Scale will increasingly become an essential part of value creation in renewable energy. But getting scale right—and maximizing the advantages it brings—is a challenge. Players that aim to create value by building strong renewables businesses will need to think holistically, take a long-term approach to scale, and understand the financial impact of different scale levers in order to compete in an increasingly tough market.

Competitive Pressure

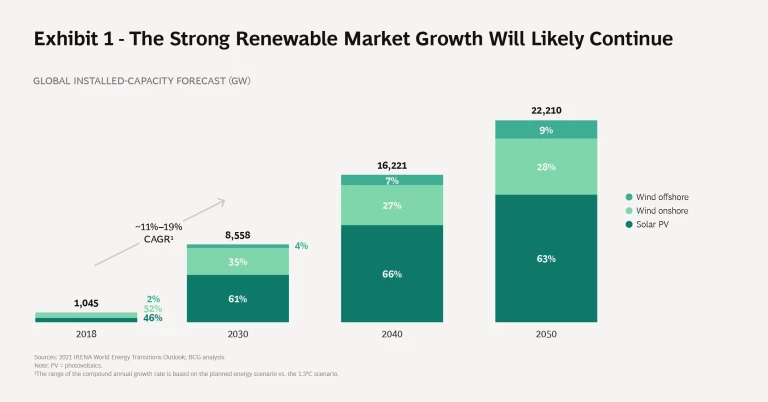

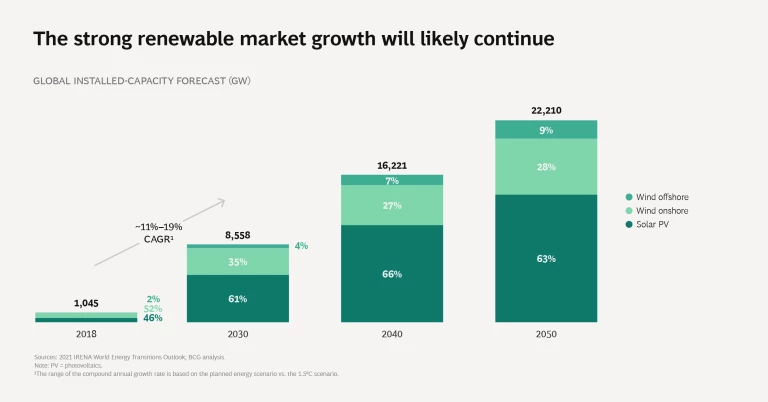

Renewable energy is booming and will likely continue to do so. IRENA and IEA expect installed capacity to grow by a compound annual growth rate of 11% to 19% through 2030 to meet global demand for clean energy. (See Exhibit 1.) New players are entering to capture part of the growing profit pool. Indeed, industry spending on renewable energy already exceeds spending on new fossil fuel and nuclear power generation and will surpass investments in upstream oil and gas in the near future, according to market analysts.

Winning in renewables is not easy. With an increasing level of competition, continuous cost improvements and the widespread use of auctions to award projects are adding to the pressure. To win tenders, players are increasingly submitting zero-subsidy bids, betting that technology advancements and future merchant market conditions will allow for healthy returns.

By applying the right levers, companies can cut the levelized cost of energy by as much as 20% and improve internal rates of return by up to 11 percentage points.

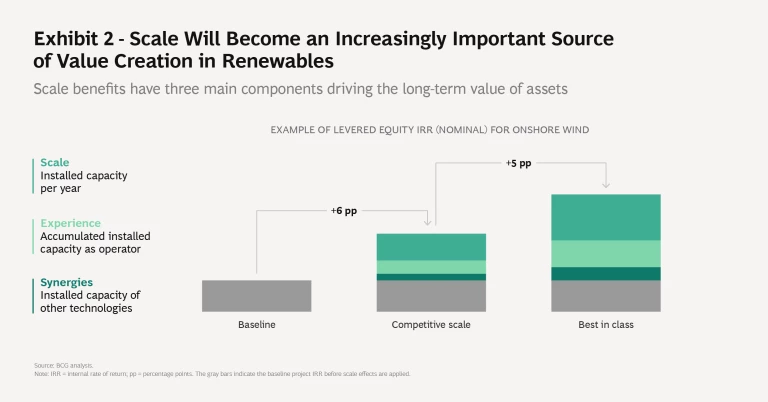

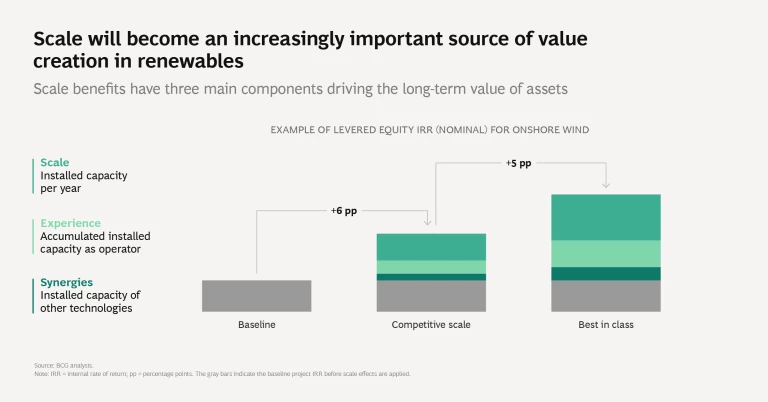

New entrants are facing difficult decisions about how to participate, including where to invest and what renewable technologies to back. But our research shows that wherever they choose to play in the renewable energy universe, scale is a key source of value . (See Exhibit 2.) BCG has developed a holistic methodology that quantifies the impact of various scale levers throughout the asset life cycle. We have found that, by applying the right levers, companies can cut the levelized cost of energy by as much as 20% and improve internal rates of return by up to 11 percentage points, boosting their relative competitiveness in auctions significantly. Additionally, creating an effective approach to scale can increase revenues and mitigate portfolio risks.

Opportunities Ahead

Up until now, renewables developers have achieved scale by expanding their portfolios and adding renewables technologies opportunistically, often in markets with low competition and generous subsidy schemes. Players generally rationalized the strategic logic for these moves after the fact, pointing to risk diversification, a better technology balance, backward integration, or market scale.

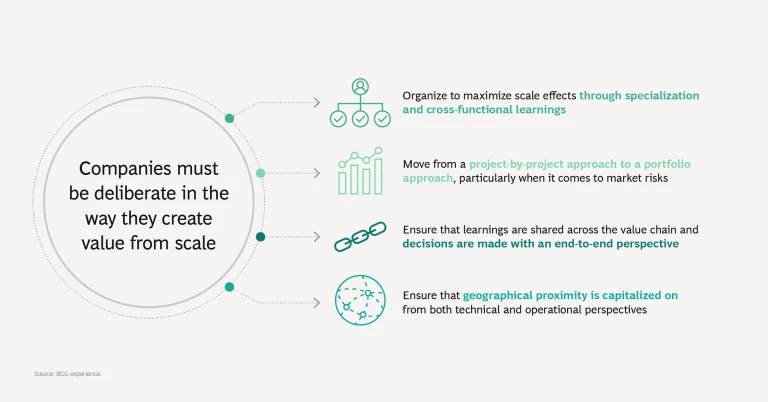

In today’s competitive landscape, however, companies must be more deliberate and structured in the way they pursue scale benefits. It is essential that they recognize that scale has several interconnected dimensions. The value and levers of scale effects differ significantly by technology, market maturity, business model, and the proximity of assets. The following emerging themes offer opportunities to create value from scale:

- As renewable technologies mature and development costs decline, value creation—and the scale levers needed to deliver it—will gradually shift from development toward operations and maintenance, opening up new opportunities.

- Most power markets are shifting from regulated returns to merchant exposure (where company returns depend on the wholesale power price). This will benefit companies with capabilities in trading and risk management.

- New entrants will need to decide where to play in the value chain on the basis of their ambitions, capabilities, and constraints. Players with capital expenditure (capex) constraints, for example, may opt for business models that enable them to recycle capital by selling equity stakes in assets after construction. The scale levers they can apply will depend on their business model. But they will need to understand thoroughly how to use these levers to create value.

- The geographic proximity of assets can create scale benefits at multiple levels, depending on which lever is used. For example, with assets closer together, players can use fewer maintenance vessels and personnel.

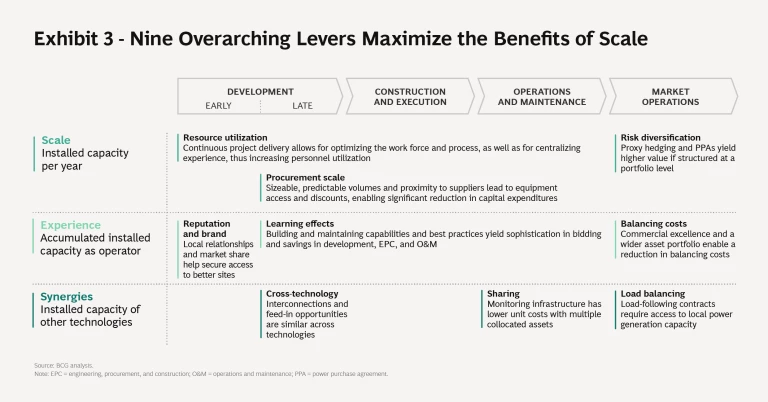

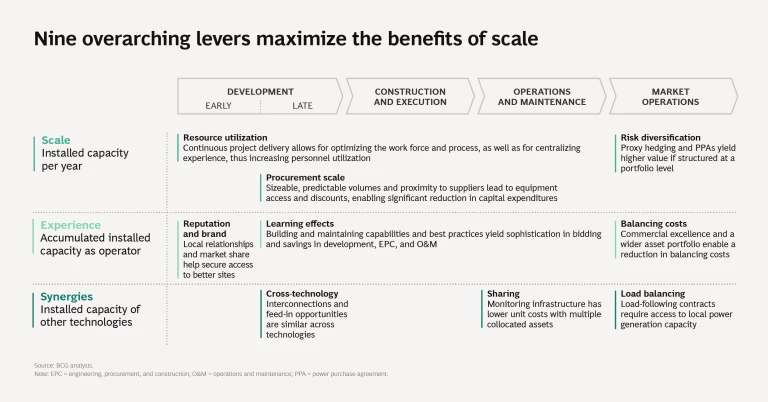

Building scale effectively isn’t simply a question of size. Renewables developers and operators can generate additional scale benefits from experience and synergies. We have found that these effects can be segmented into nine main levers. (See Exhibit 3.)

To tap into classical scale benefits, players certainly do use their size to obtain supplier discounts and rely on a high flow of projects to optimize workforce and resource utilization. What’s more, holding large portfolios enables companies to hedge risks more effectively and secure better terms from purchasers.

But companies can also use their strong brands to secure access to better sites. With experience, players can create more sophisticated bidding techniques and achieve greater operational savings than newer, smaller rivals. And they can create synergies from combining technologies. For example, some companies are exploring the possibility of floating solar panels on the reservoirs of hydroelectric dams. (For more information on the nine levers, see the slideshow “ Mastering Scale in Renewables .”)

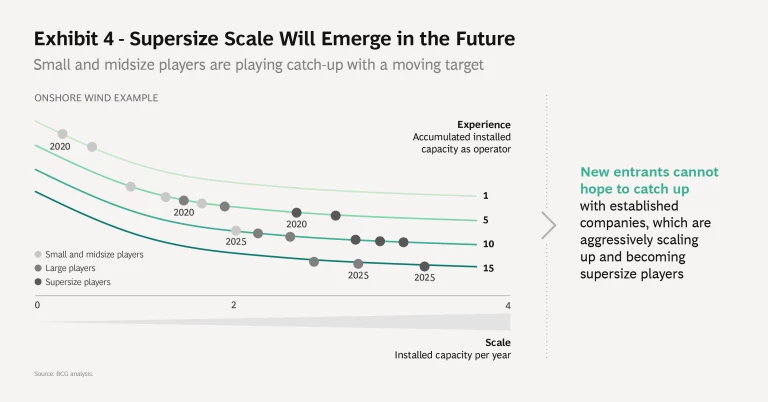

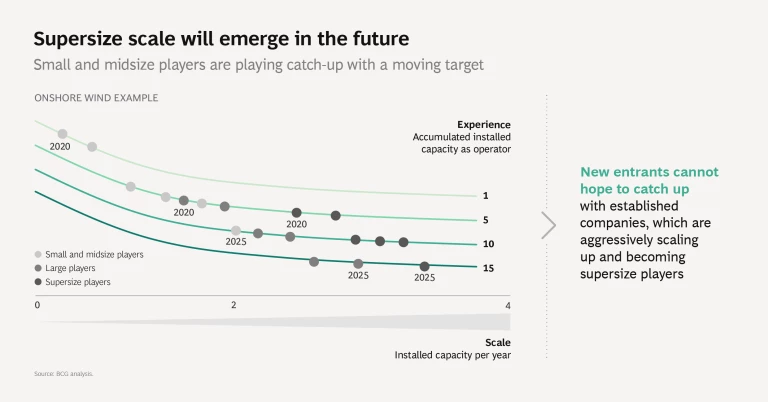

Many new entrants have limited capex budgets, however. And, in any case, they can’t hope to catch up with established companies, which are aggressively scaling up and becoming supersize players. (See Exhibit 4.) Instead, they will need to think carefully about how to use their investment firepower and create a long-term vision for building scale—one that applies across the organization and is driven from the top.

Optimizing Benefits

To build scale effectively, companies will need to make difficult decisions about their strategies and operating models. Altering both can help players to improve scale benefits, but there will also be downsides. They will often find themselves facing a tradeoff between short-term operating margins and long-term scale benefits. Players should ask themselves the following questions as they embark on their journey:

- Why us? Before proceeding, new players will need to identify what capabilities they can bring to renewables, what their competitive edge versus rivals is, and how they can extract value from scale. With renewables markets in transition, established players won’t be able to rely on the same competitive advantages they have had in the past. Instead, new capabilities will be needed at scale, giving new entrants a right to play and win in renewables.

- What is our ambition level? Companies must decide how much capex they want to allocate, what technologies they will invest in, and what their boundary conditions are. For the “utility of the future,” renewables will be a core part of their growth plans, investments will be assessed as part of a portfolio of renewables projects, and target investments will be decided through a clear scale strategy.

- What role should we play? To create value, companies first need to identify what position in the value chain will best enable them to achieve this goal. In some renewables markets, access to viable project sites gives players a large advantage over rivals, while in others having a good interconnection to the grid can be crucial to success. New entrants will need to comprehend these so-called control points, how they may change over time, and how they are affected by scale, before deciding where to play.

- Where should we play? As companies select the technologies and geographies where they want to compete, they will need to balance organic ways of building their renewables business (primarily by winning auctions) against inorganic routes that can accelerate growth. Recognizing the value of scale is essential to understanding the potential upside that M&A can provide.

- How should we play? New entrants must make tough decisions about what operating model they should use, including whether to make or buy capabilities and skills, and whether to partner with other firms. A thorough understanding of scale effects will help companies make smarter decisions.

Renewable energy is a rapidly growing market with attractive opportunities for many players. But rising competition and the removal of subsidies in most regions mean that winning in renewables is not a given. New entrants will need to think holistically, act wisely, and master scale levers if they are to flourish.