Robotics is a diverse sector with many moving parts, and what its future will look like is a complex question. To offer insight, BCG did a deep dive into the robotics industry and the potential for old and new players to grow over the next decade. Our very concise conclusion: robotics has significant upside potential. But a more-nuanced analysis is that to succeed, established companies manufacturing machinery and industrial automation hardware and software must be both nimble and aggressive, prepared to take advantage of new strategic and technological directions that will likely become more important as 2030 approaches but may not be their traditional strengths. Meanwhile, smaller rivals and startups will be pushing innovation in areas that have the potential to generate high profits and alter the dimensions of the robotics industry. But the speed with which they will be able to transform the trajectory of the field is still a wildcard.

Trends That Will Shape Robotics

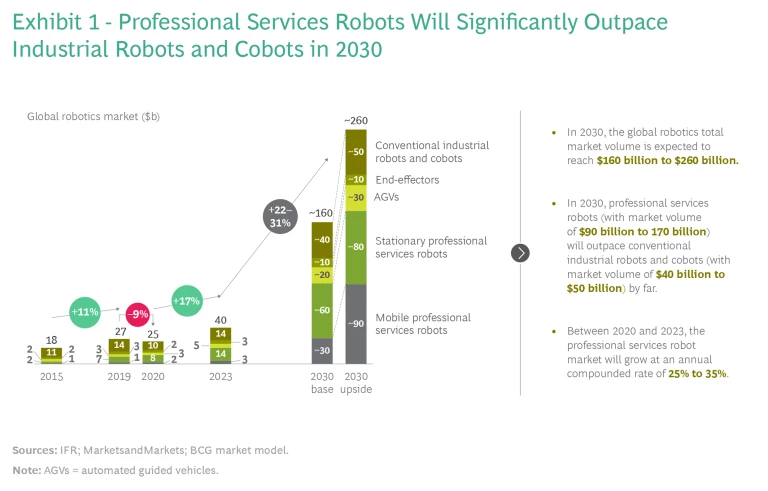

Robotics is a crowded industry of more than 500 companies making products that can be best broken down into four categories: conventional industrial robots and cobots, stationary professional services (such as those with medical and agricultural applications), mobile professional services (such as professional cleaning, construction, and underwater activities), and automated guided vehicles (AGVs) for transporting large and small loads in logistics or assembly lines.

In our view, companies of all types should focus on seven unfolding developments that will influence the direction of robotics in the next ten years.

Professional services robots will dominate the sector. Currently only a bare sliver of the market, professional services robots will have sales that may be more than double those of conventional and logistics robots. We expect the global robotics market to climb from about $25 billion this year to between $160 billion and $260 billion by 2030, with market share for professional services robots hitting up to $170 billion and industrial and logistics robot sales topping off at about $80 billion. (See Exhibit 1.)

Changing consumer preferences and social trends will accelerate the need for advanced robotics solutions. The consumer-driven demand for quicker deliveries of customized products will lead to the expansion of robot capacity in manufacturing individualization and logistics applications. Meanwhile, aging demographics will result in a greater need for the use of mobile services robots to assist in personal hygiene, exercise, meal delivery, and other jobs. An increasing emphasis on recycling and other sustainability measures will require robots to take on complex disassembly and sorting tasks.

Robots will increasingly take over traditionally lower-paying and less skill-intensive jobs. The combination of a shortage of manual laborers and wage escalation in formerly low-wage countries will drive a more rapid replacement of humans with robots. Factory worker wages in China have doubled since 2007 and risen by more than 50% in India over the same period.

Artificial intelligence and other technological advances will enhance human-to-robot interactions. Rapidly developing breakthroughs in technologies involving machine intelligence, connectivity, and control will enable expanded robot capabilities and scope while simplifying human-to-robot interactions. Among the most promising innovations, artificial intelligence (AI) will allow robots to handle unsupervised, unexpected situations; swarm intelligence will increase the flexibility of mobile robots to share and alter tasks on location; and imaging systems will enhance autonomous inspections, analysis, and movements. These capabilities will be augmented by 5G communications networks that increase mobile bandwidth and robot operational radius as well as so-called edge services, which are essentially cloud-based networks that expand robot and sensor computing power.

As these technologies take hold, we believe many customers will shift from buying core robot systems (such as arm, controller, and end-of-arm tools) to purchasing broader, modular systems comprised of the core as well as edge controllers, machine vision software, and AI for smart and autonomous activities, among other emerging innovations. These advanced systems will be easy to deploy (they’ll primarily be plug and play, requiring little or no programming) and able to tackle a specific range of tasks on their own. In addition, the convergence of IT, which manages data, and OT, which manages operational machines, will accelerate the development of smart robot systems and simplify connecting them into comprehensive production setups. Not surprisingly, dozens of technology startups are already focusing on individual niches in these robotic breakthrough areas as their product lines. In one recent survey, robotics and assembly industry purchasing managers rated the impact of AI and machine intelligence on the robotics market at 8.2 and 8.3 respectively (on a scale of 1 to 10).

Robot capabilities will include the ability to learn. Today, simulation tools are used to teach robots how to solve problems in the real world. But this brute force method isn’t satisfactory because situational complexity often makes it impossible to train robots to respond to unexpected events in flexible and intelligent ways. However, new research from nonprofit artificial intelligence think tank OpenAI that focuses on guiding neural networks to navigate progressively more-difficult and randomized environments appears to be producing strong results. The first application involves a humanlike robotic hand that can manipulate and solve a Rubik’s Cube without human input. This training effort required tremendous computing power but over the course of 50 hours, the system, using the cloud and distributed computing, collected approximately 100 years’ worth of experience. This research illustrates the fundamental difference between automation technology widely applied in factory environments today and the radical shift that lies ahead. Propelled by improvements in computer science, the required approach to automation will transition from rule based to goal based. The robotic capabilities that emerge from this shift will be especially valuable in single-batch, custom production processes.

Semiautonomous mobile machines will increasingly manage tasks in pre-mapped environments. By 2030, we estimate that Level 3 autonomous vehicles will account for about 8% of new car sales. At Level 3, the vehicle drives itself temporarily on relatively unencumbered roads and in clear weather conditions and alerts the driver to take over when it is confronted with a situation it cannot handle. Level 3 mobile robots will be able to autonomously navigate efficiently in predefined settings, such as a warehouse, signaling, or stopping when help is needed from a human. Level 4 self-navigation is fully autonomous with a backup system that can turn the machine off in ostensibly rare, unexpected situations, but no human involvement is required. We expect Level 4 capabilities to be perfected around 2030. When that occurs, we’ll see the emergence of mobile machines that are self-driving in specific limited environments, such as room service robots in hotels or last-mile delivery robots.

Asian robotics companies, currently a small slice of the market, will be competitive with US and European manufacturers. Korean and Chinese robotic companies—many of which debuted in just the past ten years—have a limited market presence today, but such firms in Asian countries will likely enjoy substantial growth in the next decade. Currently there are fewer robot manufacturers in Korea and China combined than in the US and Europe separately in each machine category. But since 2017, the density of robot manufacturing workers has increased at the fastest pace in Korea, China, and Japan. As the big Asian retailers begin to modernize and upgrade their warehouses to meet ballooning demand, more robotic equipment will be needed for logistics, and local robot manufacturers (including many more startups) should be able to capitalize on this growth. However, most of these sales will be in AGVs and conventional robots and not in the faster-growing professional services sectors.

Three Industry Scenarios

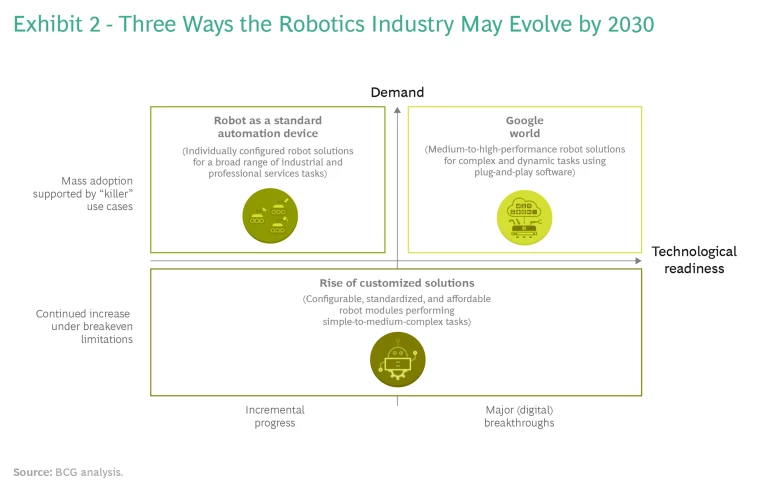

These developments need to be watched carefully over the next decade, because the degree of their impact on robotics will hang upon a host of factors, including the speed of technological breakthroughs, the development of “killer applications,” global economic growth, consumer preferences, and the overall social acceptance of autonomous machines. Examining the range of potential outcomes, three possible scenarios emerge for the sector circa 2030, each of them affecting established and startup robot manufacturers in distinct ways. These include the rise of customized solutions, the robot as a standard automation device, and what we call “Google world.” (See Exhibit 2.)

The Rise of Customized Solutions. This is the scenario that most resembles today’s landscape. In this setting, applicable to an environment that has produced either only incremental technological progress or significant gains, no new volume use cases exist. Companies design robot systems to serve specific applications—maybe a raspberry-picking machine or equipment that can take blood samples—but these products lack the widespread demand to be scalable the way a robot in an automotive factory welding or paint shop was at one point. As a result, the initial price tags for these targeted robot systems are relatively high, and companies cannot hope to rely on volume manufacturing efficiencies to bring down costs significantly.

In this scenario, the assumption is that significant technological advances—such as vehicle autonomy capabilities—will only be useful or approved by regulators for a small subset of applications and won’t be ready for broad adoption. This will further impede the potential for volume sales and delay scaling.

This type of market would be dominated by small- to medium-size companies and startups with deep knowledge in specialized robot applications that can be tailored to customer requirements, while larger players are at risk of having a leading position only in their established application fields, such as automotive manufacturing. Separately, big software companies are not likely to have a dominant presence, but systems integrators already offering technology for specific niches may be able to design machines to up- and cross-sell in their existing customer base. Overall, though, companies that succeed would be highly customer centric and provide the most-targeted and customizable features at the lowest cost, in part by adopting readily available mechatronic equipment to enhance functions and capabilities.

Companies that succeed will be highly customer centric and provide the most-targeted and customizable features at the lowest cost.

The Robot as a Standard Automation Device. This market would be led by a range of less complex systems, relative to where technology is heading, but would include highly scaled machines that are easy to install, configure, and integrate. An example could include an in-house delivery robot, an autonomous picking robot, or an e-vehicle-charging robot. Generally, the mass-use cases in this category are not especially intricate and are so standardized that they can be designed and purchased online. Moreover, there are no regulatory or social acceptance barriers to be concerned about.

The prominent companies in this market would be providers of cheap mechatronics hardware that can leverage a mass application design for maximum scale. We expect that few of the current big players will fit into this category, in large part because they tend not to be cost leaders, which is essential to market-standardized devices. However, although standardization is the crucial feature, some niche companies will be able to profit from using their expertise in specific areas to provide non-customizable products for specialized fields.

To take a leading position in this scenario, established companies would need to lower their design and manufacturing costs and improve their capabilities in hardware and software joint ventures. To profitably manufacture standardized devices, big companies would have to view themselves as hardware suppliers, using software from partners and industrywide platforms to piece together finished products.

Google World. In this final scenario, breakthrough advances in machine intelligence, physical adeptness, and connectivity result in a spate of smart robot modules handling complex and dynamic situations. These modules can be interchanged using simple plug-and-play concepts, expanding robot environments and uses immeasurably. Out of this, volume growth is driven by multiple elaborate use cases at a much higher price point than standardized robots. Because of their technological flexibility and intelligence capabilities, these robot modules can be customized for a broad suite of applications.

Some of the more creative and powerful potential applications will be in the category of mobile robotics, based on machine and vehicle fully self-driving technologies. The biggest growth area is likely to be in professional services robots (rather than the more traditional industrial robots), including autonomous hotel and consumer delivery equipment and railway or airport maintenance robots.

In this market, software will be the key success factor, and software large scalers, hyperscalers, and other digital startups will dominate. Traditional robotics companies are in danger of becoming tier 1 and tier 2 suppliers in this scenario, providing mechatronics equipment to suit the innovation and software platform standards that the software companies are generating. Mechatronics would, thus, increasingly become a commodity with the only possible potential for differentiation being in performance and quality.

Strategic Decisions

By our estimation, each of these scenarios is equally possible by 2030. The wildcard in the mix involves how quickly new machine intelligence technologies and other digital advances can be brought to a point where they cost-effectively drive the development of mass applications. However, the trend lines are obvious: in the overall robotics market the shift toward a Google world is inevitable, and this scenario will almost certainly be prevalent in the next couple of decades.

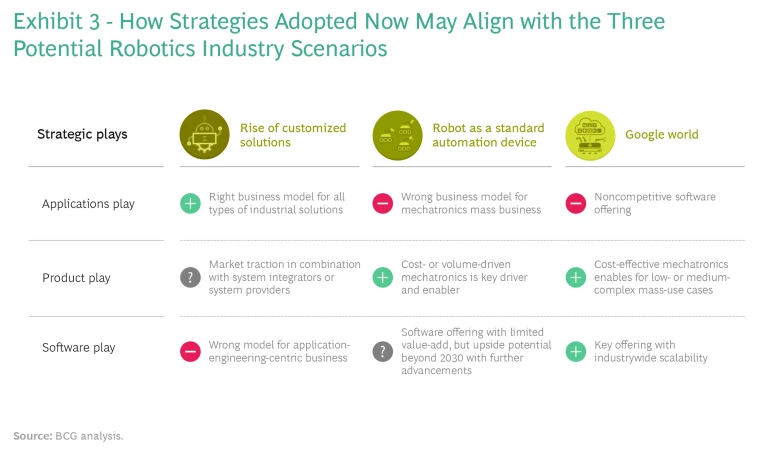

With the timing of these developments uncertain, robotics companies must choose which strategy fits their business today and best positions them for the future. The available strategic options are applications play, product play, or software play. (See Exhibit 3.)

- Applications Play. With this option, companies focus on developing robotic systems for a specific application segment or customer group. This approach will likely involve embedding relevant smart software as it emerges and could be adopted by companies that make modules for robot frames or the entire mechatronic system. Given the increasing role of software in robotic applications, non-software companies that use this strategy will probably need an ecosystem of software providers to help design and manage the digital aspect of the equipment. This strategy is suitable for the customized solutions scenario but not standard automation or Google world.

- Product Play. Adopting this strategy, companies primarily produce configurable modular systems for standard mechatronics platforms that can be used across multiple customer sectors and robot activities. The biggest gains are generated from highly cost-efficient development and production processes, including a network of low-cost production sites. This strategy aligns well with the mass-production standard automation scenario. Also, product play companies may fit in well as mechatronics module and platform suppliers to technology companies in the Google world environment.

- Software Play. Taking this approach, companies design, develop, and maintain software for industrial, logistics, and professional services that can be used with plug-and-play robotic hardware systems across all clusters. A heavy emphasis must be placed on cloud services, which can in turn improve the mobility of the equipment, and feedback loops between customers and designers in order to upgrade robotic performance and functionality remotely. This is the strategic manifestation of the Google world scenario and would require technology firms to line up hardware developers to serve as suppliers. For established robotics companies, the software play is a radical departure from their business model and carries risks, mostly surrounding a lack of internal technology capabilities and alternately the need to make significant initial investments in acquiring software partners.

Stay ahead with BCG insights on industrial goods

Clearly, robotics companies have a lot of decisions to wrestle with quickly. For instance, established companies, which are mostly manufacturing conventional industrial robots, must decide whether to enter the mobile robotics markets, where a lot of growth is expected. Separately, software will play a bigger role in the robotics sector, and large and small companies need to determine if they can compete in that area. To do so, they need to be among the first movers and scale as fast as possible. Those are just two of the most obvious immediate questions, but there are others to address as well. More broadly, robotics companies of all types must balance their innate capabilities, DNA, customer base, product design plans, and resources while choosing whether to double down on their current business models or alter them.

Robotics companies must balance their innate capabilities, DNA, customer base, product design plans, and resources while choosing whether to double down or alter current business models.

Of course, doubling down may only work as a short-term answer because the industry’s landscape is changing rapidly, and a Google world is ultimately going to predominate. Nevertheless, some companies will be able to succeed as application providers, if they are the best in a specific niche, and others have already developed low-cost manufacturing footprints that can help them survive as mass product producers. The problem is, though, neither of those approaches will have continually expanding growth horizons. In the end, some role in the technology environment—either as a supplier or a leader—will be necessary for any company that hopes to succeed in the robotics sector.