Always a major undertaking and expenditure, turnaround maintenance shutdowns can have an outsize impact on company cash flow and profitability in these times of uncertainty and shrinking margins. Sound planning is essential to turnaround maintenance (TAM) success, encompassing process design and adherence, people and organization, governance, metrics, and tools. This paper distills findings from client experience and industry benchmarking, offering ten practical solutions for strengthening the turnaround maintenance planning process.

Turnaround Maintenance–The Next Gold Mine?

A year into the devastating global pandemic and recession, times are tough. Heavy manufacturing and processing sectors confront structural or temporary drops in demand and constraints in their supply chains. While some have clawed back a recovery, others remain down. For most of 2020, global specialty chemical production, for example, remained at least 8% below previous levels.

Against this backdrop, planned shutdowns for turnaround maintenance emerge as both a challenge and an opportunity. They are cash guzzlers, influencing 10% to 20% of annual non-feedstock spend, consuming up to 50% of plants’ total annual maintenance budget, and with an additional 5% to 10% impact on facility uptime and quality.

To-date most companies have not prioritized turnaround maintenance in their cost reduction efforts. The importance of turnaround maintenance to plant safety and uptime has insulated it to some extent from normal reengineering and budgeting efforts. But with today’s cash constraints – and other efficiencies already realized – it is time to revisit this critical process. Cutting purchasing spend and shutdown time can yield substantial savings as can increasing the time between necessary turnaround maintenance events.

Through experience with major clients and expert best practices benchmarking, BCG has developed a holistic, practical approach to helping companies improve efficiency, effectiveness, and reliability in their turn- around maintenance efforts.

Pain Point And Pitfalls

In industries where plants operate continuously – like oil and gas, petrochemical, pulp and paper, or steel refineries – turnaround maintenances are instrumental in identifying and mitigating the risks associated with wear and tear on equipment and connections. They are most plants’ largest maintenance activity in terms of time, cost, and manpower. At its peak, a turnaround maintenance event can mobilize up to a thousand people between internal resources and external. Planning begins years in advance, with the shutdown itself taking anywhere from a few weeks to a few months.

When done well, turnaround maintenance may only be necessary every 4 to 6 years, depending on the specific installation. Otherwise, a plant may need to shut down for turnaround maintenance every 2 years or even less, with the associated expense, and profit forgone.

Turnaround maintenance is considered successful if it is executed on time, on budget, and with planned tasks properly completed. At best, only approximately 32% of turnaround maintenance meet these criteria. But the current COVID-19 pandemic has both highlighted and exacerbated the issues that companies face in their turnaround maintenance planning and execution. Demand and production shocks are torpedoing economic projections. Moving components and expertise across national borders is fraught with delay and difficulty. Headcount reductions have created gaps in knowledge and continuity. And the impact of cost and timing overruns is amplified in this environment of widespread uncertainty and shrinking margins. Pitfalls and pain points commonly involve resourcing, scoping, or scheduling.

- Resourcing. Normal budgeting processes may not work for turnaround maintenance planning. Turnaround maintenance budgets should be approved roughly 2 years in advance to enable long-term contracting for goods and services. Expenditures often combine CAPEX and OPEX and must include time or budget contingency to account for the opportunity costs (e.g. lost production) of plan overruns. Whether through insufficient planning or lack of early budget approvals, failure to execute long-term service contracts compromises access to scarce expertise and specialized services, in turn creating delays and driving up costs

- Scoping. Lack of rigor in the scoping process introduces a host of problems. When maintenance jobs that can be completed while the plant is in operation are bundled into turnaround maintenance, it adds unnecessary shutdown time and diverts manpower away from more urgent tasks during the turnaround maintenance event. A limited scope challenge process allows these additions, as well as increasing changes post-scope freeze. When the scope freeze is late or non-binding, it reduces the time available for planning and increases procurement costs. Lack of detail regarding individual work orders, or understanding of their interdependencies, is another source of challenge. When work orders are high- level or vague, necessary items may not be ordered, and it is difficult to estimate time and resource requirements. Insufficient visibility of interdependencies between different work orders, and with the overall turnaround maintenance scheduling, can significantly increase complexity and lead to time and cost overruns

- Scheduling. Frequent and abrupt changes in the turnaround maintenance schedule undermine the time needed to plan the work, add procurement costs, and increase the complexity of managing the new work portfolio and timelines. When unplanned shutdowns are bundled with regular turnaround maintenances, they cannot be optimized in terms of work planning or costs. As such, they throw off the turnaround maintenance planning and budgeting, virtually guaranteeing that core turnaround maintenance objectives cannot be met

Planning Is Everything

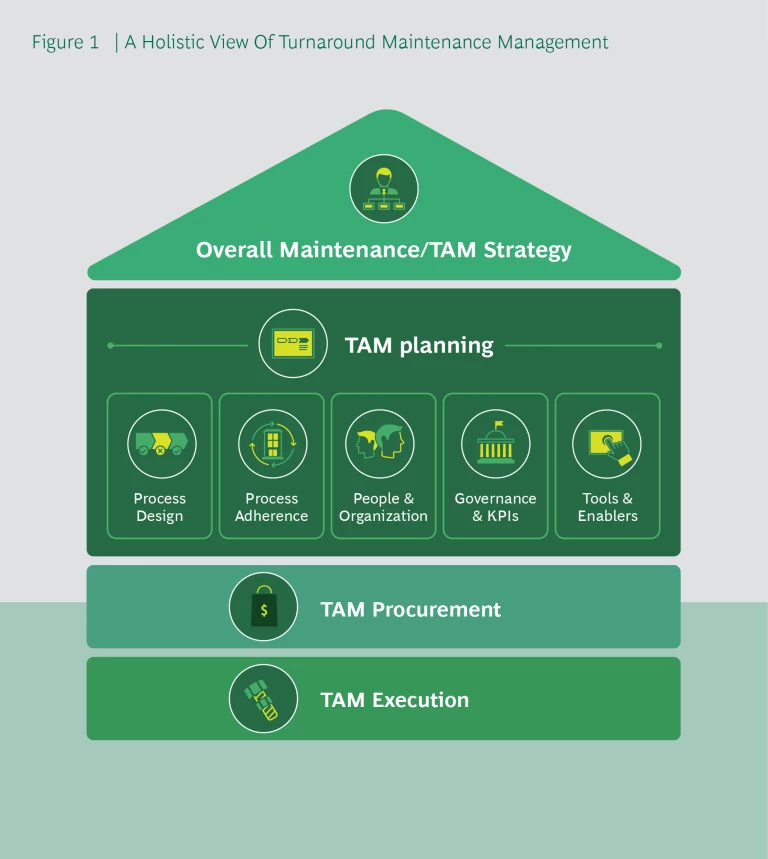

A rigorous planning process is essential to capturing the cost savings and production benefits that excellent turnaround maintenance can provide. As shown in Figure 1, the foundation for turnaround maintenance management is a company’s overall maintenance strategy, which includes preventive, corrective, predictive, and turnaround maintenance. Turnaround maintenance management encompasses first planning for the shutdown, then procurement of equipment, materials and expertise, and finally execution of the event.

Turnaround maintenance planning starts approximately 18 to 24 months before the planned shutdown and it involves:

- Process design. This includes defining the overall strategy, scope development and work order specification, and detailed task planning

- Process adherence. There is always a difference between the plan and the actual activity, often related to when and how plants reach “scope freeze”, and how additional requests are handled

- People and organization. Individual capabilities and the turnaround maintenance team structure strongly influence how effective the event can be

- Governance and KPIs. The oversight structure and metrics help guide and regulate the turnaround maintenance process and ensure appropriate accountabilities

- Tools and enablers. For undertakings of this size and complexity, appropriate planning and support tools are essential, and newer emerging technologies offer additional possibilities

Procurement for a turnaround maintenance shutdown typically involves long-term and global contracts for common products & services. These multi-year arrangements include external contracts for core manpower services such as scaffolding, welding, cleaning, and hydro- jetting. Procurement also covers critical equipment categories, such as gas turbines for industrial power plants. On the one hand, contracts must be flexible enough to accommodate limited changes in the SOW, to avoid high charges for each modification. On the other, it is critical to establish a solid planning process to minimize such changes and limit extra costs arising from modifications after the scope freeze.

Because of its profound impact on both successful procurement and execution, the focus of this paper is the turnaround maintenance planning process and key best practices for each component.

The Ten Best Practices To Drive Drive Planning Excellence

Leveraging both client experience and expert benchmarking, BCG has identified ten proven practices that companies can use to drive turnaround maintenance planning excellence. As summarized in Figure 2, they span all five components of turnaround maintenance planning and address the common challenges.

1. Create a 10-year turnaround maintenance schedule (Process Design)

Create and maintain a 10-year, all-plant turnaround maintenance schedule to optimize planning at both the individual facility and portfolio levels. Plants are long-term assets, designed to operate for 10, 20, 30 years. As such, their predictable cycles of investment and deterioration don’t mesh easily with companies’ typical 2 to 5-year planning horizons. Tracking and planning turnaround maintenance shutdowns with a 10-year, all-plant window yields insights into optimization opportunities, inefficient patterns, and best practices.

Crucially, this approach allows companies to better attract and manage service providers. Contracting for multiple turnaround maintenances across different plants for a multi-year period secures both advantageous pricing and timely availability.

Finally, this overarching turnaround maintenance schedule gives companies a way to anticipate and manage interdependencies. Impacts of the decision to advance or delay one plant’s turnaround maintenance are visible throughout the plant portfolio.

2. Sync with the budget approval process (Process Design)

Modify budget approval to ensure the budgetary estimate is secured at least one year before the actual turnaround maintenance dates based on a 10-year turnaround maintenance schedule. Where budgets are normally approved for expenses incurred in the following year, this timeframe is too short for turnaround maintenance, resulting in procurement delays and cost increases. An improved process must provide advanced budgeting for turnaround maintenances and approval for long lead time items.

This can be accomplished in two ways. Estimated turnaround maintenance costs can be included in the prior year’s budget based on historical spending and approved for use whenever necessary. Alternatively, companies can establish a separate, parallel turnaround maintenance budgeting process built to accommodate the long timelines.

3. Ensure a rigorous post turnaround maintenance closeout process (Process Design)

Enhance the post turnaround maintenance process for a smooth closeout, and in preparation for the next turnaround maintenance. Companies frequently skimp on their post turnaround maintenance analyses and activities. Instead, we recommend a structured process at three key points in time, before restarting the plant; within 15 to 30 days of the restart; and within 3 months after the restart.

Before restarting the plant, ensure all critical jobs are completed, as well as pre- startup safety reviews. Complete the evacuation, cleaning, and housekeeping procedures to allow uninterrupted operations post-start. Conduct any required training for operators and maintenance technicians. Update all impacted Standard Operating Procedures (SOPs).

Within 15 to 30 days of the restart, ensure all areas impacted by the turnaround maintenance are operating satisfactorily. Finish demobilizing contractors and accelerate the clearing of all turnaround maintenance invoices. Begin restocking supplies and refurbishing spare components. Complete and share turnaround maintenance vendor evaluations and remove any assets that must be disposed of from the plant.

Within 3 months of the restart, conduct a formal closure analysis and present findings to the turnaround maintenance steering committee, including:

- Review of the turnaround maintenance KPIs, including performance against scope, budget, and timeline

- A critique of successes, failures, and lessons to be incorporated in planning for the next turnaround maintenance

- Validation that all the turnaround maintenance modifications were properly transferred to Operations & Technical Services (e.g., SOPs, training, spare parts, P&IDs, drawings)

- Outline the initial plans for the next turnaround maintenance to include a list of incomplete activities to carry over such as objectives (e.g. duration, cost reduction, quality targets, etc), preliminary scope, and initial team selection, especially the turnaround maintenance project manager

4. Implement rigorous stage gates (process adherence)

Introduce a rigorous stage-gate scope challenge process or strengthen the current one. This high-impact improvement addresses a host of scope-related issues. We recommend a clear stage-gate decision process, with a transparent process flow and criteria, like the one followed by a global player in the rubber and polymers industry. Approximately 12 months before the event, this company defined its overall turnaround maintenance strategy, including the project leader and key achievements expected from the turnaround maintenance. Nine months prior, the turnaround maintenance project leader collected all scope requests and prepares two scenarios: a base case outlining the minimum necessary work, and a good-to-have scenario with additional items built in. With this range established, the head of the steering committee approves a go-ahead scenario.

Six months before the turnaround maintenance begins, the company launched an extensive scope challenge process with each department and operations team. It holds Main Sequence of Events and Critical Project Review workshops to facilitate the process. In the six months following this scope challenge then freeze, any additional work requests are subject to intense evaluation. Only 20 to 25 work orders are requested (<5% of total work orders) out of which only 4 to 5 are approved.

What makes this robust scope challenge process possible?

- Turnaround maintenance leader. The company appoints very knowledgeable and credible turnaround maintenance managers who can run the process and strongly challenge key stakeholders. Absent to this, we recommend a third- party expert to run the scope challenge

- Separation of turnaround maintenance and breakdowns. Turnaround maintenance is not clubbed together with emergency breakdowns unless absolutely necessary, as planning for the latter is last minute and not optimized for either cost or time

- A curated list of turnaround maintenance equipment and activities. The company has identified processes and equipment that require a full-plant outage. Other items are performed during regular preventive maintenance

- Efficient budget approval cycle. Budgets are approved 1.5 years before the turnaround maintenance. For turnaround maintenance in August – November 2021, the budget is approved in March 2020

- Strict scrutiny of scope additions. Safety and other common pretexts for work additions are rigorously challenged to distinguish genuine needs from opportunistic adds

5. Introduce a champion - Challenger Process (Process Adherence)

Formalize champion and challenger roles, perhaps involving external third-party experts, to increase rigor in the turnaround maintenance planning and scope challenge processes. Scope challenge must be deployed before scope freeze, to ensure that the jobs included are both comprehensive and sharply turnaround maintenance focused, and then post-freeze to evaluate any additions for approval.

Challengers may be experts from elsewhere in the company or from outside. These challengers may be dedicated turnaround maintenance experts, specialists in specific technologies or systems, or people brought in to fill other skill gaps like major project management. In addition to specialized technical knowledge or capability, third parties may bring “softer” benefits like better access to senior leadership or the ability to avoid internal politics and stick closely to the defined process.

One leading global petrochemical company established an independent team approximately 24 months before scheduled turnaround maintenance to test and review the scope challenge and other key stages of the process. Typically led by an ex-senior plant manager with operations or maintenance experience in a similar facility, the team’s members include senior subject matter experts and operations, maintenance, and reliability professionals from the company’s other plants. This group provides an external, unbiased point of view across the turnaround maintenance process, timelines, critical paths and resources, and an independent assessment of readiness, informing the final Go or No-Go decision 6 months prior to the turnaround maintenance.

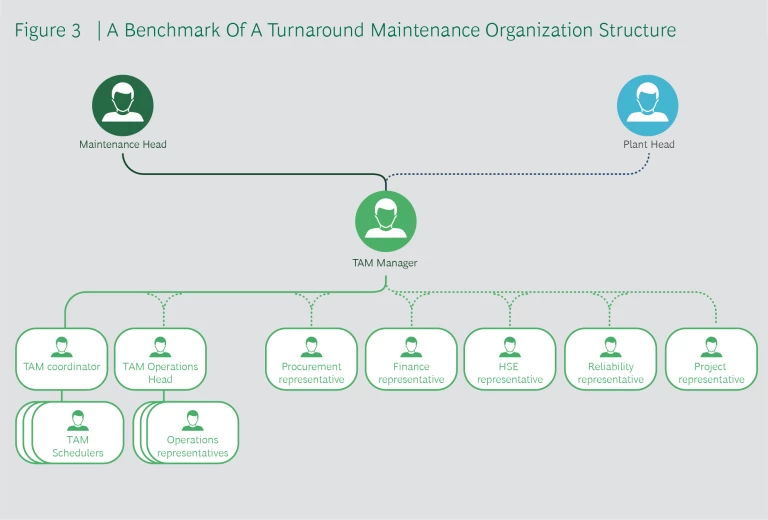

6. Ensure a dedicated turnaround maintenance manager and properly resourced teams (People and Organization)

Optimize the turnaround maintenance organizational structure, roles, and people. Turnaround maintenance organization structure aims to solve two problems. First, it must drive focus and accountability on a case-by-case basis within a multi-plant company, with appropriate load balancing. Second, it should align the turnaround maintenance hierarchy with company norms and industry best practices, ensuring team leads and members are senior enough to match stakeholders in the wider organization. It is critical to ensure full visibility of the turnaround planning to the plant restart, not leaving any activity without accountability.

Some questions to ask in considering your current turnaround maintenance organization structure.

- Are maintenance and operations at the same hierarchical level in the organization?

- Whom does the turnaround maintenance manager report to, and where does this place them in the company’s hierarchy?

- Is the turnaround maintenance manager 100% dedicated to this planning effort? And are they responsible for this specific turnaround maintenance, or allocated across multiple turnaround maintenances?

- Are key functional leads on the turnaround maintenance project team 100% dedicated to the planning effort?

- Is this project structure consistent with how other turnaround maintenances in the company are organized? Why or why not?

One leading global petrochemical company’s typical turnaround maintenance organization, shown in Figure 3, illustrates many features of an effective project structure. A turnaround maintenance manager, reporting to the heads of Plant and Maintenance, leads a core team with appropriate functional representation and detailed expertise. The turnaround maintenance manager is a senior leader with prior experience spanning at least 3 to 4 turnaround maintenances as a planner or manager. They are exclusively dedicated to a given turnaround maintenance for the entire duration of its planning and execution. Critically important is that the turnaround maintenance manager is senior enough to challenge other departments as needed.

A turnaround maintenance Coordinator is responsible for scheduling and coordinating all processes. They have a team of schedulers to detail the overall plan and work packages. The turnaround maintenance operations head is a senior operations manager from the plant, also with dedicated capacity for the turnaround. Representatives from all relevant departments ensure that the overall plan, critical paths, and work packages are aligned and meet their functional requirements.

The turnaround maintenance steering committee is typically comprised of the Plant Manager, Operations Manager, Maintenance Manager, HSE Manager, and Cost Controller. Core team membership includes:

- Production area managers

- Maintenance area managers

- Engineering manager

- Production engineering manager

- Mechanical Integrity manager

- Safety manager

- Cost accountant

- Reliability manager

- Major CAPEX project leaders

- Sourcing representative

7. Continuously build technical expertise within the team (people and organization)

Launch a capability-building program to augment technical team skills through training, secondments, and hiring (both internal and external). In many major companies, specialized teams move from facility to facility, acquiring knowledge and experience with every additional turnaround maintenance they carry out. Using general maintenance people, while possible, is inefficient and may also create risk. We recommend building a skilled technical team with experience across multiple turnaround maintenances.

Companies can augment a turnaround maintenance team capabilities in three ways:

- Training. Structure training around key roles including turnaround maintenance manager, planners, schedulers, technical team, etc. Combine classroom teaching with on-the-job learning, covering both technical and management or communication aspects of the work

- Secondments. A few key turnaround maintenance planning and technical personnel may be seconded to other organizations with similar units to experience turnaround maintenance best practices. Companies can explore opportunities across internal facilities, or with JV partners

- Hiring. Team capability may be fortified through internal or external hiring. Look for industry veterans in permanent roles, or on contract for the duration of the turnaround maintenance

A leading international rubber and polymers player uses a combination of formalized training, on-the-job experience, and hiring to build capability. The turnaround maintenance manager holds workshops to train newer team members on the process and tools to facilitate on- the-job training sessions for Operations and Maintenance personnel. The company ensures an overall high skill level by including all types of engineers (process, project, maintenance, reliability, electrical, production, etc.) with turnaround maintenance experience in its training efforts. Newer technical or engineering resources are assigned as project managers to give them exposure to turnaround maintenances. Where appropriate, equipment vendors and licensors help build specialized capabilities.

8. Create the right KPIS (Governance and KPIs)

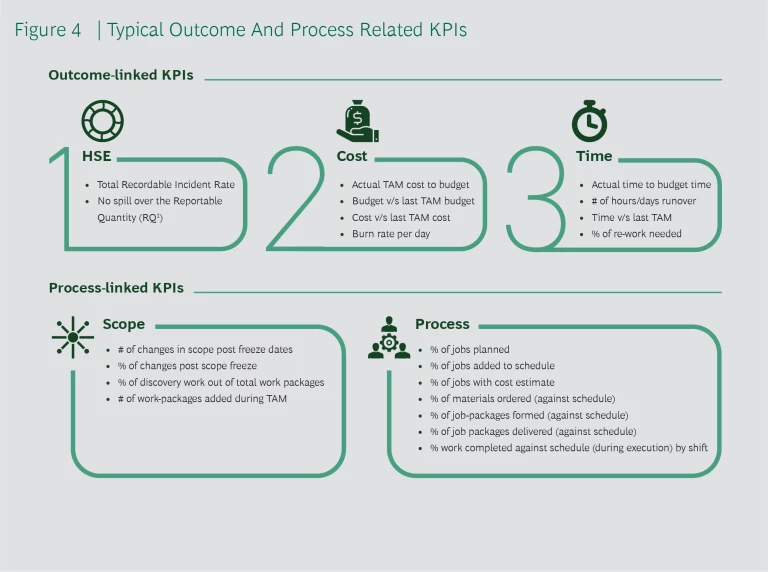

Establish a set of shared KPIs to drive collaboration and collective responsibility. Instrumental in guiding and regulating the turnaround maintenance process, the right KPIs can ensure sharp oversight and accountability and align objectives across multiple stakeholders. All steering committee members – especially the heads of Plant, Operations, and Maintenance – must share joint KPIs for cost and duration of the turnaround maintenance, as well as KPIs for on-time scope freeze, schedule changes, and HSE performance. The turn- around maintenance team and steering committee share the same set of KPIs and are jointly responsible for meeting them. The turnaround maintenance team tracks progress against the KPIs and reports regularly to the steering committee.

As shown in Figure 4, KPIs may be linked to outcomes or processes. Both types are important, with the process KPIs acting as leading indicators for the outcomes and offering insights into areas for improvement.

9. Adopt a plant-specific optimization philosophy (Tools and Enablers)

Define a specific optimization philosophy based on each plant’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margin. Specific KPI targets will differ by industry and facility. Best practice optimizes turnaround maintenance in high-margin plants for the duration and low margin plants for cost. This reflects the substantial hit to profitability associated with every day a high-margin plant is shut down.

For high-margin plants, paying more for resources may be worthwhile if the turnaround maintenance is completed more quickly. In terms of KPIs, adherence to schedule is given particular weight. Contractors may be used more liberally if it guarantees timely availability of expertise. Dedicated turnaround maintenance project managers, planners, and schedulers should be allocated to these efforts to strengthen the planning process. And it may be useful to employ an external party to tightly manage scope challenge and work order detailing, minimizing future disruptions to the working plan.

In contrast, low-margin plants have less time urgency, and procurement and staffing decisions should focus on limiting spending. Cost KPIs are weighted most heavily. The company may use more of its standing global contracts for activities such as scaffolding and equipment rentals to optimize for cost. And budgeting far enough in advance to secure the best prices is especially important.

10. Leverage planning tools and technologies (Tools and Enablers)

Integrate and unify existing tools and introIntegrate and unify existing tools and introduce new ones as needed to assist the turnaround maintenance process. The size and complexity of a turnaround maintenance shutdown make advanced planning and scheduling tools critical to tracking tasks, milestones, timing, staffing, procurement, and interdependencies.

Benefits of adopting a consistent, integrated toolkit for all a company’s turnaround maintenances include ease of use, greater flexibility in moving experts among turnaround maintenance events, work process efficiency, and greater KPI comparability. Where competing tools are used, select those that are in line with best practice and roll out as needed.

Current state-of-the-art turnaround maintenance planning tools include Primavera, STO Planner from Prometheus, and iPlanSTO. Several newer technologies are also potentially useful:

- Drone inspection and software. Drones are increasingly used to inspect equipment that is otherwise challenging or costly to access, for example in remote or harsh environments

- Digital plant modeling. It is now possible to create digital replicas of plants and use them to monitor production flows, equipment, and the impact of variable environmental or internal conditions

- Using data analytics and AI on maintenance data. Advanced analytic tools and techniques allow companies to generate new insights and predictions by leveraging available historical data

- Industrial Internet of Things (IIoT). These technologies enable real-time data collection and sharing, which can significantly improve the scope of work assessment for critical equipment

The Immediate Urgency And Action Needed

With the pandemic far from over and the path to full economic recovery uncertain, heavy manufacturing and processing companies must pursue every avenue to strengthen processes and improve profitability. For many, turnaround maintenance represents a rich and untapped opportunity.

This paper has identified ten proven best practice solutions to strengthen turnaround maintenance planning. In particular, upgrading budgeting and scope challenge processes, leveraging challenger experts, establishing shared KPIs, and defining the optimization philosophies are relatively easy to implement, while yielding substantial returns.

To learn more about your current turnaround maintenance processes and identifying the most fruitful action priorities, please contact us.