Few markets have been whipsawed by the COVID-19 crisis as severely as India. After many months of lockdowns, life in India began returning to normal during the period from October 2020 to March 2021, as cases declined. Then, tragically, the contagion raged back to terrifying levels.

Throughout the pandemic, we’ve been monitoring its impact on consumer sentiment and behavior, conducting a series of six surveys of consumers who occupy different income levels and live in a range of urban settings. Now that India has experienced two strong waves of the COVID-19 crisis, the rich data from these pulse checks gives us an opportunity to step back and look at how the pandemic has transformed people’s behavior. Which changes in the goods and services that Indian households buy—and the ways they transact those purchases—have proved to be fleeting or driven by temporary necessity? And which behavioral changes appear to be enduring to such an extent that companies should consider them the new normal?

We interviewed approximately 4,000 Indian consumers in late May, during the second wave of India’s COVID-19 outbreak, asking them about their consumption patterns in around 50 product categories and about their daily lifestyles. We compared the responses from this survey with those we obtained from our previous barometer in August 2020, when cases were declining and lockdowns were being lifted. We also compared our findings to data that we collected in March 2020, during the first phase of the pandemic.

On the basis of these responses, we grouped behavioral changes into four categories, which we call “accelerating behaviors,” “sustained momentum behaviors,” “sensitive behaviors,” and “transient behavioral changes.” Each of these categories has its own distinctive characteristics and trajectories:

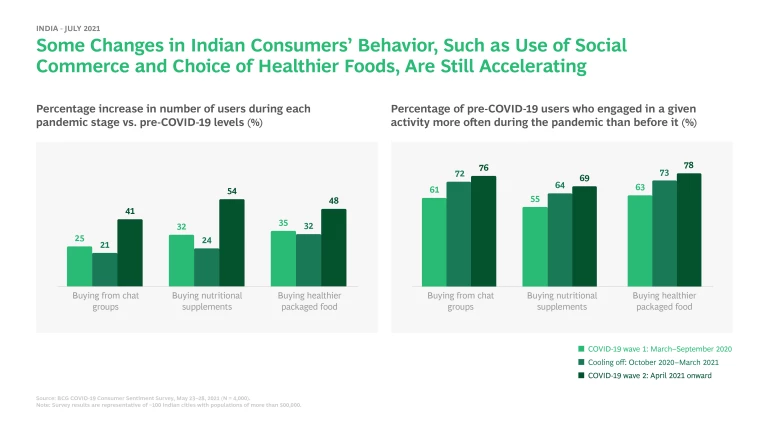

- Accelerating behaviors increased rapidly after the initial outbreak and continue to increase as time passes. For example, the number of consumers who reported buying through chat groups and purchasing nutritional supplements and “healthier” packaged foods for the first time surged by around 30% each during the first stage of the pandemic—and it was still rising as of late May. Even among consumers who already used chat groups and bought healthier foods prior to the COVID-19 outbreak, 60% to 70% said that they were now doing so more frequently.

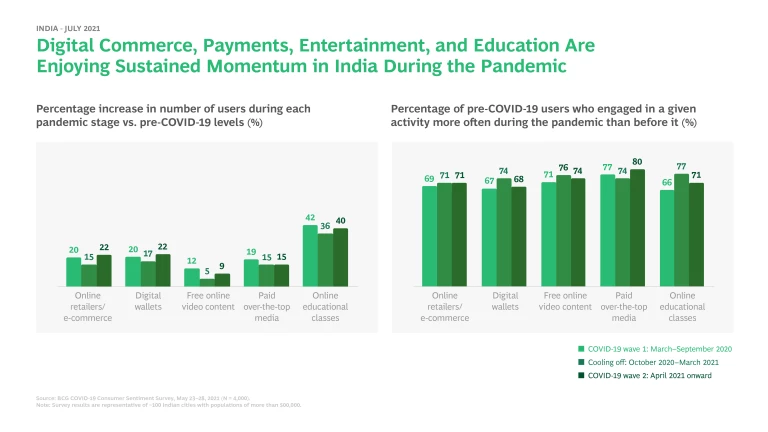

- Sustained momentum behaviors include use of a wide range of digital services, which have remained at elevated levels in India throughout the pandemic. Use of online retail, digital wallets, free online video apps such as YouTube and Hotstar, paid over-the-top media services, and online educational classes leaped early in the pandemic—and have now settled at those elevated levels. The fact that usage didn't decline from October 2020 through May 2021, when infection rates were relatively under control, suggests that these behavioral changes are more permanent than others and that the market for these services will likely remain robust in the post-pandemic period.

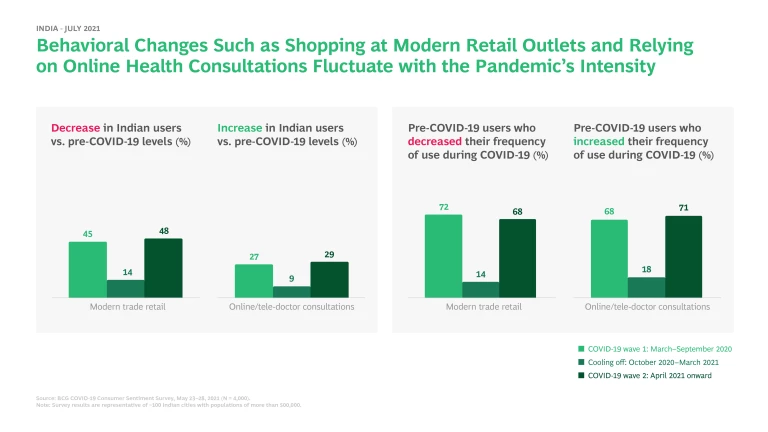

- Sensitive behaviors tend to rise and fall in response to the intensity of the pandemic and associated lockdown measures. Shopping at modern trade stores such as supermarket and hypermarket chains and relying on online doctor consultations fall into this category. Prior to the pandemic, India saw a growing trend of consumers visiting modern retail outlets. When COVID-19 hit, more people returned to buying from small general retailers in their neighborhoods—such as small shops, kiosks, and street vendors—in order to avoid crowded, indoor spaces. When the COVID-19 crisis eased last fall, many consumers returned to modern outlets; but then they avoided them once more when the pandemic roared back in the spring of 2021. This pattern indicates that growth in modern trade retailing will probably resume as the pandemic abates. Likewise, our findings suggest that the strong growth in tele-consultations, as opposed to visiting physicians in person, is unlikely to persist once the pandemic recedes.

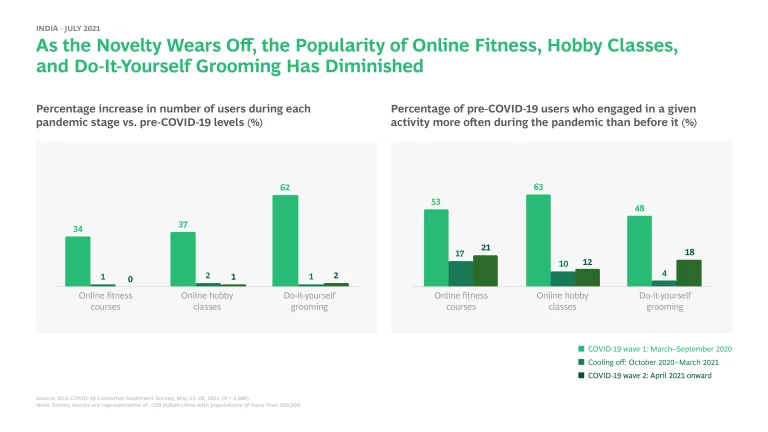

- Transient behaviorial changes gained significant traction early in the pandemic but didn’t stick. For example, in early 2020, when Indian consumers first faced lockdowns, demand for online fitness and hobby classes and do-it-yourself grooming surged. But interest dropped off sharply as COVID-19 cases declined and lockdowns eased—and it has not rebounded during the pandemic’s more recent big wave.

For companies, a key takeaway from this research is that the COVID-19 crisis has significantly altered the behavior of Indian consumers in several important aspects, such as their heightened focus on health and their embrace of digital tools and channels for making purchases. Companies should start integrating an awareness of such behavioral shifts into their planning and go-to-market strategies going forward.

Read Other Editions of COVID-19 and the Emerging-Market Consumer

- Edition 1: COVID-19 and the Emerging-Market Consumer—Five Trends to Watch

- Edition 2: COVID-19 and the Emerging-Market Consumer—The Power of Resilience

- Edition 3: Who Is the Emerging-Market Consumer in the Postpandemic Era?

-

The Surprising Resilience of Emerging-Market Consumers