Looking Back Over the Past 20 Years

Among the many industry dynamics that have shifted over the past 20 years is wealth distribution. Today, there is more wealth in more hands, and the wealth gap separating mature markets and growth markets at the beginning of the century has narrowed dramatically. Nevertheless, effectively serving the world’s wealthy is going to become far more complicated in the years ahead.

This year marks the 20th anniversary of BCG’s Global Wealth report, an annual study that offers both a comprehensive overview of the industry and recommendations on how industry participants can achieve competitive advantage. Our 20-year perspective on global wealth analysis—along with the data that we have amassed over that period—allows us to identify important patterns in the nature of wealth growth and provide an outlook on the years ahead.

Development of Global Wealth

Personal financial wealth has soared over the past two decades, nearly tripling on a global level from $80.5 trillion at the end of 1999 to $226.4 trillion at the end of 2019. This trajectory is even more impressive considering the many economic disruptions that have occurred over this period, and it demonstrates true market resilience.

Below is an interactive preview of the many insights contained in BCG’s Global Wealth Market Sizing.

Looking Back Over the Past 20 Years

Among the many industry dynamics that have shifted over the past 20 years is wealth distribution. Today, there is more wealth in more hands, and the wealth gap separating mature markets and growth markets at the beginning of the century has narrowed dramatically. Nevertheless, effectively serving the world’s wealthy is going to become far more complicated in the years ahead.

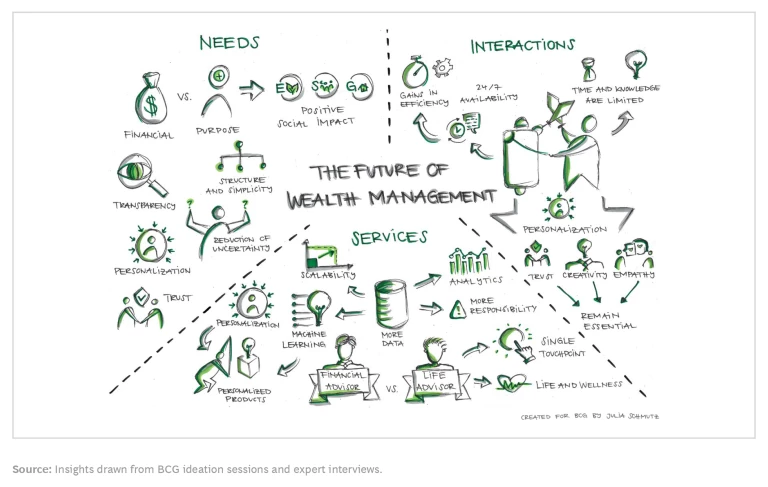

The Next 20 Years of Wealth Management

What wealth management clients will want most from their providers in the future is simpler and more accessible interactions. Strong performance will remain crucial, but delivering it will take more than healthy financial returns. Providers must earn their clients’ trust and put wealth to work in a variety of interesting and productive ways.

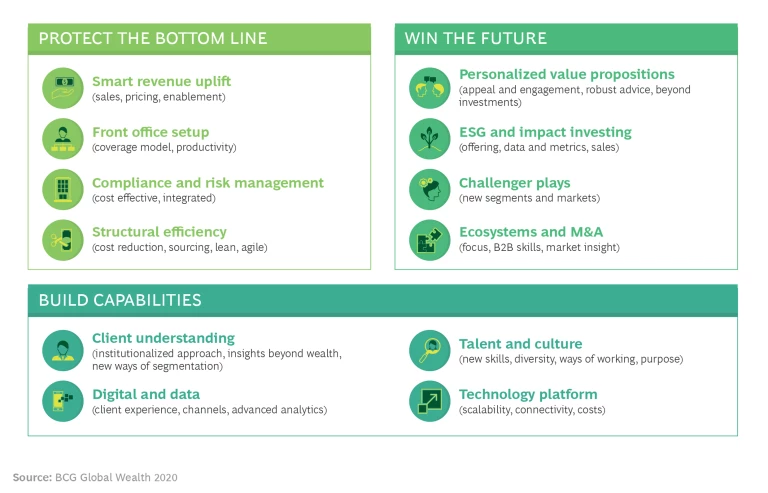

The Wealth Management CEO Agenda

Wealth management providers must treat 2020 as a turning point. A series of incremental improvements spread out over time will not deliver the performance lift that is needed in terms of client satisfaction, competitive differentiation, growth, and cost savings. We propose an agenda that will protect the bottom line, build capabilities, and win the future for wealth managers.