Traditionally, tower companies have been the “grass and steel” players of the telecom industry. They’ve found the right land at the right price, managed permits and construction, and collected rent from carriers. It’s a model that worked well when carriers’ emphasis was on footprint expansion. But times and market dynamics are changing. New 5G rollouts, more diverse network technologies, and the emergence of new business models—among other trends—mean that tower companies need to be more agile, more data driven, and more focused on pursuing new revenue streams. As companies across industries have discovered, the best catalyst for all of these things is digital transformation.

So how does a tower company, rooted in the physical world, become a digital player? The first step is for its leadership to thoroughly understand the company’s starting point—assessing not only its capabilities but the competition’s as well. From there, leaders can introduce an end-to-end framework covering the key elements of digital transformation and adapt it to the company’s particular needs. This approach requires substantial changes in capabilities, processes, technology, and ways of working. But it’s an approach that tower companies can and should master.

A New Kind of Playing Field

For tower companies, digital transformation isn’t just necessary—it’s necessary now. A perfect storm of factors is reshaping the operating environment and driving urgency to digitize core operations, respond faster to change (in particular, changing customer requirements), and leverage data to boost visibility, insights, and value generation. Several major trends underlie this dynamic environment:

- 5G Rollouts and the Increasing Velocity of Technology Upgrades. As network architectures have evolved, equipment upgrades have become increasingly frequent. And the pace of these upgrades is likely to accelerate as carriers roll out 5G. In order to stay on top of these changes, tower companies need reliable real-time visibility into what’s installed on their structures and what capacity for installing additional equipment remains.

- Increasing Market Pressure. New competitors, higher investor expectations, and a rise in M&A and restructuring deals (most notably in Europe) are putting pressure on tower companies to continue delivering strong returns. To maximize asset monetization, tower companies must fully realize revenue growth opportunities, both in the core and in new business lines, and must improve operational efficiency and revenue assurance (for example, by tracking what operators have installed on the towers and by ensuring that all contract escalators are exploited).

- Changing Equipment Specifications. Next-generation telco equipment tends to be bigger and heavier than earlier hardware, upping the requirements and the pressure on tower companies as they build new structures and evaluate installation requests. Older towers, in particular, will require precise analysis of weight, wind, and ice loads to ensure structural integrity.

- Getting Ready for Prime. Market leaders are actively seeking additional revenue sources—and looking to get there ahead of the competition. Many routes are available to them. One option is to leverage the distributed nature of tower sites to support companies like Amazon, Google, and Microsoft in areas such as edge computing. To make these new business models work, tower companies need to possess both asset quality and a continuous view of the relevant assets.

- An Increasingly Acute Shortage of Skilled Personnel. Finding, training, and retaining qualified staff is a growing challenge. Compounding the problem, the traditional way of collecting data about the equipment and conditions at a site—deploying technicians to climb the tower—has significant disadvantages, including injury risks, manual workflows, and potential data integrity problems.

Digital Is a Value Driver

A study by BCG covering more than 1,900 companies in the US and Europe spotlighted the link between digital maturity and business performance . By prioritizing digital initiatives, strategy, and talent, companies can boost revenue growth, market share, time to market, and cost efficiency, ultimately increasing shareholder returns.

This dynamic spans industries, and tower companies—along with infrastructure units within telcos—can join the ranks of organizations reaping significant benefits from digital acceleration. But what is the best way to begin the journey?

The crucial first step is to undertake a comprehensive but rapid assessment of the tower company’s current digital maturity. The goals of speed and thoroughness might seem mutually exclusive, but in this case a savvy business can have its cake and eat it, too. One useful assessment tool is BCG’s Digital Acceleration Index (DAI), which helps organizations quickly zero in on their digital strengths and weaknesses, and gauge how they stack up against their peers.

The crucial first step in digital transformation is to perform a comprehensive but rapid assessment of the company’s current digital maturity.

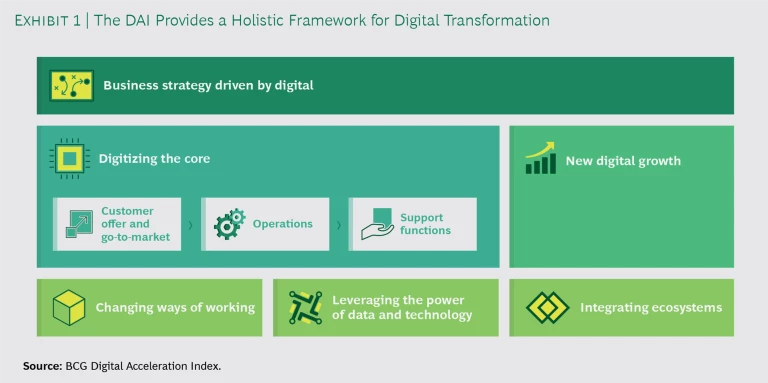

Using a tool like DAI gives companies a holistic framework for developing end-to-end digital capabilities. (See Exhibit 1.) It enables company leaders not only to know their starting point, but also to identify the most critical priorities so they can focus their resources on these matters. Although assessments and paths forward will vary from one company to another, most tower players will probably need to devote particular attention to three elements of the framework: digitizing the core, developing new digital growth, and changing ways of working.

Digitizing the Core

At the heart of all digital transformations is the business strategy. From the very start, it is critically important for a company to link strategy to value, prioritize initiatives, and identify the enablers—such as data, talent, and accountability—it needs to achieve its digital vision.

For tower companies, the key is to obtain a comprehensive, real-time view of what is going on at each structure. Fast access to timely, accurate tower data (for example, measurements precise enough to feed CAD applications) has a massive upside. Having a better window into onsite conditions can boost efficiency, leading to optimized maintenance schedules, for example. It can improve revenue reassurance, since real-time tower audits will disclose exactly what equipment a carrier has installed and whether that equipment should trigger contract escalators. It can promote automation and responsiveness—for example, by allowing customers to use self-service tools to obtain permits to enter tower sites instead of relying on cumbersome and time-consuming manual processes. And it enables companies to leverage the data to seize new business opportunities.

In our experience, the best way to gain a comprehensive, real-time view of each tower is to create a service image or digital twin—a dependable set of data points providing end-to-end visibility across tower company or telco infrastructure unit assets. The service image and the data underlying it set the stage for all of the benefits noted above. Moreover, in an M&A-intensive industry, it can act as a “single source of truth” when assets are transferred.

The best way to gain a comprehensive, real-time view of each tower is to create a service image or digital twin.

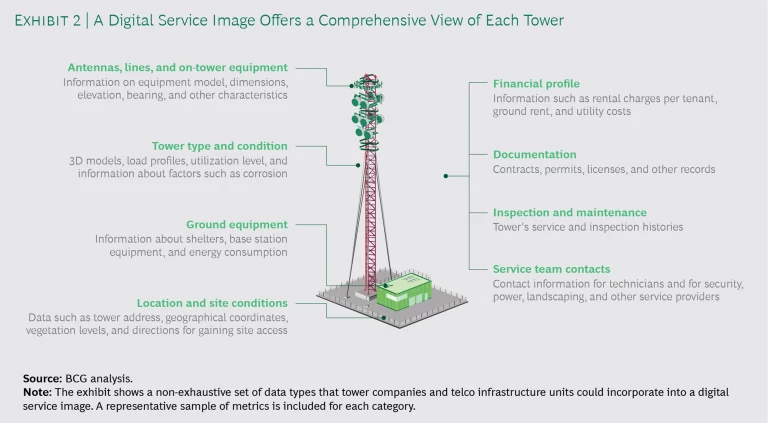

A service image can include a wealth of detail about a tower—its location, financial profile, carrier equipment, ground equipment, site condition, weather, degree of corrosion, and more. It can also store supporting documents and permits, inspection and maintenance histories, and key service contacts. (See Exhibit 2.) Indeed, best-in-class tower companies today track more than 180 parameters for their assets.

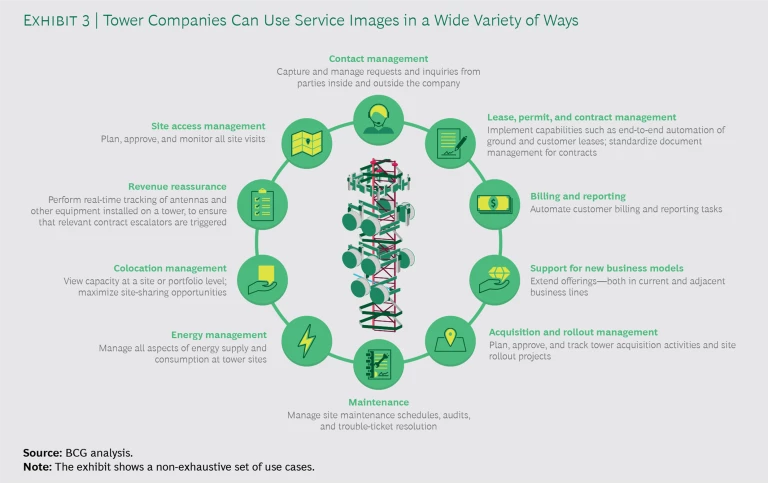

Incorporating data into a service image takes time and costs money, so savvy companies take a phased approach to implementation. A service image can support an array of use cases, including maintenance, access management, billing and reporting, and revenue reassurance. (See Exhibit 3.) The key is to prioritize and to let the most promising or pressing use cases define the rollout schedule.

For example, one telco infrastructure unit started its digital journey by focusing on maintenance. It used its service image to schedule site visits more efficiently, resulting in a 25% reduction in maintenance costs. Another company used its service image to tackle energy management, lowering energy costs by 5% to 20% per tower. In yet another case, a tower company boosted revenues by 10% to 30% per structure by knowing precisely what equipment the operators had installed on the towers and triggering appropriate contract escalators.

Asset types lend themselves to different levels of granularity in the service image. For example, monopole towers tend to be less complex and easier to monitor than guyed lattice towers. They also usually have a lower ceiling for revenue growth. So a simpler service image—one that excludes the highly accurate CAD models that guyed lattice towers require, for instance—could be a good enough solution in that case.

A company’s tools and data acquisition strategy greatly influence its cost and time investments.

Similarly, a company’s tools and data acquisition strategy greatly influence its cost and time investments. Data collection efforts shouldn’t boil the ocean; rather, they should focus on the information needed to fuel a use case (whether that use case is maintenance, revenue assurance, or something else). As for tools, more sophisticated doesn’t always mean more efficient. It is often unwise to deploy the most advanced or hyped solutions, since doing so can unnecessarily delay rollouts and increase operational complexity. A better approach is to deploy a thoughtfully selected cocktail of tools and resources of varying sophistication, each augmenting the others. The following elements are typical:

- Internal Company Records. Today’s character recognition software, machine learning, and other advanced technologies make the task of digitizing physical records relatively straightforward and inexpensive.

- Geoservices and Satellite Images. Working with geoservices and satellite image providers can be a low-cost way to obtain data on such details as ground conditions, vegetation levels, and potential obstacles and threats at a tower site. And given the thousands of structures a tower company may have in its portfolio, it is much easier to scale these solutions than to deploy personnel to inspect each tower.

- Laser Tools and Phone-Based Apps. These tools can capture the dimensions, the precise location, and contextual photos of towers and equipment.

- Contractors and Climbers. Deploying personnel to the towers is a traditional way to collect data on equipment and conditions. But the approach is costly and depends on the availability of qualified people. One scalable, low-cost alternative is to use crowdsourcing platforms to ask individuals to take and upload photographs of tower sites. But this approach does raise quality concerns, since, for instance, not every participant in the effort may be using a high-quality camera.

- Drones. A medium- to high-cost option, depending on the service provider and the type of hardware involved, drones can provide detailed information about installed equipment, corrosion, the surrounding area, and other site-specific factors. The downside is that drones require skilled pilots and expensive photogrammetry software. But advances in autonomous mission deployment and data processing may soon rebalance the current equation.

Capturing data is just part of the process, of course. It is also necessary to interpret that information quickly and accurately in order to generate insights. Traditionally, data interpretation has been a tricky business: two climbers might see the same thing on a tower and yet draw different conclusions about it. At first glance, photos and video—whether from drones, phones, or satellites—might seem likely to introduce even more uncertainty. But this is where AI-based analytics and machine learning come into play. Today’s algorithms can identify the type, brand, and model of installed equipment; ascertain the equipment’s dimensions, elevation, tilt, and bearing; evaluate the location and severity of corrosion; and so on.

In part, digital transformation is about making things that have worked well for a long time work even better.

New Digital Growth

As they roll out 5G networks, wireless carriers are under increasing pressure to restrain capital expenditures and operating expenses. One way to do this is by sharing the cost of infrastructure such as towers. But telcos could also share costs in other ways, and this opens the door to new business models for tower companies. One possibility here is to offer maintenance services to telcos that rent space on their structures. Suppose, for example, that three telcos have antennas on a tower. It costs less for one person to climb the tower and service all three antennas than for three people to climb it separately and service one antenna each. Tower companies could pass part of those savings back to telcos while still making money on the work.

That is just one possibility among many. Savvy tower companies have a host of opportunities to expand their offerings and their value creation. Among these new routes to revenue are the following:

- Wholesale Access for Enterprises. Provide dedicated high-speed connectivity solutions to businesses (for example, for high-frequency trading).

- Ground Station Infrastructure for Satellite Providers. Small satellites typically orbit the earth at speeds that enable just 15 to 20 minutes of communication with a given ground-based antenna. But developing more ground stations to maximize communication time is a time-consuming and expensive proposition for many small-satellite operators. Tower companies could provide a solution by offering such operators the use of their network of existing antennas.

- Edge Computing Services. Edge computing, which locates computing resources closer to where they are needed, can support multiple use cases. But the primary initial use case is likely to be cloud-RAN and virtualization of telecommunications networks. Tower companies are in a natural position to offer this service to carriers.

- Imaging and Logistics Services. Increasingly, companies are deploying drones for tasks such as surveillance, inspection, and delivery. But drones require base stations, pilots, and in many cases a secured environment. Tower companies can provide a ready-made platform, with the necessary real estate, security, and end-to-end asset imaging services. Such an offering could be particularly compelling for asset-heavy enterprises—such as utilities and oil and gas players—that regularly need to perform and optimize maintenance, upgrades, and construction.

- Fiber Fronthaul, Fiber Backhaul, and Small Cell Locations. In areas where the potential for 5G rollouts is high, but where mobile operators lack a dense fiber infrastructure, partnerships between carriers and tower companies can have significant cost-sharing benefits. For example, they may make it much easier for companies to secure permissions for sites and to leverage existing infrastructure.

- Data Intelligence Services. By combining their own sensor information with information from third-party sources, tower companies could provide valuable insights and monetize the data they collect. For example, cameras on towers located near highways could feed traffic- or security-related services. Weather data could be valuable for agricultural uses. The list goes on.

New Ways of Working

Technology and data are crucial to digital transformation, but so are capability building, partnerships, and people and processes . To move faster on their digital journey, companies must embrace and facilitate change. For tower companies, the to-do list can be extensive: developing new technical capabilities such as machine learning and drone flying; administering all-new systems; creating and promoting an agile, cross-functional team environment ; and stressing customer centricity and transparency (for example, by providing carriers with greater visibility, opportunities for self-service, and new customer journeys).

At the same time, tower companies can augment their traditional processes with AI-enabled tools for such functions as automated dispatching, preventive maintenance, and optimized field visits and energy consumption. Digital transformation isn’t just about implementing something new. It’s also about making things that have worked well for a long time work even better.

In most cases, adopting new ways of working, building the right new capabilities, and augmenting traditional processes will require a multiyear effort that touches every employee in the organization. Yet it’s important to begin taking those steps now. Companies that get out of the gate first often gain a competitive advantage that slower-moving companies find hard to match.

For tower companies, today’s market trends highlight the urgent need to change. Growth requires new technology, new methodologies, and new paths to revenue. Digital transformation is a proven way to develop all of these things. Getting there isn’t easy or quick. But by assessing its starting point, embracing a holistic framework, and adopting a phased, prioritized approach to implementation, a company can realize the full potential of digitization before the competition does.