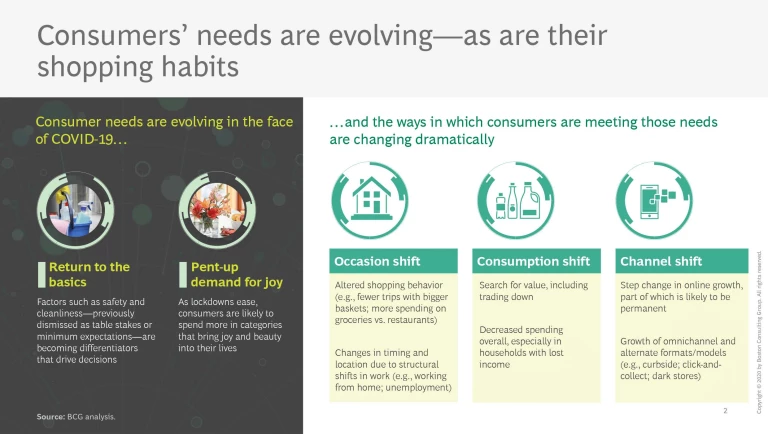

Many retailers are in the process of reopening their doors to a changed world. The COVID-19 pandemic has altered what consumers are looking for and has driven an even more radical shift in how they shop to meet those demands. Moreover, as consumers worry about their health and the prospect of a prolonged economic downturn, a return to pre-pandemic levels of shopping and spending is far from guaranteed. For retailers, this raises a daunting question: how can they reignite consumer demand in a way that reflects the new reality?

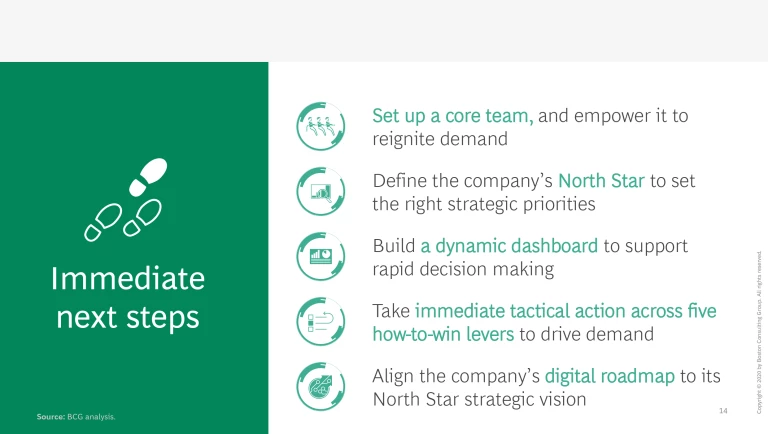

To find the best answer for their specific operation, retailers must understand consumer needs and shifts in consumer behavior, and take concrete action to adapt to them.

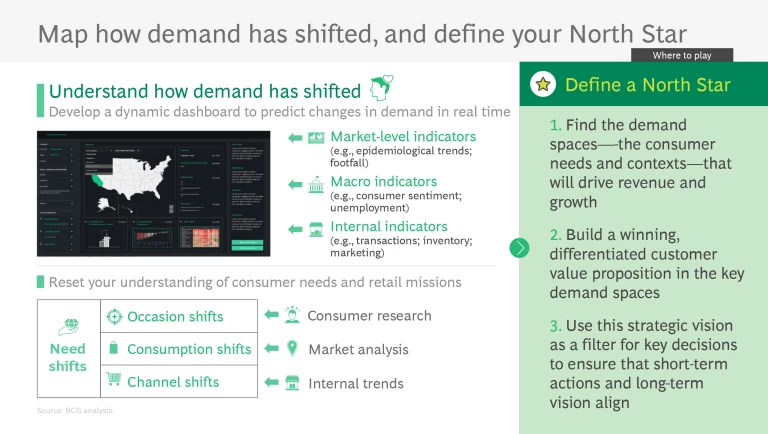

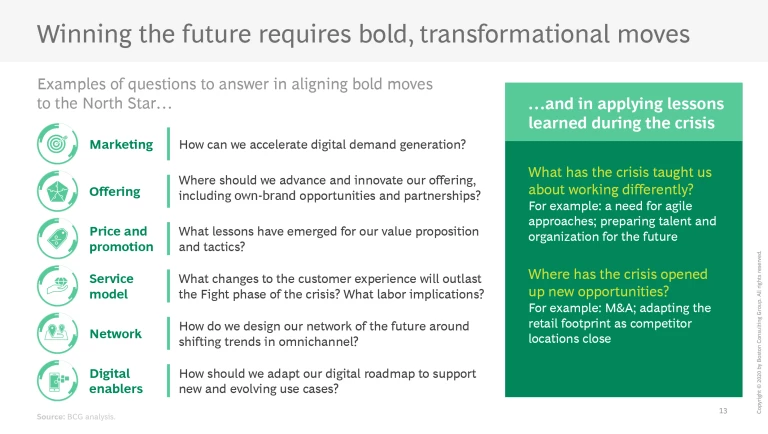

Retailers must first decide where to play, which requires understanding the changing size and shape of demand and defining a North Star—a specific demand space (or multiple demand spaces) that the retailer can target, serve better than any rival, and win.

Using that North Star to guide their growth strategy and customer value proposition, retailers should then take five crucial actions:

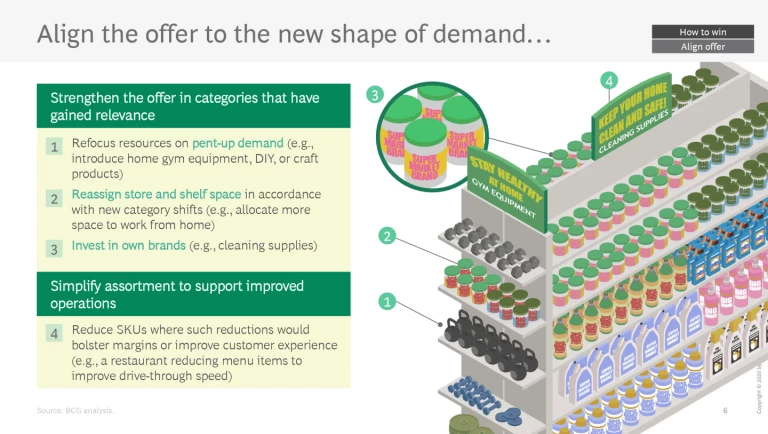

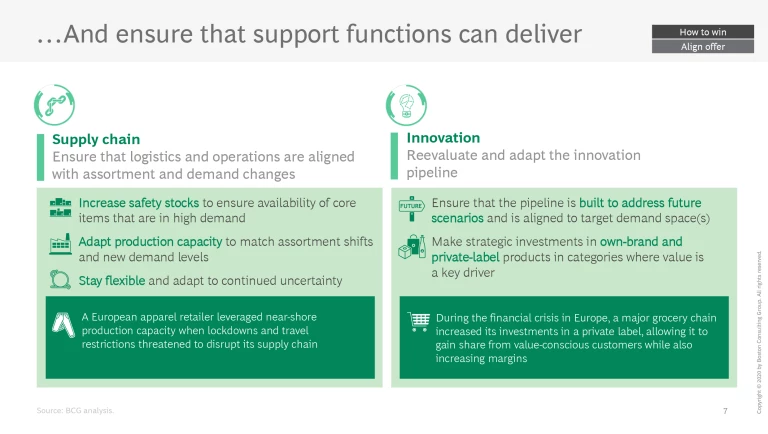

- Align their offer (and their support functions) to evolving customer demand

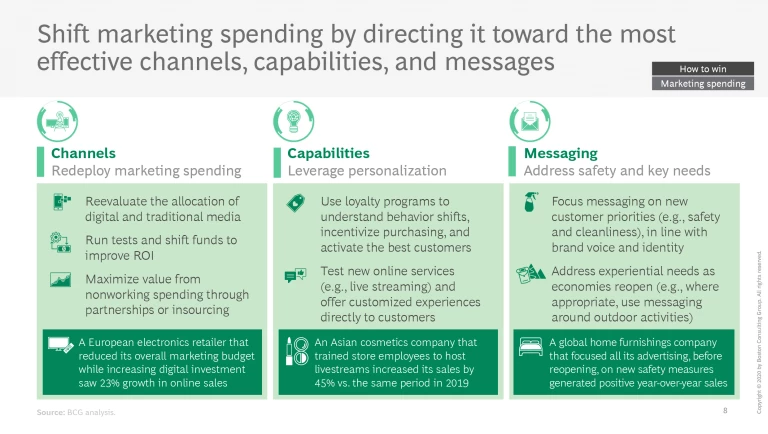

- Shift their marketing spending by reallocating resources to the most effective channels and messages

- Adapt their pricing and promotions to reflect new customer needs and expectations

- Enhance their service model to be safe and frictionless and deliver on changing customer expectations

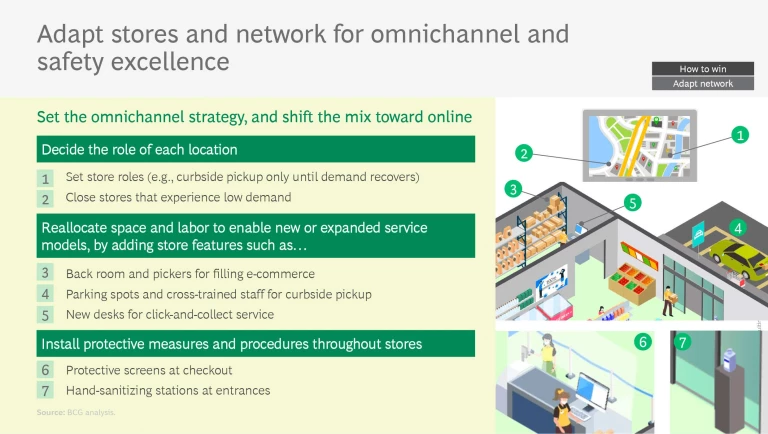

- Adapt their store network to provide omnichannel and safety excellence

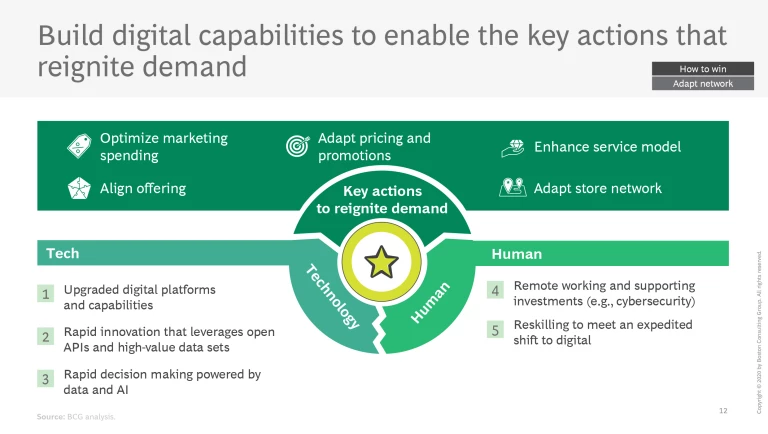

At the same time, retailers need to invest in and develop digital capabilities (such as AI-powered decision making) that support and enable each of the five actions outlined above.

Those that move quickly to understand and respond to the changing consumer reality will be well-positioned to thrive in the face of economic headwinds and take the lead in the eventual rebound.

Explore more of our insights into how retailers can reignite demand in the slideshow below.

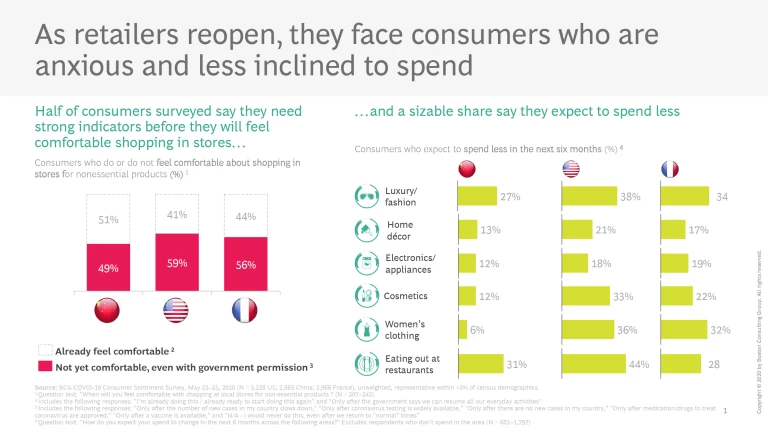

59% of US consumers are not yet comfortable returning to stores to shop for nonessential products, as of May 22–25, stating that they need to see additional positive indicators, such as a slowdown in the number of new cases or a vaccine or other major medical development before their attitude will change.

1/3 of US consumers expect to spend less in the next six months in categories such as cosmetics, women’s clothing, and restaurants.

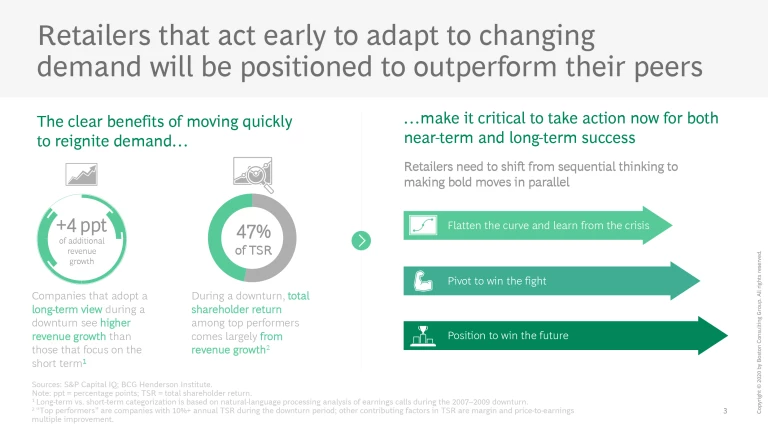

+4 ppt of additional revenue growth, on average, results when companies take a long-term perspective during a downturn rather than a short-term focus.

47% of TSR for top performers in a downturn comes from revenue growth, which is also the largest single driver of long-term performance.