According to a recent BCG survey, many companies in Germany, Austria, and Switzerland may struggle to simultaneously refinance outstanding debt and fund large-scale business model transformation.

Indebtedness among companies in Germany, Austria, and Switzerland, collectively known as DACH, was already on the rise before COVID-19 hit, and then it accelerated as governments offered billions in state aid during the pandemic. According to BCG’s third survey among the German-speaking finance-restructuring community, the repercussions for both financiers and debtor companies as these debts come due will be significant. (See “Methodology.”)

Methodology

Although we don’t foresee a so-called maturity wall—when thousands of companies try to refinance state aid at roughly the same time—in the near term, some heavily indebted companies will soon have trouble refinancing these funds. But the bigger risk, for financiers and companies alike, will be in the medium term when certain companies need to simultaneously refinance outstanding debt and fund large-scale business model transformation but might not have the financial maneuverability to do so.

Debt Levels on the Rise

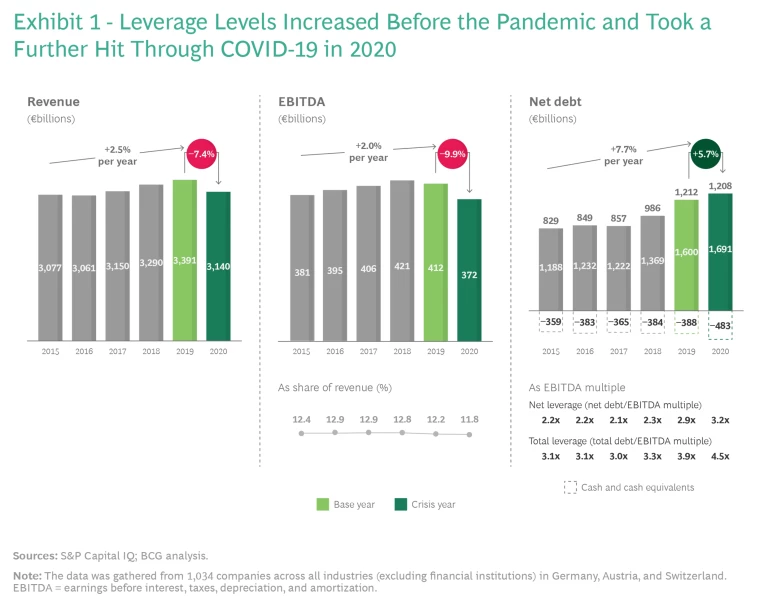

DACH economies took a big hit during the pandemic. The German economy, for example, contracted 5% in 2020. In our survey, we looked at a sample of more than 1,000 of the largest companies in the DACH area across all sectors. We found that, in 2020, corporate revenues declined by about 7%, and corporate profits—which had grown at a rate of 2% per year from 2015 to 2019—plunged by about 10%. (See Exhibit 1.)

The companies most at risk are those in industries facing intense pressure to transform operations, along with those that will take a long time to regain precrisis levels.

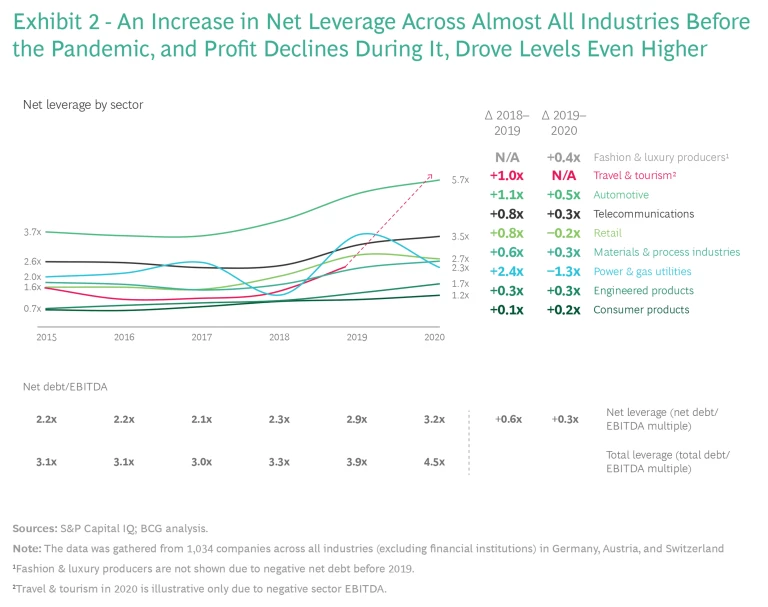

State aid and common debt financing helped to cushion the blow but raised overall leverage from already-high levels. (See Exhibit 2.) Across industries, total debt levels increased by roughly 8% per year from 2015 to 2019 and then by about 6% in 2020. These increases—combined with the drastic earnings declines in 2020—moved total leverage, on average, from 3.1 times earnings before interest, taxes, depreciation, and amortization (EBITDA) to 4.5 times EBITDA and net leverage from 2.2 times to 3.2 times. This puts net leverage at the threshold between investment and noninvestment grade, above which refinancings tend to become more complicated. Interestingly, cash and cash equivalents rose even higher than total debt in 2020, increasing by €95 billion from 2019. This suggests that, when possible, companies built up crisis reserves instead of spending those funds.

We found these trends to be consistent across industries, although some sectors were more affected than others. For example, the automotive industry was coping with cost pressures related to the shift to electric vehicles even before the pandemic, and travel has suffered acutely during the crisis. The companies most at risk are those in industries facing intense pressure to transform operations, along with those that will take a long time to regain precrisis levels.

Because banks supplied much of the pandemic state aid credits, outstanding bank debt volume grew by 5% in 2020. But other sources of financing declined precipitously during that year:

- Bond volume fell 1%, compared with 3% annual growth from 2016 to 2019.

- Private debt declined 1%, compared with 9% annual growth during the same period before COVID-19 struck.

- The issuance of German promissory notes, known as Schuldschein, fell 35% compared with 2019.

- Funds provided by fintechs, such as platforms for crowdfunding, fell 22%.

No Looming Maturity Wall

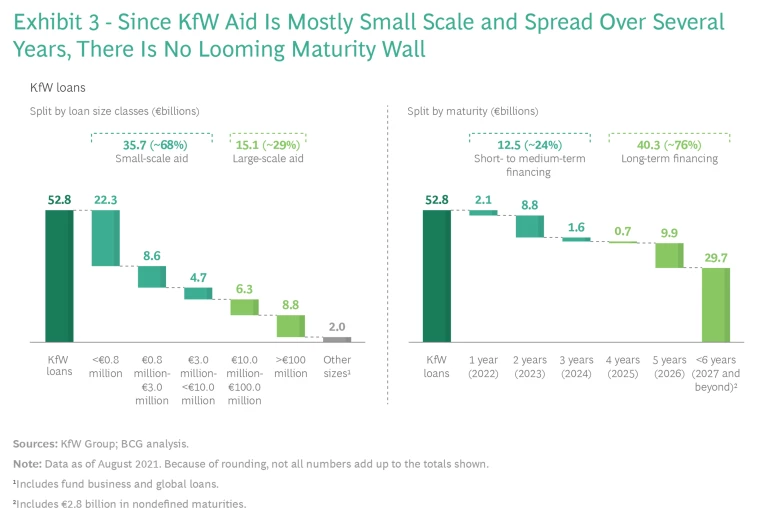

Despite commonly voiced concerns, only 15% of the experts we surveyed firmly believe that the DACH region will face a maturity wall. On the basis of our analyses, we believe that there are three key reasons for this. One reason is that state aid was often synchronized with existing instruments, or existing financing was extended along with longer-term aid. As a result, the €53 billion of loans disbursed from the beginning of the pandemic to August 2021 by Germany’s national development bank KfW Group are now scheduled to mature over several years: 24% will come due by the end of 2024, 20% will mature in 2025 or 2026, and the majority (56%) will come due in 2027 or later. (See Exhibit 3.) The second reason the DACH region will avoid a maturity wall is that most of the loans are not enormous: 70% have an individual nominal value of less than €10 million. The third factor is that a hefty portion of aid was in the form of nonrefundable subsidies, such as refunds for short-time work, which don’t affect corporate balance sheets. In Germany, for example, 60% of the aid fell into this category.

Nevertheless, sources of refinancing pressure in the near term still exist. For example, the already high debt levels prior to the pandemic suggest that net leverage is likely to remain at an elevated level—potentially above the investment grade threshold of 3.0 times EBITDA—for several years, even if profits at least partially recover after 2021. These individually unsustainable debt levels raise the pressure in complex refinancing situations, which, according to our research, will increasingly occur in the short term. And it’s not certain if the restructuring community will adopt a more relaxed definition of investment grade, even given the context of the pandemic. Only 20% of experts firmly believe in a permanent upward shift from the investment grade threshold. That’s a tough stance, and it could lead to significant pressure on the companies above that threshold.

Another source of refinancing pressure in the near term stems from companies that were underperforming before the pandemic and yet received state aid. These organizations are likely to face difficulties when the time comes to refinance their funds. We randomly sampled fourteen companies that received state aid and found that ten had EBITDA margins of less than 10% (six with less than 3%) before the pandemic. The profits of nine of these companies were declining prior to the pandemic, and six had declining sales. Indeed, 89% of experts in our survey believe that many companies that received pandemic-related state aid were not performing well before the crisis began and, as a result, that aid has postponed potential refinancing issues. If so, the number of challenging refinancing situations could start to rise in the near future.

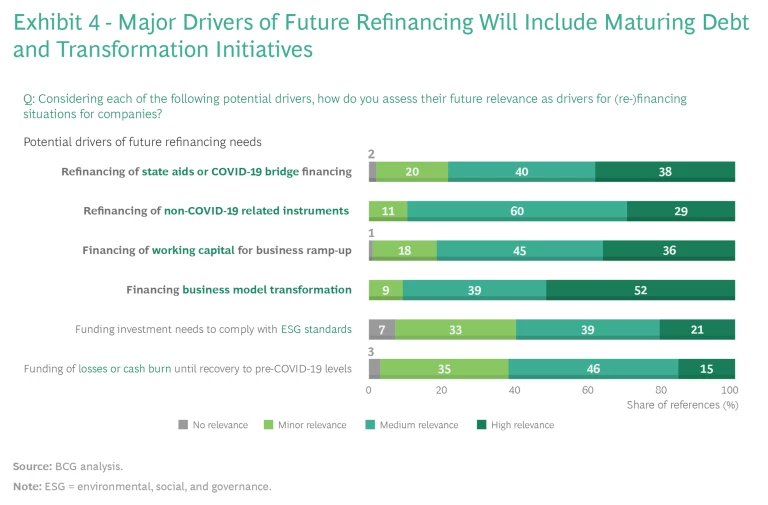

But according to our survey, 80% of respondents believe that the biggest financing challenges are likely to crop up in the medium term as today’s existing debt financings mature. Among the factors at play here will be the need for both state-issued pandemic aid refinancings and conventional refinancings of non–state aid. But the single most important factor will be the need to fund various transformation initiatives, such as digitization, electrification, and sustainability. In fact, 91% of survey respondents said that transformation initiatives will be a medium or high factor in companies’ refinancing decisions. (See Exhibit 4.)

Alternative Financing Will Return

As the DACH economy recovers and companies wean off state aid, financing activity will shift from banks to alternative financing. Our growth projection for bank financing is just 2% per year through 2024. A big reason for this expected pullback is the highly leveraged nature of the companies that will be trying to refinance. We expect that banks won’t want to take on these risky credits, especially in sectors facing transformative pressure, longer recovery time to precrisis levels, or individually challenging situations. Moreover, regulators are forcing banks to accelerate the sale of nonperforming loans (NPLs), which will make banks even less likely to extend credit to existing customers that they deem risky.

We expect private debt funds to play a key role in the coming wave of refinancings.

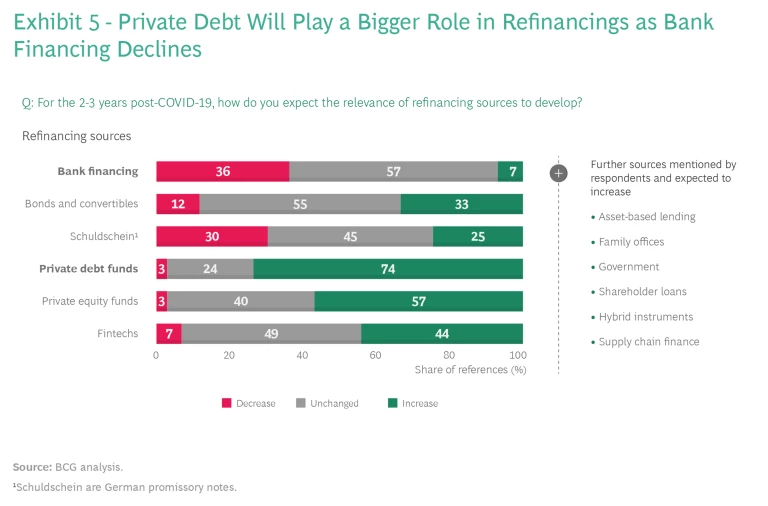

In this environment, bonds, private debt, and, to a lesser degree, alternative financing forms (such as fintechs) will reengage, returning to their prepandemic growth trajectories. In particular, we expect private debt funds to play a key role in the coming wave of refinancings. (Our survey showed that 74% of respondents expect debt funds to become increasingly important in the next two to three years.) Not only are they sitting on huge stores of dry powder, which grew 50% during the pandemic, but they also have a higher appetite for risk than banks do, and they face less regulatory pressure. What’s more, issuers of Schuldschein loans may turn to private debt to refinance maturing tranches. Among fund types, the assets of distressed-focused European private debt funds grew the most in 2020, putting them in a position to pick up large parts of banks’ NPL sales in the future. (See Exhibit 5.)

Industry-Specific Challenges

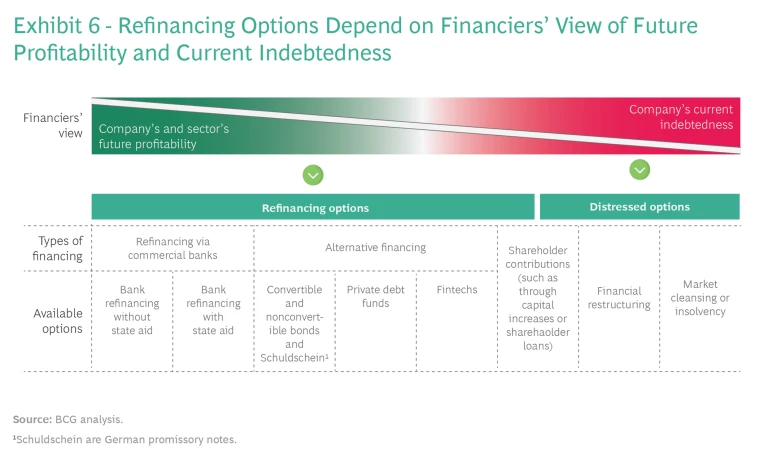

In the long term, two major factors will shape the success of these refinancing situations for a company: its indebtedness (where, of course, a high leverage is associated with high risk) and its earnings attractiveness. Along the interplay of these two variables, several refinancing options either open up or disappear. (See Exhibit 6.)

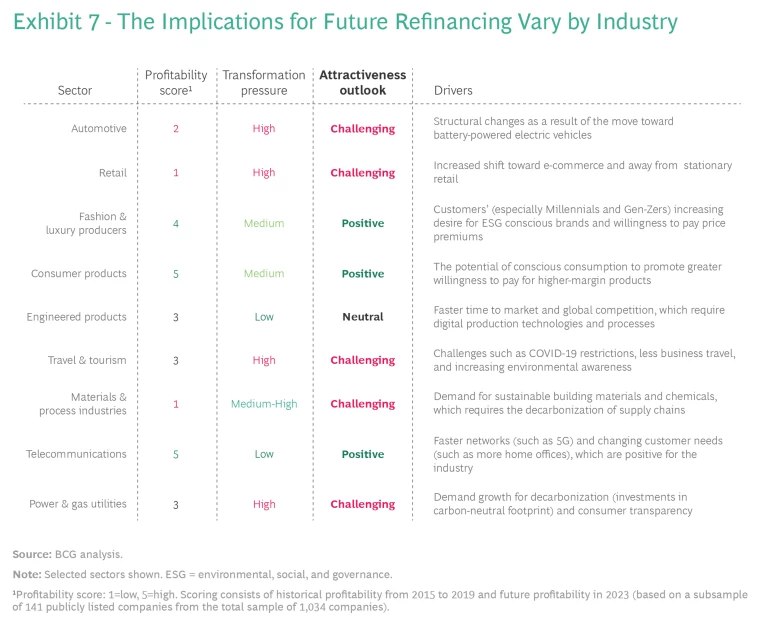

To develop a rough understanding of the challenges that individual companies will face when refinancing their debts, we analyzed the overall industries’ attractiveness on the basis of past and future profitability as well as expected future transformation needs. We found remarkable differences among industries. (See Exhibit 7.)

First are the industries that already had low profitability before the pandemic, resulting from megatrends that created transformative pressures, such as digitization in retail. Second are industries that performed well before the pandemic but now have to cope with significant challenges because of structural changes in demand patterns, such as travel and tourism. Third are industries that benefit from current macroeconomic trends. The telecommunications industry, for example, stands to benefit from the trend toward increased home office work.

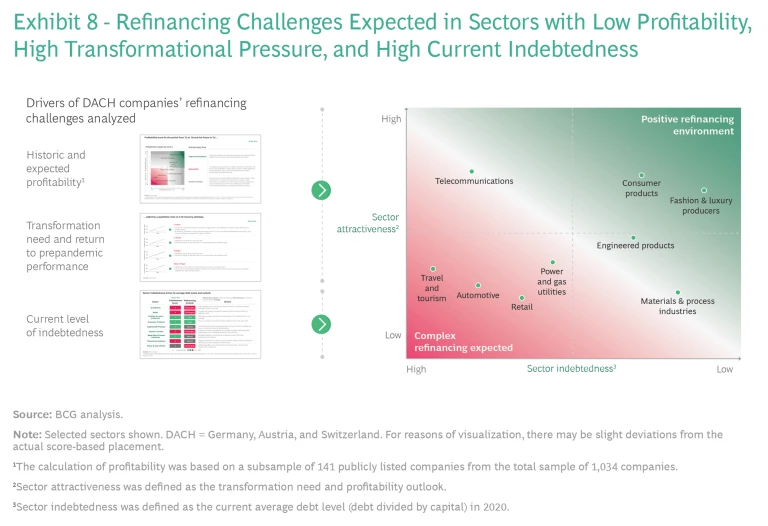

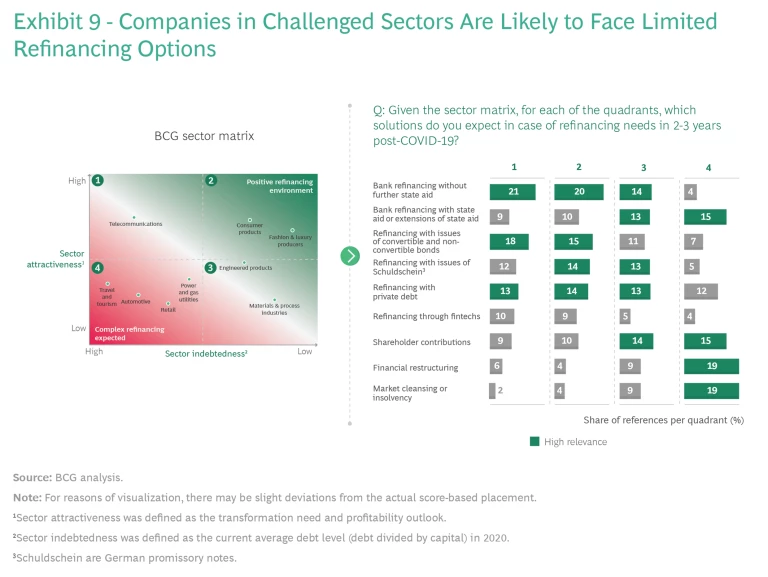

As part of our research, we plotted the two main influencing factors for refinancing success—indebtedness and earnings attractiveness as measured by historical and future earnings potential—against each other to create a matrix of different refinancing patterns. (See Exhibit 8.)

The top left-hand quadrant of the matrix, characterized by high attractiveness but also high debt levels, contains industries, such as telecommunication companies, that have a positive earnings outlook and are likely to achieve required leverage ratios. We expect that banks will refinance these companies further without state support. At the same time, such higher-return opportunities might attract capital markets and private debt funds.

In the top right-hand quadrant of the matrix are industries that have highly attractive companies with relatively low debt. Consumer products, along with fashion and luxury producers, fall into this category. We expect that these companies will have access to a variety of financial options similar to those in the first quadrant, while being even more flexible in their choice, given the lower leverage. Capital markets will also reward their lower leveraged balance sheets with higher ratings and lower interest rate expectations.

The bottom right-hand quadrant is characterized by low attractiveness and low debt. We expect a rather broad set of possible options for companies in these industries as well, which include materials and processing companies (such as chemical companies) and engineered products. While earnings outlooks are clouded mainly by the need to comply with environmental, social, and governance (ESG) standards, these players show rather low indebtedness on average. Yet a given company’s risk-return profile needs to be carefully evaluated in order to assess, for example, whether the relatively higher interest cost of private debt funding can be serviced. Shareholders also might have to step in more frequently with cash or contributions in kind to provide trust in the business model .

The bottom left-hand quadrant of the matrix includes industries in which companies are highly leveraged and display low attractiveness. These companies are most at risk of not covering debt service, which could result in more frequent financial restructurings and even insolvencies. This quadrant includes travel and tourism, automotive, retail, and power and gas industries. Companies in these industries could end up relying heavily on cash injections from shareholders and state-supported bank loans to fund longer-term transformations. Alternative capital providers, as well as banks, will be extremely cautious to finance these sectors because of the future outlook on repayments and upcoming regulatory complexities, such as ESG compliance and portfolio restrictions.

Overall, the results of our survey confirmed our hypotheses about the availability of financing instruments along the axes of indebtedness and sector attractiveness. (See Exhibit 9.)

The good news for financiers and companies alike is that they will not face a short-term maturity wall that could set off a frenzy of refinancing, and companies with solid financial performance should be well positioned to undertake refinancings. However, they should brace for an increasing number of individually complex refinancings in the medium term, especially in sectors facing significant transformation pressures. Adding to the challenge is that financiers are likely to stick to 3.0 times EBITDA as the standard definition for investment grade—even though overall indebtedness has grown.

From a financier’s perspective, a clear view on companies’ business models and underlying transformation needs, sometimes fueled by the pandemic, is critical to managing risk. From a company’s perspective, success will depend on managing complex refinancing processes and accommodating more stakeholders: the state itself, state-supported banks, private debt funds, and existing shareholders.