In December 2019, Russia’s Gazprom opened the “Power of Siberia” pipeline to China, to significant media and industry interest. The 8,100-kilometer-long pipeline has been a substantial undertaking and will significantly impact China’s gas market, providing up to 10% of China’s entire gas supply by 2022.

Equally important, though less high profile, was Beijing’s announcement during the same month of its long-awaited decision to create a holding company to own and manage the country’s oil and gas transmission and distribution infrastructure. This announcement is an important indicator that while the journey to natural gas market reform in China has been long and slow, progress is accelerating.

A Single Pipeline Operator

Chinese demand for natural gas is growing rapidly. The country is now among the world’s top three consumers of natural gas and is the fastest growing source of demand; from 2017 through 2019, China accounted for around 40% of global growth in liquefied natural gas (LNG) consumption.

Boosted by China’s push to improve urban air quality, which includes establishing emissions reduction targets and policies that require switching from coal to gas, demand for natural gas is expected to rise by more than 8% per year through 2025. The high cost of gas and questions about the availability of accessible supply, however, raise concerns about the sustainability of longer-term growth in Chinese gas demand.

China’s domestic demand for natural gas is expected to rise by more than 8% per year through 2025.

The country’s establishment of the National Oil & Gas Pipeline Group is an important development in tackling these obstacles and meeting China’s growing thirst for natural gas—a key driver of global gas markets.

The new state-owned holding company will control the combined pipeline assets of China’s three biggest national oil and gas companies (NOCs)—China National Petroleum Corporation, Sinopec Group, and China National Offshore Oil Corporation. By providing better access to the transmission network, Beijing aims to increase and expand sources of gas supply, develop a broader gas market, and encourage private investment.

Providing better access to the transmission network could make gas more competitive domestically.

It could also bring down the delivered cost of natural gas to customers, making gas more competitive with coal and oil products domestically. In the past, the primary goal of China’s NOCs was to maximize revenue from their own natural gas supply. But an independent pipeline operator would act more like a regulated utility. The Chinese government could incentivize it to expand the network, setting tariffs just to recover invested capital, not to maximize the company’s own revenue.

Opportunities Ahead

There are still big questions about how the holding company will operate. Policymakers have not yet set rules governing how the new pipeline operator will function, nor have they announced how or when third parties will gain access to the network. Nevertheless, we see significant opportunities for natural gas industry operators and investors as Chinese policymakers continue to liberalize the country’s natural gas market.

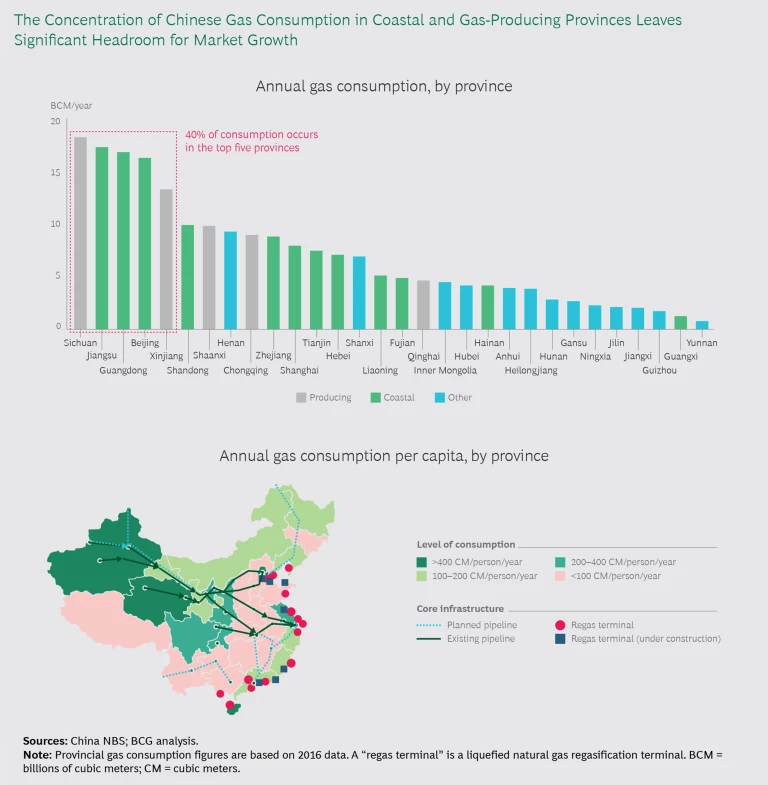

Access to Gas. In the past, China’s NOCs developed their gas pipeline infrastructure to optimize production and supply. As a result, the existing transmission network does not well serve vast swathes of the country—particularly inland provinces and southern noncoastal regions. (See the exhibit.)

Putting the network in the hands of an independent operator with the ability and incentive to raise the capital needed to meet the high costs of network expansion could promote more rapid pipeline development, especially in areas that contain untapped potential for market demand growth. This in turn could be a key driver of future market growth for global LNG suppliers and operators within China.

Downstream Investment. Once new gas players have more control over their midstream businesses—through improved pipeline access—they are more likely to make further investments along the value chain in downstream assets across China. For example, companies may expand into natural gas marketing or develop integrated gas value chain businesses in industrial or petrochemical sectors. The business opportunity is substantial, given that BCG estimates that the gross margin pool in midstream and downstream gas within China could grow to more than $12 billion by 2025.

Gas players that have more control over their midstream businesses are more likely to invest further along the value chain.

For foreign companies, there is a bonus. Beijing is also in the process of easing ownership rules in several parts of its economy, but regulations and tax policy make it challenging for foreign investors to repatriate capital outside the country. China’s gas market overhaul would enable foreign players to redirect their investments into new market growth opportunities in gas.

Although an administrative step toward establishing a gas holding company may not be particularly attention grabbing, it offers significant potential for delivering on Beijing’s stated aim of making China’s skies blue again by replacing coal with gas.

For an extensive overview of the global gas market and key trends, consult Global Gas Report 2019 .