COVID-19 has brought a confluence of major challenges for the B2B energy retail arms of major utilities. These include sharp declines in business energy demand and a liquidity crunch stemming from margin calls triggered by hedged positions, late payments from customers, and a wave of customer insolvencies. For some players, the challenges are substantial enough to threaten their ongoing viability.

Many B2B energy retailers ultimately have the means to weather the storm. But to do so, they will need to move quickly and decisively to protect the business in the short term. They will also need to rethink, restructure, and optimize critical elements of their business in order to secure the long-term viability of their business model.

A Perfect Storm

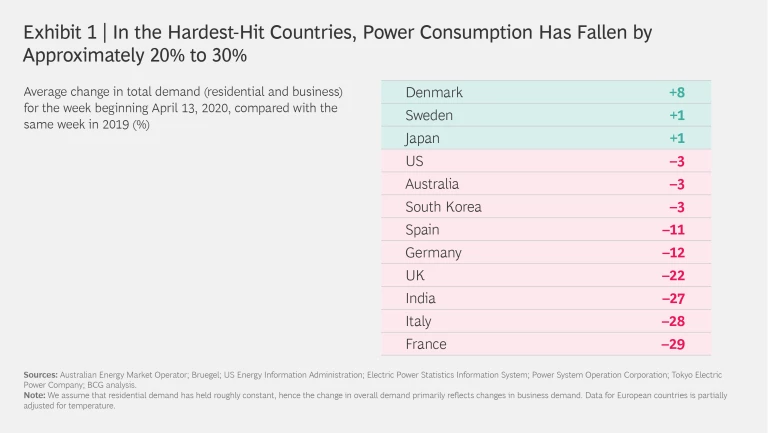

The pandemic hit B2B energy retailers from several angles at once. Demand from industrial and commercial users (including small businesses), which typically represents 40%−50% and 20%−30%, respectively, of total electricity demand in most markets—with residential users accounting for the rest—has plummeted with the decline in business activity. (See Exhibit 1.)

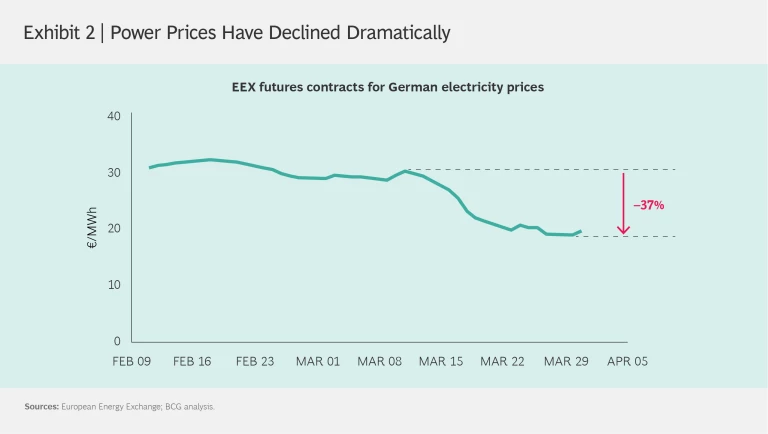

In parallel, B2B energy retailers are being squeezed by financial effects of plunging electricity prices. (See Exhibit 2.) Many of these players hedge their exposure to volume risk and price volatility by buying forward contracts according to the projected usage of a given client at the time of onboarding. With demand now sharply lower than expected, retailers find themselves with too much and too dear a supply. To rid themselves of the surplus, they are being forced to sell it into the market at depressed spot prices—effectively locking in losses.

Simultaneously, many governments, seeking to throw businesses a lifeline, have instituted extended grace periods for the payment of rent and utilities, including power. Further, many customers that are wrestling with the combination of shrinking revenue and ongoing fixed costs—both businesses and governments themselves—have asked for temporary payment reductions. The negative impact of these forces on B2B energy retailers’ cash flows has been sizable.

The upshot is a growing risk of substantial losses—a daunting prospect, especially given the modest margins, and hence the small profit cushion, that characterize the business segment. Indeed, many retailers face losses that, in just months, could wipe out their aggregate profits from B2B sales over the last decade.

Taking Defensive Measures and Positioning for the Future

There are several steps that B2B energy retailers can take to boost their resiliency and prospects for the future. In the short term, they should focus on securing liquidity, such as by centralizing liquidity management and instituting a weekly cash flow forecasting process. They should also take proactive steps to improve liquidity—for example, by reducing employees’ working hours, reviewing capital projects and suspending them where warranted, and converting large accounts payable into shorter-term notes. Speed is of the essence; fortunately, retailers can undertake some of these measures immediately.

Many retailers face losses that, in just months, could wipe out their aggregate profits from B2B sales over the last decade.

Additional critical short-term steps are to use scenario planning (to prepare the company for a variety of possible ways that the crisis might evolve), optimize debt management, and institute sales force readiness measures to ensure that employees can work productively during the crisis and are prepared for an eventual market rebound.

In the medium term, B2B energy retailers should focus on improving the risk-return profile of their business. We see three main avenues they should consider. The first is to rethink offerings with an eye to shifting greater risk to the customer—for example, by providing less flexibility in usage volume or by indexing customer rates to wholesale power prices. The retailer will of course need to make a realistic assessment of whether such adjustments will still allow it to compete effectively. Additional significant cost cutting—replacing account managers’ personal visits to key clients with telephone sales, for example—can help alter the calculation.

B2B energy retailers can also broaden their offerings to include services (such as energy consumption consulting) or energy solutions (such as decentralized generation assets) and make these their primary emphasis. The retailer would continue to offer power to clients and potential clients, but the commodity’s role would be relegated to that of an add-on or door opener.

Finally, B2B energy retailers can focus exclusively on certain customer cohorts or, in extreme cases, they can exit the business segment entirely. Full exit has been the choice of several retailers in the past, and we expect more to follow in the medium term as the economic effects of COVID-19 continue to unfold.