This article is the second in a series that examines consumer decision making today and how it has evolved.

How do consumers shop for wireless plans and decide which one to buy? To answer this question, we asked almost 700 US consumers who had bought a new wireless plan in the past year about their shopping journey. This was one of many shopping journeys that we explored in a larger Google-BCG Path to Purchase Survey. (See “About the Survey.”)

About the Survey

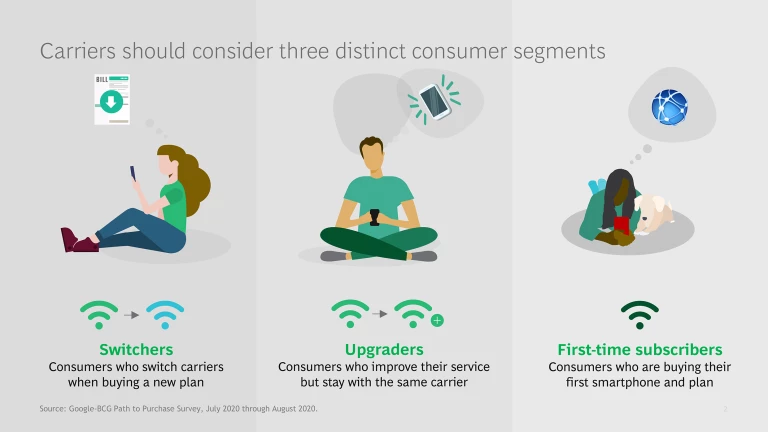

Survey respondents fell into three distinct categories. Those in the first category changed carriers when buying a new plan; we call these participants switchers. Those in the second improved their service but stayed with their current provider; we call these respondents upgraders. The remainder, a much smaller contingent, were buying their first smartphone and plan; we call these respondents first-time subscribers.

The distinction is important for carriers. Switchers and first-time subscribers offer the potential for providers to capture significantly more customer lifetime value, making it a priority for carriers to understand how to win a greater share of these categories. However, these consumers can be more difficult for carriers to understand, given the lack of a preexisting relationship. Upgraders, in contrast, create value for their carrier by being loyal to the brand, extending the lifetime of their plan, and not contributing to churn.

Our survey revealed several ways in which carriers can gain a larger share of the valuable switchers market.

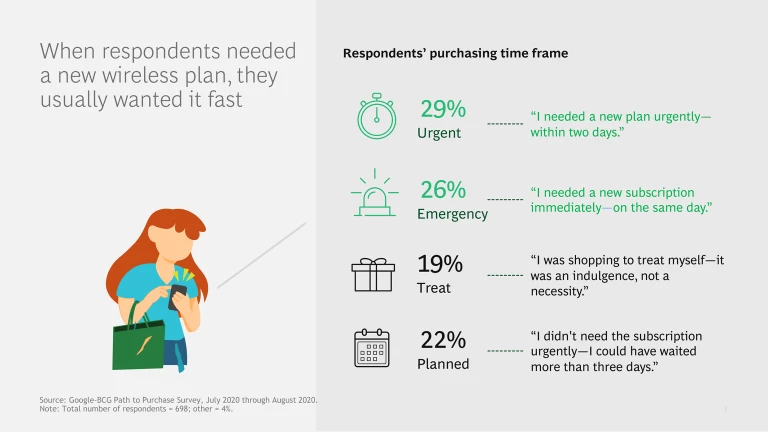

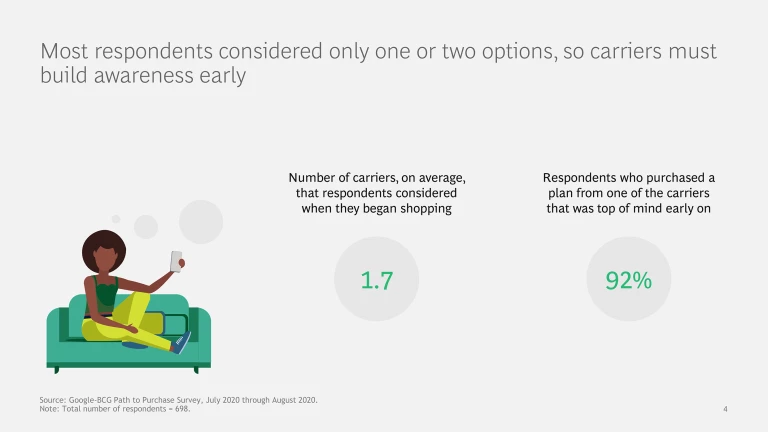

Build awareness early to be top of mind when switchers need a new plan. When they were buying a new wireless plan, many respondents were in a hurry, with 55% saying the need was either “urgent” or “an emergency.” In addition, most already had one or two carriers in mind. As a result, carriers should create brand awareness well before switchers have the need to buy a new plan. This is particularly critical given that survey respondents considered only a short list of providers and that the vast majority (92%) chose to purchase a plan from a carrier that they had in mind at the start, rather than from one they discovered while researching their options.

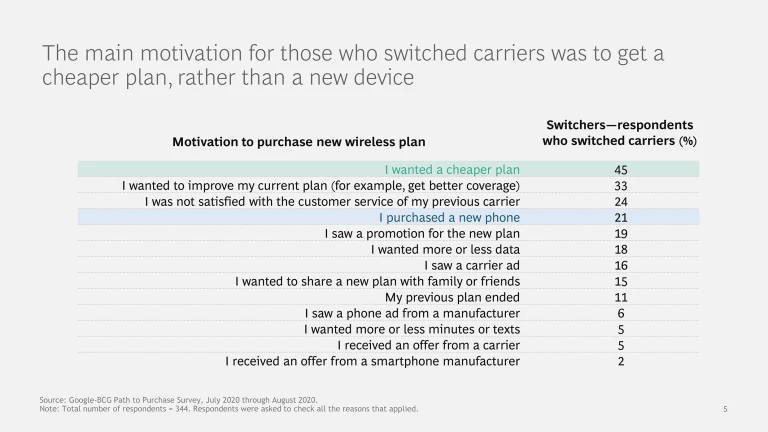

Develop content that speaks to the switcher’s motivations. Marketing content that promotes the latest smartphone will motivate some consumers, but not all. The switchers in our survey were primarily encouraged by a price that was lower than the one for their existing plan (45%)—twice the percentage of switchers who were motivated by a new smartphone (21%). A better plan, such as one with improved network coverage, was the second most popular reason for switchers to make a move (33%).

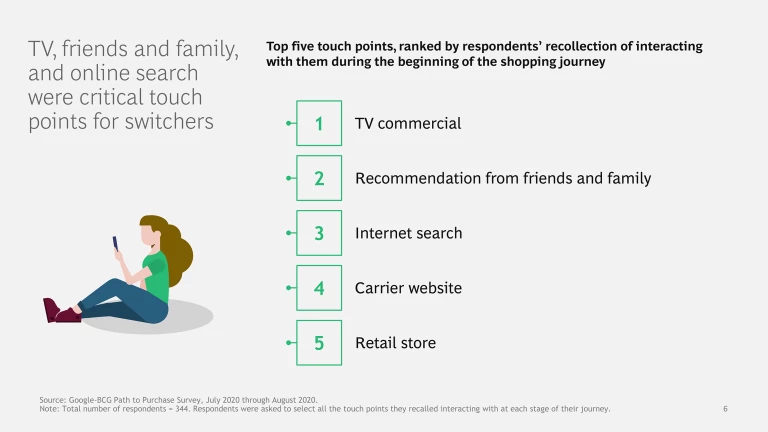

Focus on the most effective channels and influencers. Although a large number of respondents ultimately acquired or upgraded their plan in a store, more than 70% reported that their shopping journey involved online touch points—in particular, search engines. It is important, however, to understand that consumers are swayed by different channels and influencers at different stages in the shopping journey.

For example, to attract switchers at the most critical point of the journey—the beginning—carriers need to build awareness in advance by running ads on TV, encouraging existing customers to give recommendations to friends and family, and capturing the attention of potential switchers while they are searching for a new plan online. As a case in point, of the switchers in our survey, 24% recalled getting a recommendation from a friend or family member at the start of their shopping journey. That is four times higher than the average percentage of respondents who recalled interacting early in the journey with any of the other 37 touch points mentioned in our survey.

Carriers should aim to win over switchers by promoting their brand using the right touch points and offering a proposition centered around price and coverage, rather than the latest device. Our findings provide insights that demonstrate the importance of each of these imperatives. Explore a snapshot of the findings in the slideshow below.