Companies always have to worry about cannibalization when they launch new products that resemble existing ones but that could hold greater appeal for more price sensitive customers. Yet during times of crisis and economic turmoil or recession, the need to mitigate cannibalization becomes even more pressing because many customers become especially budget minded.

Companies therefore feel pressure to launch more affordable versions of their existing brands in order to meet their customers’ more stringent requirements. But these value-based offerings can steal share of wallet from a company’s premium products, which can ultimately erode overall profitability as well as customer lifetime value.

It doesn’t have to be this way. BCG’s in-depth analyses of brand masters in action reveal that savvy companies in a diverse array of industries deploy a variety of tactics to stave off cannibalization of their premium brands by more affordable alternatives. We’ve identified six particularly potent—and often interconnected—strategies for doing so.

Value Pricing for Different Sets of Features

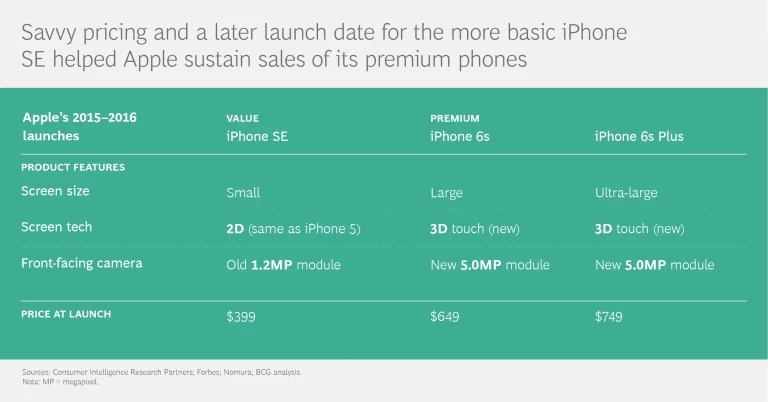

When it comes to value pricing, the launch of Apple’s $399 iPhone SE shows a master in action. The company identified the key features—screen size and cutting-edge display technology—valued by its premium customers and designed price-versus-feature tradeoffs to maximize the amount a customer would be willing to pay.

The company also crafted a smart plan for the commercial launch of the iPhone SE, timing it for six months after the introduction of the company’s premium iPhone 6s and its ultra-premium iPhone 6s Plus. Customers who could afford the premium phone would have bought it when it first came out, so the six-month gap between launches removed the distraction of the lower price tag for the SE, thus minimizing cannibalization. At the same time, the iPhone 6s Plus launch helped raise the psychological price ceiling for customers, so they viewed the iPhone 6s as a more compelling middle-price option.

These moves paid big dividends. Though statistics show that the SE had cannibalized some iPhone 6s sales in developed markets, Apple saw progress on other fronts. Because the SE filled a hole in the company’s product lineup in the down market, Apple successfully acquired numerous new users—including first-time buyers in developing countries, such as China, as well as people who had owned older iPhones and decided to finally upgrade.

Clear Brand Differentiation

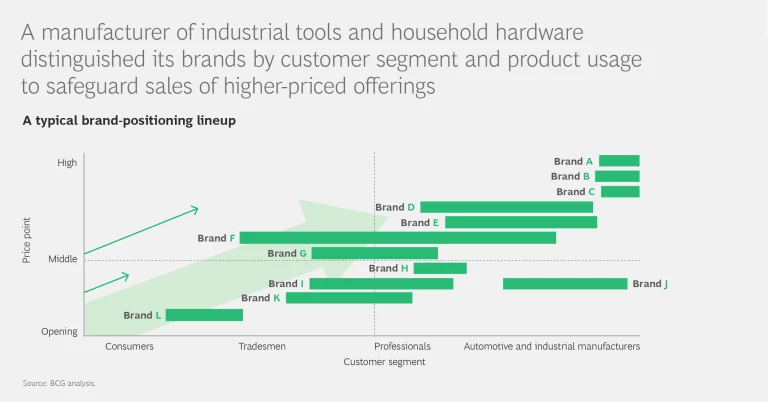

A manufacturer of industrial tools and household hardware had built up a complex portfolio of diverse brands. The company positioned its many brands to target specific customer segments by establishing high, middle, and base price points. This stratification ensured that all of the company’s brands were clearly dissociated from one another. The manufacturer drew on analysis of consumers’ perceptions of differences on such criteria as quality, durability, applicability to tasks requiring a high level of skill, mobility, user friendliness, cost, and association of a professional brand. It also considered product usage settings—for instance, use within a consumer’s home, at a professional construction site, or in an industrial factory—as well as brand image.

Each brand was given a clearly defined market position that was fully reflected in the brand’s product offerings. For example, every brand focused on a specific set of products and usage settings and had a separate delivery channel.

The result? The business has successfully deployed its multibrand strategy for many years, and each brand continues to boast customers who have remained loyal.

Channel Separation

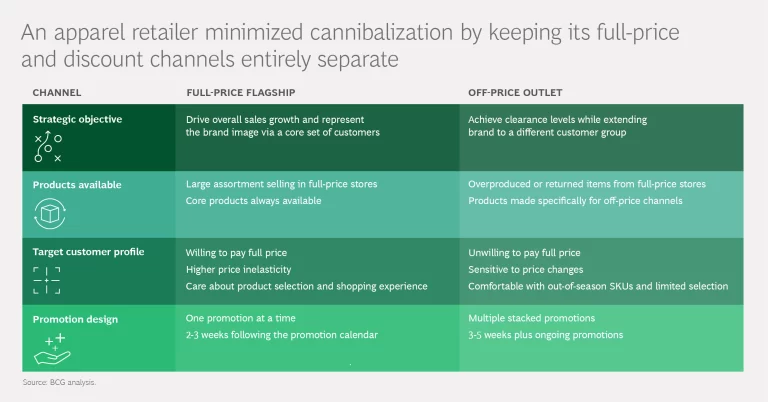

Many apparel retailers use one channel to distribute their full-price offerings and another for their discounted offerings. When using this tactic, retailers must clearly separate and distinguish the channels to minimize potential cannibalization between the two. The channels should differ in several respects: strategic objective, products available, target customer profile, and promotion design.

To make this strategy work, retailers need to identify the target customer for each channel and develop detailed profiles for each customer segment. They should also craft a comprehensive commercial strategy for each channel, including support services. For instance, to shape consumers’ perceptions of the shopping experience at a company’s premium, flagship stores, a retailer can consider offering personalized advice and consultation, a unique store layout that makes shopping feel like an event, leading-edge fashion collections to inspire shoppers, and digital features (such as a virtual dressing kiosk) to further enhance the in-store experience. Companies must still take care to avoid long-term brand erosion by balancing the mix of flagship and outlet-store businesses. Retailers that have succeeded with this strategy include Burberry, Nike, and Ralph Lauren.

Pricing Model Transformation

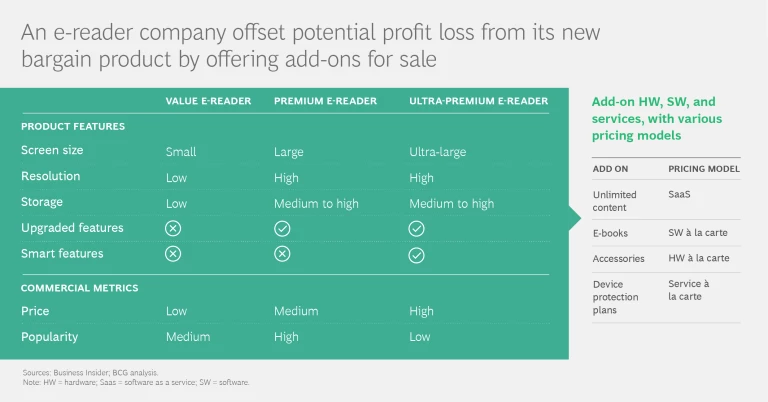

To acquire new, more price-conscious customers, an e-reader manufacturer introduced a lower-priced device with a more modest screen size, resolution, and storage capacity than the company’s premium and ultra-premium offerings. Aware of the potential loss in revenue capture that could come with the lower-priced new product, the company transformed its pricing model to drive revenue and maximize customer lifetime value. To do so, the company provided à la carte accessories, unlimited software-as-a-service e-book subscriptions, and add-on services, such as hardware protection plans.

The new value-based offering proved to be more popular than the ultra-premium product and enabled the company to effectively tap into the unpenetrated e-reader down market. What’s more, the innovative pricing model helped extract maximum value from customers who otherwise would not have become e-reader owners in the first place.

Differentiation by Use Case and Demonstrated Value

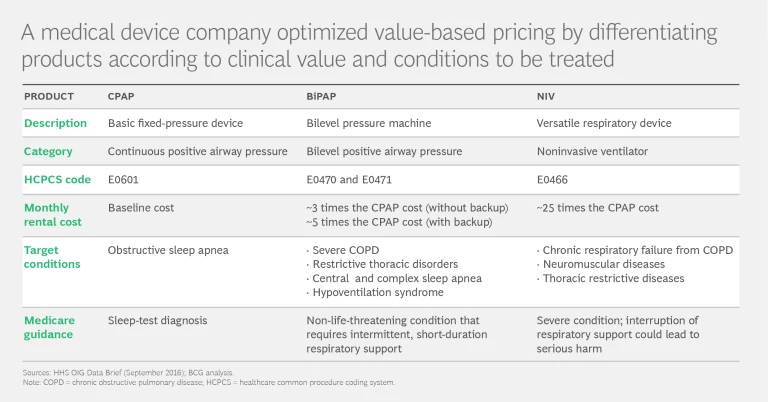

A number of companies that make respiratory therapy technologies—such as continuous positive airway pressure (better known as CPAP), bilevel positive airway pressure (BiPAP), and noninvasive ventilation machines—have stratified their similar technology offerings by clearly demonstrating the clinical value and optimum applications for each one. The primary differentiators are target conditions (such as obstructive sleep apnea) and the use settings of machines (for instance, for sleep tests).

The clarity provided by this differentiation was important for determining Medicare reimbursement rates, which can vary drastically depending upon the severity of a given condition. Therefore, companies must clearly differentiate the target indication and patient population for each product and offer corresponding clinical evidence for claims filed. This will help avoid potential perceived overlap that may result in payers cross-referencing between these machines and benchmarking reimbursement to the least-expensive machine.

In addition to target conditions, manufacturers can use other features or components to differentiate pricing. For instance, reimbursement rates differ for BiPAP machines with varying intelligent backup rates.

These strategies are important for manufacturers that produce a core technology serving multiple groups of end users, especially in markets, such as durable medical equipment, that have come under increasingly strong pricing pressure and scrutiny. Tailoring product offerings for each use case can help manufacturers optimize value-based pricing by leveraging different clinical value for each customer group.

Product Localization

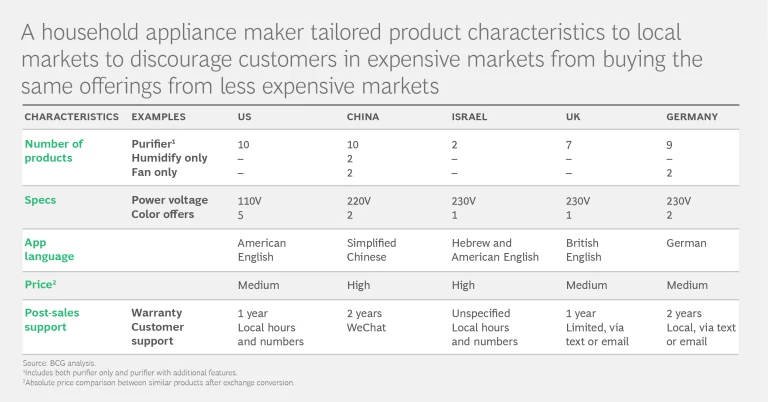

Many multinational brands today face an increasing risk of cannibalization when savvy customers in more expensive markets try to buy the same products from less expensive markets—thus eroding sales and margins. A household appliance manufacturer mitigated this risk by localizing its offerings. To do so, the company considered such dimensions as the number of products offered in each market, technology specifications (such as power voltage and color choices), software app languages, price, and post-sales support. For instance, the company tailored its value-based pricing to each market in order to maximize local customers’ perception of value for money and to safeguard its premium brand image in each market. Technology specifications matched to local requirements further helped to sustain sales by discouraging customers from buying products from other markets.

What’s more, strategically important markets were offered a more comprehensive portfolio of products that were selected on the basis of local climate conditions and consumer behaviors, such as higher interest in air-treatment technologies in some Asian countries because of smog. Certain features, such as color choices and software-app language, were also tailored to local market preferences. And localized post-sales support—for instance, a WeChat channel set up specifically for the Chinese market—encouraged customers to buy from their local retailers as well.

Though prices differ, sometimes significantly, among similar products across different markets, the company has reported minimal parallel-trade issues. Moreover, its customers generally seem to be satisfied with and loyal to the offerings available in their region.

Despite concerns about cannibalization, launching value-based offerings is frequently the right strategic step for companies seeking to expand market share and fuel growth, especially in challenging economic environments. The good news is that companies can take action to mitigate the risks. Leading companies are already demonstrating the power of the six tactics described here, and their successes offer valuable lessons for enterprises embarking on this journey for the first time.

The authors would like to thank the following contributors for their effort in materializing these insights: Just Schürmann, Javier Seara, Melanie Kraemer, Amadeus Petzke, Felix Krueger, and Carl Tilbury.