This publication is coauthored by BCG and MedTech Europe and describes our ongoing collaboration on value-based procurement in medtech.

Over the past five years, health care stakeholders have begun to address the challenges of unacceptable patient outcomes, unsustainable cost increases, and low-value care by changing the way the health care industry buys and sells products and services. A new approach, value-based procurement (VBP), is already having a significant impact.

VBP focuses not only on the price of a particular product or service but also on the overall value of the solution it can create, in terms of improved outcomes for patients, reduced total cost of care, and benefits to stakeholders such as health care workers. As a result, it is becoming an important lever for improving the quality of care and the financial sustainability of providers and health care systems.

The initial applications of VBP have been encouraging, and the concept is building strong momentum across Europe. But most organizations are still in early stages. To get a detailed picture of the current state of VBP in Europe’s health care industry, in early 2019 we surveyed experts at procurers (including contracting authorities at hospitals and national health systems) and medtech suppliers across Europe. We studied successful applications of VBP to illustrate its potential. And our analysis highlighted the challenges that have limited VBP’s adoption thus far, along with some specific solutions to those challenges.

A common theme from this research is the need for greater urgency. Regardless of whether their organizations have already embraced the new approach or have not yet begun to implement VBP, all health care stakeholders agreed that they want to go further, faster. The time to act is now.

The Link Between Procurement and Value

Health care systems continue to face escalating costs, low-value care, and huge disparities in patient outcomes. For example, among countries in the Organization for Economic Cooperation and Development (OECD), average mortality rates for stroke patients in some countries can be four times higher than for patients in other countries. Reoperation rates following hip replacement surgery in Germany are 18 times higher in the worst performing hospitals than in the best. Across the EU, health care costs are rising faster than GDP growth. In particular, the costs of care delivery are rising disproportionately, according to Eurostat. These costs make up roughly 70% of total health care spend. The problem of low-value care is also large. A 2017 OECD report found that 10% to 34% of health care spending is wasted on inappropriate care. It is clear that a singular focus on cutting the costs of procured products and services will not resolve the challenges; a more holistic approach is needed.

In 2014, the European Parliament and Council passed a directive on public procurement that encourages contracting authorities to move away from price-focused procurement. The directive established a wider perspective for procurement that factors in quality, total costs over the product life cycle, and broader socioeconomic benefits for a given product or service. It also advocated for the development of methodologies to implement this holistic view in practice. These include fostering innovation, reducing red tape, and creating dialogues between suppliers and procurers as part of a formal tender process.

Health care systems continue to face escalating costs, low-value care, and huge disparities in patient outcomes.

In the spirit of the directive, BCG and MedTech Europe (the European trade association representing the medical technology industries) partnered with leading procurers to develop a framework that can help contracting authorities in the health care industry make smarter procurement decisions that are based on an enhanced ratio of quality to price. The main goal of the VBP framework is to Procurement: The Unexpected Driver of Value-Based Health Care —as part of the premarket consultation and during the tender process itself—to improve patient outcomes, reduce the total cost of care, and generate benefits for other stakeholders. The approach thus applies the fundamental logic of value-based health care to the procurement of medical technology.

Assessing the Current State of Play

To better understand how the VBP concept has taken root since 2014, and to identify specific challenges and solutions, we surveyed medtech companies and contracting authorities (including hospitals, group purchasing organizations, and regional and national health authorities). We also conducted deep-dive case studies on VBP tender pilots, getting detailed input from both buyers and suppliers. The research yielded several key findings.

Momentum is building across the EU. First and foremost, momentum is clearly building for this concept. Among other benefits, the 2014 EU public procurement directive strengthens the procedure by which procurers talk to medtech companies after issuing a formal tender. Through pre-tender market consultations and these expanded in-tender dialogues, procurers gain critical insights from suppliers about relevant solutions and innovations in the market and how these offerings can improve outcomes, reduce total costs, fulfill clinical staff needs, and even address broader societal concerns like sustainability.

At the same time, medtech companies gain a richer understanding of the problems that a provider may be trying to solve when it offers solutions instead of just responding to the technical tender specifications. On the basis of the latest EU tender data, we project that the number of the most collaborative tender approaches—those that allow a competitive dialogue, negotiation, or innovation partnership between suppliers and procurers—will hit approximately 700 in 2019, or 2% of all medtech tenders (up from nearly 0% in 2015).

Even more encouraging, countries and health systems are starting to use VBP as a key underlying principle in their medtech procurement. NHS Wales is the first health system to systematically apply VBP to large central tenders to integrate and improve care in areas such as blood thinning and wound management. The organization plans to apply VBP to 100% of appropriate medtech tenders starting in 2020. (For more details on the implementation of VBP by NHS Wales and other organizations, see the sidebar “Four VBP Case Studies.”)

Four VBP Case Studies

Four VBP Case Studies

A wealth of VBP cases are currently underway. The four described here illustrate the variety of real-world applications.

A digitally connected hospital bed unlocks value. The Erasmus Medical Center in the Netherlands wanted to buy hospital beds for its new facility. Rather than basing its decision on purchase price and product features, the center sought a manufacturer that could offer a smarter, comprehensive solution to generate longer-term value and solve some critical challenges Erasmus faced in care delivery. For example, the new facility’s design included doors with no windows, requiring nurses to open each door to make sure patients were still in bed. Digitally connected hospital beds, by contrast, can automatically alert nurses when patients who should be in bed are not (potentially due to a fall, or simply restlessness). The beds also improve workflow efficiency (for example, by automatically measuring patient weight, saving a step for nurses and freeing them for more important tasks) and reduce pressure ulcers and the risk of infections. After evaluating these benefits against its predefined, value-based award criteria, Erasmus purchased a comprehensive service contract that included more than 800 hospital beds, mattresses, a robotic bed-washing solution, integrated digital monitoring devices, and process and outcome improvement commitments from the medical equipment manufacturer.

The service arrangement was structured as a 15-year partnership through which Erasmus and the manufacturer will collaborate to capture real-world evidence of value from the advanced beds and, over time, jointly develop an even more value-enhancing hospital bed solution. In terms of financial savings, an early estimate projects that Erasmus will be able to reduce labor costs in nursing by more than €500,000 per year. “We shared our unmet needs with the suppliers to raise awareness of future opportunities,” noted an Erasmus executive. “It was crucial for us to create trust with suppliers early on, to have them engaged in the process.” Furthermore, Erasmus expects to reduce length of stay by a day for some patient groups, thanks to improved weight and fluid monitoring. For the manufacturer, the connected hospital beds bring its product development teams much closer to daily clinical work and allow them to measure performance in a real-world setting. Constant user feedback helps the manufacturer shorten R&D cycles and continuously improve its products.

NHS Wales implements a solution-based approach for blood thinners. NHS Wales used VBP to improve its services for patients who require blood thinners. Rather than looking for a single product, it sought a broader, solution-based offering, including medical devices, diagnostics and consumables, training, software, and care expertise. The new approach will allow patients to monitor their own blood levels—in conjunction with a health care provider—rather than requiring them to go to a hospital. That increases the quality of life for patients and frees care providers to focus on more critical patients and needs. (Currently, NHS Wales conducts nearly 400,000 blood tests for this group of patients each year.) With the new approach, some patients will be more likely to stay on top of their blood levels and not need to schedule—and potentially skip—a formal appointment with a doctor. As a result, the approach will reduce the likelihood of a patient showing up in the emergency room due to a blood clot or a more severe complication, such as a stroke. The tender resulted in contracts being awarded to a single provider of testing equipment and all consumables and a single provider of anticoagulation dosing software. The solutions provide an opportunity to generate consistent information that, when added to broader data, documents the impact of this approach on patient care.

“We need to change from a focus on volume at the lowest cost to one of improved effectiveness in the use of our resources,” said Alan Brace, director of finance for the Health and Social Services Group in the Welsh government. “This is particularly true in our procurement activities. The disruptive effects of personalized and precision medicine will expose the traditional procurement practices as no longer fit for purpose. The health systems that embrace VBP quickly will be able to engage in the future as equal partners.”

A Dutch insurer opts for a value-based approach to purchase cataract care. Zilveren Kruis, the largest health insurer in the Netherlands, put out a tender for comprehensive, integrated care for patients with cataracts. Rather than the traditional criteria (primarily price and volume), the tender was for an integrated care solution based on long-term value: improved care outcomes at a lower total cost, with key value criteria defined by the care providers themselves, not by Zilveren Kruis. In this case, four providers won the tender. All of them had expertise in eye care and were able to establish their ability to provide high-quality care during the tender process. The tender was extremely novel in that the insurer did not follow the usual process of defining minimum standards for product and procedure features; instead, it sought a broad solution based on outcomes (including the incidence of complications) and long-term cost of care (including cost of re-operations and follow-up care). It then allowed the providers to compete on the basis of the quality criteria that they themselves defined, using quality-of-care measurement techniques based on their expertise. The Zilveren Kruis example shows that VBP is not just for providers—it also helps payers contract for high-quality, value-based care.

A hospital in Spain confirms the potential of VBP in two trial projects. The University Hospital Clinic de Barcelona (HCB) conducted two “pilot learning projects”—akin to practice runs without an actual buying decision—using VBP. The first covered a specialized technology for an advanced heart procedure known as transcatheter aortic valve implantation (TAVI)—a means of implanting replacement valves for patients with severe aortic valve stenosis. The scientific literature shows that TAVI procedures are more costly than open-heart surgery but also less invasive, so they offer a shorter stay in the hospital. As a result, TAVI can lead to a substantial reduction in the overall cost of care for patients who require valve replacements, along with quality-of-life benefits for those patients.

One common post-procedure complication for TAVI patients is the need for a pacemaker, which can cost up to €8,000 in Spain. Medtech companies in the VBP project submitted very different (varying by a factor of more than four) expected pacemaker implant rates for patients after TAVI procedures. Similarly, companies submitted data that indicated a variation of two to three times for the rates of other neurological or vascular complications. The project showed that using VBP to choose the right supplier (the one with the lowest complication rates and the best evidence thereof, as well as the most beneficial impact on total cost of care) can result in a substantial return on the extra time invested by the procurement and clinical teams.

The second pilot learning project focused on a category of disposable products—diapers and underpads for incontinent adults. These may seem like basic products, but more absorbent products can improve patient comfort and reduce complications such as skin rashes and bladder infections. Smarter design can also reduce the number of changes required, thus reducing staff time and the number of replacement pads needed. The result is a beneficial impact on total cost of care—and better value, even if the initial purchase price of the products is higher.

Ferran Rodrígues Omedes, head of clinical and biomedical engineering and deputy director of infrastructure at the hospital, said that the learning projects were a critical first step for the organization and that they clearly substantiated the promise of VBP. “Given the learnings from our VBP project, we looked back at relevant past tenders and saw that a significant number of those would have had a different result, with a higher price paid for a solution with substantially higher clinical and economic value for our hospital and patients.” HCB improved its procurement process as a result of the VBP pilot projects and is looking to expand the methodology to other areas.

Other health systems are following suit. Catalonia, an autonomous region in Spain, is devoting €60 million to VBP projects to bring innovative solutions to its health system. Medtech companies have already used the approach to present 260 projects to health authorities in the region; 20 of the projects have been approved so far. The active projects involve areas such as telehealth monitoring services for patients with chronic conditions and solutions to improve surgical precision and safety and reduce the length of operations.

For both procurers and providers, early VBP applications are leading to improved patient outcomes, lower total costs (thanks to reduced complications and inefficiencies), and increased benefits for other stakeholders, such as health care professionals.

The Dutch Healthcare Authority is advancing value-based contracting as a central concept throughout the Dutch health care supply chain, in tandem with a wider government initiative to shift toward outcome-based health care. Denmark is also considering whether to standardize medtech procurement for the entire country; key officials are arguing in favor of making VBP a centerpiece for that process.

Ireland has just published a new national framework agreement for procuring medical technology that encourages procurers to put up to 80% of awarding weight on outcomes and benefits to care providers.

Given such substantial moves by countries and health systems to apply VBP in procurement, there is clearly an imperative for medtech companies to be fully ready as well.

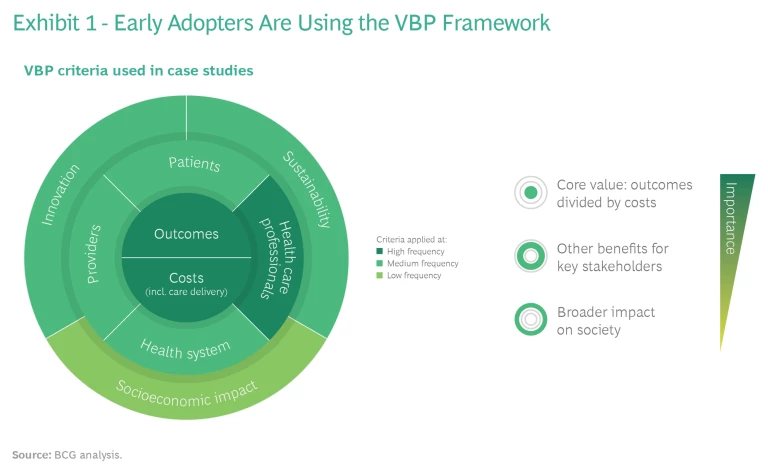

Assessed cases show broad adoption of the VBP framework. A centerpiece of the new value-based procurement approach in medtech is the framework that MedTech Europe and BCG designed in 2015, in close partnership with leading procurers, to support VBP. Its intent is to apply the vision set by the EU procurement directive by proposing a nomenclature for the main value dimensions that enables a more effective dialogue between providers and medtech companies. The framework defines and categorizes more than 30 of the most relevant criteria for procurers to select from and build on (and for medtech companies to use in their value propositions).

As illustrated in Exhibit 1, the VBP projects we looked at used criteria from all of the value dimensions, and the central dimension of outcomes over costs was used most frequently—as intended. Encouragingly, benefits for health care professionals, such as health care worker safety, were also used with high frequency. This was an important validation of the robustness of the framework.

Early adopters are reaping substantial benefits. For both procurers and providers, early VBP applications are leading to improved patient outcomes, lower total costs (thanks to reduced complications and inefficiencies), and increased benefits for other stakeholders, such as health care professionals. Organizations are establishing multidisciplinary teams that are motivated to find the best solution—not just the product with the lowest purchase price —and expand the concept of VBP into additional categories and therapeutic areas.

Similarly, medtech companies that have embraced the VBP approach are seeing a higher win rate on tenders—and have been rewarded for the additional value they created, reflecting the improved care impact that comes from selling a comprehensive solution rather than just a product. (Roughly two-thirds of the VBP tenders we assessed involved a solutions approach.) Moreover, the early adopters are helping to guide the initial VBP tenders, which will likely influence the design of tenders in other contracting authorities going forward. And they are learning and building new capabilities, addressing gaps in how they provide supporting evidence—such as through real-world data—and sharpening their innovation pipeline and contracting approaches.

As one strategic procurer put it, “There are procurer and medtech organizations that are shifting to VBP faster. Their experiences will allow them to benefit from sharing best practices and put them at an advantage over competitors who are not changing.” Conversely, companies that haven’t started face an even greater urgency. A medtech executive said, “I do not see an alternative to shifting away from the counterproductive price-only focus. This is a necessary strategic pivot.”

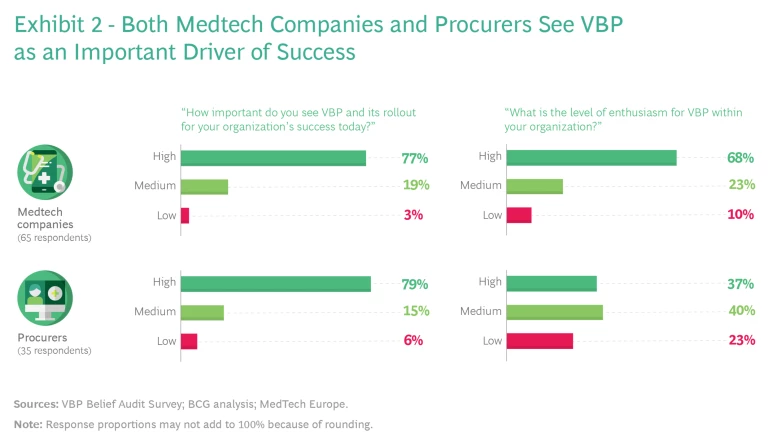

VBP is broadly seen as an important driver of success. Nearly 80% of the respondents to our survey—including both procurers and medtech companies—believe that VBP is highly important, and nearly 70% of medtech respondents say they are enthusiastic about the concept. (See Exhibit 2.) Procurers are a bit more split in their opinions, though those that have direct experience with the concept are more enthusiastic. Respondents see VBP as a powerful mechanism to align interests, shift tender discussions away from the upfront purchase price toward a deeper exploration of how to measure and demonstrate value, and build partnerships of mutual benefit.

Andy Smallwood, head of sourcing for NHS Wales, said, “If you buy cheap, you buy twice. Lowest-price procurement leads to short-term consideration of the product in isolation from its use. Instead, we need suppliers to become more broadly involved in fixing our most urgent care pathway pain points, looking at efficacy, efficiency, and impact on patient outcomes.”

Lars Dahl Allerup, new business development manager and VBP lead at corporate procurement in the Capital Region of Denmark (the largest health care region in the country), agrees: “Value-based procurement is the single most important means to drive sustainable, high-quality, and innovative health care systems today and in the future.”

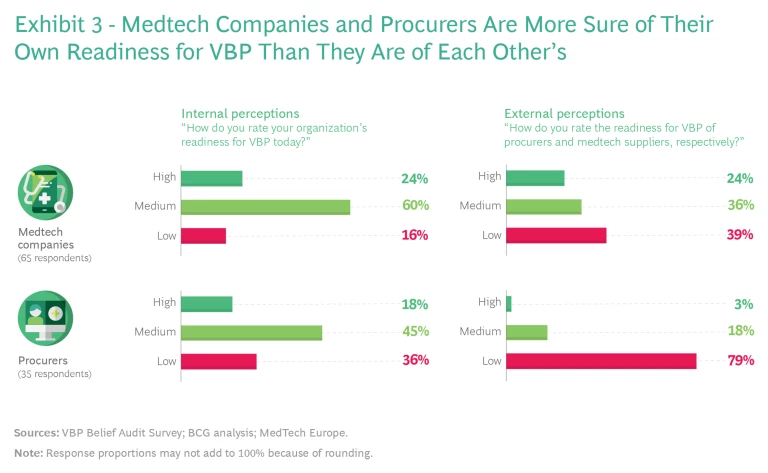

There is still a lot of work to do. As shown in Exhibit 3, respondents were most likely to describe their own organizational readiness for VBP as medium (medtech companies) or low to medium (procurers). And external perceptions of stakeholder groups were even more hedged. For example, 60% of medtech respondents put their company at the medium level of readiness, yet only 36% of procurers believed the same about medtech. Among procurers, 45% put themselves at the medium level of readiness, while 79% of the industry respondents pegged procurer readiness as low. There is clearly a lot of work to do and ample room for both sides to collaborate and support each other on this innovative journey.

Although early pilots show the promise of VBP, even the organizations that adopted early are just starting to scale their approach across medtech categories and markets. VBP holds tremendous potential, yet it also represents a new way of working, not just within a single organization but across both sides of the procurement transaction. In our discussions with industry leaders, both procurers and medtech executives emphasized that getting VBP right takes time. It is a revolution in mindset that must evolve in practice.

Capitalizing on the Promise of VBP

As part of our research, we identified specific measures that procurers and medtech companies can take immediately to begin capitalizing on the promise of VBP, along with ways for the two groups to collaborate more directly.

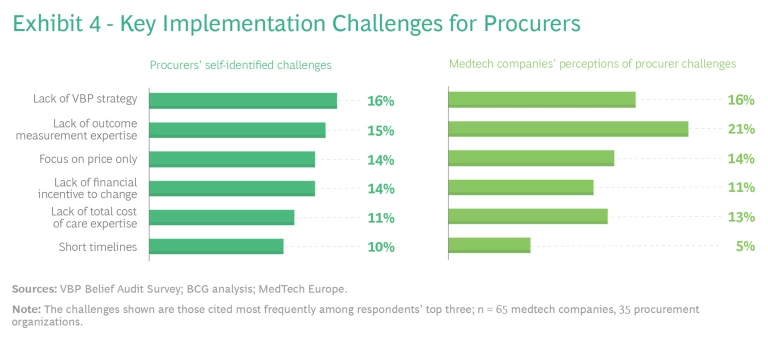

Procurers can play a key role by making VBP a strategic priority and creating the organizational elements needed to overcome the challenges. Many of the procurer respondents said they lack a VBP strategy—a clear direction and willingness among leaders to make a bold leap into VBP and put the right organizational elements in place for success. In addition, many providers do not have the expertise required to measure the value proposition of a given product, service, or solution. Procurers often still focus on upfront price alone, making their purchasing decisions on the basis of financial incentives to hit short-term procurement budgets.

We also asked medtech respondents to cite the biggest challenges for procurers, and their answers largely aligned with those of procurers. Notable differences were that a higher percentage of medtech companies cited the lack of outcome measurement expertise as a key challenge, and fewer medtech companies recognized the challenges imposed by short procurement timelines, which are an important barrier. (See Exhibit 4.)

To address these challenges and deploy VBP successfully, three critical actions are necessary.

1. Make VBP a strategic priority and set up a multidisciplinary VBP team to drive the change. Leadership teams at procuring organizations should make VBP a strategic priority. This entails building a team of people from multiple disciplines, including clinical and health economics expertise, to define the pain points that must be addressed in each VBP process and to broaden the evaluation criteria. They should also spread awareness throughout their organizations, not only among clinicians but also within administrative functions, and collaborate with peers to share best practices. Another critical aspect is devoting sufficient time to work on the initial tenders that apply VBP (contracting authorities often cite lack of time as a key obstacle).

2. Prioritize and focus, through VBP pilots that build up internal expertise. As part of the VBP strategy, procurers should prioritize projects in which the potential value from VBP is clear—defined by a limited set of criteria—and there are clinical champions within the organization who are willing to engage. Early and open communication with medtech companies is key, particularly on the specific pain points for which the organization is seeking a solution. Procurers can learn from these initial projects and broaden the application of VBP over time. Success often comes through a step-by-step progression, rather than a big bang.

3. Develop organizational capabilities. The procuring organizations need to build the appropriate expertise and infrastructure to measure patient-relevant outcomes and total cost of care—the core components of VBP. This will enable them to demonstrate the real-world quantitative and qualitative benefits over traditional procurement methods. Similarly, procurement incentives should align with long-term value, rather than with just the upfront purchase price or financial rewards for hitting short-term budget targets. “We need to be able to measure a baseline and then the improvement for VBP initiatives more easily,” said the deputy head of procurement at an academic medical center. “We can’t start anew with every project.” (See the sidebar “How Procurers Create the Right Operating Model to Support VBP.”)

How Procurers Create the Right Operating Model to Support VBP

How Procurers Create the Right Operating Model to Support VBP

Advancing from pilot projects to a broader and more ambitious VBP approach requires changes to the operating model. Here’s how two procurers accomplished that.

NHS Wales realized that trying to reduce the price of medtech products was having limited impact on the overall cost of care. Instead, it changed its strategy for procurement to a value-based approach. The organization established a team of three dedicated VBP managers, who serve as internal ambassadors for the concept. Those managers are setting up multidisciplinary groups within NHS Wales to identify clinical pain points, develop value criteria, establish metrics, build institutional expertise, and support the overall VBP approach. To date, NHS Wales has trained more than 100 procurers on VBP, and it is now expanding its focus to the finance function. With the foundation in place, NHS Wales has now expanded the VBP approach to large medtech tenders, and it aims to include 100% of appropriate medtech tenders from 2020 onwards.

Similarly, the health system for the Capital Region of Denmark set up a dedicated, four-person function for VBP, innovation, and strategic partnerships. It also created multidisciplinary steering committees for specific medtech categories, each staffed by eight to ten specialists. The organization built standard approaches and templates for commercial, legal, IP, IT, and data components across disease areas by partnering with a software provider. Part of the IT effort is a proprietary database that allows the organization to track VBP execution and innovation. The first two implementation waves led to seven VBP projects, about 30% of the total, comprising €10 million in spending. The system plans to expand with additional projects.

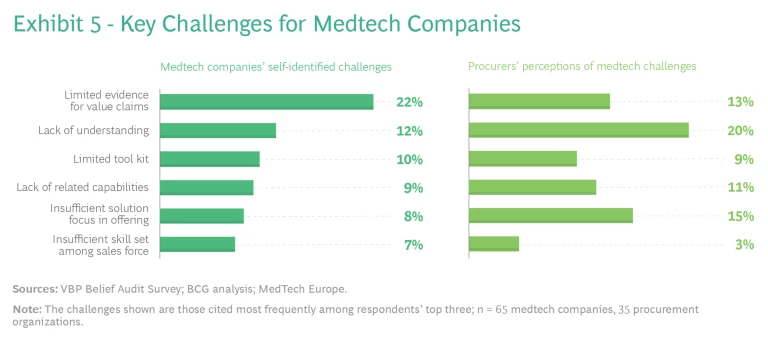

Medtech companies should focus on solution-based offerings, evidence of value, and capabilities. For medtech companies, our research points to specific challenges as well. (See Exhibit 5.) They often do not have sufficient specific evidence that their products and solutions create value in real-world settings. And they often lack a holistic understanding of VBP and the tools and capabilities needed to execute it. Typically, their commercial models still emphasize products rather than comprehensive solutions.

Procurer respondents to our survey saw similar challenges for medtech and highlighted, in particular, a lack of understanding and insufficient focus on solutions. Regarding the latter, procurers told us that they are dependent on suppliers to educate them on what is possible. They typically do not have the capacity to work with medtech companies in conceiving new solutions from scratch; rather, they prefer that suppliers come with “productized” solution packages that can be easily adapted and deployed.

To address these challenges, we recommend that medtech companies take five specific steps to establish a virtuous cycle of continuous improvement and expansion of their VBP offerings.

1. Prioritize where to play based on existing solution capabilities and value proofs. First, medtech companies should identify the parts of their offering that are most conducive to a VBP approach. A systematic assessment will determine where they can capitalize on existing solution capabilities and related evidence to help providers address their biggest outcome variations, cost of care inefficiencies, and other pain points. From early successes, they can broaden their focus into new capabilities over time.

2. Create multidisciplinary teams to develop value propositions that align with the VBP framework. Medtech companies should also identify the personnel—typically from marketing, sales, market access, and medical, among other areas— who should come together on multidisciplinary teams to craft new value propositions in the prioritized areas. Rather than highlighting the features of a given product or service, companies should work from the VBP framework, starting with customer needs. This entails creating a deep understanding of the variations in outcomes, the inefficiencies that lead to higher total costs of care, and the other pain points for the main stakeholders; identifying the underlying levers that can be used to address these points; and, lastly, mapping the related existing and potential solutions the company can offer. On the basis of this deep exploration, the teams can then craft a competitively differentiated, needs-based value proposition.

In our experience, such new value propositions can be so impactful that companies use them broadly in their go-to-market approach and roll them out to regions beyond Europe as well.

3. Enable the commercial teams. In addition, medtech companies should determine which roles in the commercial organization are needed to identify and realize VBP opportunities, and then enable those teams accordingly. Traditional sales reps will find it hard to realize a full VBP tender on their own, without the appropriate expert support. But they will play a crucial role in creating awareness among their customers, identifying opportunities, and bringing the right experts to the table. This step can also be a good occasion to strengthen tender methodologies and tool kits and align incentives to foster collaboration in the field.

4. Rigorously execute, starting with prioritized tenders. Medtech companies should establish task forces on a regional or country level, to coordinate the implementation of the new VBP approach. They should prioritize the tenders that are coming up in the next 12 to 18 months, focusing on those with the greatest potential for a VBP approach. From that point, companies should rigorously drive execution, actively support the frontline teams, and track the progress of each opportunity.

“The single biggest driver of success was our new VBP SWAT team,” said an executive at a medical device company. “We invested in know-how, capabilities, and boots on the ground. Our teams then focused on selected VBP tenders in our key markets. This cross-geography, cross-functional approach helped us win the vast majority of the prioritized VBP tenders and demonstrate—to our clients and also internally—the value of this new way of collaborating.” (See the sidebar “How Medtech Companies Create the Right Operating Model to Support VBP.”)

How Medtech Companies Create the Right Operating Model to Support VBP

How Medtech Companies Create the Right Operating Model to Support VBP

Some winning medtech companies are taking the steps necessary to adopt VBP more broadly. For example, one company wanted to become more competitive against strong rivals. To do so, it developed a central team that coordinates VBP strategy, capabilities, tools, and training across Europe. Country-based teams implement the concept locally, but they benefit from central support, particularly on large tenders. The company also revamped its marketing to emphasize real-world evidence of value from its products. Key account managers and sales reps are trained on value-based selling. As a result of this organizational approach, the company won 70% of the tenders in which VBP was used, a substantial step up from its overall market share of 40%.

Another medtech company set up fully dedicated VBP functions at the global, regional, and local levels, which coordinate among the sales, marketing, government affairs, and legal departments. The company also has a VBP academy for more than 20 VBP projects in the EU, to serve as a central repository of topic expertise and to share best practices among teams. As a result, the firm’s value-based solutions and integrated care offerings are growing faster—in terms of the number of tender projects and revenue—than its traditional portfolio, and the company is recognized as a leader in value-based solutions and contracting.

5. Capitalize on the first-mover advantage. Finally, medtech companies should apply the lessons from initial pilots to generate real-world evidence and leverage the experience from implementing new solutions. In this way, companies can create a virtuous circle of improved value generation that expands into other parts of the portfolio and geographic markets.

Procurers and medtech companies should forge a true partnership. VBP calls for a collaborative partnership, including a willingness to engage on clinical and organizational pain points and to measure jointly—and share—data regarding outcomes. Clearly, that kind of partnership requires significant trust. (See the sidebar “The VBP Community of Practice.”)

The VBP Community of Practice

The VBP Community of Practice

An early dialogue between procurers and suppliers, in advance of the formal tender process, is a crucial prerequisite for success. Through such dialogue, both sides get greater clarity on objectives and potential solutions, and they can jointly define outcome criteria and how best to generate real-world evidence.

For procurers to lead the way in these pre-tender dialogues, we’ve identified three key imperatives:

- Identify the pain points in care that are in scope, and ask suppliers to provide insights and early-stage guidance on how the partnership can address those pain points, considering available solution packages and the status of related value proofs.

- Clearly define all elements required for an effective VBP tender process—criteria, units of measurement, types of acceptable evidence, and so forth.

- Ensure that senior leaders on both sides engage in and deliver excellent project management, including clarity on all timelines and milestones.

Value-based procurement holds tremendous potential to transform health care, leading to better patient outcomes while helping to control ever-escalating costs. Strong momentum is building, and the experience of early VBP adopters so far has been very promising. To seize this opportunity fully, the health care industry needs to strengthen the foundation for value-based procurement, by acting now. Those that do so will realize a significant first-mover advantage in a world of patient-centric and sustainable health care.