Variable renewable energy generation will transform electricity systems and increase price volatility. To navigate these changes, companies need to be more flexible in the way they consume electricity.

This article is the first in a series exploring changes to our electricity and broader energy systems—and the implications for energy consumers and governments—that will arise from the massive increase in variable renewable energy needed to achieve global decarbonization ambitions. This article lays out the overarching issues we intend to explore, while future articles will focus on specific aspects of the transition.

To achieve net-zero emissions by 2050, we’ll need to increasingly electrify our energy consumption and deploy renewable energy generation at a pace far exceeding today’s—and beyond what governments are currently planning for. But the process brings with it significant challenges: deep penetration of renewable energy, especially solar and wind, will dramatically affect the underlying physics of our electricity systems as well as the economics of our electricity markets.

We believe the effect that deep variable renewables penetration will have on energy-consuming industries and the ability of countries to attract them is not yet fully appreciated. The fact is that more volatile electricity prices will be ever more pervasive.

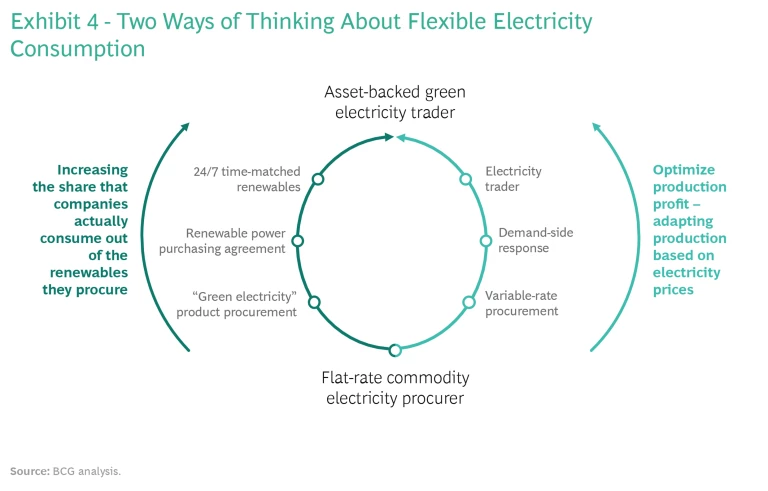

This transformation of our electricity systems and markets will offer a competitive edge for companies that can be more flexible in the way they consume electricity. This is more than typical demand response. Managing assets as an electricity trader rather than an electricity consumer will allow those companies to harness the price volatility that accompanies increasing penetrations of variable renewable energy, while also improving resilience to shocks. Companies that remain focused entirely on full utilization will need to pay a premium to insure against volatility—or remain hostage to it.

Along with the economic benefits, doing so also will allow them to increase the proportion of renewable electricity that they actually consume, compared with the renewable energy they procure (better matching their hour-by-hour consumption to when the sun shines and wind blows).

To enable the changes that are necessary in industrial energy usage, both governments and electricity markets will need to do more to confront the challenges they face.

Governments and electricity market designers in countries on the frontline of the energy transition already are starting to pivot to accommodate greater penetration of renewables in their electricity systems. But we believe that, to enable the changes that are necessary in industrial energy usage, both governments and electricity markets will need to do more to confront the challenges they face.

This article examines how the technical and physical issues that come with large volumes of variable renewable energy in our electricity systems demand changes to how large electricity consumers operate. Before addressing these challenges, however, we start with the scale of change to our systems.

Deep Penetration of Variable Renewable Energy Is Inevitable

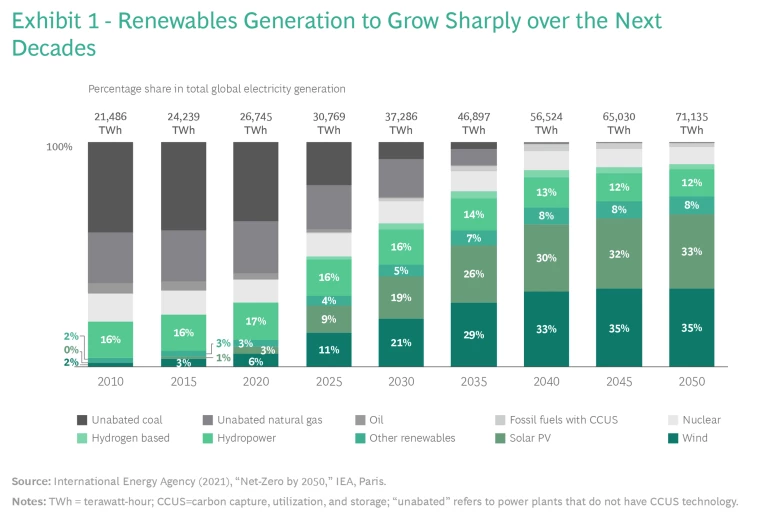

Today, about 40% of global emissions come from using fossil fuels to create electricity and heat. To meet net-zero ambitions by midcentury, fossil-fueled generation will have to give way—almost entirely—to renewable-powered generation. According to the International Energy Agency (IEA), renewable energy will need to make up close to 90% of the global generation mix by 2050, compared with about 29% today, even as the total amount of electricity generation increases more than two-and-a-half-times (Exhibit 1).

To achieve this degree of renewable penetration, companies and governments will need to move quickly.The IEA’s net-zero pathway calls for strong growth of renewables already this decade, with annual additions of around 630 gigawatts (GW) of solar photovoltaics (PV) and around 390 GW of wind by 2030—four times the record levels set in 2020. The IEA also calls for a halt on final investment decisions for new unabated coal-fired generation (with existing coal plants to be either phased out or retrofitted).

Renewable energy comes in two forms: either “dispatchable” generation (which can be turned on and off according to demand) or “variable” generation (which depends on favorable weather conditions).

Dispatchable renewables mainly comprise generation from hydro, geothermal, and biofuel plants. They operate in a similar way to conventional power generators, with water or steam being used to drive a turbine to generate electricity. While they offer many of the advantages of conventional plants, the availability of these renewable resources is constrained by geographical and natural conditions.

Most new renewable generating capacity will have to come from variable sources: primarily solar PV, onshore wind, and offshore wind.

As a result, most new renewable generating capacity will have to come from variable sources: primarily solar PV, onshore wind, and offshore wind. These sources currently make up just a sliver of electricity generation, accounting for around 9% in 2020 (and just 2% in 2010). But according to the IEA’s net-zero pathway, they would represent close to 70% of the global generation mix by 2050.

Variable Renewable Energy Challenges Traditional Electricity Systems

Variable renewable energy behaves differently to conventional power generation . By definition, variable renewable energy depends on the sun shining or the wind blowing; it is uncertain (and despite increasingly accurate weather forecasting tools, challenging to predict perfectly); it is distributed (generators are smaller and less centralized); it has near-zero marginal cost (costs are almost entirely fixed); and it relies on inverters (power electronic devices that change the direct current electricity from solar panels or wind turbines into the alternating current of power grids). These characteristics create challenges for both system operators and market participants, including companies that depend on a reliable electricity source, in two ways:

- Technical and physical issues around reliability and stability.

- Economic challenges around price volatility and the viability of conventional power plants.

Deep variable renewable energy can destabilize grids

Electricity grids were designed with conventional fossil fuel-reliant power generation, rather than variable renewable energy sources, in mind. As a result, electricity systems with a high degree of variable renewable generation are generally at greater risk of instability without follow-up actions. They require investment in new infrastructure, the retention of enough dispatchable (conventional) generating capacity, and/or increased flexibility on the demand side to function reliably and securely. Four things prove particularly challenging: resource adequacy, network adequacy, frequency stability, and voltage stability. (See “Variable Renewable Energy: Four Physical Challenges.”) In locations with a lot of variable renewable generation—for example, Australia, California, Germany, and Texas—we are already seeing such problems arise, with sometimes expensive consequences.

Variable Renewable Energy: Four Physical Challenges

Network adequacy and congestion. Grids were built to carry electrical power from large, centralized power plants to demand centers. However, renewable generation sources tend to be both smaller and far more dispersed. This can lead to mismatches between the location of renewable generators and where the grid is most developed. In some cases, it can mean grid capacity is insufficient to transport electricity from generator to consumer. In Germany, with most wind generation concentrated in the north and solar in the south, the cost of re-dispatch measures—designed to ensure that demand and supply balance even when the internal grid would otherwise be congested—have over the past years risen to more than €1 billion a year.

Frequency stability. For electricity systems to function reliably, the frequency of the power signal within the grid (typically either 50 or 60 hertz) must be stable and kept within acceptable limits. This is achieved through an instantaneous balancing of power supply with demand. High variable renewables penetration can jeopardize this balancing ability, through an increased tension between a higher demand for and lower available supply of so-called operating reserves (which are used to restore the supply-demand balance when needed), the fact that some (conventional) plants are must-run and can create situations of oversupply, and reduced inertia because of the exit of conventional generation (inertia helps system operators to maintain a balance between power demand and supply, as it gives them time to react and activate operating reserves). For example, following inertia shortfalls in South Australia, synchronous condensers are being installed and fast-acting frequency control services are being procured to compensate for the loss of inertia.

Voltage stability. System strength indicates the ability to maintain voltage waveform and phase angle at all locations in the power system following disturbances. With conventional power generation, synchronous machines are a source of system strength because they are electromagnetically coupled to the system’s voltage waveform. In contrast, variable renewable generators do not contribute to system strength: they interface with the grid by means of an inverter, and, at present, do not create a voltage waveform like a synchronous machine does.

As the share of variable renewable energy in the generation mix increases, these four challenges will become increasingly urgent for system operators. To overcome such problems, operators will need to consider a range of measures to ensure their grids are reliable. Both technical and market design solutions are available, though in general they add to the cost of the overall power system.

Increasing variable renewable energy means greater price volatility

In liberalized electricity systems where prices are set by the market, a high proportion of variable renewable generation can also lead to more volatile prices, particularly when they force the exit of base and mid-merit dispatchable generators. One comment made by those anticipating an energy landscape dominated by renewables is “Electricity will be free.” They need to add “except when you really need it”—and then it will be expensive relative to the average. There are several reasons for this.

During periods of high variable renewable generation—such as the middle of the day in the summer months in the case of regions with significant solar generation—electricity becomes very cheap (far cheaper than with conventional generation) and is sometimes even sold at negative prices, with generators paying consumers to take surplus generation. The proportion of demand that needs to be met by dispatchable generation at these times is low (or zero), keeping the cost of electricity—which is determined by the marginal generator—in check. According to research company BloombergNEF, for example, the midday electricity price in California has declined from a premium of 25% above average daily prices to a discount of around 30% due to the explosion in solar power in the state.

By contrast, electricity becomes more expensive when variable renewable generation is low, such as during evening peak demand periods or when sun and wind are unavailable for energy generation, or when the supply of dispatchable generation is physically interrupted due to a technical accident. This is because remaining dispatchable generators—which supplement variable renewable output—increasingly consist of peak-load technologies (such as gas-fired generators), with base and mid-merit technologies with lower marginal costs being pushed out of the market.

The availability of variable renewable energy sources changes constantly from one hour to the next. The overall impact of these variations, combined with more extreme low and high price levels, is an increase in the volatility of electricity prices.

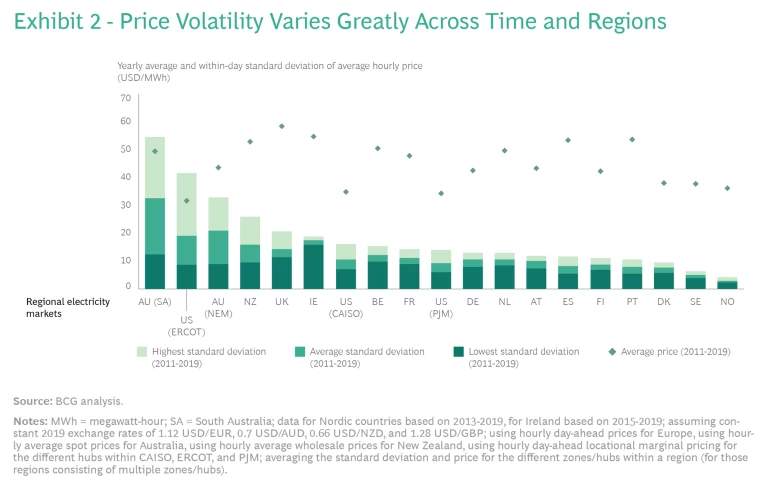

At the same time, the availability of variable renewable energy sources changes constantly from one hour to the next. The overall impact of these variations, combined with more extreme low and high price levels (as discussed above), is an increase in the volatility of electricity prices. Indeed, in South Australia, greater volatility has caused the value of daily arbitrage—the value of the ability to shift generation from the cheapest hours to the most expensive—to triple over the last decade.

This phenomenon is not yet universal. (See Exhibit 2 for an international comparison of within-day electricity price volatility.) Price volatility is clear in markets like South Australia, Texas, and California. In others, it might be outweighed by other factors that dampen volatility. For example, “insurance” through capacity markets that can help to keep conventional (dispatchable) plants online; large pumped-hydrostorage and hydroreservoirs; market-design features such as stringent price caps and floors; and high levels of interconnectedness with markets that have less volatile prices and diverse resources. Even if in some markets these factors are present today, large consumers cannot afford to ignore price volatility since we expect market developments over the next decade to change the balance.

Large Energy Users Can Benefit from More Flexible Operations

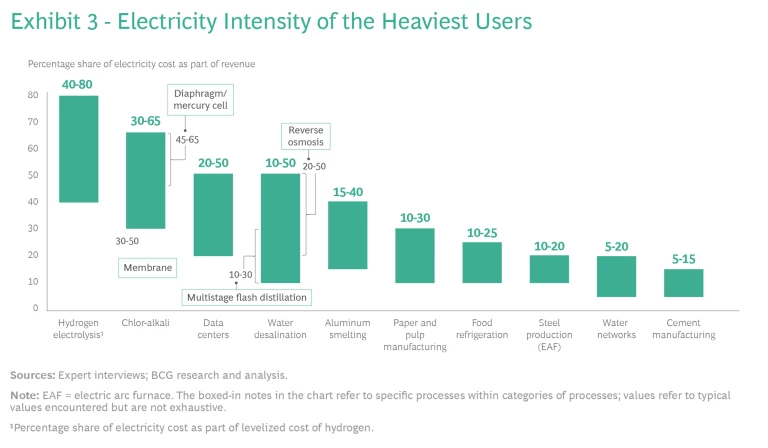

The largest electricity consumers are inevitably most exposed to the challenges of high renewables penetration in electricity systems. These consumers mainly comprise companies that use the following types of processes:

- Electrolytic processes, such as aluminum smelting, chlor-alkali, water desalination, and potentially hydrogen electrolysis.

- Electric arc furnaces used in steel and other metal manufacturing.

- Electronics, primarily data centers and cryptocurrency mining.

- Cooling, primarily data centers and food refrigeration.

- Mechanical processes including pumping (for example, natural gas compression and water distribution), grinding (for example, mining processes), and pulping processes (for example, paper).

Players in all these industries use very large amounts of electricity. For an aluminum smelter, between 15% and 40% of revenues goes toward paying its electricity bill. The figure is up to 50% for a data center. And in the case of a chlor-alkali plant, it can be more than 60%. (See Exhibit 3.) At these levels, when electricity prices routinely vary to multiples of the average electricity price, the calculus for how you consume electricity must change.

As other industries electrify to avoid greenhouse gas emissions from the direct combustion of fossil fuels, they too could be exposed to the effects of high penetration of variable renewable energy. For example, companies that carry out gas-fueled compression in pipelines or that use gas for heating.

Large energy customers have been sheltered from volatility—until now

Up to now, large energy customers have historically located their facilities next to a source of reliable, competitively priced electricity, such as a coal mine and power station or a hydroelectric dam. According to the International Aluminium Institute, in 2019 around 85% of primary aluminum smelting worldwide was powered by either coal-fired generation or hydropower. In many cases, generators have been stranded—that is to say, the smelter is the majority customer and there are few opportunities for selling electricity to other users. Alternatively, large customers have avoided price volatility through long-term fixed price contracts—often at low prices. These contracts have underpinned demand for base-load generators.

In this environment, energy users have been able to focus decisions on maintaining high usage of their assets—effectively keeping their plants running all the time—and maximizing output. But in the e coming renewables-dominated energy landscape, where the availability of conventional dispatchable generation is far smaller, the base-load demand that these large industrial companies provide ceases to be an asset to the electricity system and instead becomes a liability. The danger of focusing solely on high utilization is that either users will start to pay higher fixed prices (in the case of long-term contracts) or that costs will quickly mount during periods of highly fluctuating electricity prices (if they choose to be exposed to time-based wholesale prices). These players will need to embrace flexibilizing their energy usage.

In the coming renewables-dominated energy landscape, the base-load demand that these large industrial companies provide ceases to be an asset to the electricity system and instead becomes a liability.

We see two clear and strategic reasons why big electricity users should improve the flexibility of their operations and electricity consumption profile so they can respond to the increase in variable renewables. These mirror the physical and economic challenges posed by high penetration of variable renewable energy.

- From a sustainability perspective, they can increase the level of renewable energy that they actually consume compared with the renewable energy they procure (overcoming obstacles posed by the variable nature of solar and wind).

- From an economic perspective, they can improve their ability to navigate volatile prices and benefit from fluctuations in the cost of electricity.

Early movers are demonstrating future pathways

Some electricity consumers in the most affected sectors are starting to move toward making their electricity consumption profile more flexible.

On the physical side, Google has announced that it will target “24/7” carbon-free energy (at all times of the day and in all locations) by 2030 to increase the amount of renewable energy that it truly consumes (versus what it on aggregate procures). To help achieve its target, the company might change the source of electricity (for example, to carbon-free dispatchable generation such as geothermal). But Google has announced that it also intends to adjust the time and locations in which they process some data, particularly data that is non-time critical.

Google has announced that it will target “24/7” carbon-free energy (at all times of the day and in all locations) by 2030 to increase the amount of renewable energy that it truly consumes.

In Germany, aluminum group TRIMET has focused on the economic advantages of flexibilizing operations, using it to offset rising wholesale electricity prices. TRIMET has been testing new heat exchange and magnetic compensation technologies, together with improved process control at its smelter in Essen. This combination of technologies allows TRIMET to vary the smelter’s electricity consumption and aluminum production in both directions by up to 25% (whereas typically this is less than 5%). TRIMET refers to this as a “virtual battery,” and given its longer duration (targeting to maintain this variability for up to 48 hours) relative to lithium-ion batteries, makes it very valuable in the context of a volatile electricity market.

Energy users should act like “green”-electricity traders in a world dominated by variable renewable energy

Some aspects of crafting more flexible operations are not new. These are typically referred to as demand-side management or demand response (DR). Historically, they have often been limited to turning down energy consumption in high demand periods or small adjustments in production schedules to make consumption more flexible. In wholesale electricity markets, third parties known as “aggregators” act as intermediaries and help energy users take advantage of this flexibility. (See “Demand Response: A Brief History.”)

Demand Response: A Brief History

- About 140 years ago Thomas Edison invented the light bulb, marking the beginning of the era of commercial electricity use. To power his light bulbs, Edison used a coal-fired power plant located in New York’s Pearl Street.

- However, Edison faced a challenge: people only consumed electricity for lighting at night when it was dark. There was a surplus of electricity waiting to be consumed during daytime. To solve this problem, his company started to offer cheap rates during the day that incentivized people to switch to electricity. Thus, demand response (DR) was born.

- Between the 1920s and the 1980s, companies around the world strengthened electricity grids and built more power plants, and consumption grew. Consumers could access as much electricity as they wanted, when they wanted it. Power generation followed demand. And for DR, these were quiet times.

- In the 1980s, the concept of altering demand so that it better matched generation patterns reemerged with the rise of the so-called “Negawatt” concept (a unit of energy saved due to conservation and efficiency measures).

- Ever since, DR has gained more and more momentum. Today, many companies globally engage in some form of DR, interrupting or altering their consumption profile so that they use less energy at certain times of the day.

What we envisage is more holistic: first, we foresee users reconfiguring their assets and production processes to make their consumption of electricity more flexible; and, second, they will need to treat their assets like real options—much as an asset-backed commodity trader would. The idea: to maximize the profit of facilities by flexing production plans to take into account fluctuating input costs and output prices, rather than to maximize production. That means electricity ceases to be a procured input, but something that can be traded and retraded as prices shift (though to be clear, we are not proposing speculative trading). As this type of flexibility affects core production processes, consumers themselves will need to take on a bigger role in optimizing their interaction with electricity markets: one cannot fully give away the production keys to a third party.

We see two different pathways for consumers to become the kinds of “asset-backed green-electricity traders” that we’ve just described. (See Exhibit 4.) The first pathway focuses initially on maximizing the true amount of carbon-free energy consumed—like Google’s 24/7 carbon-free energy program. The second pathway focuses on harnessing flexibility to optimize the tradeoff between electricity input costs and revenues—as TRIMET does. As our electricity systems become fully carbon-free, these two pathways will converge: maximizing the volume of renewables truly consumed will align with optimizing electricity consumption from an economic perspective, and vice versa.

Electricity Markets Will Need to Be Reconfigured

In markets at the leading edge of the energy transition, policy and design bodies are already looking at ways to reconfigure electricity markets. For example, Australia’s Energy Security Board has embarked on a post-2025 review to redesign the market to accommodate higher levels of renewable generation, reliably and affordably.

The challenge is to ensure that changes are not too narrowly focused and go beyond today’s supply-side issues, such as the economic pressures on conventional generators.

We believe that redesigns must take a holistic approach to be effective. Market designers, therefore, will need to take the following steps:

- Reward all the services required to provide a physically stable grid (in terms of electricity generation and capacity, frequency control, congestion, inertia, and system strength).

- Accommodate a range of different means to provide these services:

- Conventional and renewable generating resources

- Energy storage systems, like pumped-hydro and batteries

- Industrial consumption flexibility (including new sources of electricity demand often referred to as Power-to-X)

- Building and household consumption flexibility

- Grid capacity

Finally, policymakers need to treat the electricity market as part of a broader industrial ecosystem. They need to plan across industry and energy supply to make sure that the composition of their electricity systems, the features of their energy markets, and the resulting price levels and volatility provide the necessary support for the industries they want to encourage.

The high levels of variable renewable energy needed to achieve net-zero emissions by midcentury will transform existing electricity systems built around centralized, fossil-fuel-based power generation. All players will need to adapt to the evolving landscape to achieve their goals. Energy-intensive users will have to act like electricity traders by making their operations more flexible and managing their production and electricity costs together. Policymakers and market designers will have to holistically reconfigure electricity markets to address technical and physical challenges, accommodate new sources of supply and demand, and attract or retain key industries. We will explore these topics in greater detail in subsequent articles in this series.

The authors thank BCG’s Thomas Baker, Antti Belt, Eric Boudier, Christophe Brognaux, François Candelon, and Lars Holm, as well as Robert Hutchinson, with whom they have exchanged ideas during the preparation of this publication. These rich and engaging discussions have allowed the authors to push their thinking further. They also are grateful to Matthew Fletcher for writing support.