The M&A market for software companies has been booming. The cumulative value of software M&A deals soared to an all-time high in 2020 even as overall M&A activity decreased. And the volume of software deals has continued to grow, approaching the record level of the dot-com bubble. Nontechnology companies and financial sponsors are helping to fuel the hot market, as they increasingly join traditional technology players in pursuing software targets.

However, our analysis found that, on average, these nontraditional strategic buyers struggle to create value one and two years after an acquisition. This suggests that they are overpaying for targets or that they are not certain about how to create value.

To succeed in software M&A, nontechnology players and financial sponsors, in particular, need an in-depth understanding of what drives valuations in the industry as well as for specific companies. Conducting a comprehensive and rigorous due diligence process at the company level is essential to gather facts for an accurate assessment.

Rapid Growth and Favorable Economics

In an increasingly digitized world, software applications have become omnipresent in businesses. There are three broad categories of software: horizontal applications that cut across industries (such as for customer relationship management and enterprise resource planning), vertical applications for a specific industry (such as health care or insurance), and infrastructure software (such as for IT security and network management).

The global market for these applications has grown faster than the GDP of Western countries, and we expect this impressive growth to continue. In fact, Gartner projects that the global software market will grow by approximately 10% each year through 2024.

From a buyer’s perspective, the software industry is attractive because of several factors:

- A Large and Growing Industry. The megatrend of digitization is propelling high growth in the software industry—many segments are growing at an annual rate of more than 10%.

- Recurring Revenues. Many software business models feature recurring revenue streams—such as annual subscription or licensing fees and a periodic maintenance charge.

- A High Potential for Scaling Profitably. Because the product has already been developed, an incremental increase in sales does not lead to a corresponding increase in costs for inputs.

- Customer Stickiness. Churn rates are typically quite low, owing to high switching costs for customers. This is especially true for business customers—software, once adopted, can become integral to business operations. A quite common sales strategy is to get a foot in the door by selling customers small bundles of products or services. The company then expands the relationship through upselling and cross-selling of additional software products.

- An Abundance of Potential Targets. The software industry is fragmented, offering the potential for consolidation. More than 10,000 assets globally are held by private equity and venture capital owners, and many more are in public markets (approximately 1,500 companies) or privately held (more than 40,000).

The high growth rate, favorable economics, and numerous prospective targets promote the overall attractiveness of software companies.

The Pandemic Has Accelerated Trends Affecting the Industry

The software industry has been among the most resilient industries during the pandemic. As the threat posed by the novel coronavirus became clearer in February 2020, stock markets plummeted. By late March, however, valuations began to improve as investors took encouragement from further quantitative easing of monetary policy and government stimulus programs in Europe and the US. The M&A market largely froze, but then it gradually returned to the historically normal range of monthly deal volume in the past ten years .

An industry-level analysis reveals a more subtle picture. Some industries—such as travel and tourism, oil and gas, and insurance—were generally hit hard because the pandemic caused investors to question companies’ future viability. Other industries—notably medical technology, software, and high tech—held up strongly, on average, although there were winners and losers in their ranks.

Software companies’ performances during the first three months of 2020 were mixed, creating M&A opportunities.

Looking at software industry players in depth, the first three months of 2020 saw a mix of well-performing and poorly performing companies. This diversity of performance created attractive M&A opportunities. As of the end of 2020, a greater share of companies had a net positive share return, indicating that software is among the winning industries in the crisis. As would be expected, software companies were among the first to restart plans for IPOs and other transactions.

Underlying the software industry’s generally strong performance is the fact that the pandemic has pushed businesses to take several types of actions:

- Accelerate Digital Transformation. The crisis has made companies realize that they need to digitize their core operations and offer radically improved customer experiences through a digital-first approach. Many have begun to catch up by implementing next-generation digital sales and marketing solutions.

- Use Data for Competitive Advantage. Companies are increasingly looking for software solutions that will allow them to leverage unstructured data and democratize the use of data in their organization.

- Focus on Flexibility and Agility. The increasing prevalence of remote work and the need for cost flexibility (to shift spending from capital expenditures to operating expenses) has required companies to deploy new software solutions.

The crisis has also accelerated trends in the software industry:

- Increased Implementation of Cloud 2.0. Cloud providers are beginning to implement the next generation of cloud computing, which features hybrid and multicloud environments and focuses on platforms, integration, and interoperability.

- Faster Innovation Cycles and the Growing Use of Automation. More and more, new solutions and products have substantially shorter life cycles, which means software companies need to constantly push for innovation. At the same time, customers are increasing their use of automation, creating an opportunity for software companies to expand their offerings.

- Expanding Interest in Data Analytics and Cyber Protection Software. Ever-increasing amounts of data mean that customers need more analytics and cybersecurity software solutions—ones that incorporate technology such as artificial intelligence and machine learning.

- The Adoption of New Business Models. Software companies are increasingly adopting the as-a-service approach and transaction-based business models to capture higher margins.

These trends will drive higher demand and affect the technological playing field. They will also create new competitive advantages and M&A opportunities in the coming months and years.

The findings of a recent BCG survey of enterprise IT purchasers reinforce the view that the software industry’s resilience and growth will continue in the coming years. (See “IT Purchasers Expect Spending to Rebound.”)

IT PURCHASERS EXPECT SPENDING TO REBOUND

IT PURCHASERS EXPECT SPENDING TO REBOUND

Applications for analytics, business intelligence, cybersecurity, and overall corporate security were cited by respondents as the most critical software for competitive advantage. Respondents also expect more software applications to transition to the cloud.

Across industries, spending on cloud-based applications will be highest for communications, collaboration, content management, customer relationship management, and artificial intelligence and machine learning solutions. The survey found that media and technology companies plan to allocate the highest share of their IT budgets (more than 40%) to cloud applications.

As this overview makes clear, now is the time for companies to consider M&A as a way to gain access to new software capabilities and assets. The timing is also good for companies to divest businesses that are no longer part of their core strategy for digital and that may create more value under new ownership.

A Closer Look at the Software M&A Market

Our analyses of M&A activity in this article focus on only part of the full universe of technology M&A —those deals involving targets that have software as their core offering.

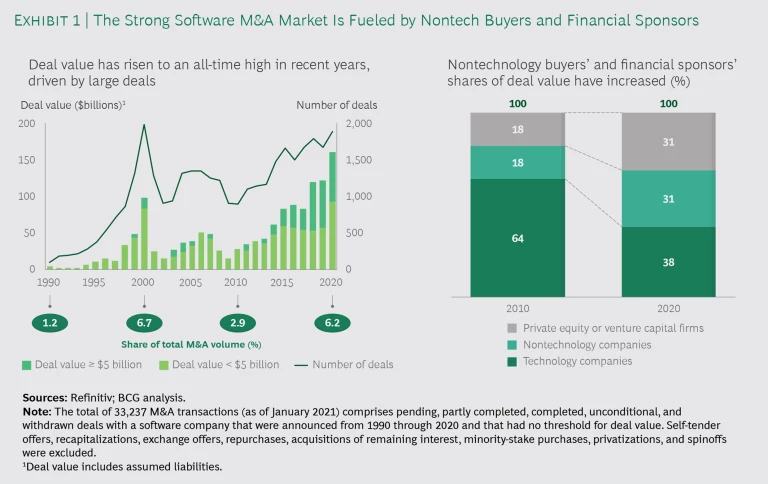

In recent decades, software M&A activity—in terms of deal value (the cumulative value of reported transactions) and volume (the number of deals)—has generally followed broader market trends. Activity was high during the buildup to the 2000–2001 dot-com bubble, before the 2008–2009 financial crisis, and during the bull market that preceded the pandemic. Recent years have seen new highs for deal value and a return to volume levels last seen during the dot-com bubble. (See Exhibit 1.)

However, in 2020, the software M&A market seemed to decouple from the broader M&A market, which slumped because of the pandemic. Software M&A deal value soared to an all-time high despite the economic headwinds.

In 2020, the software M&A market seemed to decouple from the broader M&A market.

As we know, internet software deals drove the high levels of software M&A during the dot-com bubble. In contrast, the recent surge has been strongly driven by acquisitions of companies that sell enterprise software, including customer relationship management solutions, tools for digitizing core operations, and analytics applications.

In terms of volume, software acquisitions in 2020 represented approximately 6% of all M&A deals. This is about twice as high as the percentage ten years ago, and it supports the view that software assets are increasingly important across all categories of buyers.

The majority of software deals in 2020 (73%) were valued at less than $100 million. However, recent years’ deal values have been strongly driven by large deals involving US and European targets. Notable recent US deals include:

- Salesforce’s acquisitions of Slack Technologies ($29.3 billion) and Tableau Software ($17.4 billion), announced in December 2020 and June 2019, respectively

- Hellman & Friedman’s acquisition of Ultimate Software—$11 billion, announced in February 2019—which it combined with Kronos

- Visa’s acquisition of Plaid—$4.9 billion, announced in January 2020

Large European deals include:

- Insight Partners’ acquisition of Veeam Software—$5.0 billion, announced in January 2020

- EQT’s acquisition of SUSE—$2.5 billion, announced in July 2018

- Schneider Electric’s voluntary public takeover of RIB Software—$1.3 billion, announced in February 2020

The robustness of the IPO market for software companies on both sides of the Atlantic also points to the strength and resilience of software companies. For example, in September 2019, TeamViewer was listed on the Frankfurt Stock Exchange with a valuation of $2.2 billion. And even after the onset of the pandemic, the market remained active. Among the noteworthy deals, Snowflake listed on the New York Stock Exchange for $3.4 billion in September 2020. And SAP took public its subsidiary Qualtrics in January 2021.

Which organizations are buying software companies? In many cases, the acquirers are not technology companies. From 2010 through 2020, the share of deal value attributable to acquisitions by technology companies decreased from 64% to 38%. During this period, the share of deal value for private equity and venture capital firms, as well as for nontechnology companies, rose from 18% to 31%, respectively. Financial sponsors recognize the potential for high returns . Nontechnology companies, even in seemingly hardware-dominated industries such as automotive, see software as a future differentiator. Or as a German automotive manager put it: “Tesla builds the car around a computer; we’re now trying to get the computer into the car.”

Capital markets appear to perceive software deals as creating value, especially for nontechnology buyers.

Capital markets appear to perceive software deals as creating value, especially for nontechnology buyers. Our analysis found that over the past two decades, publicly listed acquirers of software targets had positive abnormal returns upon the announcement of a deal. The announcement return was even higher by 0.6 percentage points, on average, for nontechnology buyers, compared with the returns for technology buyers. Interestingly, technology buyers, on average, pay a higher transaction multiple than nontechnology or private equity buyers (20 times EBITDA, compared with 15 times and 13 times, respectively). For nontechnology buyers, the benefits of such acquisitions can extend beyond strengthening their competitive positioning. If done right, these deals offer the potential to transform how investors perceive companies—and thereby increase the valuation multiple.

The value-creation advantage for nontechnology companies can also hold true for occasional buyers and serial acquirers. Investors apparently regard experience in making software deals to be less important than whether the buyer is from outside the technology industry.

Our discussions with nontechnology buyers suggest that their higher returns may be attributable to the fact that they carefully consider these transformative, cross-industry acquisitions from a strategic perspective. As a result, they are generally better prepared to capture value than they are when consolidating with a company in their industry to capture synergies. For technology buyers, in contrast, software deals do not materially affect share prices, on average, because they are business-as-usual transactions. They are commonly used to accelerate product development, secure critical talent, or promote growth in adjacent segments, markets, or customer groups.

However, longer-term value creation has been more challenging for nontechnology buyers. They have not outperformed technology buyers in terms of relative total shareholder return one or two years after acquiring a software target.

The challenges of longer-term value creation point to a clear imperative for nontechnology buyers: gain a strong understanding of the value drivers for software M&A generally and for individual targets specifically.

What Drives Valuations for Software M&A?

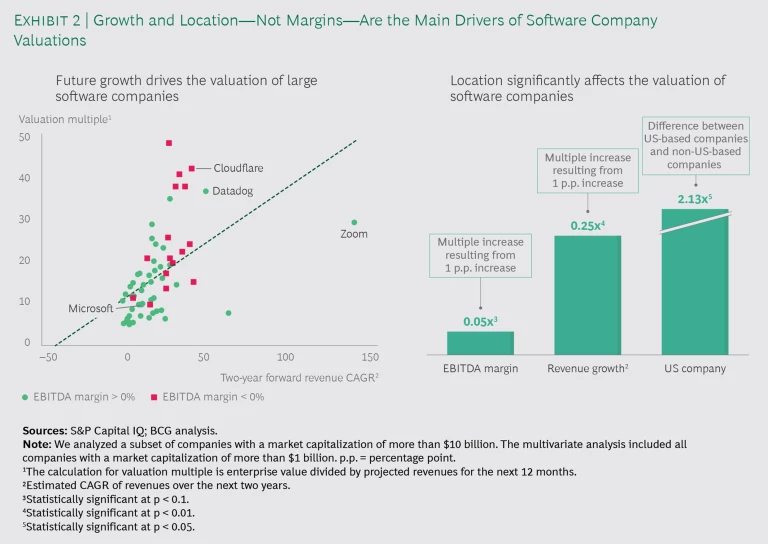

To understand what drives the valuation of software M&A transactions, we analyzed the valuation of a set of publicly traded software companies. We found that valuation multiples (measured as enterprise value divided by projected revenues for the next 12 months) strongly correlate with two factors: a positive growth outlook and a US headquarters. (See Exhibit 2.) Contrary to standard valuation theory, profitability does not explain valuation levels. Strikingly, even after controlling for profitability and growth, US companies have a statistically significant premium for the valuation multiple—approximately two times revenues.

One possible explanation for this finding could be the presence of broader and more-liquid capital markets in the US. Indeed, the total market capitalization of software companies is 13 times larger in the US, while the daily trading volume is 40 times higher.

Another factor is that US companies have direct access to the larger US software market. This access promotes revenue growth and provides revenue potential, and thereby value. The US is one of the biggest markets for software products, largely due to the high affinity for technology among US companies.

Looking at software deals, we similarly found higher valuations for US-based software targets. For acquisitions involving these companies, the median transaction multiple (enterprise value divided by EBITDA) from 2015 through 2019 was 27, which is at least 10 points higher than it was for software deals involving non-US targets or for deals in general. And, as with trading multiples, profit margins were not a significant factor in determining transaction multiples.

How Can Buyers Create Value from Software M&A?

It’s imperative for buyers to understand the path to value creation given the average transaction multiple.

In contrast to the valuations for targets in other industries, the valuations for software targets are primarily a function of the outlook for growth. Moreover, when acquiring a software company, the average transaction multiple that buyers pay is higher than the average paid in other industries. In fact, it is often significantly above the acquirer’s trading multiple. Given these facts, it is imperative for buyers to understand the path to value creation followed by successful acquirers.

We analyzed European software deals over the past decade (using data from Cepres). Our analysis considered majority buyouts as well as growth deals (usually minority investments) by financial sponsors. It broke down the total value creation for buyers into three categories: top-line growth, margin expansion, and valuation multiple expansion.

We found that value creation was strongly driven by top-line growth (accounting for 57% of the total valuation increase) and margin expansion (27%). However, for the most successful deals, the lion’s share of value creation (74%) was attributable to increasing the valuation multiple, even in the face of a negative contribution from profits. This finding highlights the path of financial sponsors, which seek to maximize their exit proceeds. They make what is called an initial platform acquisition and then build upon that with subsequent acquisitions, developing the investment story of the combined assets, rather than improving profits.

Strategic acquirers, specifically nontechnology buyers, tend to follow a similar route. For them, increasing their overall valuation multiple by adding and integrating a software asset into their company is a key value-creation approach.

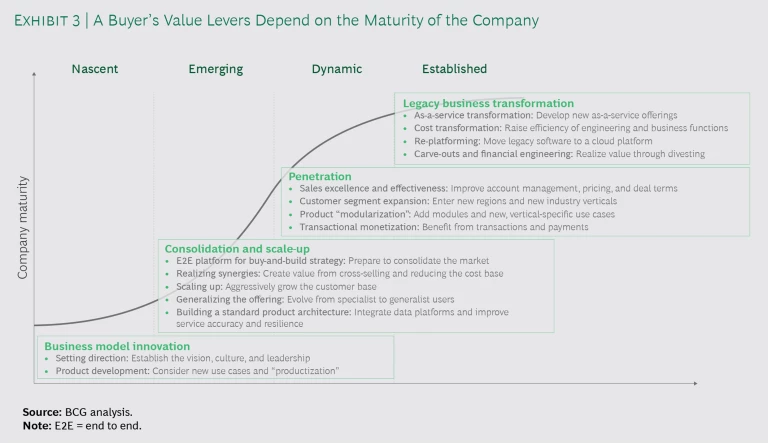

In our experience, the exact set of value levers, especially for nontech buyers, depends on the organization’s maturity with regard to software capabilities. (See Exhibit 3.) First-time buyers of software assets primarily create value through business model innovation and, potentially, new products. More mature companies are most likely focused on consolidating the market and scaling up their business by acquiring assets along different steps of the value chain. Buyers with the highest maturity deploy the new software capabilities throughout the whole organization, thereby increasing the penetration of new technology in the company and transforming their legacy business.

An Accurate Assessment Requires Rigorous Due Diligence

In order to accurately assess a target and avoid overpaying, buyers of software companies need to conduct a comprehensive and rigorous due diligence process. In the software industry, the process is distinctive in some respects, especially with regard to assessing the potential for technological disruption.

A buyer should structure its software due diligence along three dimensions.

Market Growth, Trends, and Risks. A buyer needs to understand:

- The Market. Investigate the sizes of the total addressable market and the serviceable addressable market; the growth potential of each software application, market segment, and region; and the underlying growth drivers.

- The Market’s Maturity. Evaluate the customers of a prospective acquisition, their adoption levels of the target’s products, and the cyclicality of demand. Determine how using various business models, such as software as a service (SaaS) and on-premises software, could affect the growth of the target company and its market penetration.

- Potential Technological Disruptions. Identify the key trends and risks that could disrupt the target company’s business.

The Competitive Landscape and Advantage. A buyer should assess four main topics:

- Customers’ Key Purchasing Criteria. Determine why customers buy the target company’s solutions and how innovation and marketing can address different customer segments.

- The Go-to-Market Strategy. Evaluate the prospective acquisition’s distribution channels, key customers, and partnerships, which are all crucial to its go-to-market strategy.

- The Product Portfolio and Innovation Pipeline. Ascertain each product’s contribution to the company’s revenues and its market penetration. Also assess the robustness of the company’s innovation pipeline, considering the adaptability of the software architecture, technology platform, and language to future applications and the suitability of the software for cloud-based SaaS offerings.

Additionally, look at whether the company implements best practices for software development (such as DevOps and agile). In many cases, it is also helpful to understand the technical debt (that is, the necessary development work that has been delayed). - Key Strengths and Weaknesses. Evaluate the company’s competitive advantages relative to those of its peers, as well as its market positioning and resilience against disruptions. Issues to consider include how frequently the company has prevailed over direct competitors in recent years and the risk of competitors’ products substituting for or disrupting the company’s offerings. The assessment should also consider the likelihood that open source software or free add-ons will render the company’s products obsolete.

Performance and Value Creation. A buyer needs to understand the target’s opportunities and challenges and the current management’s ability to address them:

- Value Creation Levers. Identify opportunities to expand the customer base, access new regions, upsell and cross-sell, expand into adjacent value chain segments, improve pricing, or transition to SaaS. Financial sponsors will want to determine if the company can take advantage of these opportunities within their holding period, given that they seek to take the software asset to a higher level of performance. Technology companies should pay attention to the potential for revenue synergies, in particular. BCG’s synergy database shows that revenue synergies are a major factor in value creation for half of the transactions involving technology and software companies, compared with one-quarter of the deals across all industries. A recent BCG survey of software companies found that it takes, on average, two years after closing a deal for synergies to materialize. Given that they are critical to value creation, it is important to pursue synergies even before finalizing an acquisition. Practical approaches such as using a clean team can prepare a buyer to accelerate go-to-market planning and take advantage of cross-selling opportunities.

- Challenges to Value Creation. Assess the threats arising from switching and churn, new competitors, complexity, and technology. The challenges also include capability gaps within the organization and a current management team that could impede efforts to take the company to the next level.

- Company Culture and Ways of Working. Evaluate the target’s approaches to innovation and work. Following the merger, strategic buyers need to focus on integrating the software company’s culture and ways of working into the existing organization. This post-merger integration can be highly beneficial for the buyer’s existing organization and help to foster future innovation.

- Management Buy-In to the Value Creation Plan. Determine the feasibility of the current business plan and the ability to engage the current management in pursuing changes if it stays on. In assessing the organization’s ability and willingness to change, the buyer should consider the risk of losing key talent (such as the founder) and whether the target has developed or is actively developing the skills it needs for the future.

High prices for software targets are an economic consequence of the high demand for software assets and capabilities. To ensure that an acquisition price accurately reflects the value of the assets and capabilities, buyers need to first understand which companies they are competing against and the underlying drivers of valuations. They can then dive deeper into the sources of value for specific industry segments and, ultimately, specific targets. Buyers that succeed in acquiring the right software assets and capabilities at the right price will position themselves to reap significant benefits in the digital future.