzanna has deposited 10,000 zlotys from a fixed-term investment that has just matured at a competitor bank; in that case, the bank might offer her a special bonus savings rate to dissuade her from reinvesting the funds at the other bank.

Of course, a single campaign such as this can only provide a partial picture of what the marketing operations layer does. The real challenge is coordinating the execution of hundreds of campaigns, which necessitates selecting from among dozens of formats and managing multiple channels and millions of communications each day.

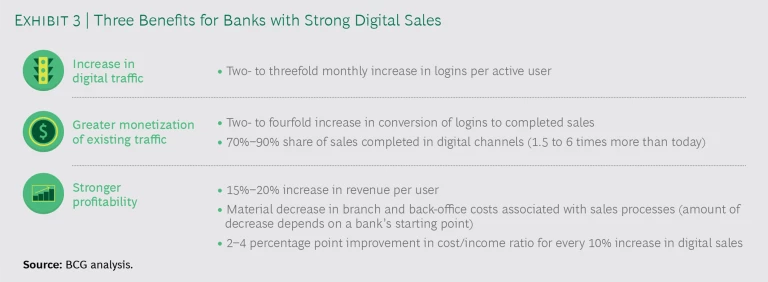

The payoff from having a well-developed digital-sales stack isn’t just the increase in digital sales. A bank that has built up its digital operations in this way will reap other benefits as well, including an increase in digital traffic and a reduction in costs. (See Exhibit 3.)

The Way Forward

For many banks, it helps to start with a self-assessment: Where are we today for each of our main offerings in the market? Where are we lagging and why? Do the gaps matter, given our strategic priorities? What is our current level of digital sales? What would we like it to be two years from now? Do we have a mobile app with features our customers love to use? How well-developed are the different layers of our digital-sales stack?

Data and analytics isn’t the only capability that banks need in order to sell more through their digital channels. All five layers of the stack are important. The good news is that it’s possible, indeed advisable for most banks, to develop the digital stack incrementally. Fortunately, there are several viable paths to become best in class in digital sales. The right approach depends on your own bank’s strategy, customer base, and technology roadmap.

Begin with some no-regrets steps. Identify your strategic priorities as a bank: what needs you wish to serve, what products you have to meet those needs, which market shares you want to grow, and which customer segments to target. Then optimize your existing stack. Put people who are experienced in delivering digital campaigns in key roles, deliver campaigns more quickly, and improve governance.

Next, turn your attention to deeper improvements. Build the analytics engine and use it to drive digital traffic along the sales funnel. Start with one customer segment and a simple high-volume product, one distribution channel and messaging format. Build what you need, and quickly learn and scale from there. Over time, add customer segments and products, and build out the stack. In our work, we have seen programs start delivering end-to-end capabilities in six to nine months. It doesn’t need to take years.

Your efforts to increase digital sales will have the best chance of succeeding if they are part of a broader digitization strategy—that is, if you are also building capabilities and skills to support a dramatically improved customer experience. In addition, your digital development needs to focus on customer advocacy and the structural lowering of costs. And it helps if you have an ongoing program to explore new tech-led business models and revenue streams, including revenue streams outside of your core business.

But their low levels of digital sales mean that most banks should make it a priority—all on its own—to increase their readiness to sell more products digitally. Remember that with every passing day, your customers’ expectations of a great digital experience are increasing. And as in any race, you can’t win if you haven’t even qualified to compete.

The right approach depends on your bank’s strategy, customer base, and technology roadmap.