All companies faced extreme disruptions from COVID-19, but a subset faced an even bigger challenge: they had been struggling prior to the pandemic and were in the middle of a transformation to improve performance. For many of these organizations, the pandemic could have been the death blow, yet some managed to not only survive but thrive.

We recently identified a number of companies that were in a position of weakness and had transformation initiatives underway in early 2020. When the pandemic hit, they didn’t scrap their transformation plans but rather adjusted them. They redoubled their efforts and recognized it as a window to actually accelerate the transformation, building digital capabilities and introducing new ways of working. Now that the crisis is beginning to ease, these efforts are paying off, helping companies compete more effectively and boosting their resilience for the next crisis to come. All were in major trouble, and all have significantly rebounded.

We believe that transformations can help virtually all companies, from market leaders seeking to reinforce their position to companies in need of a structural turnaround. These companies put that thesis to the test. One such story—that of the Danish jewelry retailer Pandora—is a living proof that with strong leadership and a solid transformation plan, companies may be down, but they’re never out.

Company Performance is in the Hands of Management

When entire industries are in a crisis, some management teams may be tempted to use that as an excuse for subpar performance in their own company. But our research shows that the story is much more nuanced. Even within a struggling industry, companies can still take action to improve their performance relative to their peers. They can also invest to position themselves for the coming recovery.

We have studied about 8,000 companies in a proprietary BCG database, representing 15 sectors and covering all major countries and regions. Specifically, we looked at performance over the past three years across a variety of KPIs, including margin, revenue, cost of goods sold (COGS), sales, general and administrative (SG&A) and capex. This sample included almost 300 Nordic companies from Norway, Denmark, Sweden and Finland. That data tells an interesting story about how companies responded to COVID-19.

During the pandemic, some industries were hit much harder than others. For example, the automotive and fashion and luxury sectors saw revenue declines of 10% to 15% in 2020 (compared to 2019). Oil and gas companies saw even bigger drops of more than 20%, and travel and tourism companies saw their revenue fall by nearly 50%. (In contrast, biopharma and technology companies experienced an increase of 7% and 6%, respectively.)

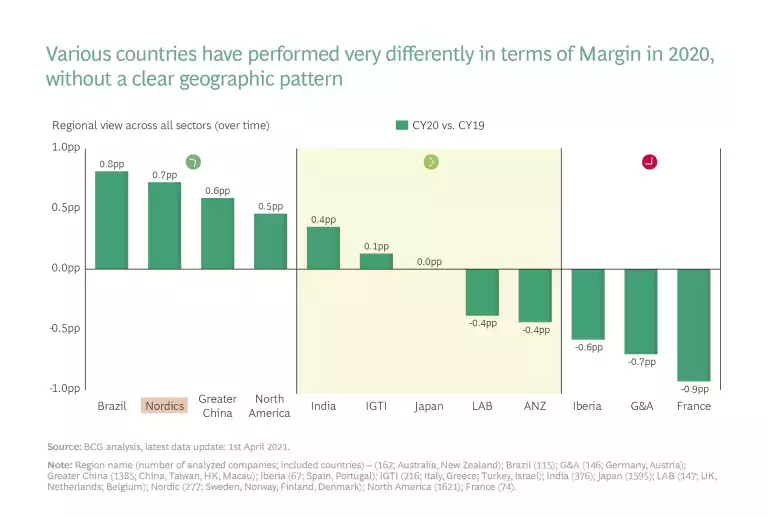

Similarly, geographic regions experience varying levels of fallout from COVID-19. One of the main findings, however, which should boost the confidence of the Nordic business leaders and the general public alike, is that the Nordic region has demonstrated an incredible amount of resilience in the face of COVID-19, especially when compared to how other parts of the world fared in this crisis. When comparing margin numbers for the year 2020 vs 2019, we see that Nordic companies actually managed to improve their performance by about 0.7 percentage points. This puts Nordic businesses ahead of those in almost all major geographies and second only to those of Brazil which achieved a 0.8 pp increase. This is especially remarkable given that companies in half of the global regions saw their margins decrease, and for some of the European regions this decrease was quite dramatic–Iberia at -0.6 pp, Germany and Austria at -0.7 pp and France at -0.9 pp.

Similar to most of the world, Nordic companies experienced a drop in revenue in 2020 vs 2019. At -1.1% this drop does not seem to be large but when compared to the revenue increases in the previous years, 6.9% increase in 2019 vs 2018 and an even higher 8.6% raise in 2018 vs 2017, we realize what a blow the corona pandemic has dealt Nordic businesses.

However, many companies in the region have demonstrated a remarkable willingness and ability to react fast to the changing circumstances and introduced a strong cost discipline.

Even in the face of declining sales, both COGS and SG&A remained flat as % of revenue. This was not a trivial achievement which is reflected in the performance of some other regions, including the European ones. Companies across UK, Benelux, Iberia, France and Germany saw their COGS and SG&A expenses as % of revenue go up, sometimes by as much as 0.5-0.9 pp.

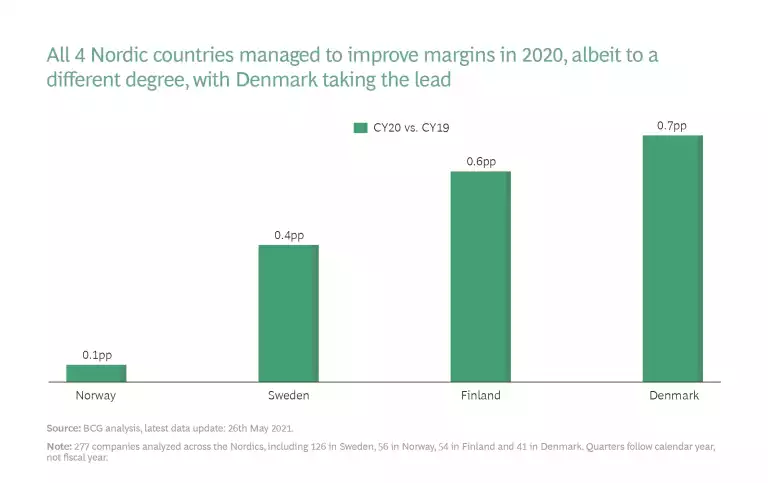

Going to the next level of granularity we have realized that there are significant performance differences not only when comparing various industries or geographies, but even within regions. The Nordics represents an excellent case study of how the four countries in the region dealt with the challenges of the year 2020. For example, at a regional level we see that all four Nordic countries managed to improve their margins in 2020 vs 2019. However, where in Norway that increase was a mere 0.1 pp, Denmark led the way with a 0.7 pp improvement.

For Denmark this performance is even more remarkable given that the 2019 vs 2018 margin change was a negative 0.2 pp, leading to a combined 2-year increase of as much as 0.9 pp where for Sweden the two-year result was 0.2 pp, for Finland 0.4 pp and 0.5 pp for Norway.

One of the key ingredients of the Danish success recipe was the ability to preserve revenue.

Denmark was the only country in the region which saw the 2020 sales rise over the 2019 level, albeit by a minor 0.5%. However, when compared to the performance of the other countries this was clearly not a trivial accomplishment as Sweden’s revenue fell by 0.7%, Norway’s by 1.7% and Finland’s by as much as 3.5%. The cost side of the story also provides some interesting insights into how countries dealt with the revenue challenges. All 4 of them managed to counterbalance sales declines with cost measures but they clearly chose to focus on different areas and with a different level of intensity. Sweden, for example, doubled down on COGS and in 2020 was the only Nordic country reducing it as % revenue vs the 2019 level, by 0.1 pp. In comparison, Finnish businesses kept their COGS as % of revenue flat where the Danish and Norwegian ones saw their COGS go up by 0.1 pp each. When it came to SG&A expenses, though, Denmark was a clear leader cutting it by 0.5 pp, while Norway’s SG&A as % of revenue went up by almost as much, namely 0.4 pp. The area where all 4 Nordic countries united in their approach and where the degree of cuts was quite dramatic across the region was capex. All 4 countries viewed capex as the safest and fastest way to save cash in the face of extreme uncertainty, but even there some nations went much further than the rest. Thus, across Denmark the 2020 capex expenditures compared to those of 2019 went down by 5.5%. Finland was a close 2nd with a 5.7% reduction, followed by a much more aggressive Norway which implemented a 10.3% cut. However, no one in the Nordics, and only a few other countries in the world, came close to what Sweden introduced with a capex reduction of as much as 14.7%.

Yet our research also shows that even within those hard-hit industries, regions and countries, some companies managed to outperform the competition. Even more surprising, some of these companies went into the crisis facing their own internal challenges and launched transformations that were underway already in early 2020. Despite that, they still emerged from the pandemic ahead of their peers.

The key takeaway is that even when an entire industry or region is struggling, management still has significant control over performance and can execute—or continue to execute—a transformation to generate improvements.

FIVE MEASURES TO BOOST RESILIENCE IN A CRISIS

There is no single plan for how organizations should transform during a crisis. The right approach depends on a company’s starting position and its unique challenges. However, after supporting hundreds of transformations across industries and geographic markets, BCG has identified several common themes that make companies more resilient in the face of a major crisis. Critically, companies should avoid choosing from among these—when implemented together, they reinforce each other to generate stronger results.

Take a holistic approach to performance. Most organizations undergoing transformation seek to cut costs, for understandable reasons. Facing liquidity crunches, they reduce spending on nonessential and employee-related items, R&D, and capex, in an effort to conserve cash. However, most successful organizations think beyond cost cuts, simultaneously launching quick-hit measures to boost revenue as well, in areas such as pricing, activating the sales force, and focusing resources on the top-selling products and services. In doing so, these organizations craft a more promising future, generating buy-in from employees and investors. Costs are important, but they can’t be the sole focus. It’s critical to pull multiple value-creation levers at the same time, but also to adjust the degree of focus on each lever based on the ever-changing situation.

Put employees first. The pandemic and its impact on workforces reminded management teams that employees are not a cost item that can be optimized during a crisis. Instead, they are a major—if not the main—asset in an organization. Prioritizing employee wellbeing and engagement during COVID-19 sent a clear message and built loyalty. Not every company applied this approach, but it was a clear theme among the winning organizations we looked at.

Focus relentlessly on digital. Virtually all companies have invested in digital to some degree over the past decade, yet many still have further to go. During the pandemic, when many organizations had to close their manufacturing facilities and retail locations, and when travel restrictions altered buying patterns and global supply chains were disrupted, winning companies prioritized the switch to e-commerce, digital platforms, and process automation as a matter of survival. They built the requisite infrastructure and expanded their digital capabilities. We believe that these investments will pay off, by giving companies a competitive advantage in both calm and turbulent markets. If organizations are struggling to generate progress, they can start with smaller, more focused initiatives to build institutional capabilities and momentum.

Stay agile. The ever-changing conditions in a crisis challenge leadership teams to quickly identify emerging trends, make decisions quickly amid uncertainty, and—crucially—determine when to stick to a decision and when to adapt. Strong leaders make bold bets and do what is needed to bring their organization along.

Create dedicated response teams. Because situations can change rapidly, few plans developed in advance of a crisis will remain 100% applicable. Successful companies put teams in place that can react quickly to evolving conditions and challenges. In response to COVID-19, these companies introduced new infrastructure, tools, processes, strategies, and behaviors, and then gauged results and adjusted on the fly. Response teams are not meant to be permanent—the crisis called for a sense of urgency and focus that likely wouldn’t be sustainable over the long term. But organizations should maintain the ability to mobilize a large response team with the right mix of business and functional capabilities, and with appropriate governance and accountability.

CASE STUDY OF A TRANSFORMATION IN A CRISIS – PANDORA

Our research and work with companies highlights a specific case study—company that faced steep challenges before the pandemic hit but applied the principles we highlighted and turned their fortunes around.

Through much of the 2010s, Danish jewelry retailer Pandora grew extremely rapidly, becoming one of the largest global brands in the category. With 2,700 stores (of which about 1,400 are company-owned), the company generated about $3 billion in annual sales by 2016. By around 2018-2019 that growth stalled, however, and sales started declining. The company responded by launching a multi-year end-to-end transformation, called Program NOW, aiming to completely relaunch the brand, supported by digitization of the brand experience, development of omnichannel capabilities and, in parallel, implementation of a $200 million cost reduction effort.

COVID-19 complicated those plans. The retail segment was among the hardest hit, and Pandora saw its sales fall by nearly half. Management closed about 90% of Pandora stores, yet costs remained high, in part because the company continued to pay the full salaries of its roughly 11,000 employees. During the crisis, Pandora monitored cashflow on a daily basis and implemented some cost-saving measures. The company also modeled future scenarios based on country-specific infection rates, to ensure that it was considering all contingencies.

Critically, management stayed true to its transformation plan during the pandemic—in fact, it even intensified its efforts in some areas, particularly digital. The company opened a digital unit in its headquarters city of Copenhagen and staffed it with about 100 software engineers, who were tasked with boosting the company’s digital presence and accelerating the shift to e-commerce. The digital hub rolled out new features like a virtual try-on simulation, a remote shopping assistant, and new distribution channels enabling customers to buy products online and collect (or return) them in physical stores. In marketing, the company increased its media spend and launched personalized email campaigns.

The e-commerce initiatives generated results fast. Online sales in 2020 surpassed in-store sales for the first time in the company’s history. And Pandora is continuing to invest in new capabilities, in areas such as data science and advanced analytics.

Overall, the transformation has delivered. Like-for-like sales have rebounded to a 2% increase, and the cost-management measures are on track to generate more than $200 million in annual savings. Pandora’s stock price has more than doubled since January 2020. As CEO Alexander Lacik noted in a quarterly earnings statement in 2020: “Pandora’s business model has proven its resilience during the crisis, and our consumers have continued to engage actively with the brand despite closed stores.”

All leadership teams faced challenges in navigating COVID-19, but for companies that had transformations underway, the difficulty was that much greater. Yet the four organizations identified here did not treat the pandemic as a reason to stop implementing change. For them, the crisis was more than just another obstacle to overcome; it was an opportunity to regroup and make ambitious changes that may not have been possible in ordinary circumstances. By sticking to the objectives of their transformation—while adapting as needed to developments such as remote work—these companies continued to make transformation progress and ultimately set themselves up to capitalize on the recovery. They show all companies what is possible through transformation.