“My biggest learning as the CEO of Ørsted is always to be ready to look at how you are allocating your capital towards industries where you have long-term growth opportunities, so you don’t end up in industries that are slowly dying. You need to have the bravery to change your capital allocation.”

—Henrik Poulsen, CEO of Danish wind energy company Ørsted, from interview in Børsen, August 2020

The global financial crisis was a time of unprecedented uncertainty for energy and utility companies as the prices of oil and gas fell and electricity demand declined. Whereas most energy companies resorted to typical recessionary strategies involving cutting costs, protecting core activities, and making defensive moves, the Danish utility and energy company Ørsted (then Danish Oil and Natural Gas) instead launched a new strategy to become a leader in renewable energy and supported that strategy with aggressive capital reallocation.

Ørsted significantly accelerated investment in newly identified growth areas: 42% of its investments were allocated to wind farms, even though they only accounted for 8% of profits at the time. It reallocated capital away from legacy businesses, stopping the production of four coal power plants and converting existing plants from coal to biomass. As the first mover into wind energy, Ørsted rode a wave of growth in the industry to become a market leader today.

Capital reallocation becomes even more important in times of crisis—such as the COVID-19 pandemic—when new opportunities are likely to emerge . To shed light on just how important it is, we studied the role of capital allocation in the top 500 US companies during and after the last two financial crises.

The Nature of Postcrisis Growth

In the wake of crises, growth is the primary factor that drives competitive performance. Across the last two downturns before COVID-19, revenue growth contributed 42% of TSR for companies that outperformed their industry over the following five years. A further 39% was due to increasing P/E multiples, which mainly reflect investor expectations for future growth potential.

However, the growth areas after a shock are likely to be different than those that existed before it. Crises often cause a shift in customer preferences, as people are forced to unlearn old habits and adopt new ones. This may accelerate existing trends, such as when e-commerce gained traction as a result of the 2003 SARS outbreak in Asia. Or it may cause new trends to emerge, such as the adoption of more fuel-efficient cars following the oil crisis in 1973. Either way, there is a shift in sources of growth. For example, in the last recession, there was very little correlation between business segments that had above-average growth before, during, and after the

Growth areas after a shock are likely to be different than those that existed before it.

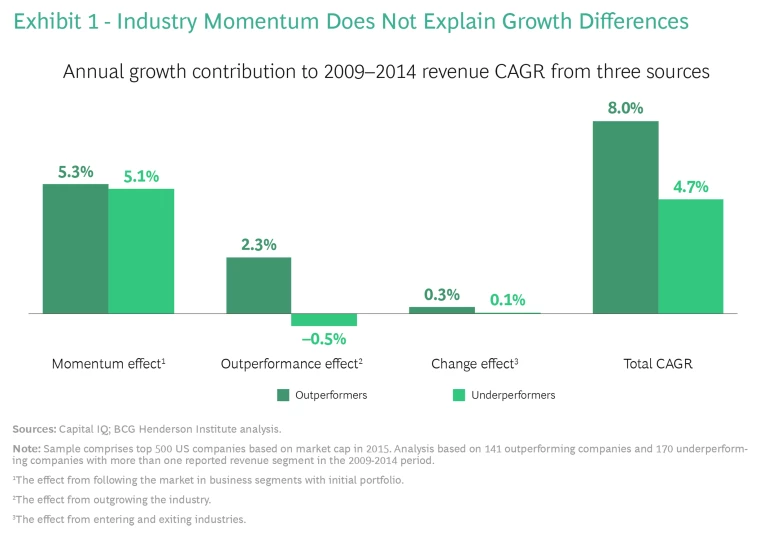

If postcrisis growth opportunities are new, one might assume that what matters is how a company is positioned, with companies having business segments in high-growth industries being advantaged. To test this assumption, we disaggregated each company’s growth into three sources: a “momentum effect” based on the industry growth rate of each of the company’s business segments (weighted by their initial share in the portfolio), an “outperformance effect” from business segments being above or below the industry growth rates, and a “change effect” from entering completely new industries (or exiting

When analyzing the last two recoveries, we find that industry is not destiny. Successful companies had roughly the same momentum growth contributions as their less successful peers, and both groups created little net growth from entering new industries. Instead, successful companies significantly outperformed within their industries. This suggests that new growth opportunities present themselves in all sectors. (See Exhibit 1.)

New growth opportunities are likely to be within specific areas of an industry, rather than across the entire industry. Our analysis shows that 80% of companies’ postcrisis growth is driven by business segments that account for only 40% of their initial revenue, suggesting that differential growth opportunities within industries drive industry outperformance. As an example, the financial crisis caused a shift within the banking industry, with lower demand for traditional retail banking but higher demand for asset management and wholesale banking. Wells Fargo took advantage of this increased demand and as a result achieved 87% of its recovery growth in these areas, which in 2009 had accounted for only 41% of revenues.

Though most successful companies did not change the industries they operated in, that does not mean they focused only on their core offerings. Instead, outperformers were more likely to realize growth in peripheral business segments of their portfolio: 25% of outperformers’ growth came from outside their core, compared with 9% for underperformers. An example is American Express, which made strategic bets during the financial crisis to become stronger within financial services segments rather than its core business of consumer finance. As a result, the company realized only 45% of its recovery growth from its core consumer finance business, with the remaining 55% coming from new opportunities in other parts of its portfolio, such as digital payment solutions. This suggests that companies should explore the full range of new growth opportunities—and be willing to shift their priorities as necessary.

Capital Reallocation During Crises Fuels Postcrisis Growth

In a postcrisis environment where growth drivers have shifted and may be found in different areas of a company’s portfolio, leaders need to allocate capital against these new opportunities. Accelerating growth in certain areas may require developing new products or features, building or retooling factories, and creating new sales and marketing channels, all of which require investment. Crucially, by the time a recovery is in full swing, it may be too late to gain an advantage—businesses need to reallocate capital during a crisis to gain advantage after it.

Actively reallocating capital during a crisis leads to better performance in the recovery.

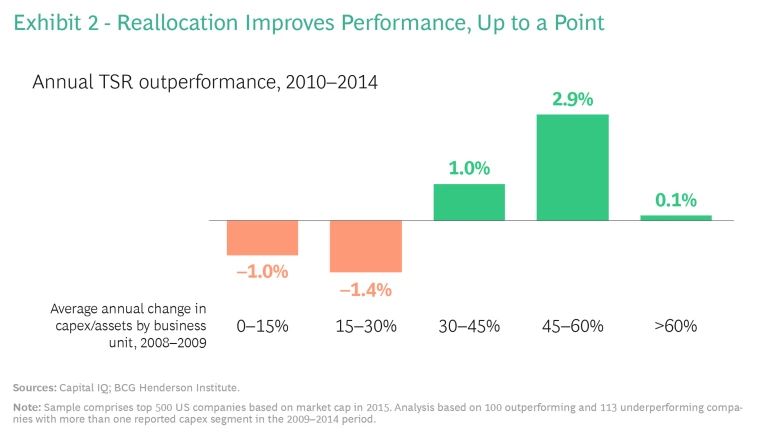

To analyze how actively companies reallocate capital (as opposed to sticking with their existing mix of investments), we measured the absolute year-to-year change in capex/assets ratio across a company’s business

Tyson Foods, the US meat producer, provides a good example of this practice. During the financial crisis, the company grew only 2% annually as consumers switched away from beef and prepared food segments to consume pork and chicken, which are cheaper types of meat. Anticipating that consumers would switch back to beef and prepared food in a recovery, and expecting a structural increase in demand in China, Tyson Foods nearly doubled investment in those segments during the crisis, reallocating capital away from the chicken segment. As a result, its growth rate increased by 11 pp annually in beef and 4 pp in prepared foods. This helped drive above-industry-average growth for the company as a whole in the five years following the crisis and 28% annualized TSR, 8 pp higher than that of its peers.

Of course, more reallocation improves performance only up to a certain point. We find that 30% to 60% year-over-year changes during a crisis was the optimal range—companies that go even further did not perform as well. (See Exhibit 2.) Changing a portfolio too much and too quickly can be risky.

Few Companies Reallocate Capital Decisively

Despite the importance of capital reallocation during a crisis, many companies don’t appear to be using this lever amid COVID-19. In a BCG survey conducted in May 2020, only 38% of companies said they are modifying investment plans to target new growth drivers, and only 21% are investing in new business models. This is not an aberration: many companies tend to follow simple rules of thumb for capital allocation that prevent them from shifting their investment patterns decisively.

First, many companies tend to roll over their historical allocation from year to year. From 2004 to 2015, more than half of all companies changed their average capex/assets ratio within segments by less than 25% (significantly lower than the optimal rate). This is in line with recent academic research on capital reallocation, which also found that companies reallocate capital to a degree less than

Second, many companies appear to follow a heuristic of proportional allocation, allocating capital on the basis of business segment size instead of future potential. Roughly half of all companies show signs of using proportional allocation between 2004 and 2015, judging from their nearly identical capex/assets ratios across business units. This indicates that leaders may be more inclined to let business units make their own bets rather than setting an overall prioritization for the company. Though this might be a simple and convenient way of allocating capital, it is not an effective strategy for maximizing growth and returns.

Finally, to avoid having to make tough decisions, companies may be tempted to just increase their level of capital investment. However, this is not a silver bullet: our analysis shows that both during a crisis and in the subsequent recovery, the level of investment alone does not predict success. In fact, underperformers had a capex/asset ratio 20% higher than that of outperformers during crises, but this did not translate into higher growth. Prioritization and focus appear to be more important in practice.

These heuristics are symptoms of two deeper flaws in capital allocation. First, they demonstrate a lack of deaveraging, assuming that one rule or target is sufficient for the entire organization. And second, they demonstrate a focus on the current state of the business instead of on future sources of potential growth.

How to Improve Your Capital Allocation

Because reallocating capital becomes even more important in times of crisis, leaders today need to master the art of taking a deaveraged, future-oriented approach to capital allocation. A few principles can help leaders avoid convenient but ineffective rules of thumb, invest against promising opportunities, and improve return on investment.

Dynamically reallocate capital from mature businesses to growth areas. In companies with multiple segments, there will always be business units at different stages of maturity, with different and shifting investment needs. This means that in order to optimize for growth, companies need to continuously adapt capital allocation between business units, subsidizing the growth of some business units with the mature cash flow of others. Reverting to rules of thumb like historical or proportional allocation will limit the growth of high-potential business units.

Differentiate allocation between temporary and permanent opportunities. Crises lead to a mix of temporary and permanent shifts in consumption patterns, and different strategies are needed to leverage each. For instance, investments in temporary shifts need short payback times to be worthwhile and should be revisited often, while investments in permanent shifts should have longer time horizons and focus on shaping the future landscape. Companies need to use new techniques to understand shifting behaviors —like studying high-frequency data and spotting anomalies—and calibrate investment decisions accordingly.

Don’t demand certainty and precision when assessing investments. Prospective investments in new growth pillars are intrinsically uncertain—less established areas of the business will often be disadvantaged with respect to data availability and quality to base projections on. Compounding this uncertainty, companies have significant potential to shape new markets, which introduces reflexivity in predictive investment models. This means companies with strict decision rules based on ROI calculations may not invest against less easily quantifiable opportunities, defaulting instead to familiar and predictable bets that may not move the needle. Companies should take a broader view when evaluating opportunities—such as considering how much they will learn about the world from an investment, whether it will provide more optionality in the future, and to what extent the environment can be shaped to the company’s advantage—which may help strengthen the case for an investment if there is massive uncertainty on returns.

Establish agile allocation processes that can bypass the standard annual cadence. Finally, companies need to be able to invest as opportunities arise and reevaluate investments more frequently than annually. Research has shown that formalized processes improve capital

By reallocating capital today toward future long-term growth opportunities, companies can position themselves for creating differentiated growth, which will ultimately determine their success in recovering from the COVID-19 crisis.