Agriculture companies face an urgent imperative to implement automation and artificial intelligence (AI) in their operations. The economics of the industry demand it. Agribusiness is coping with rising labor costs, high labor turnover, and increasing costs from food loss and waste . The consequences of the COVID-19 crisis, including virus outbreaks in processing and packaging facilities and the related shutdowns, have intensified these challenges. Meanwhile, food commodity prices have not increased to offset the higher costs, resulting in compressed margins.

A transformation focused on automation and AI can realize returns faster and with lower capex than a wholesale redesign of operations. It is also more effective than implementing traditional lean approaches that capture only incremental improvements in process efficiency. With thoughtful implementation of automation and AI, agriculture companies could see results within one year.

Several industries, including automotive and industrial manufacturing, have already embraced digital operations to enable more profitable and efficient production amid rising labor costs and talent short-ages. Although agribusiness has trailed behind, leading players in the industry are starting to tackle the challenges of adoption at scale. To remain competitive, other players must apply the lessons learned from the frontrunners’ success.

The Case for Digital Operations

Many agriculture companies are struggling to make ends meet. A high-level look at the agriculture industry’s economics shows why margin pressure has intensified.

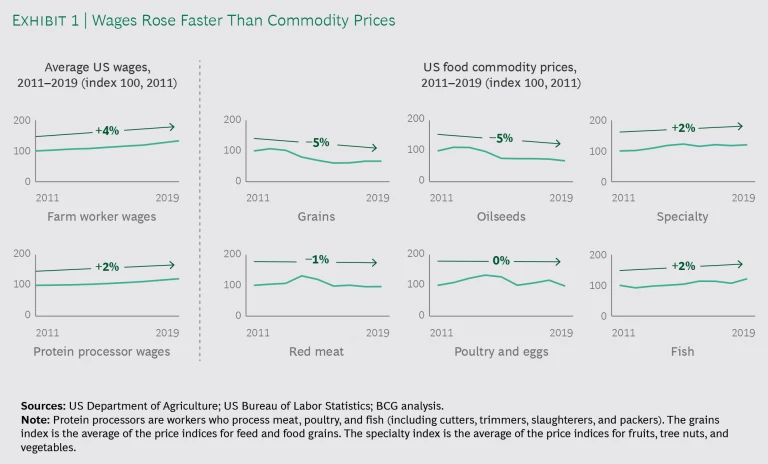

- Labor Costs. From 2011 through 2019, labor input costs generally rose faster than food commodity prices in the US. The result has been compressed margins across the industry. (See Exhibit 1.)

- Labor Turnover. The industry’s labor turnover rate is high—40% to 70% of employees are replaced annually. The lack of a consistent, predictable workforce makes it hard for agriculture companies to meet demand efficiently.

- Loss and Waste. Food loss and waste amount to more than $1 trillion annually, according to a BCG study . Agricultural production and processing account for a significant share. The biggest sources of loss and waste are fruits and vegetables, especially in the harvesting stage.

- Workplace Safety. Meat processing, for example, has the highest worker density of any US manufacturing industry (3.2 workers per 1,000 square feet). Coronavirus infections closed down multiple plants in the early summer, resulting in meat shortages. Although plants have reopened, operations are still hampered by the need to use protective equipment and observe distancing procedures. Even prior to the pandemic, meat processing was among the more hazardous jobs in the US, with 4.3 injuries per 100 workers annually, resulting from dangerous equipment and ergonomic issues.

The pandemic has accelerated companies’ efforts to address these challenges not only to keep operations profitable but also to keep them open for business. Digital technologies, especially automation and AI, offer the most effective solutions. The reduction of manual work streamlines processes, reduces waste, and improves safety. It also allows companies to redeploy people to more value-adding work. The amount of capital investment that is needed for digital technologies is lower than what’s required for a full-scale redesign of operations, and the time frame for achieving a return on investment is measured in months, not years. Lean approaches can lay the groundwork for deploying automation and AI by driving process efficiencies, but they are not sufficient by themselves to generate the step-change improvements called for in today’s environment.

Leading Players Are Pursuing the Opportunities

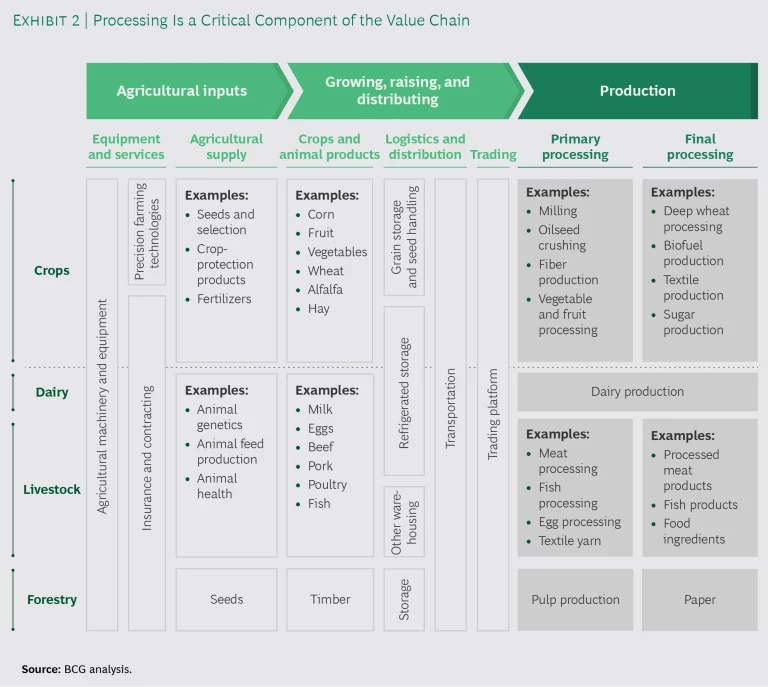

Plant and protein processing are critical components of the agriculture value chain. (See Exhibit 2.) Recognizing the value of digital operations, leading players in these value chain segments are pursuing opportunities that other industries have already been capturing for years.

Plant Processing. Specialty crops (such as fruits and vegetables) have seen the highest levels of automation. Growers and processors benefit from higher market prices for these crops, and they have directed a share of their profits to technology investments, such as equipment for berry harvesting and apple sorting. Leading companies are using automation in combination with analytics to improve equipment performance.

Broader adoption beyond specialty crops has been slower, and smaller companies in the fragmented market lack the scale to invest efficiently. Concerns about the efficacy of automated equipment—such as its ability to adjust to differences among individual fruits and vegetables—have also impeded adoption. Some companies have historically waited to invest in specific automation technologies until their viability has been proven. However, there is an opportunity for companies to move more aggressively by coinvesting with vendors to bring technologies to market.

Larger row-crop processors (including ADM, Bunge, Cargill, Louis Dreyfus, and Glencore) are using heavily automated equipment to process oilseeds and other row crops. We see an opportunity to leverage data from existing equipment to streamline processes even further. Using data analytics to modify equipment settings could lead to greater oil extraction in the crushing process or more customized end products.

Protein Processing. Several leading protein producers have made moves to automate operations:

- Tyson Foods invested $215 million in robotics and automation from 2014 through 2019. The company has created an innovation center to experiment with new technology for processing red meat and poultry, and it is integrating innovations into its existing plant in Emporia, Kansas. The company is also extracting data from equipment on its plant floor to gain visibility into operations, as well as updating its data and IT infrastructure.

- Maple Leaf Foods has invested in building new, automated facilities for processing red meat. It has created a factory in which it is testing the use of the Internet of Things (IoT), including sensors and smart cameras, to monitor yields and production in real time.

- JBS has invested $100 million in acquiring automation and engineering players (including Scott Technology and Normaclass). The company has started to automate its lamb production facility, and it plans to automate the production of pork and beef in the next few years.

- Smithfield Foods has moved its data from physical data centers to the cloud. It is also among the companies experimenting with using blockchain technology for food traceability in shipping as well as for certification and safety. (See the sidebar “Automation in Action: Traceability.”)

- Norway Royal Salmon (NRS) is using automation and AI to collect salmon production data and streamline its operations. The technology, developed by NRS in partnership with Microsoft, uses underwater cameras to collect images of salmon in their pens. An AI algorithm then estimates the fish biomass and counts the fish population. Employees need to make fewer trips to the pens, which enhances their safety and reduces operational costs.

- Cargill’s protein business in North America is pairing digital twin simulation capabilities and machine learning. Jon Nash, who leads the business, told us: “We are using this digital twin capability to better understand complex tradeoffs in our operations and evaluate future scenarios for how to optimize production.”

Automation in Action: Traceability

For example, Nestlé and Austral Fisheries have piloted OpenSC, a technology-enabled platform launched by the conservation organization WWF-Australia in partnership with BCG Digital Ventures. The platform uses such tools as data science, machine learning, and blockchain to enable businesses and consumers to verify claims about sustainable and ethical production and to trace products throughout their supply chains. Nestlé has used the platform to trace milk from farms and producers in New Zealand to its factories and warehouses in the Middle East. The platform has enabled Austral Fisheries to trace Patagonian toothfish from catch locations in Antarctic waters across its supply chain to customers in Asia, Europe, and the Americas. Although achieving this degree of visibility is difficult, it represents a largely untapped opportunity across the agriculture value chain.

Despite the early success stories in automating plant and protein processing, many players are still finding it difficult to implement digital operations at scale. BCG has identified a number of the challenges. The most significant are a lack of investment in change management, the existence of silos across traditional IT and operations technology (OT) areas, and insufficient internal digital capabilities to build and scale solutions.

Four Steps to Capture the Value

An implementation program starts with a compelling vision that guides the development of agribusiness solutions and a digital operating model. New capabilities and talent are essential to support the effort.

Set a clear and compelling vision. Establish an ambitious but achievable vision and integrate it across functions. A successful vision can express a variety of objectives—such as enabling a broader strategy, attaining a competitive advantage, improving customer service, increasing speed and resilience, or reducing costs—for transforming operations.

A clearly defined vision unites the company behind a common objective, sets the right ambition level, and encourages innovative thinking. Because people at all levels understand what matters most, resources can be allocated more effectively. Ensure executive agreement and sponsorship in order to reinforce commitment and galvanize the company to act.

Develop a strong portfolio of solutions. Select solutions that will help the company achieve the ambition set out in the vision by addressing the business’s needs. Avoid the trap of investing in the latest hot technology and then looking for ways to apply it.

Three categories of solutions are essential:

- Digital Processes. These applications should increase data availability and transparency and improve process efficiency to enable real-time decisions and reactions. They will require removing paper-based activities from the company’s operations.

- Data Science and Production Steering. These solutions should optimize agricultural production, processing, and planning using data-driven insights.

- Next-Generation Automation. These applications should improve safety, efficiency, and throughput in the plant.

The selection of solutions should be informed by a strong understanding of the current state of available automation technology, its readiness to address pain points, and what the company can actually achieve by implementing existing solutions. Many agricultural companies do not even know what is feasible because they have not explored the possibilities.

Start to demystify the technology by assessing how companies in agriculture and other industries are automating their operations. After understanding the current frontier and implementing value-creating technologies, make targeted forays into new technology with a select set of vendors to explore innovative solutions with an acceptable ROI. To implement effectively, develop a clear roadmap to guide rapid piloting and, where successful, deployment at scale.

As companies build up the intellectual property (IP) related to these solutions, it is important to manage vendors carefully. Rather than develop all of their new technology in-house, companies often need to rely on vendors—many of which could or do work with competitors. Companies need to balance the benefits of sharing IP with vendors against the risk that competitors may gain access to it.

Establish a digital organization and operating model. Create a dedicated digital organization that maintains a high level of collaboration with agile teams in business units and operations’ facilities. Hire the necessary new talent—such as data scientists, user interface and user experience designers, front-end engineers, and digital product owners—who can speak fluently about digital technologies and lean operations. This talent may already exist in different areas of the organization today, so assessing what is available internally is a key first step.

Support digital operations with a clear governance and funding model in order to unlock capital for required investments. Make investment decisions on the basis of an integrated portfolio of solutions (instead of funding individual ones) as well as on evidence, obtained from rapid pilots, that solutions clearly deliver value as measured by KPIs.

Put in place the technical infrastructure. Digital solutions need to be enabled by a data and digital platform and by investments in the underlying infrastructure (such as WiFi, mobile devices, and edge computing). This platform should bring together data from factory systems, enterprise systems, and IoT devices into a single data lake. It should also include analytics capabilities and front-end applications in order to allow users to interact with data and facilitate scalable solutions. Additionally, it is essential to integrate OT and IT by connecting factory systems with corporate IT systems, such as for enterprise resource planning and HR management. Integrating OT and IT can be challenging because it often entails managing different decision makers, clashing cultures, and competing priorities.

Applying the Lessons of Experience

We have supported transitions to digital operations across industries and distilled the lessons we’ve learned into the following guiding principles:

- Prioritize a handful of exceptional solutions. Focus on a small number of high-impact solutions that solve issues at the core of the company’s agenda. Concentrate sufficient resources to implement these applications.

- Demonstrate value quickly. Accelerate the pace of work and prove that the company can move fast to capture value.

- Lead from the top down. Prioritize and govern from the top. Set the strategy up front. Establish clear decision rights, and cascade the strategic initiatives into deliverables for the company.

- Start small and scale fast. Don’t be afraid to fail. Launch, fail fast, iterate, and, if needed, stop initiatives. Aggressively scale the solutions that demonstrate value.

- Measure the impact. Clarify KPIs and how the company will measure success. Ensure that the company can quantify the value that it is achieving. Use the KPIs to gauge the success of pilots in order to determine when to proceed with the next set of solutions.

The challenges of automating agricultural processing are significant, but so too are the payoffs from getting it right. Having already applied traditional levers, companies must turn to automation to unlock the next wave of urgently needed improvements. Today’s unique challenges demand nothing less than immediate actions to explore the possibilities and implement solutions.