The semiconductor industry is critical to economic competitiveness and national security in an era of digital transformation, artificial intelligence, and 5G communications. The US semiconductor industry has long been the global semiconductor leader, consistently accounting for 45% to 50% of global revenues. But the US share of semiconductor manufacturing capacity, which was 37% back in 1990, has dropped to 12%. Moreover, only 6% of the new global capacity in development will be located in the US. In contrast, it is projected that during the next decade China will add about 40% of the new capacity and become the largest semiconductor manufacturing location in the world.

This trend could have significant repercussions. With a reduced, shrinking manufacturing footprint, the US semiconductor industry would be challenged to stay at the forefront of further advances in manufacturing-processing technology, architectures, and materials critical for developing the next generations of semiconductors that will make artificial intelligence or quantum computing possible. Furthermore, because 75% of the global capacity is already concentrated in East Asia, maintaining domestic manufacturing capabilities is essential to ensure the US semiconductor industry has a highly resilient, geographically diversified supply chain. This is particularly critical for semiconductors used in US advanced defense systems.

The US ranks high in factors that are key when selecting where to locate front-end fabrication facilities (fabs), such as synergy with existing footprints and ecosystems, access to skilled talent, and protection of intellectual property. But the ten-year total cost of ownership of a new fab located in the US is approximately 30% higher than in Taiwan, South Korea, or Singapore, and 50% higher than in China—an enormous gap considering that the ten-year cost of a state-of-the-art fab ranges between $10 billion and $40 billion, depending on the type of product. As much as 40% to 70% of that cost differential is directly attributable to government incentives.

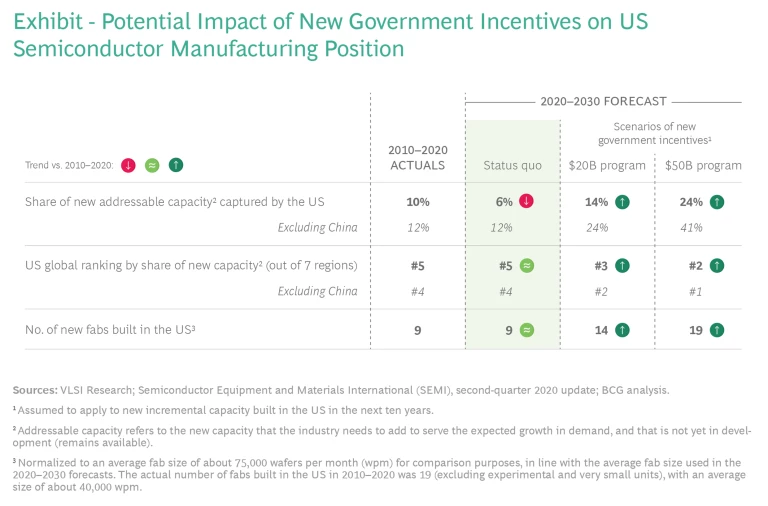

Global manufacturing capacity is forecasted to increase by more than 50% from 2020 to 2030, presenting a market opportunity for the US to attract a higher share of the new future fabs. According to our analysis, a $20 billion to $50 billion federal-government program of additional grants and tax incentives for new state-of-the-art fabs built in the next decade would be effective in reversing the last 30 years’ declining trend in US semiconductor manufacturing.

Depending on the size of the program, the US could potentially double or triple its participation in the new additional semiconductor manufacturing capacity that still needs to be developed globally to meet the expected growth in market demand, achieving a 14% to 24% share, as opposed to just the status quo’s 6%. (See the exhibit.)

Such government investment would mark an inflection point in establishing the US as a highly attractive location for semiconductor manufacturing. For example, we estimate that a $50 billion incentive program would enable the construction of 19 advanced fabs in the US over the next ten years, doubling the number expected if no action is taken and increasing the capacity located in the US by 57%. These new fabs would be commercially viable and have sufficient capacity to cover the demand from the US defense and aerospace industry. In addition, they could create about 70,000 direct jobs, significantly expanding the US talent pool of highly skilled semiconductor manufacturing technicians; foster the development of local high-tech clusters; and contribute to improving the US trade balance in goods.

Together with continued leadership in R&D, strengthening its capabilities in manufacturing would position the US semiconductor industry to lead the way in the new innovation frontiers of materials, architectures, and fabrication processes that will power the critical advancements in computing and electronics for the next decades.

This report would not have been possible without the contributions of our BCG colleagues Gaurav Tembey, Charles Yang-Flint, Ray Loa, Andy Zhou, Jesus Guardado, Sohini Kar, and Yeonsoo Lee.