The threat may be virtual, but it’s starting to feel very real.

On the one hand, companies around the world are increasingly waking up to the advantages of switching to e-commerce in the B2B market. The internet’s relevance is already high—and still rising—at every stage of the customer buying journey—from comparing product information, to ordering, paying, and scheduling, and even procuring after-sales services. The pandemic accelerated this trend, given the obvious advantages of digital transactions during a time of social isolation and business lockdowns.

On the other hand, several digital players—led by global market leaders Amazon, Alibaba, eBay, and Wayfair—are already renewing their efforts to break into the space. So far, these e-commerce giants have disrupted almost every retail category they’ve entered over the last two decades. They are now increasing their focus on the lucrative B2B market, attempting to carry over their business models from the B2C world and using data-driven processes to engage customers and boost sales.

While brick-and-mortar players still clearly dominate the B2B market, they are nevertheless beginning to take the consequences of the “Amazon effect” seriously. Most CEOs now have the need to address the growing digital threat on their strategic agendas. According to the CEO of an international B2B distributor specializing in electrical products and services, “as long as there is a product with a product description, the threat from digital attackers is both real and inevitable.”

Many B2B distributors remain unclear about the full implications of these market changes and how they will influence their businesses. Nevertheless, there’s growing fear: of potential disruption to established business models; of being squeezed out by producers going directly to customers; and of new, online-only distribution channels.

To combat the mounting digital threat, incumbent B2B distributors require a proven, strategic approach to assessing the potential impact, threats, and opportunities of e-commerce in B2B distribution. Once they’ve understood what they’re up against, these businesses should adopt a strategy of resilience that differentiates them from the emerging digital competition.

To combat the mounting digital threat, incumbent B2B distributors require a proven, strategic approach to assessing the potential impact, threats, and opportunities of e-commerce in B2B distribution.

Our work with multiple clients suggests a highly effective approach in three steps.

Understand the Business Model, Strengths, and Weaknesses of Digital Attackers

We observe two main archetypes of new, online-pure-play distributors entering B2B markets.

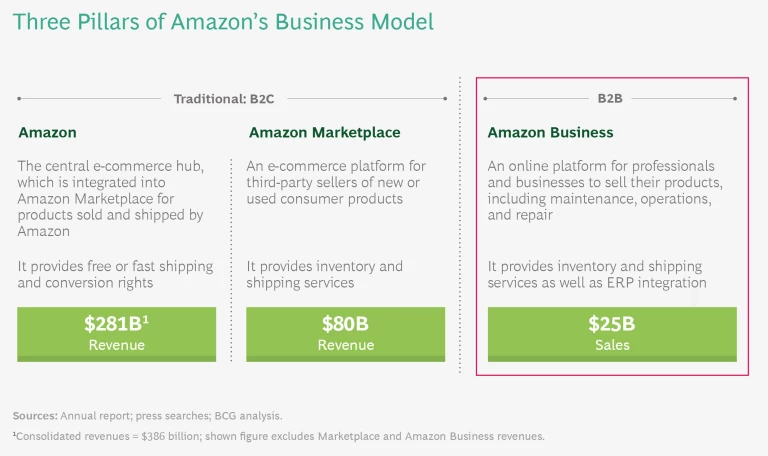

The first is established online B2C players that are expanding their coverage. Among these players, Amazon has the greatest foothold, with the largest turnover and a significant presence in developed, mature B2B markets based in the US and Europe. Other global e-commerce players include AliBaba, Ebay, and Wayfair.

The second archetype encapsulates the wide variety of mostly local and specialized startups entering the scene. These startups typically focus on B2B markets with one or more of the following characteristics:

- Close proximity to the end customer, as is found in the B2C model, which we have seen with building distributors that sell bathroom layouts online, given the relevance of design, choice, and virtual configuration.

- Relatively deep profit pools, as is the case for power tool distribution.

- Highly specialized products, such as underfloor heating.

Startups can pose a minor threat in specific categories, but the larger, fundamental challenge for B2B distributors comes from international e-commerce players. They attack incumbents with a much broader scope, reach, and product selection, as well as an established operating model. In addition, they can often draw on considerable financial and operational resources—logistics networks, for example—to launch their attack.

Understanding how these players win in the B2C market offers insights into how they will achieve success in a B2B context. A broad selection, very competitive prices, and seamless customer experience are the main drivers for customer satisfaction in B2C markets. Amazon and others believe that a rigorous focus on customer satisfaction is the foundation for long-term growth, which in turns drives down costs and enables a virtuous cycle. A business model focused on long-term growth, as opposed to short-term profitability, requires a highly scalable platform powered by simplification, standardization, and process automation.

Such a model generates widespread customer satisfaction but discourages deviations from standard procedures. Complex manual processes and tailored solutions for individual customers are inherently detrimental to the way these companies operate. (See “Reviewing Amazon Business’s Market Entry.”)

Reviewing Amazon Business’s Market Entry

Our research further suggests that a significant share of these claimed gross sales are the result of customer transfers from Amazon’s original and “Marketplace” channels to Amazon Business, such that they are really reclassifications of existing revenues. We estimate the true net sales (as opposed to the larger, published gross figure) from Amazon Business to be significantly less.

The difficulty of disrupting B2B distribution markets becomes even more apparent when looking deeper into the gross revenues of Amazon Business with a category-specific view. The vast majority stem from highly standardized, high-velocity categories with product types well suited to Amazon’s business model, such as office, janitorial, and electrical supplies.

Success in other, more complex product categories remains limited to date. As an example, a study on maintenance, repair, and operations (MRO) distribution in the UK revealed that approximately 70% of the product assortment was at the time unavailable on Amazon. Moreover, prices for those MRO products that could be found on Amazon Business were on average 30% higher than at a local B2B distributor, with delivery times averaging one work week. It is hard for Amazon to compete in the B2B landscape, where same-day emergency deliveries may be required.

We expect the e-commerce giants to play to their strengths in B2B markets. They will most likely be successful in segments with relatively simple products that require very little technical service, and by extension, no specialized or expensive resources for customer support. They will also focus on areas that can be covered by established and standardized logistics processes—characterized by common package sizes, lightweight, nonbulky products, and moderate requirements for delivery speed. Lastly, digital attackers will benefit from those segments with transparent pricing, dissatisfied customers, and producers that support new distribution models.

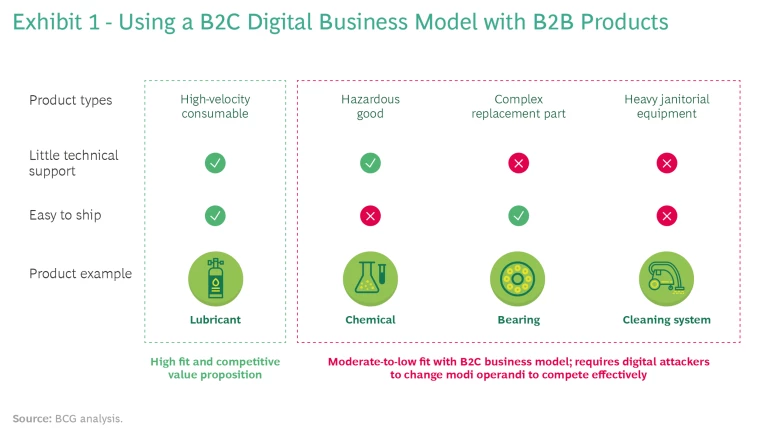

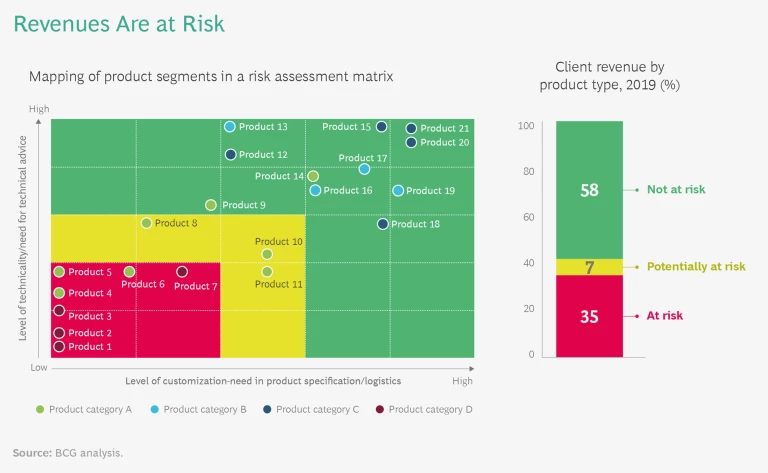

Exhibit 1 illustrates how some of these advantages translate into real industrial B2B products, with a focus on logistical and service needs.

While high-velocity consumables such as lubricants (or other products that are sold with great frequency) perfectly suit the online business model, complex and heavy items, like cleaning systems, are less attractive for digital players. A broad spectrum exists between the two extremes.

Identify and Quantify Your Company’s Exposure

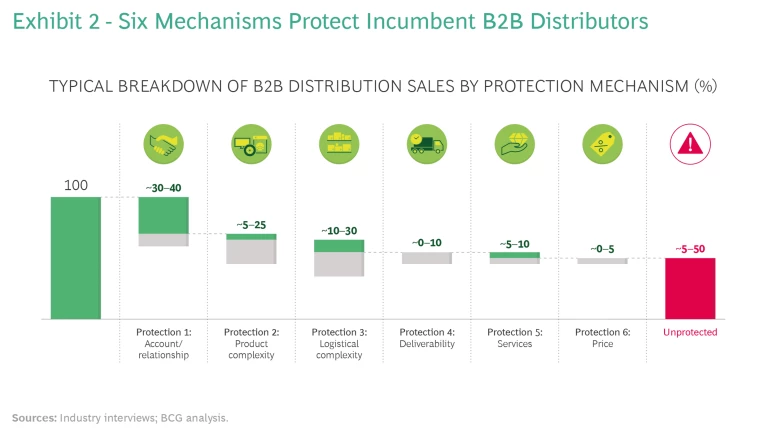

Incumbents can draw conclusions from the e-commerce business model to assess how exposed their businesses are to digital attackers. To quantify their risk of disruption and protect themselves, B2B distributors should consider the following six mechanisms for protection:

- Accounts and Relationships. Distributors can protect themselves through long-term contracts negotiated with key accounts. B2B clients prefer contracts because of their price reliability and fixed payment terms that allow for budgeting, and due to their attractive, legally binding features that may include stipulations on product quality, liability provisions, and purchase terms. The quality-furniture market thrives, in part, on the strength of its relationships.

- Product Complexity. With complex products comes the need for consulting services. Incumbents can differentiate themselves via onsite support services, tailored solutions, and product customization, as those who distribute spare parts for machinery often do. One CEO mentioned that the frequency of requests “containing broad combinations of SKUs and high specificity”—such as a certain length of cable—allows his company to outperform the digital competition.

- Logistical Complexity. Logistical challenges require nonstandard distribution. When it comes to handling products with challenging dimensional characteristics (high weight and large volume, for example) and tailored safety measures, existing B2B distributors have the upper hand. Chemicals with complex transportation requirements fall into this category.

- Deliverability. Unplanned orders provide the opportunity for outperformance. Traditional players typically have core products stored in branches and distribution centers to reduce lead times and enable faster delivery. Their warehousing capacity increases the range of product availability and mitigates the risk of unmet demand for unplanned spending. Janitorial equipment may, for instance, be needed in an emergency order.

- Services. Distributors provide value-added services during the sales process. Broadly speaking, these services are: logistical, which may apply to products offered within customer facilities; technical, needed in the case of customization and repair; or engineering related, such as conditional monitoring. Consider the service model required by forklifts with onsite installation.

- Price. As always, price has a big role to play. We’ve found that price differences need to be significant enough to protect from spot purchases on a like-for-like item comparison. E-commerce players have typically limited ability to further discount based on volume and supplier negotiations for low-margin products. Electrical parts with year-end volume rebates offer this sort of price flexibility.

Although these six barriers to disruption are strong, they do not fully protect all sales. There will be a remainder of unprotected sales that may be scooped up by digital attackers. Exhibit 2 shows the extent to which each mechanism may protect a distributor’s sales.

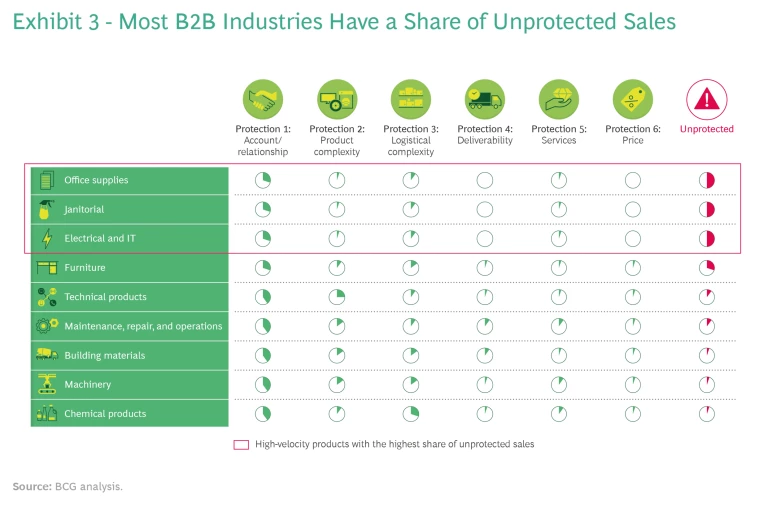

The specific risk of sales loss to digital attackers varies widely across product offerings. While chemical products and machinery typically have a very low exposure, with unprotected revenue shares between 5% to 10%, other categories, like office supplies or janitorial equipment, are highly exposed, with unprotected revenue shares of up to 50%. In other words, half of these incumbents’ existing business may be up for grabs by new entrants. Exhibit 3 outlines our findings.

As always, the devil is in the details, and for any assessment to be considered thorough, it must be conducted at the company level. Depending on the specific product portfolio of a particular player, the share of unprotected revenues can vary considerably even within a given market. B2B distributors should therefore assess and quantify their individual risk exposure. (See “A Sample Risk Assessment for an MRO Distributor.”)

A Sample Risk Assessment for an MRO Distributor

To gauge its exposure to digital attack, the company conducted a structured assessment across its product portfolio. (See the exhibit.)

It found that 35% of its revenues were at risk, 7% were potentially at risk, and the remaining 58% were not at risk of being disrupted by digital attackers. Compared to other MROs, this company’s share of at-risk revenues was relatively high. A large portion of its product portfolio was composed of high-velocity, nontechnical products fitting standardized logistical processes—which is where the big online players excel.

In order to pose a broader threat to the MRO market and to target more-technical and complex products, companies like Amazon would have to disrupt themselves and play against their strengths of offering commoditized products and relying on simple, efficient logistics.

Even so, if they are to survive the digital onslaught, companies must evaluate themselves carefully to ensure the major players don’t have an easy opportunity to overtake them.

Develop a Strategy of Resilience

It’s clear that the threat posed to established players by digital attackers is real, but it is usually limited to a certain business model and logic. Despite the e-commerce giants’ obvious limitations, established B2B players need to understand the risk in detail and identify areas that are most prone to disruption. To stay ahead of the curve, incumbents must act by strengthening their resilience against new entrants and, perhaps even more important, seize the opportunities created by an evolving B2B market.

It’s clear that the threat posed to established players by digital attackers is real, but it is usually limited to a certain business model and logic.

The following five levers have proven to be largely effective in increasing resilience to digital attackers:

- Protect customer relationships and key accounts. In the relationship-driven B2B market, traditional leaders can differentiate themselves by demonstrating their proximity to customers. They should work relentlessly to increase penetration in key accounts and become stronger anchor suppliers through technical and advisory roles that digital attackers cannot replicate. For example, a leading US-based B2B distributor, Fastenal, has established a network of nearly 100,000 easy-to-access vending machines within its customers’ facilities. This move creates a win-win situation by supporting customers’ inventory management and providing the distributor with a good excuse to be on customers’ premises frequently.

- Increase value-added offerings. Incumbents can improve customer stickiness and stand out from the crowd by increasing the value of their offerings in a way that digital attackers are unable to emulate. Another US-based B2B distributor has doubled down on establishing private-label brands, which tend to be cheaper without sacrificing the distributor’s high-quality standards. Margins are typically better in the absence of direct competition, needless to say.

- Price competitively. Every customer likes low prices. Competitive pricing mitigates the impact from increased price transparency that digital attackers typically bring and "lower-than-list" prices that nudge customers’ purchasing choices. A European B2B distributor, for example, ensured that it was pricing competitively by refreshing its list prices actively each month, based upon a fact-based peer comparison.

- Broaden your e-commerce platform. Even small improvements in the customer experience can deliver a big impact. Distributors should take advantage of the market trend toward online transactions with a more holistic platform and offering than the big online players can provide. A distributor in North America has successfully grown its online sales by curating and supporting its product information with a dedicated team. The company has also created a consistent taxonomy that has significantly improved customers’ ability to find items more easily than they would on a digital attacker’s site.

- Compete directly online. Small or midsize customers who are targeted by Amazon’s value proposition can be captured by eliminating the giant’s perceived advantage. A B2B distributor in Europe launched a more comprehensive offering on its own website in key European markets to compete directly with the big players.

The Time to Act Is Now

Digital attackers have recognized that B2B customers are increasingly open to e-commerce and, with this recognition, smell an opportunity for market entry.

Despite significant activity, digital attackers have still only seen relative success in B2B distribution, meaning it’s high time for incumbents to increase their resilience. Building resilience won’t be easy, and it will mean transforming at all levels of the organization—requiring top-management attention, sufficient lead time, and a focus on change management. Still, in the wake of digital attackers, the rewards will be well worth the effort.

B2B distributors, take heed: act now to defend your market position and seize on the opportunity for further competitive advantage.