The

upstream oil and gas (O&G) industry

is in the midst of a value-creation crisis and has for the past decade delivered subpar shareholder returns. The demand collapse following the pandemic outbreak is both enhancing the urgency and acting as a catalyst for change. To survive, O&G

To evaluate the industry’s current digital maturity, BCG recently conducted a

Digital Acceleration Index (DAI) study

of 46 O&G upstream operators, using a combination of online surveys and deep-dive

O&G Lags in Value Creation and Digital Maturity

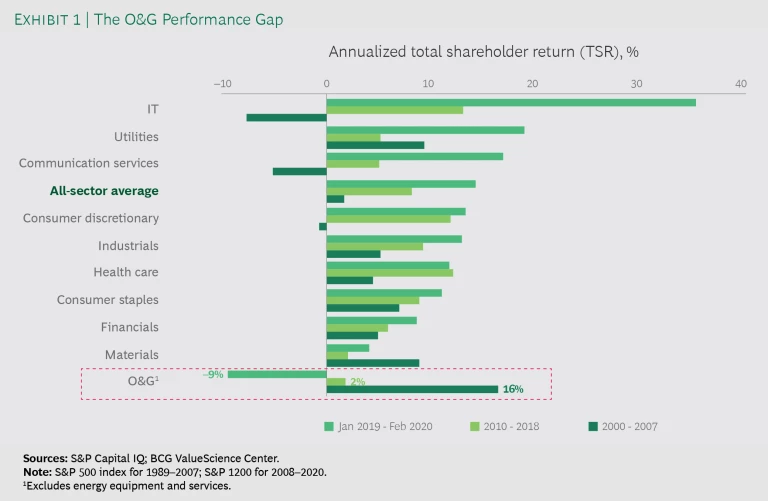

While there is new urgency for transformation to improve performance, the industry has been delivering subpar value to investors for years. From 2010 to 2018 the O&G companies on Standard & Poor’s global 1200 list generated only 2% annualized total shareholder return (TSR), the lowest among the ten industries measured. And from January 2019 to February 2020, O&G TSR fell 9%, making it the only industry to actually destroy shareholder value. (See Exhibit 1).

O&G’s poor performance compared with other industries also shows up in the DAI results. As part of the survey we scored companies to place them in one of four categories:

- Digital starters—companies that are addressing digital topics based on ad hoc demands but are usually not aligning them well across business units. These accounted for 22% of O&G companies, compared with 9% across industries in the DAI database.

- Digital literates—companies that are digitizing processes but doing so mostly in functional silos. These accounted for 50% of O&G companies, compared with 38% across industries.

- Digital performers—companies where business units are jointly building capabilities across all areas, managing digital in an integrative manner, and building and commercializing digital initiatives. These accounted for 28% of O&G companies, compared with 40% across industries.

- Digital leaders—companies that are creating significant value through digital and have embedded it throughout the company, in areas such as innovation, value proposition, tech, operations, and strategy. These accounted for 0% of O&G companies, compared with 13% across industries.

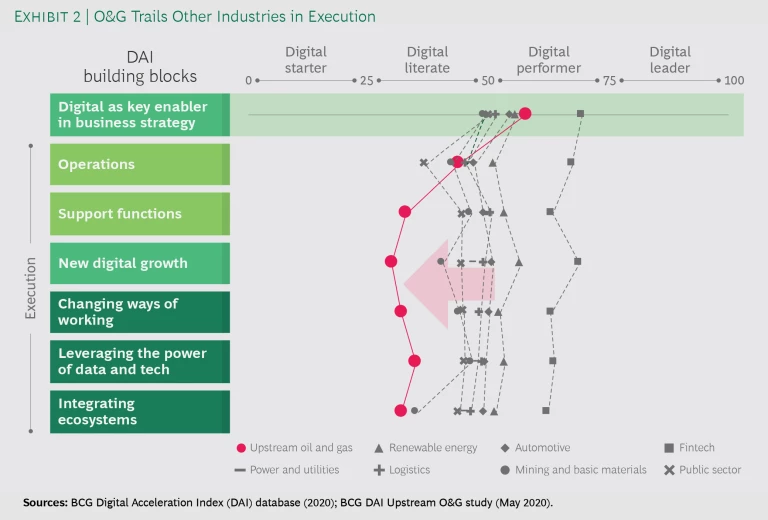

The underperformance is somewhat surprising—particularly in that no O&G company is a digital leader—given that nine out of ten respondents said they have a digital vision for the company and two out of three said they have clearly defined digital ambitions. Moreover, many O&G companies said that digital is a key enabler of their business strategy. So where is the disconnect? Why the poor performance? Part of the explanation may be that only one in six O&G executives said that the digital strategy is fully understood throughout the company.

This lack of understanding clearly weakens the ability to move from strategy to execution. On five of the six DAI execution measures, the O&G industry trails all other industries that have been studied. (See Exhibit 2.) Less than 15% of O&G respondents said that digital has substantially contributed to value creation, 90% are not scaling their solutions across organizational and geographical silos successfully, and most are struggling to assign the right ownership for the adoption of new digital solutions. These frustrations are starting to show. As one executive put it, “Digital in upstream O&G has in the past delivered a lot of promises, but not a lot of value.”

The DAI survey sheds some light on the factors underpinning these execution issues. First, only one out of three companies has strong digital champions to lead the cultural change; this is a serious problem given that most large O&G companies are biased toward command-and-control cultures and tend to value predictability over agility. But agility is critical for digital success. Another important issue is digital talent: 80% report being dissatisfied with their ability to attract and retain digital talent. Finally, many feel that execution has been hampered by a piecemeal, incremental approach to digital improvements that doesn’t fundamentally rethink ways of working.

There are, of course, some pockets of excellence in the industry. For example, within the field of big data analytics, seismic interpretation has contributed to the development of supercomputing, and many O&G companies are quite sophisticated at leveraging digital technologies to monitor the state of equipment and, in some cases, predict failures. But most of these pockets of excellence are very specific within single disciplines. To unlock the full value potential from digital initiatives, companies must reinvent and optimize core workflows end to end. To do so they need to liberate data across silos using horizontal technology layers and deploy multidisciplinary operating models that can make fast, effective decisions. Tellingly, less than 10% of the companies in our study have leveraged data in this way.

Digital Maturity Links to Value Creation

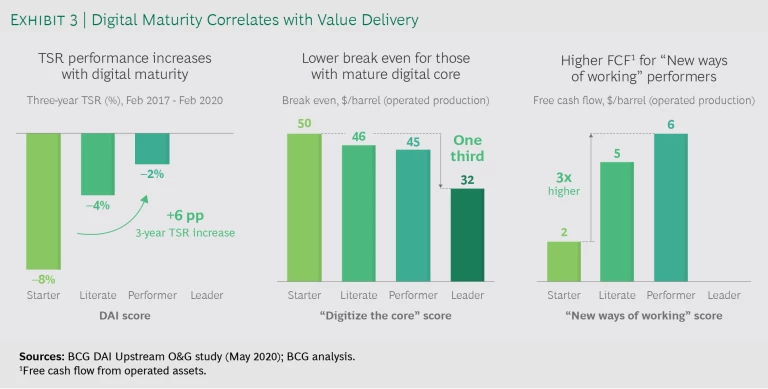

Our second major finding from the DAI survey was a strong correlation between digital maturity and value creation, as measured by TSR, portfolio break-even price, and free cash flow. (See Exhibit 3.) Of course, correlation is not the same as causality. However, we have observed these correlations consistently across industries. Moreover, business leaders and investors consistently credit digital as an important source of value creation.

When analyzing TSR from February 2017 to February 2020, we see that the upstream O&G companies with the highest DAI scores (digital performers) average six percentage point higher TSR than those in the lowest scoring category (digital starters). Given that the average TSR in the industry over the past decade has typically been only a few percentage points positive or negative, a swing of six percentage points could very well make the difference between creating and destroying shareholder value.

There’s also a correlation between digitizing the core and a lower break-even price. While many factors determine the break-even price, the correlation with digital suggests that digitally mature companies can positively affect the break-even price by increasing production, reducing capex, and/or reducing opex. Finally, evidence also suggests that companies advanced in adopting new ways of working—such as agile and multidisciplinary teams—have higher free cash flow.

Pandemic Intensifies the Need to Modernize

The third major finding of the DAI survey is that digital’s importance will grow during the pandemic. This finding was reinforced by the soon-to-be-published results of another BCG survey of the energy industry in which 83% of respondents said the crisis makes digital transformation more urgent. Some of the common reasons that executives in the DAI survey cited for the increased importance:

- Improvements through digital require relatively small investments; most technologies are readily available.

- Time to impact is fast and can help free up needed cash in the short term.

- Digital can reduce the risk of virus transmission by, for example, facilitating remote operations and collaboration.

- Moving to a lower-cost, nimbler operating model with fewer people helps build resilience for the long term.

What remains to be seen is how the industry will balance the need for digital transformation with tight budget realities. While 53% of respondents in the other BCG survey predicted that digital funding will increase, nearly all said digital spending will come under greater scrutiny. One big reason that digital investment may win over investment in legacy hardware technology is that payback times are often measured in months instead of years. Digital technologies such as robotics, machine learning, and big data analytics have proven this to be the case across other industries.

Transform for a Bionic Future

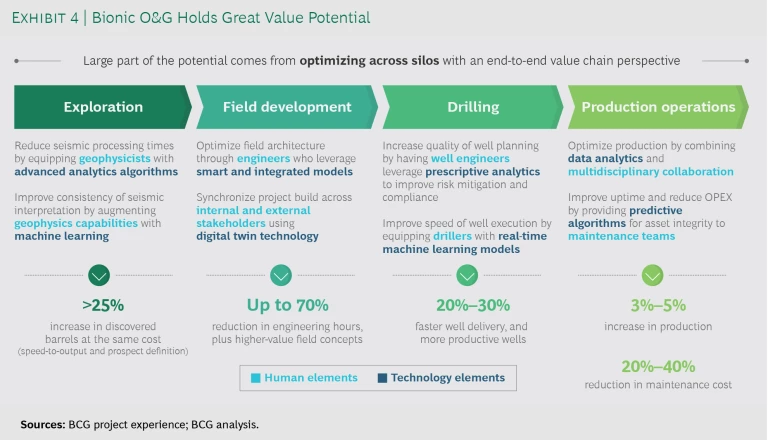

Peering beyond the current crisis, what does the “target” digital state look like for O&G companies? We believe it is about an end-to-end reimagining of the core upstream workflows in order to remove frictions. To maximize value creation, this implies augmenting human talent with digital technology in a seamless manner. It will also require upskilling the workforce to master the new digital tools. BCG uses the term “ bionic ” to characterize companies that achieve this state. We strongly believe that there is huge upside potential for those that get it right. (See Exhibit 4.)

Achieving this target state is no easy task. But O&G companies can begin to set more specific objectives and timelines by defining the bionic implications across four dimensions:

- Strategy and Purpose. In the future, bionic leaders will consistently integrate technology innovation into their business strategy. For O&G this means leveraging digital to make the company stronger and better prepared for the energy transition and/or to help rationalize the portfolio. In addition to a well-defined strategy, bionic companies will also have a clear purpose that aligns and energizes the organization.

- Outcomes. Bionic companies will organize their human and technological capabilities around business outcomes and move fast to achieve them. This requires clear accountabilities for end-to-end workflows across exploration, drilling, project maturation, and operations. It also means leveraging data across silos, such as technical disciplines and various producing assets, for fast, integrated decision making. Bionic companies will optimize the entire value chain to maximize value creation, from delivering molecules from the subsurface reservoir all the way to the end market.

- Human Enablers. Bionic O&G companies will use their human enablers—organization, talent, and ways of working—to reach the desired outcomes. They will remodel their culture, replacing burdensome layers of approval with autonomous, multidisciplinary teams empowered to make decisions quickly. Bionic leaders will facilitate a tightly integrated ecosystem of suppliers and partners as they drive and fund innovation.

- Technology Enablers. To augment the human enablers, bionic companies will put a modular technology stack at the heart of the new data-fueled organization. Combined with intelligent and user-centric front-end applications, this stack will enable new operating model elements, such as integrated operations centers, remote drilling centers, and unmanned production.

Take the Reins

Value creation depends on digital transformation, particularly in light of the COVID-19 pandemic. Companies need to transform their legacy businesses to drive efficiency, and to innovate new business models in order to tap new value pools. Most of the ingredients to do so are well known, but the formula for putting them all together is neither immediately evident nor easy to implement. In other words, the real challenge lies more in the “How” than in the “Why” and the “What.” In the end, success at scale comes much more from replicating the right approach than from replicating a series of digital products.

To succeed, O&G executives must take the reins, make transformation a priority, and focus digital initiatives on the biggest sources of value. It is much more powerful to define a handful of truly transformative initiatives that the business fully supports than to release a swarm of “mosquito” initiatives that do not move the needle and risk stealing management’s attention from what really matters. Bear in mind that the bulk of the effort and value lies in fundamentally changing the way people work—and how they interact with data and technology. Bringing humans and technology together in this way is the essence of a bionic company.

The authors are grateful to their BCG colleagues Michael Leyh, Prashant Mehrotra, Wilhelm Thorne, and Theodor Borsche for their contributions to this article.