As most of the medical technology (medtech) sector grapples with difficult market conditions during the pandemic, some companies might be tempted to pull back on their long-term innovation investments. But that would be a mistake. BCG’s recent innovation-benchmarking study found that leading innovators in the industry consistently outperform peers in top-line growth while preserving, or even expanding, gross margins. (See “Our Methodology.”)

Our Methodology

From there, we measured business units on a “freshness index,” which is based on the percentage of revenues generated from products launched within the last three years (2017 through 2019), and identified the top two innovators in each segment. While we observed no general size advantage among the benchmark group, clear winners emerged. ( See how medtech companies fared in BCG’s 2020 Most Innovative Companies survey.)

Since 2010, the sector has outperformed the S&P by 150%, with breakout players lifting the overall average. Of course, making smart acquisitions remains important for both innovation and growth, but medtech companies must tend their internal innovation forges if they are to remain on a trajectory of success.

Innovators Exist in Each Segment

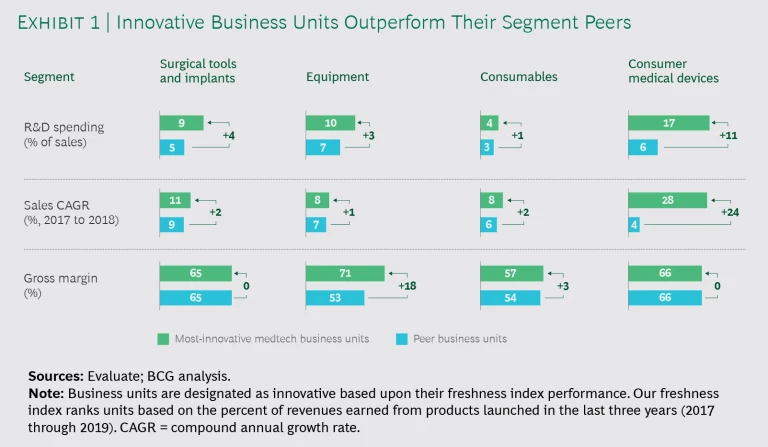

Our first observation was that innovators spent more on R&D than their peers—and they applied funding differently. The pattern held true across all segments. (See Exhibit 1.)

The results speak for themselves. In terms of sales, we found that the top equipment innovators outgrew competitors by 1% year-over-year, while leaders in surgical tools and implants and consumables outperformed by 2%. Top innovators in the fast-paced consumer medical devices segment grew sales faster than competitors by a whopping 24%. We also observed that these competitors at least held their ground on gross margin. Leaders in surgical tools and implants and consumer medical devices kept margins on par with peers, while the top consumables performers pushed margins 3% higher. Equipment players reported an impressive 18% advantage on that front.

The Five Key Differentiators

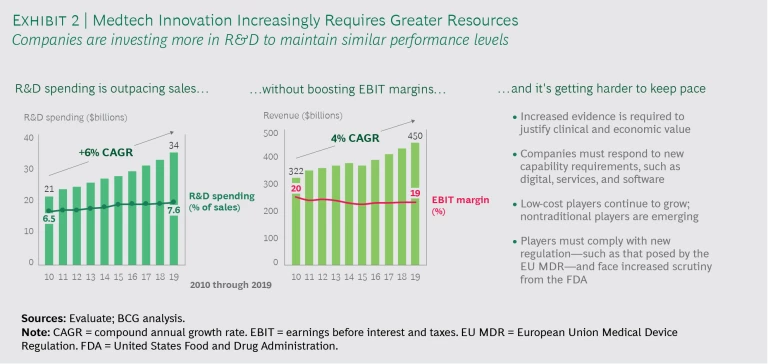

While top medtech innovators fund R&D at higher levels than others, simply spending more on R&D is not a recipe for success. Our research shows that many medtech companies operate in a challenging, competitive landscape and are spending more on R&D just to maintain similar performance levels. On average, medtech R&D spending is growing faster than sales. (See Exhibit 2.)

What exactly have top innovators done to overcome these challenges and turbocharge growth? Our survey reveals five important ways that the top innovators across all segments behaved differently from their peers.

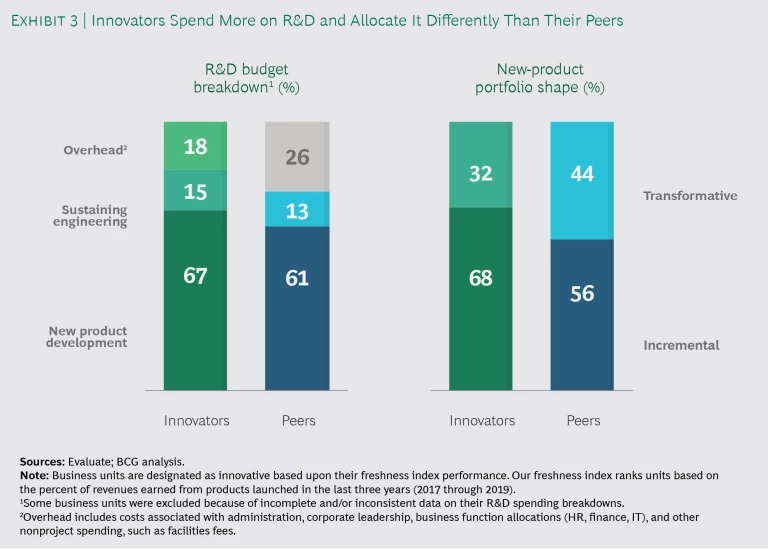

Innovators pursued rapid, incremental innovation. In most segments, leaders spent an average 68% of their total R&D commitments on incremental innovation—12 percentage points more than their less-innovative peers—and 32% on true breakthroughs. The difference was most pronounced among consumer medical device businesses, where a rapidly launched product platform is typically followed by a steady stream of fixes and enhancements. Leaders across the board emphasized that successful incremental innovation requires quick cycle times to keep their development shops working effectively. Interestingly, surgical tools and implant leaders spent 10% more on transformative R&D than their peers, bringing relative spending on incremental innovation to 69%—in line with leaders across the other three segments. (See Exhibit 3.)

Transformative R&D remains critical, but our survey suggests that leading innovators don’t bet the farm on giant steps. They favor a measured approach.

In the words of one leader, “We’ve had much more success with our incremental launches than we’ve had taking large bets. In fact, I cannot remember a single major transformative project that was not significantly delayed in my many years of experience in medtech R&D.”

Innovators embraced external partnerships. Leaders across all segments embraced external collaboration. They simplified terms and conditions, built financial and operational flexibility into external deal structures, and, critically, adapted their core innovation processes—including prioritization, portfolio management, and technical execution—to enable a more seamless operating model with external parties. While leaders generally focused internal new product development (NPD) on incremental innovation, they also used external partnerships and M&A to make bolder bets.

Leaders across all segments embraced external collaboration.

One leader told us, “Our external ventures team is a real benefit. They are quite well-connected to our business unit strategy, which helps them bring us relevant ideas. We try to treat those investments with a similar level of focus as we do our internal R&D projects.”

Innovators optimized their R&D overhead and life cycle. Top innovators have lean innovation centers and spent an average 18% of their R&D budgets on overhead, whereas peers spent 26%. Leaders moved aggressively to centralize standard activities, such as sustaining engineering, in offshore locations to gain functional scale benefits. They simultaneously created centers of excellence for core capabilities, such as software development, where critical mass is important. The net result was that innovation leaders reallocated, on average, 6 percentage points more from their R&D budgets to NPD than peers.

One leader explained, “We are increasingly outsourcing sustaining engineering and low-value work to our resources in emerging markets, a move that enables our R&D hubs to focus on innovation and NPD.”

By building robust medical-affairs and strategic-marketing capabilities, leaders were able to fine-tune product design and generate evidence of existing and emerging market needs.

Innovators identified and invested in unmet clinical and economic needs. Innovation leaders stressed the importance of ferreting out unmet needs and building the business case for their innovation initiatives. By building robust medical-affairs and strategic-marketing capabilities, leaders were able to fine-tune product design and generate evidence of existing and emerging market needs.

According to one leader, “We all know the importance of uncovering unmet needs, but we still find projects late in development for which the clinical relevance and economics are being challenged.”

Innovators ensured R&D stage-gate discipline. Top innovators used stage gates and other program-management capabilities to prioritize their spending and focus their resources, making tough decisions to kill initiatives as required—with an emphasis on accelerating the cadence of new product launches. This is not an easy discipline to enforce. Business conditions, short-term goals, and impromptu decisions made by overreaching executives continue to make this seemingly simple imperative difficult for most of the companies we surveyed.

As a member of one of these companies explained, “We need more discipline around the stage-gate process to force hard prioritization decisions and give clarity to our teams. Too often, we don’t hold ourselves accountable to adhere to the decision criteria.”

While these five differentiators were consistent across medtech segments, the study uncovered some important differences. For example, in order to invest successfully in unmet needs, equipment segment leaders need to ensure consistent funding for the full product development cycle—which often extends beyond a single budget year. On the other hand, consumer medical device innovators have excelled by doing almost the opposite. They fund attractive opportunities across the portfolio and rapidly deploy resources in a much tighter timeframe, frequently within the same budget year.

Segments also differ in their approach to the stage-gate process. Surgical tools and implant innovators tend to move through stage gates at a consistent, steady pace over time, looking to hit development milestones for early-stage innovation, NPD, and sustaining engineering. Meanwhile, consumer medical device leaders often act faster, making final decisions in a single meeting and rapidly communicating new priorities to functional leaders to rebalance the portfolio.

Stay Committed to R&D

There is a great temptation to postpone longer-term projects to preserve current- year cash flow as companies grapple with the market effects of the pandemic. But as elective surgeries resume and pent-up demand comes online, businesses that fail to keep up with clinical and technological progress will face sluggish top-line results for years. The evidence shows that medtech companies do best when they keep calm and carry on funding R&D.