COVID-19 has prompted many people to assess whether they should return to using public transit or consider driving instead. According to BCG research , 8% of European consumers say they are more likely to buy a car because of the pandemic. That number is 16% in the US and 60% in China.

Will these sentiments translate into a global wave of new vehicle purchases? That will depend, in part, on whether potential buyers can overcome their reluctance to visit a car dealer. Many consumers remain wary of engaging in face-to-face negotiations, providing paper signatures, and attending finance office meetings, all of which are typically part of the vehicle purchasing process.

E-commerce can address these concerns, but very few cars are currently bought online. Indeed, autos represent one of the last bastions of almost exclusively physical sales. Most consumers prefer to see, touch, and drive a car before buying. Automakers and dealers therefore need to step up their collaboration in order to provide the contactless test drives and online pricing and financing tools needed to launch digital sales .

The companies and brands that move fastest could gain a competitive advantage, improving market share and profit margins by culling digital data that can be used to create targeted offers and reduce incentive spending. The payoff will be big. Incentives accounted for 11.1% of average US new-vehicle transaction prices in 2019, or about $65 billion, according to auto price information company Kelley Blue Book. Just a 1% reduction in incentive spending would add $650 million to the bottom line of automakers.

Growth Potential

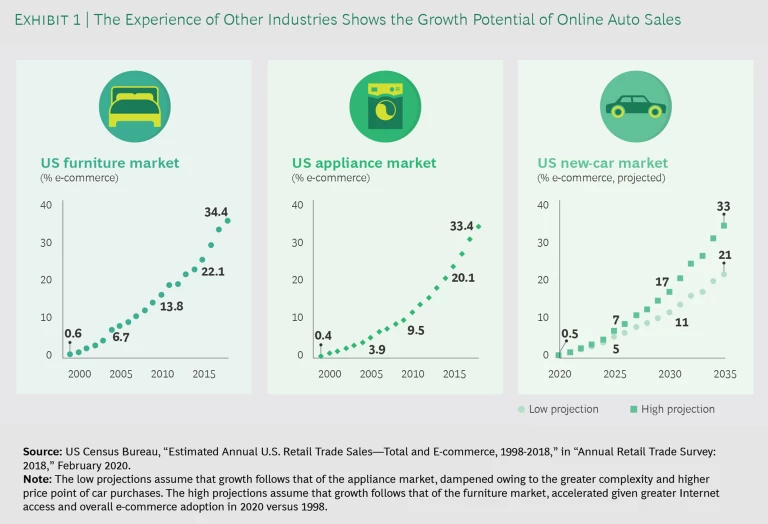

Sales of other durable goods demonstrate how changing consumer preferences will push car buying online. (See Exhibit 1.) About two decades ago, e-commerce had barely penetrated the furniture and appliance industries. But over the years, consumers easily transitioned from the online purchase of small items such as books to bulky, big-ticket goods, including consumer durables like technology-rich appliances. It is only a matter of time before online car purchases become just as common.

The auto industry is unlike furniture and appliances, however, in the significant differences between two product segments: new and used cars. Used cars are ahead of new cars in the transition to online sales, largely because they don’t require coordination between franchised dealers and automakers. Used cars also don't have the same high depreciation challenge as new vehicles. That facilitates online sales by allowing for marketing initiatives such as a seven-day return policy. Used-car retailers can offer that benefit without much risk of a large depreciation hit, and it reassures online buyers. Online-only used-vehicle dealers like Carvana and Vroom are leading this transition. In the new-car segment, Tesla’s use of e-commerce and pilot programs from other automakers present a promising picture of the digital sales channel’s potential.

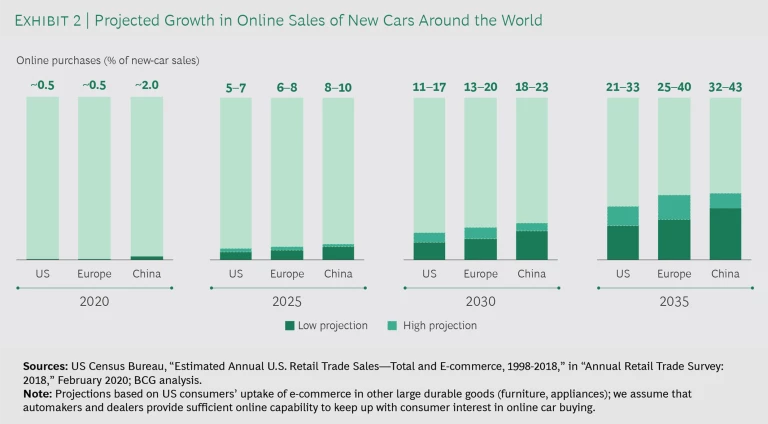

BCG projects that online transactions extending to billing and payment could account for about 5% to 7% of new-vehicles sales in the US by 2025 and for as much as 33% by 2035. (See Exhibit 2.) That represents significant growth, as less than 1% of these sales are conducted online today. Digital shopping for cars is expected to grow slightly faster in Europe because a larger portion of its new-car market is built to order. Additionally, dealer franchise laws are relatively weaker than in the US, giving the industry more flexibility. China should see the fastest adoption, with digital sales reaching as much as 10% of new-vehicle sales by 2025 and 43% by 2035, in line with Chinese consumers’ already high usage of e-commerce channels. Changes in US franchise laws to allow automakers to sell directly to consumers would accelerate adoption of digital sales.

The shift to online sales presents an opportunity for automakers and dealers to gather more data and develop a better understanding of consumer behaviors. That data can be used to break down silos both within auto manufacturing companies and between brands and dealers. By tracking the customer’s journey through the purchasing process, automakers will be able to learn what types of incentives and sales promotions have the most effect, which options and trim levels have the largest uptake, and at what point consumers are most likely to bounce to rival brands. Such data can be used to fine-tune everything from what gets produced on the factory floor to what arrives in the showroom.

Moving sales online for a growing number of vehicles will require better collaboration between automakers and dealers. It could also create tension around the points in the process where customers are handed from an OEM to a dealer and about who controls the customer data that each sale generates. Will automakers require a standardized system across all of their brand dealers? Who will be responsible for communicating the process? Who will build the digital sales platform and maintain it? Who will set prices? Which customers will be eligible for returns and who will manage them? By working together to sort out their respective roles, automakers and dealers will ultimately be able to better target consumer preferences, hone vehicle configurations, and reduce the need for discounts and sales incentives.

The Digital Sales Vision

Online used-car players have made great strides toward digital sales, but the opportunity is even greater in the new-car market. Under a true digital sales model, consumers conduct their research online and have the tools they need to easily compare the pricing and characteristics of vehicles within a brand. Shopping might start with a search in a broad category, such as three-row SUVs. After deciding on a model, the customer selects the vehicle and searches through the dealer’s inventory. The sales portal then seamlessly carries the buyer through vehicle selection to financing to delivery.

The rapid growth of online-only used-car dealers in the past several years validates consumers’ willingness to buy cars online. Carvana saw more than 100% year-over-year growth in vehicles sold from 2014 to 2018, and both Carvana and Vroom saw 89% growth in units sold between 2018 and 2019. These companies pioneered the use of online trade-ins as an important part of the car-buying process, and that has helped fuel their growth.

In addition to satisfying consumers’ interest in online buying, sellers of new cars have the opportunity to gather customer data such as model preferences, location, and purchasing criteria in order to drive digital marketing and inform product volume forecasting. They will be able to fine-tune pricing of add-on packages consistent with customers’ willingness to pay, even differentiating by geography. This will help both automakers and dealers decrease variable marketing expenses.

Obstacles to Digitization Are Longstanding

Thus far, the industry’s organization and a patchwork of regulations have stymied the creation of a cohesive digital purchase experience. Automakers produce vehicles that they sell to dealers, which resell the vehicles to end customers—consumers and fleets.

Sales franchises range from single family-owned stores to vast publicly traded dealership networks, and digital capabilities vary accordingly. Moreover, dealers and automakers focus on different parts of the business. Automakers want to sell new vehicles, but dealers also sell used cars, service, parts, and after-market products. Only through a collaborative approach, addressing both the individual and the shared needs of automakers and dealers, can e-commerce become a meaningful sales channel for new cars.

Automakers and dealers need to step up their collaboration in order to provide the contactless test drives and online pricing and financing tools needed to launch digital sales.

In most markets, automakers are prohibited from competing with their own dealers, but the rules around online sales are somewhat unclear. The best approach is a partnership between automakers and dealers, with the digital customer moving seamlessly between the two.

There’s also the issue of profit margin compression. One benefit of online shopping is the ease of comparing prices. This price transparency could put further pressure on transaction prices and have a negative effect on industry profits. Dealer referral services such as CarGurus, TrueCar.com, and the Costco Auto Program provide pricing information that savvy consumers can use to launch negotiations on the basis of an already discounted price. But progressive OEMs and dealers can turn this potential challenge into an opportunity by using data to devise incentives, options, or service plans likely to be attractive to specific individuals. Such a strategy can reduce price elasticity across multiple product and service categories.

COVID-19 Is Accelerating Digital Sales

Many car sellers are moving to increase digital sales during the pandemic. Infrequent practices are now almost commonplace, with dealers offering programs that include convenient and contactless test drives, virtual showrooms or video-based car walkarounds, and home delivery or contactless pickup.

In addition, automakers are launching pilot programs for near-complete e-commerce offerings, which guide customers through the selection process and then hand them off to a dealer to complete the sale. Honda launched its Shop Simple initiative earlier this year, expanding from two cities to a nationwide presence in a matter of weeks. The online platform allows customers to search the company’s inventory, filter for desired features, and obtain details about colors, trim levels, packages, and options. It provides a discounted internet price, calculates the value of trade-ins, and adjusts the price accordingly. After selecting a vehicle, the customer picks a finance or lease option and, if desired, adds a protection plan such as a limited warranty or extended-service contract. Once the order has been submitted, the customer is directed to a local dealer, who delivers the vehicle and the paperwork.

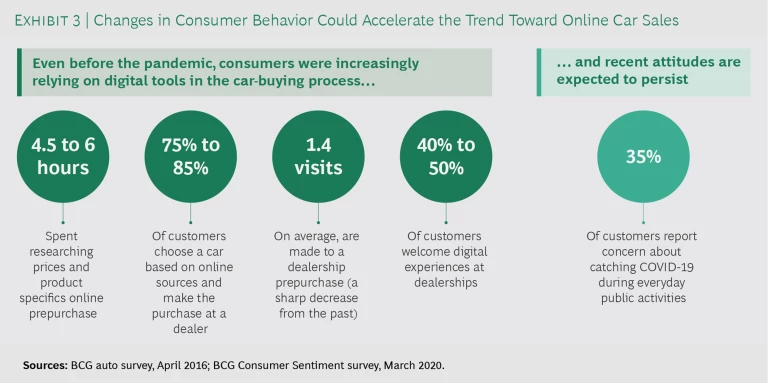

Programs like Honda’s represent a strong start to online new-car sales, but opportunities remain to make the experience more seamless for consumers and to unlock more data for sellers. Even before COVID-19 hit, consumers were moving research and other parts of the buying process online, and the pandemic has only accelerated that trend. (See Exhibit 3.)

Five Capabilities to Unlock Online Sales

As the industry builds a digital sales model, automakers need to develop five baseline capabilities that will speed the transition.

A Clear Buying Process. Many consumers find car buying to be a confusing and sometimes frustrating experience. That makes it especially important to clearly communicate the process to shoppers looking to avoid brick-and-mortar dealerships. Customers must understand what can be done online and what, if anything, must be done in person. The industry should gather data to determine at what points in the process customers want self-service and where they want human support and dealer input. That will help companies adjust their digital offerings or supplement them with targeted in-person options.

The shift to online sales presents an opportunity for automakers and dealers to gather more data and develop a better understanding of consumer behaviors.

Searchable Inventory. Automakers need to make their entire inventory available across multiple local dealerships. Buyers will want to browse and filter the inventory and search for specific model builds using online configuration tools. Dealers must offer similar capabilities. This will create a flood of information that will give automakers better insights into consumer preferences and help them to more accurately forecast vehicle demand and develop better targeted marketing.

Accurate Pricing. The digital sales process bypasses the haggling on the sales floor that’s long been associated with the auto industry. Dealers must provide prices that online consumers are willing to pay. Shoppers will expect discounts such as rebates and incentives to be integrated into the offer. This information can help the industry to develop a more nuanced understanding of the price tradeoffs that are acceptable to consumers and to offer more personalized incentives. Ultimately, automakers will be able to target funds to the most effective promotions and provide fewer discounts to customers who are likely willing to buy without them.

Flexible Vehicle Trials and Returns. The industry needs to allow online consumers to test-drive and see vehicles in person before committing to a purchase. Potential options might include test drives from the customer’s home or at some other convenient location, either before the purchase or upon delivery. At-home test drives will get more consumers into vehicles and give dealers more opportunity to upsell. Moreover, the data on conversion rates for different vehicles could provide a foundation for finely targeted marketing that increases sales. Finally, the industry must consider flexible return policies, a large hurdle considering the rapid depreciation of new motor vehicles and the complexity of financing.

Online Financing and Payments. Dealers must upgrade their finance offerings by making the process easy and digestible for all consumers. They need to build trust by offering multiple finance options with competitive rates. Analysis of the uptake rates for various options will give the industry better consumer financial data that will power better targeting and upselling.

Begin Now and Build for the Future

Automakers should take steps now to build a comprehensive digital sales experience. Starting with a subset of the business—such as a single car model or geography—create high-volume packages attractive to particular customer segments, such as commuters reluctant to take public transit because of the pandemic. Begin in regions where it’s easiest to quickly obtain any needed regulatory changes.

Dealers, too, need to move quickly to align their business with digital sales. Reimagine the used-car purchase experience with an eye to how online disruptors are changing the sales process. Leverage service opportunities to maximize customer loyalty throughout the ownership life cycle. Use data to identify when existing customers are likely to replace their vehicles, and provide personalized offers.

It is more important to start by launching an end-to-end solution than to offer a full spectrum of products online. Automakers should build and launch now while changing consumer preferences are creating momentum. The industry can start to get feedback and adjust in the course of building more robust and comprehensive sales platforms later on.

By working together to sort out their respective roles, automakers and dealers will ultimately be able to better target consumer preferences, hone vehicle configurations, and reduce the need for discounts and sales incentives.

Even under accelerated timelines, the industry should be setting up a digital sales architecture that can be easily expanded in the future. For example, all digital investments must be cloud-native, with off-the-shelf APIs for easy integration. Still, this will happen in fits and starts. The industry’s need for a rapid response will make a perfectly cohesive solution impossible and make iterative learning cycles essential.

Managing the Transition

Much of the transformation to a digital sales model will require rethinking how the auto industry has taken its products to market for a century in the industrialized West. Dealers and automakers will have to embrace flexibility, simplicity, and convenience in order to meet the customer expectations established in other industries. And they must remain open to consumer preferences regarding which parts of the purchase are conducted online and in person.

Automakers should take the lead by investing in change management with dealers and providing them with the resources and support they need to make the transition. For most dealers, shifting to digital sales is a departure from typical business processes. From building digital tools to designing the processes to accommodate them, automakers and dealers will face a great deal of uncertainty in navigating this new environment.

But incumbent players will put themselves at considerable risk if they fail to embrace collaborative change. Already they are facing disintermediation in important markets. Tesla, which sells only online or through company showrooms, is making significant inroads in California, the largest auto market in the US. The Tesla Model 3 compact sedan outsold every other model in the state during the first quarter of 2020, commanding more than 50% of the market for premium sports sedans. The BMW 3 series was a distant second with less than a 10% share.

Automakers must work hand-in-hand with dealers to provide a rewarding customer experience. Benchmarking other industries and their transition to e-commerce can help both automakers and dealers define their approach. In addition, leveraging third parties to facilitate communication and change management across the dealer network can help overcome operational hurdles and make the process seamless. The biggest risks lie in execution. Failure during the transition will damage brand reputation and customer trust.

The COVID-19 crisis has created a window of opportunity for automakers and dealers to redefine their relationships and collaborate to address some of the challenges that have made digitizing difficult in the past. Building and launching an end-to-end digital sales journey will allow the industry to meet new customer needs and unlock vast amounts of data that will provide a better measure of customers, more accurate forecasting of demand, and efficiencies throughout production and marketing. Automakers and dealers must adjust now to capture this unique opportunity.

The authors thank Supriya Hobbs for her contributions to this article.