The significant potential of advanced analytics (AA) and artificial intelligence (AI) in the consumer packaged goods (CPG) industry is becoming increasingly clear. Over the past several years, some leading CPG players have strategically deployed AA and AI with impressive results—boosting revenue, improving productivity, and enhancing the effectiveness of their marketing expenditures. The key to their success is the ability to seamlessly The Bionic Company at scale. That ability will become more critical in the months ahead as companies grapple with how to anticipate, adapt to, and shape changes in consumer demand and behavior in the wake of the COVID-19 pandemic.

Many CPG companies, however, are struggling to effectively harness AA and AI. Though often pros at branding—with first-rate marketing, advertising, and product innovation capabilities —they are typically less advanced in implementing large-scale analytics or technology transformation programs. This stems in part from the decentralized and matrixed nature of many CPG organizations. The structure has led to marketing and product development prowess, but it can hinder a company’s ability to invest in data and analytics platforms or to build the agile ways of working necessary to scale them. At the same time, many CPG companies lack consistent access to the most granular levels of sales data (such as retail sell-in and sell-out data) or first-party data (information on individual consumer purchasing behavior) on their end consumers, gaps that can discourage companies from aggressively investing in AA and AI applications.

CPG companies that are winning in AA and AI have focused on executing in critical areas, including three that are particularly challenging: developing the right talent base and operating model, ensuring effective data strategy and governance, and building the right data and digital platforms . Effective deployment of scaled AA and AI solutions will be a source of competitive advantage during the economic shock created by the pandemic and the recovery that will follow. CPG companies that have yet to master these tools should take a page from the playbooks of those who have already shown how it can be done.

Effective deployment of scaled AA and AI solutions will be a source of competitive advantage during the pandemic and the recovery to follow.

The Power of Advanced Analytics and AI in CPG

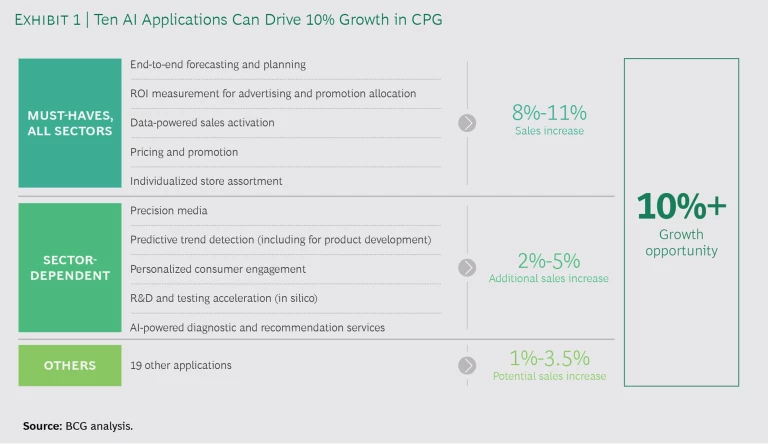

There is little doubt that AA and AI offer significant potential for CPG companies. A 2018 study by BCG and Google identified the ten most promising AA and AI applications in CPG , including end-to-end forecasting and planning along with ROI measurement for advertising and promotional spending. According to the report, companies that deploy these ten applications at scale can boost revenue by at least 10%. (See Exhibit 1.) Given the extremely challenging and uncertain macroeconomic environment, some of those applications will become even more vital, including predictive trend detection and the demand-forecasting, inventory optimization, and supply chain risk-modeling activities within end-to-end forecasting.

The potential value of AA and AI has been confirmed by success stories from early adopters:

- A global fast-moving consumer goods (FMCG) company deployed an AI-driven demand-forecasting model using internal and external data across key categories and markets. The new approach drove an increase in forecasting accuracy of 5 to 15 percentage points and helped optimize sourcing, production planning, and transportation to save more than $40 million by avoiding write-offs and other inefficiencies. They are now implementing a similar AI-driven approach in their supply-planning efforts to create an end-to-end solution.

- A large, global FMCG company used advanced-analytics modeling to optimize its process for allocating marketing spending. This effort went well beyond traditional approaches, implementing common metrics to assess and compare ROI across brands, markets, and media channels and creating a dynamic model to assess different potential scenarios for allocating that spending. The model helped the company make better spending decisions and led to an increase of more than 10% in ROI on the company’s marketing expenditures during the first 12 months.

- A leading multinational beverage company used AA and AI to improve the way it served more than 500,000 individual retail accounts. With a combination of internal and external data, the company built an AI model that could predict how various sales programs and initiatives would impact sales for an individual account. That allowed the company to move away from regional strategies, which had uniform account programs for specific locations, and to develop highly customized and localized account management approaches instead. A pilot of the project found that accounts served using the new tools had a volume increase of nearly 2% compared with accounts served under the traditional approach. A broader rollout of the model has yielded significant sales improvement.

- A leading beauty-focused consumer health company developed several unbranded-content websites and consumer applications to bolster consumer engagement with beauty experts and products offered by the company and by others. The content and applications allowed the company to build a strong base of first-party consumer data and insights, which the company leveraged to develop targeted campaigns and personalized offers. The result: the company improved category and product awareness and increased sales.

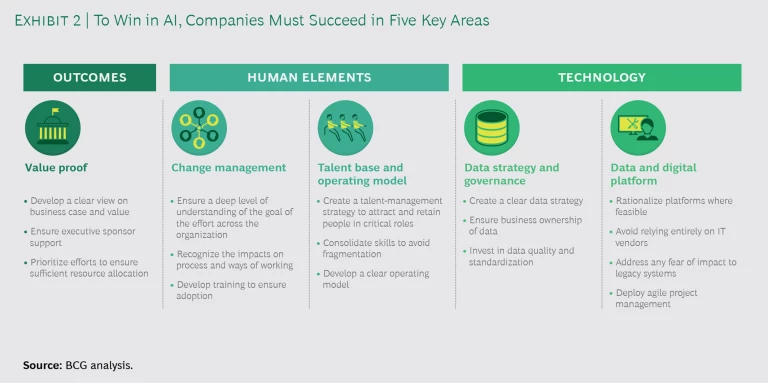

So, what does it take to rack up such results? In general, any company looking to win in the digital age must become bionic—combining technology and the human elements of the business, including new ways of working and talent, to drive a clear set of business outcomes. To win with AA and AI specifically, this means honing capabilities in five areas. (See Exhibit 2.)

- Value Proof. It is critical for companies to develop a clear business case for deploying AA and AI, including outlining the investments required and the projected upside. They should first identify the issue or challenge they want to solve and then develop the tools and solutions to do so. Too often, AA and AI efforts are not closely tied to business objectives and yield limited impact as a result. Once a series of AA and AI solutions have been identified, they must be prioritized through the development of rigorous business cases to ensure proper focus and allocation of resources.

- Change Management. Companies must help employees shift away from viewing AA and AI efforts as the domain of the IT department and toward seeing them as central to the strategy and direction of the business. Consequently, AI efforts should not be developed narrowly in an IT or analytics function silo, but rather should be led by frontline business leaders in partnership with the company’s technology and analytics experts. The findings from the 2019 MIT Sloan Management Review–BCG AI Global Executive Study and Research Project indicated that AI efforts led by the CIO are about half as likely to be successful as those led by the CEO or a chief digital officer. The reason? Winning strategies in AI reflect the rule of thumb that 10% of the effort is about developing the right algorithms; 20% concerns building the right technology to support it; and the remaining 70% is related to change management and business process transformation. As a result, C-suite sponsorship and support for an AI effort is needed to ensure that those running the business units embrace and adopt the AA and AI tools.

- Talent Base and Operating Model. Leading adopters create a clear strategy and process for attracting, retaining, and deploying the right people, including data scientists, engineers, software developers, and IT architects. They also develop a clear operating model that supports the development of scaled AA and AI solutions. They avoid an overly distributed model that leads to fragmented and subscale projects and embrace agile ways of working, which leverage cross-functional teams and rapid sprints to quickly develop AA and AI solutions.

- Data Strategy and Governance. Data is the foundation for AA and AI, and early adopters have identified a cohesive data management strategy to ensure they have access to high-quality, standardized data. By developing the right data-management strategy and governance, companies can leverage broad, uniform data sets in AA and AI applications that cross traditional brand and market organizational boundaries. Successful companies develop a strategy and governance approach that is initially driven by a few priority projects but is suitable for a broad range of AA and AI applications as well.

- Data and Digital Platform. Companies must ensure that they have the right data and digital platform to support powerful AA and AI applications. Often, this requires rationalizing multiple platforms used within the organization. Companies need to approach this by separating their AA and AI data and digital platform development from the necessary, but often slow, upgrades of their legacy operating and transactional IT systems.

Getting AA and AI Right in CPG

Certain industry characteristics create hurdles for CPG companies that want to execute well in AA and AI. For one thing, many companies have a matrixed organizational structure with business units defined by brand or product, function (such as finance, marketing, or sales), and location. This structure helps CPG companies nimbly identify and address consumer needs in specific categories and markets, but it also creates obstacles when they are trying to drive large-scale or cross-functional transformations, such as the development and deployment of AA and AI.

At the same time, the data and technology strategies and processes of CPG companies are often less advanced than those of businesses in other industries. CPG organizations have historically invested heavily in market and business insights but less aggressively in core data infrastructure and big-data capabilities.

To achieve AA and AI success, CPG companies must focus especially on their talent base and operating model, data and strategy governance, and data and digital platforms.

As a result, while all companies face challenges in executing well in all five areas critical to AA and AI success, CPG companies tend to have particular difficulty in three of them: talent base and operating model, data strategy and governance, and data and digital platforms. Some leading CPG companies are moving aggressively to create winning approaches in each area. (See “One Company’s Winning AI Roadmap.”) Our work with, and study of, those successful early movers shows what CPG companies should do to surmount obstacles and successfully scale AA and AI.

ONE COMPANY’S WINNING AI ROADMAP

ONE COMPANY’S WINNING AI ROADMAP

A leading fast-moving consumer goods company took aggressive steps to accelerate its AI efforts. In doing so, the company focused on three major challenges. The company’s actions have helped put it at the forefront of leveraging AA and AI while transforming its technological foundation to improve speed and agility.

Organizational Challenges

Historically, the company’s IT operation focused on serving the needs of each individual business entity, for example a region, market, or business unit. That structure led to large numbers of AA and AI projects (some of which were redundant or never moved out of the proof-of-concept phase) and discouraged the development of scalable solutions. In addition, IT was poorly equipped to attract, screen, and retain the data scientists, software engineers, and other experts required to scale AI projects.

To solve this problem, the company created a global AI hub consisting of one team in each of the company’s three primary regions. The global hub cut across the matrix and was responsible for supporting the acceleration of AI use cases selected through a centralized prioritization and governance process. The projects were driven by agile, cross-functional teams—including data scientists, engineers, software developers, and UI specialists from the global AI hub as well as managers from the frontline business—that rapidly built, piloted, and scaled up each AI solution. In the first few months, the company’s executive committee prioritized about 10 AA and AI projects, with efforts coordinated among the three regional teams.

A Lack of Structured and Uniform Data

Individual entities within the organization had developed their own taxonomy for just about everything—consumers, products, marketing expenditure categories, and so on. That lack of uniformity made it difficult to pool and use data in AA and AI. The company’s second move, therefore, was to identify roughly 20 domains that covered all the key data of the company. It then set up a centralized data management and governance office and brought together a group of businesses leaders who were given responsibility for certain domains. The new office and the data domain owners harmonized taxonomy at the top two levels of the data hierarchy for each domain, while regions and markets were given latitude to use their own taxonomy for the lower two levels of data.

Technology System

The company had too many disparate core systems, with different regions and business units running their own systems for such functions as sourcing, HR, and finance. At the same time, business units were developing hundreds of applications that often could not be used by, or connected to, applications within other business units. The company addressed this third challenge by reducing the number of core systems and putting rules in place to ensure that applications were developed in a way that would allow them to interface with applications built by other units.

Talent Base and Operating Model. To win in AA and AI, CPG players need to address the barriers to developing the right talent base and operating model created by their decentralized, matrixed structure.

To quickly scale across this matrix, CPG companies often conduct AA and AI efforts in a center of excellence (COE) under such global functions as finance, operations, and IT. The COE model involves establishing AA and AI teams in certain regional locations rather than in every business unit. That structure reduces the burden of recruiting top talent in areas such as data science, user interface and user experience design, and product management because the company isn’t trying to fill positions in those areas for every individual business unit. And potential recruits are likely to find that working in a COE, which includes a community of analytics experts and abundant resources, is more dynamic and compelling than working in a siloed business unit. These advantages are particularly important early in a company’s AA and AI journey because it will need to quickly expand its bench of AA and AI talent. The COE model, however, does have some potential downsides, including the risk of creating “stranded” technology that is too removed from frontline markets, consumers, and competitive dynamics. To overcome this, CPG organizations must cultivate the right relationship between the AA and AI team and the business’s frontline.

Many companies have fostered such relationships by implementing agile ways of working and collaboration—leveraging cross-functional teams that include key stakeholders from the business, as well as analytics, data, and technology experts. This improves the relationship between the business and a chosen function and increases the speed of both communication and delivery of a solution. Developing this symbiotic relationship between the AA and AI teams and the frontline business can not only elevate the profile of the teams but also helps frontline users to understand, and be comfortable with, their tools. That familiarity ultimately becomes a critical enabler to scale the efforts more broadly.

Beyond establishing agile ways of working and cross-functional teams, companies can also establish and deploy “SWAT teams” from COEs into specific markets and business units to provide support in developing high-potential, scalable AI and AA solutions. By providing on-the-ground support to ensure the sustained, widespread rollout of these solutions, such teams further increase the connection of AA and AI efforts to the frontline business.

Over time, the operating model must typically evolve in order to make certain that AA and AI solutions are deployed and sustained across the company. Sometimes that will mean rolling out a uniform solution in all markets, while in other cases it will mean adapting solutions to fit local conditions. In order to do both well, companies will need to either ensure that the central support team maintains its strong market connections or establish in-market AA and AI teams to help develop market-specific applications over time as capabilities mature.

Data Strategy and Governance. CPG companies face significant data challenges. First, they often have limited access to granular and consistent sell-out data across channels and markets, as well as limited—or even no—access to first-party consumer data. These challenges have historically been addressed by purchasing data from third-party providers. That data, however, is often incomplete and inconsistent. Data for individual stores, for example, may be available in some markets, while in other markets either such breakdowns are unavailable or entire categories of retailers are not captured. But even without the most granular sales or first-party consumer data, CPG companies can often develop a range of AA and AI applications that deliver value.

Second, many CPG players today have lax data management, owing in no small part to their decentralized, matrixed structures. Each unit typically leverages different data sources and systems, often with unique taxonomies and levels of granularity. This means that, over time, these units have established their own data management processes, leading to a wide variety of taxonomies for products, ingredients, marketing channels, and the like across the company.

Early adopters have taken steps to address both issues. A number of CPG companies, for example, have been pursuing partnerships with retailers to gain access to more granular sell-out data. Even in those cases, however, it is difficult to access first-party consumer data. That’s driving some CPG companies to develop loyalty programs, direct-to-consumer service offerings, and content platforms as a way to access first-party data.

To solve the data management challenge, successful early adopters of AA and AI have established centralized governance of their data layers and focused on data standardization. In particular, they have undertaken major efforts to standardize taxonomy for the information that is required for high-priority AI and AA solutions. This has helped organizations to overcome the challenges created by individual business units using different terms or even different data sources.

Data and Digital Platform. CPG companies often have a fragmented systems landscape made up of separate legacy core systems (including enterprise resource planning and customer relationship management systems) used by individual business units or locations within the matrix. Each unit then creates custom applications that run on these core systems. As result, companies struggle to access and pull uniform data from the disparate core systems and applications for use in scalable AI or AA solutions.

To address these challenges, early adopters have built data and digital platforms that sit above those disparate core systems, which allows them to extract key data for use in AA and AI applications. This creates a scalable platform for AA and AI applications and digital innovation while also helping to create a bridge from legacy to modernized core systems. The development of such a platform typically begins in large, data-rich markets with a clear sequence planned to pull all markets onto the platform.

Building the New Bionic CPG Company

Early adopters of AA and AI in CPG have racked up impressive wins and revealed the potential of these new tools and solutions. This success, however, is just the beginning. As CPG players expand the ways they leverage AA and AI, momentum will build; and a smart operating model with a strong talent base, careful data governance, and robust digital platforms will deliver increasingly impactful results.

Those companies still in the early stages of developing their AA and AI strategies should look to the examples set by their leaders and consider some critical questions:

- What are the most important and valuable business outcomes that we can drive with AI and AA? Where are the compelling business cases?

- Do our efforts have sufficient business and leadership buy-in to really drive the process and behavior changes required to ensure adoption and capture value?

- How are AA and AI teams organized in the company today, and what operating model will foster high-impact, scalable solutions?

- Are we adopting new agile ways of working in our approach to rapidly prototype, pilot, and scale?

- Do we have the data platform, strategy, and governance to enable multiple AA and AI solutions at scale?

- How can we use a data and digital platform to deliver value with AA and AI while simultaneously upgrading or rationalizing our core systems?

As companies answer these questions for themselves, they can begin to prioritize and sequence efforts to build AA and AI solutions and the capabilities required to deliver them. When that happens, the promise of AA and AI in CPG will become a reality.