The coming decade affords mobile network operators a multitrillion-dollar opportunity. Because of their unique combination of core business, customer base, and capabilities, telcos can capitalize on broadening societal expectations for corporate purpose and performance to build new sources of revenue and business.

In a report published with the GSMA, How Telcos Can Unlock New Value Through Total Societal Impact, we highlight how telcos can use their strengths and capabilities to score a double win—with customers and investors. It starts with putting a total societal impact (TSI) strategic lens on the business, assessing the benefits to society from the company’s products, services, operations, core capabilities, and corporate social responsibility initiatives, including the explicit decisions a company makes to adjust its core business.

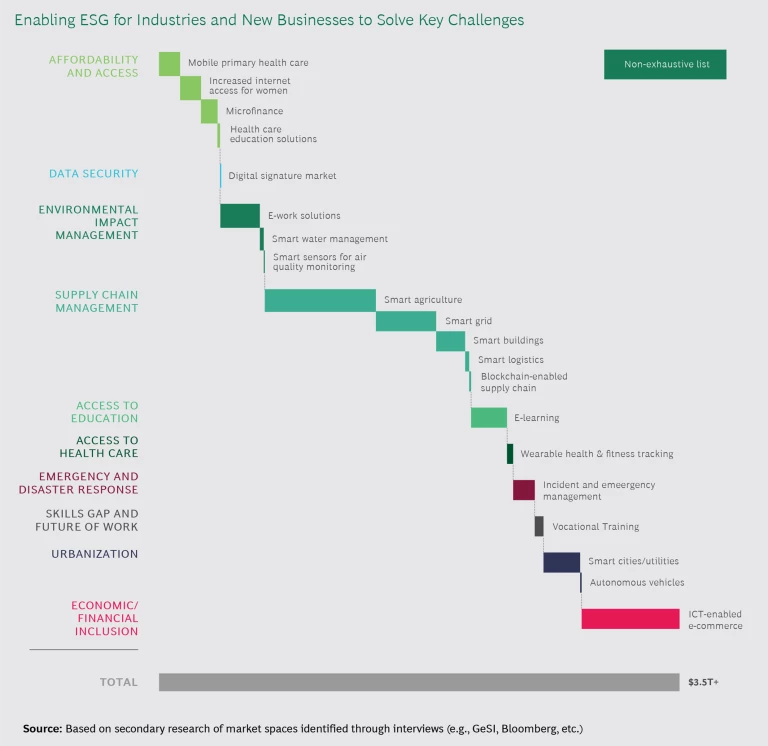

We believe telcos are perhaps uniquely positioned to make TSI a driving source of value. Operators can help companies in other industries address their own environmental, social, and governance (ESG) issues. We have identified more than 50 such areas of opportunity. Telcos can also use an ESG lens to point to entirely new channels for growth. We highlight more than 20 opportunity areas spanning a half-dozen topics of major ESG relevance.

Our analysis indicates that these revenue opportunities could exceed $3.5 trillion in total market size over the coming decade. There is also potential for telcos to influence how they are valued by redefining the ways in which capital markets—applying a TSI lens—view them, their industry, and their role in business and society.

A New Approach

Many telcos are already building a TSI approach into their business. “The role that telcos can play in creating new sources of value is very significant; we can utilize our assets to enhance social value as part of our core businesses,” said Keisuke Suzuki of NTT Docomo. “We are entering an era where the value of a company won’t just be measured in terms of economic or social performance, but also by its contribution to society,” said Stephane Richard of Orange.

There has been a significant increase in discussion of ESG issues on company earnings calls. Our analysis of the earnings calls of 30 large telcos between the first quarter of 2015 and the third quarter of 2019 found that topics related to cybersecurity and energy are discussed most often (about 60% of the total) and that climate topics have also grown in importance. A similar analysis of terms related to how telcos can help enable other industries found topics related to mobile money and smart cities were most common (about 75% of the total).

Similarly, our analysis of one news aggregator’s content since 2014 reveals active coverage of mobile enabling other industries and creating new businesses. We found almost 1,000 stories involving business opportunities for telcos, with the volume of relevant news stories increasing steadily over the last five years. Overall, smart cities and mobile money represent almost two-thirds of the coverage. The Internet of Things (IoT) is receiving rising attention. Regionally, mobile money is the most covered topic in Africa and Southern Asia (it is also big in other developing countries), while telemedicine stands out as a prominent topic in Australia and New Zealand. The Internet of Things is a major topic across Asia.

BCG has shown that TSI can become an important consideration in valuation multiples today in many sectors and that investors have awarded top TSI companies multiples 3% to 19% higher than sector medians. To date, higher valuations have correlated primarily with factors that reduce ESG-related risks. Over time, however, we believe that investors will also recognize the upside of positive ESG performance on a company’s longer-run competitive advantage and value. Investment advisers and managers are already developing data-driven tools that enable clients to create portfolios using a comprehensive set of ESG tools (including methodology, asset classes, and themes) and data on expected performance and ESG impact.

Where the Opportunities Are

Telcos can create new value by executing a three-stage agenda:

- Establishing their own “license to lead.” Addressing material ESG topics, such as climate impact, data security, and digital inclusion, and communicating how they are improving, are essential first steps. Many operators are already demonstrating significant progress and success.

- Enabling companies in other industries to better address their ESG issues. Telcos can build new business models that leverage their strengths to tackle industry-specific ESG topics and deliver new solutions for others. Education, health care, and financial services are three fertile fields, but there are many others. This will drive innovation and diversify operators’ business portfolios.

- Creating new businesses that address environmental and societal challenges. Telcos can establish ventures that leverage their capabilities to build products and services that take them into new markets and lead to additional innovation, diversification, and sources of financial opportunity.

The Sustainability Accounting Standards Board has identified a broad range of material ESG topics across multiple industries in the second two areas. We have examined opportunities for telcos to serve customers in other industries in various ESG topics based on network operators’ customer base (and customers’ trust), data assets, last-mile advantage, and technological capabilities. Assisting banks and others with digital payment platforms, providing digital identity authentication and data security services, and developing IoT services for a host of applications from buildings to water and waste management are a few examples.

Telcos also have plentiful opportunities to create new business revenue streams by addressing environmental and social issues. Consider personalized health tracking and time-sensitive remote health applications, digital platforms for vocational training, mobile financial trading platforms, and mobile platforms for disaster preparedness and post-disaster response. While many of these opportunities will need to be pursued with partners, often from other industries, they are all rooted in network operators’ existing advantages such as their large customer base (and customers’ trust), data assets, last-mile advantage, and technological capabilities.

Without trying to be exhaustive, we estimate the aggregate market at more than $3.5 trillion in this decade in sectors that include health care, education, environmental impact management, and financial services and economic inclusion (see the exhibit). These potential opportunities represent total market estimates. Operators will have to carve out their positions through innovation, partnerships, and building on their inherent advantages and capabilities. They will face competition from tech companies and industry incumbents, among others. In many areas, they will likely need to pursue a How the Internet of Things Will Change the Pricing of Things that bring expertise and capabilities telcos do not have.

What It Will Take

The transformation to a new model is never easy. And no one should not underestimate the barriers, which include the need for deeper customer insight capabilities, limited investment budgets, the tightening regulatory environment in some markets, and challenges in monetization for new business models. Perhaps most significant are competition from the tech giants and industry incumbents and companies’ own cultural bias against risk-taking and change.

Achieving the TSI agenda will require telco managements to deliver on five imperatives for success:

- Bold vision and purpose. Companies need to articulate a vision and purpose that connects value creation with broader environmental and societal impact.

- Clear strategy. Companies can identify the most profitable, scalable, and high-impact opportunities that link to the value drivers of the business.

- TSI business model innovation. We have laid out seven avenues of sustainable business model innovation (S-BMI) with ESG impact.

- Partnerships and ecosystems. In addition to working with current customers—especially enterprise customers—to secure positions as valued partners on ICT matters, telcos will need to mobilize partnerships or entirely new ecosystems of players that combine to deliver the desired product or service and enable operators to own the customer relationship.

- New capabilities. Achieving success will require investment in new capabilities, talent, and technologies. It will also need to be supported by aggressive communication with investors, employees, customers, the public sector, and communities, specifying new goals and the metrics on which progress should be measured.

Operators can score big wins with their customers (both consumer and enterprise) and their investors—if they move quickly. The opportunities are here. Is the industry ready to seize them?