Hospitality companies around the world are suffering disproportionately from the impact of COVID-19. These businesses—from restaurants and bars to hotels, comedy clubs, and music venues—are critical to the global economy and to local communities. In addition to their economic impact, they play an outsized role in making our cities and towns vibrant and appealing. Yet, given their inherently social nature, these businesses are also highly vulnerable to the financial pain the pandemic lockdown has inflicted. This is especially true for small and midsize enterprises (SMEs), which form the bulk of the industry. Prune, an independent restaurant in New York City that closed its doors in March 2020, serves as one powerful example.

A 20-year-old institution with just 14 tables and a cult following, Prune struggled to get clear information about the pandemic lockdown or potential financial aid. As its owner, Gabrielle Hamilton, wrote in the New York Times, SBA disaster loans wouldn’t cover the lockdown, and the US government’s Paycheck Protection Program would only help if Prune rehired its employees by June—an impossible task. A relief bill came before Congress, but it left out small, independent restaurants. Hamilton felt she had no choice but to shutter. And she was far from alone. Every restaurant and bar in the city was placed under lockdown, and most had no means of generating revenue to pay expenses or wages. Laid-off employees struggled to claim unemployment support in the rush of applicants.

Delays seen with government funding have been especially painful for SMEs, which have limited resources and difficulty accessing capital.

Governments and some private businesses have provided help to the hospitality community, but it’s seldom been enough. The delays seen with government funding have been especially painful for SMEs, which have limited resources and difficulty accessing capital. What’s more, the level of red tape surrounding applications for government aid has often been a prohibitive burden. Critical funds are not reaching SMEs in developed countries, while those in developing ones often exist outside the formal economy and thus have no direct channels for receiving aid.

If we are to prevent significant economic and social fallout from closures and unemployment, smaller businesses like Prune need meaningful and coordinated support from those with the scale and financial fortitude to shoulder more of the burden, whether governments, private enterprises, or multilateral organizations.

Operating Without a Net

While some sectors have fared relatively well during the pandemic, SMEs in general and hospitality SMEs in particular have been hard hit by the crisis. Small Business Recovery Research conducted by American Express found that nearly one in four US owners of SMEs stopped paying themselves a salary during the pandemic to keep their business open. But many more restaurants and bars had to shut down entirely. A National Restaurant Association survey released on September 14, 2020, found that 100,000 restaurants in the US—one in six—had permanently closed, and 40,000 expected they wouldn’t survive another five months without additional support. The New York Times reported that more than 2 million restaurant jobs and nearly 200,000 bar jobs were lost in the US between February and August of this year. The pattern we see at Prune and so many other small businesses has been repeated on a broad scale around the world.

The situation is even worse in developing countries, where the average cash buffer for hospitality SMEs is just two to three weeks. Latin America and the Caribbean in particular have struggled through the pandemic restrictions. The IMF found that 45% of jobs in those regions are in contact-intensive sectors such as restaurants, versus 30% in developing markets overall.

Many SMEs, particularly in developing countries, are informal businesses with no direct ties to government. That fact, paired with few financial buffers, puts these businesses at significant risk of layoffs or permanent closure. The informal economy in which these SMEs operate is estimated to have generated around 23% of global GDP in 2016, and the figure was even higher in developing countries. The informal economy in Brazil, for example, is estimated to have generated around 37% of GDP in that same year.

Some of the other issues plaguing hospitality SMEs include the following:

E-commerce Limitations. E-commerce has grown rapidly during the pandemic lockdown, with some businesses finding a lifeline in third-party services, such as Uber Eats and Grubhub, that have allowed them to access online customers. However, these services often erode margins by charging significant fees and seldom fully replace offline business. Other hospitality SMEs have simply been unable to move their business online or gain any access to third-party platforms.

Additional Restrictions. Burdensome restrictions, such as alcohol prohibitions, can further hurt already at-risk businesses. In some regions, as much as one-third of restaurant revenue—and an even higher portion of profits—comes from alcohol in locations that sell it. Research from the Transnational Alliance to Combat Illicit Trade (TRACIT) shows that in addition to weakening already struggling SMEs, such restrictions can also lead to the production, sale, and smuggling of harmful illicit alcohol.

Access to Credit. Reporting by the Financial Times shows that consolidation of the banking industry has eliminated many community banks that once focused on small-business lending. As those banks disappeared, access to loans meaningfully declined as well, leaving SMEs of all types struggling to access credit in this crucial time.

Ramifications for the Global Economy

While small businesses such as Prune might not seem critically important in the grand scheme of things, in fact just the opposite is true. The SME hospitality sector lifts entrepreneurs, allowing them to make better lives for themselves and their communities. In China, India, Brazil, Mexico, the US, and South Africa alone there are more than 15,000 food service SMEs, accounting for 95% of the food service industry and more than 24 million jobs. (See Exhibit 1.)

The hospitality industry as a whole is critical to the global economy, generating 10% of global employment and contributing $8.9 trillion to global GDP. And SMEs generate as much as 70% of the industry’s revenues globally. (See Exhibit 2.)

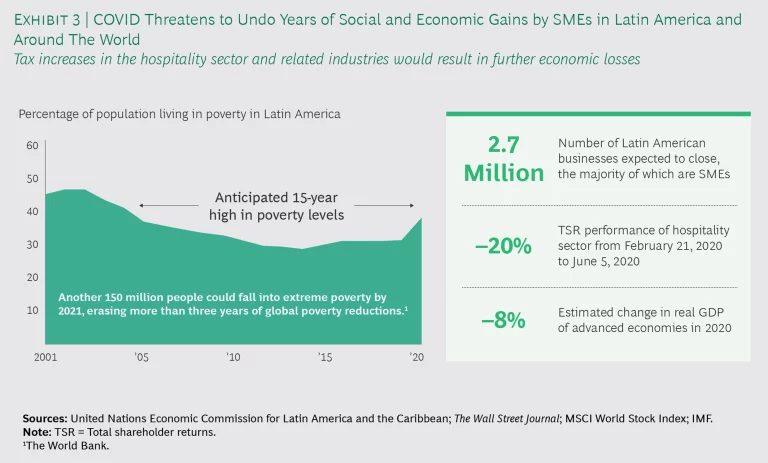

The importance and scale of the hospitality industry worldwide, the vulnerability of hospitality SMEs, and the impact of COVID-19—including the risk of closure for so many—threaten to add fuel to a growing economic fire. A substantial rise in poverty levels is already looming: the World Bank estimates another 150 million people worldwide could fall into extreme poverty (defined as living on less than $1.90 a day) by 2021, erasing more than three years of global poverty reductions. This would mark the first rise in the percentage of people living in extreme poverty in about 20 years. Adding to the pain, and in stark contrast to past recessions, the IMF finds that employment has contracted more than GDP during this crisis.

The importance and scale of the hospitality industry worldwide, the vulnerability of hospitality SMEs, and the impact of COVID-19 threaten to add fuel to a growing economic fire.

COVID-19 is also threatening to undo all the social and economic gains SMEs have made in Latin America over the past 15 years. Both the IMF and the World Bank forecast that Latin America will have the largest percentage of decline in real GDP in 2020 of all developing regions. (See Exhibit 3.)

Not only are hospitality SMEs vulnerable in their own right, but their labor force is also more vulnerable than that of the global workforce because it includes a large proportion of women and part-time workers. The hospitality labor force in OECD countries as a whole consists of more than 56% women and 37% employees without a high school degree. Many of these vulnerable workers have lost not just their jobs in the pandemic but their health insurance, too.

The situation is even more exaggerated in developing countries, where women make up nearly 70% of the workforce. Further, there are 740 million women worldwide working in the informal economy, which has struggled to receive aid. During the pandemic, women have lost jobs across all industries at a faster pace than their male counterparts. In Colombia, for example, employment fell 28% for women versus 18% for men from April 2019 to April 2020. Given that hospitality relies most heavily on women, the effect will certainly be disproportionately worse for them in that industry.

Unfortunately, the harm is expected to continue to grow. We have found in consumer research that more than 25% of US adults anticipate going to restaurants less frequently after COVID-19 is under control. Hospitality businesses have already had to adjust to changing consumer sentiment and comfort levels, as well as capacity constraints and the cost of new safety compliance measures. This means the industry won’t immediately recover even when all restaurants and hotels can fully reopen; instead, their recovery will lag behind the relaxing of government restrictions, prolonging the impact of the pandemic.

The Importance of Ongoing Support

Clearly this sector must remain a priority, and resources need to be allocated accordingly. As of July 2020, G20 countries had spent about 15% of their GDP on stimulus packages intended to provide support to the industry. Yet the magnitude of stimulus spending has varied across countries, and even more needs to be done to get the sector through ongoing COVID-related restrictions. Government programs should directly address the needs of SMEs and the hospitality sector. Here are some important steps.

Do No Harm. To begin with, governments should proactively avoid harming the industry with any new policies. While restrictions are sometimes necessary to protect consumers, restrict the spread of the virus, and—in the long run—recoup revenues to offset stimulus packages, it is important not to inflict further burdens and costs on those already hardest hit. Funding delays, which affect SMEs most significantly, should also be avoided.

Stabilize and Clarify. Governments need to stabilize today’s often unclear, frequently changing, and generally onerous regulations and restrictions and clarify their expectations for the future. They can do so by, for example, giving businesses early and detailed information on what they will be allowed to do, what the regulations will look like, and the kind of support they can expect. This clarity will enable effective budget planning and minimize the costs incurred in attempting to reopen and then being forced to close again, such as the expense of rehiring staff and purchasing supplies.

Take Tactical Steps. Governments should take tactical steps to optimize reopening plans without high COVID-19 risk. They can, for example, prevent evictions by providing rent subsidies and tax credits to SMEs or by helping SMEs digitize and move more easily into the e-commerce space (this was a priority at this year’s G20 Business 20 (B20) Summit, the official voice of the G20 business community).

Collaborate. Governments need to actively collaborate with private enterprises to support struggling SMEs. The outsized impact of the pandemic lockdown on the global hospitality market will not be relieved through government stimuli alone. Instead, the market will require a support ecosystem that draws from governments, private enterprises, and multilateral organizations that have the scale and financial strength to support small businesses. And there is much more room for public-private partnerships to grow and support the recovery.

Consumer packaged goods companies can form a vital part of this ecosystem. In fact, many CPG companies have already invested in the industry’s recovery and demonstrated tremendous effectiveness. (See “CPG Companies Are Playing a Crucial Role.”) With localized value chains that focus on SMEs, they know the hospitality SME landscape better than most. They also have a vested interest in keeping the industry alive and well. Private enterprises often have direct connections to SMEs in the informal as well as the formal economy, enabling them to create a bridge that governments can’t provide.

CPG Companies Are Playing a Crucial Role

Anheuser-Busch InBev

AB InBev, a multinational drink and brewing company operating in more than 100 countries, has raised millions of dollars for more than 15,000 bars and restaurants across the globe. It is also using Tienda Cerca, its online platform in Latin America, to facilitate online ordering for delivery and in-store pick-up. In Colombia, where roughly two-thirds of alcohol sellers are SMEs, Tienda Cerca now supports more than 65,000 shops. In addition, in South Africa, the company’s Sabela program supports inclusive recovery for microentrepreneurs and provides dedicated COVID-19 education.

PepsiCo

PepsiCo, a food, snack, and beverage company that reaches consumers in more than 200 countries and territories, created a Restaurant Employee Relief Fund along with programming to help raise money for that initiative. PepsiCo also built a resources website to provide support to its SME retailer customers through digital solutions that can help set the stage for reopening and future growth.

Unilever

Unilever, a multinational consumer goods company that operates in 190 countries, is supporting its SME retailer customers and suppliers across the globe with €500 million in cash flow relief in the form of credit lines to selected small-scale customers whose business relies on Unilever as well as early payments to SME suppliers to help them retain financial liquidity.

Bars and restaurants in particular are a critical channel for the CPG alcohol category (and made up around 45% of alcohol volume in China and about 60% of volume in Brazil in 2019, for example). In Mexico, beer is one of the most profitable categories for retailers. And in Colombia, beer is a best-selling product across retailers that sell alcohol, accounting for more than one-third of sales and approximately 75% of profits for retail SMEs.

In this extremely difficult economic environment, we must all stand behind small businesses. As stories like Prune’s play out around the world, it is critical to do more to prevent further unemployment and business closures in this fragile sector. Governments in particular should respond by doing more to prevent harm, providing new financial and regulatory assistance, and boosting their work with private enterprises, whether by supporting individual initiatives or through collaborative efforts.