Cryptocurrencies such as Bitcoin and Ethereum, which emerged after the 2008 financial crisis, have grown increasingly popular as investment alternatives. Still, the impact of the underlying technology has not yet been fully realized. Digital ledger technology (DLT), known as blockchain, simultaneously enables anonymous or pseudonymous financial activities without central control and renders participants accountable for their transactions. Even as innovation continues in earnest in this field, regulatory efforts are also progressing in breadth and clarity. This allows a keen observer to track the trends around DLT, including their potential impact on banks and other financial services institutions . The broader the market grows, the more opportunity is available in the emerging field of blockchain banking.

In this BCG report, we chronicle the top seven major trends for blockchain and DLT, taking a global view and highlighting the aspects of the technology that are most relevant to banks around the world. These seven trends are as follows:

- Smart Contracts. Digital implementations of formal agreements

- Initial Coin Offerings. Alternative methods for raising startup funding

- Asset-Backed Digital Tokens. Tradable cryptocurrencies linked to other sources of value

- Nonfungible Tokens (NFTs). Cryptocurrency tokens with their own inherent value

- Central Bank Digital Currencies (CBDCs). Proposals for new nationally backed cryptocurrencies

- Decentralized Finance. Blockchain-based banking and financial applications

- Robo-advisory Services. Automated guidance and support for DLT activity

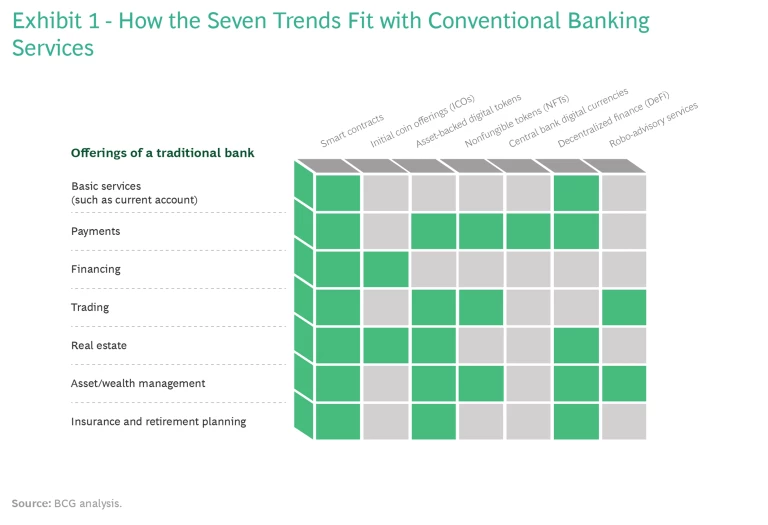

Although innovation is thriving across the globe, with many product launches in Europe and the US, the most active geographic center of innovation is the Asia-Pacific region. (See “Where in the World Is Cryptocurrency Flourishing?”) The region’s lead is prodigious, in part because of activity in China, but it is not necessarily permanent or exclusive. Over the next few years, new DLT products and services will be introduced everywhere. And there is a surprisingly robust potential fit between these novel fintech advances and conventional bank lines of business. (See Exhibit 1.)

DLT (or blockchain) is among the emerging digital technologies that BCG has identified as most likely to transform the way people work and live. Banks, of course, will be in the thick of this change. The technology is based on peer-to-peer, cryptographically secured communication that organizes transactions and other information into hashed, time-stamped blocks and appends each block to the prior one; hence the term blockchain. The digital ledger, which the technology typically stores redundantly across multiple computers, records every change. These aspects of the technology, along with other strong encryption and anti-tampering features, ensure that the data can’t be retroactively altered. DLT-based applications become, in effect, self-governing shared entities. Participants in the network can verify each transaction and can trust the system because its data is widely distributed and transparent.

Banks can take advantage of these innovations in several ways. Here are some representative examples. They can offer cryptocurrencies of their own, or help their clients make purchases with cryptocurrencies. They can establish advisory services and serve as honest brokers of these new financial instruments. They can also take on a role of enhanced verification, maintaining and overseeing mechanisms that ensure trust in this new field. This would be an amplification of a role suggested in BCG’s 2020 report, How Banks Can Succeed with Cryptocurrency .

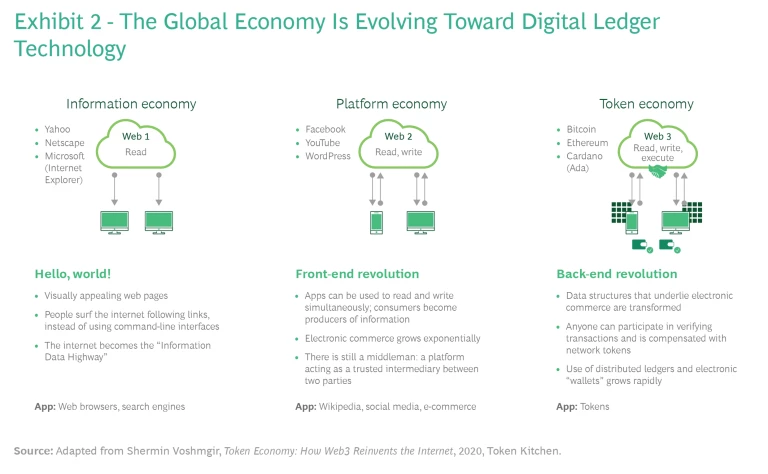

Because of its roots in cryptocurrency, DLT may be controversial in some quarters. But cryptocurrency is only one part of the DLT story. The digital ledger is so pragmatic and utilitarian in its own right that it may ultimately be taken for granted as a cornerstone of the banking industry. Indeed, some observers argue that the digital ledger marks a third great wave of internet-based technology. (See Exhibit 2.) This “token economy,” as the World Economic Forum calls it, originated with the internet and its free exchange of information, but then progressed to platforms, which offer more functionality and control, and now to tokens—data structures that can reliably execute transactions without human oversight.

In the end, some aspects of DLT-based banking will grow into billion-dollar lines of business. Some may become the core of emerging sectors. Others may falter or crash. But the field as a whole will be transformational for the financial services industry and it will be a major source of its vitality during the next ten years.

A Banker’s Guide to the Trends

At BCG, we have been close observers of the international financial technology sector for many years. We have worked with many players in this field, including payment companies , asset managers , crypto exchanges, and high-tech startups. In the subsections that follow, we present a global overview of seven of today’s most significant DLT trends, with the caveat that cryptocurrency and blockchain regulation vary and will continue to vary across regulatory jurisdictions. We hope to raise awareness among financial services leaders of the challenges and opportunities that blockchain offers. Banks that ignore them will fall behind.

Trend 1: Smart Contracts

Smart contracts are digital implementations of formal, legally viable agreements. Like other contracts, they establish obligations and criteria for decisions made among several parties. But because smart contracts use blockchain technology to track changes and other related activity, they have features unavailable to conventional contracts. When a provision in a smart contract stipulates a change in the event that parties to the contract satisfy certain conditions, the contract can automatically act on that provision. For example, the smart contract may provide that when customers extend the scope of a project, the vendor receives a payment—and it will send the specified currency when the condition is met.

Smart contracts also maintain accountability through automated oversight of the document itself. It is illegal to revise a contract and to forge or paste another party’s signature to the revision without permission. Now, it is also technically impossible. Every contract has a link to each signer’s digital identity, and every provision is automatically time-stamped.

Typical smart contracts consist of if-then statements that are coded on a blockchain ledger. These statements reflect the conditions of a legal or contractual agreement among multiple parties. When the conditions specified in the contract—a stock reaching a certain price, for example, or a transaction reaching its conclusion—are met, the blockchain on which the contract is stored will automatically execute the specified outcome. The outcomes may include purchases, transfers of tokens or ownership, changes in legal status, or changes to the contract itself. It is important to map out all eventualities because the provisions will go into effect exactly as coded.

Among the benefits of smart contracts are transparency and resistance to manipulation. Because they are self-verifying and self-executing, the programmed outcomes are difficult to alter. To be sure, they remain vulnerable to cyberhacking; Reuters reported in August 2021 that intruders hacked into a smart contract and diverted $600 million from the token exchange Poly Network. Verification services are still needed to audit the code and its underlying logic, but the technology is continually improving.

Other benefits of smart contracting include efficiency and broader access to contract-based agreements. Due in part to the elimination of legal intermediaries, the cost of a smart contract can be significantly lower than the cost of setting up and executing a contract in the current legal system. Most other technologies described in this report, such as coin and token offerings, rely on smart contracts in their technical operations and design. Users are applying the tool to fund distribution, vehicle registration, ticket issuance, and a rapidly growing number of legal and financial agreements. Although legal requirements, which differ by jurisdiction, will dictate the enforceability of smart contracts, the innovation offers an accessible tool for digital organization and agreement. Banks that offer smart contracts may be able to offer clients a vast range of low-cost services that were previously available only from law firms.

Trend 2: Initial Coin Offerings (ICOs)

The use of cryptocurrency to raise entrepreneurial capital is already an established trend in the blockchain and investment community, and many venture capital experts are familiar with it. Meanwhile, its scale and scope continue to grow. The ICO process is similar to that of an initial public offering (IPO) but without the protections that accompany regulated public offerings. Also, because it offers only returns based on financial performance, rather than equity, it generally gives the issuing company a higher level of independence. For this reason, some entrepreneurial firms use ICOs not merely to augment their IPOs, but to replace them.

Typically, these new ventures create their own cryptocurrency offerings and sell electronic coins directly to investors. Like other cryptocurrencies, these coins derive their value primarily from speculation and exchange. But the issuing startup can also link its coin’s value to its success, as measured by criteria programmed into the offering. In addition to potentially benefiting from increases in their tokens’ value, participants may gain voting rights or protocol governance status, enabling them to make decisions about the company’s future.

The first ICO was conducted in 2013 by the team behind the Mastercoin cryptocurrency. It raised $600,000 by offering an adaptation of Bitcoin’s design, with added software functions for pegging the coin’s value to the value of another currency or commodity. This was the birth of the idea of the stablecoin. Within five years, ICOs became a worldwide phenomenon. More than $6.2 billion was raised through more than 360 ICOs in 2017—an amount surpassed in just the first quarter of 2018, as crypto ICOs raised a total of $7.8 billion. One of the most prominent ICO-funded coins is Ethereum, which initially raised funding in 2014 and has since become a central platform for additional ICOs and other forms of distributed ledger financing.

In most cases, ICO participants receive utility tokens that have value only on the issuing company’s platform. Like avatars in a popular multiplayer game, owners can sell these tokens to a broader group outside the platform. As a result, they can be a good investment if the company’s value rises or if the token gains widespread popularity. Many early ICOs lacked equity or investor protections, and their funding came from individual retail investors. Then the ICO bubble of 2017–2018 occurred, with many offerings skyrocketing and then collapsing. Since then, governments have regulated ICOs more closely, advising them to abide by local laws or risk penalties for noncompliance. ICOs are also becoming vehicles for institutional capital, venture capital, and private equity.

Commercial and investment banks may find opportunities to participate in ICOs as underwriters and intermediaries, as they do for IPOs now. Benefits to clients include higher speed and greater access. Participants can trade tokens in real time, just as they can stocks, but at all hours and from all parts of the world. Because financial regulators have relaxed some restrictions on ownership over the years, the barriers to entry are lower than they used to be. Asset owners and developers can market their projects globally to retail investors as well as to institutions. Tokenization also brings greater liquidity and transparency to the initial offering domain.

Despite these benefits, critics still pan ICOs because of their challenges and relatively high risks. ICOs often make bold promises about their offering’s potential to be disruptive and yield high future profits; and given the technical complexity of an offering, investors may not know exactly what they are buying. Moreover, those technical details are not always available for inspection. Some funds, such as the Based on Blockchain fund headquartered in Singapore, have explicitly stated that they intend to make ICOs more “trustworthy, reliable, and profitable for all industry participants.” If the sector can achieve this goal, ICOs could become as commonplace in the near future as IPOs are today.

Trend 3: Asset-Backed Digital Tokens

The tokenization of financial instruments and physical assets is a major emerging trend in the DLT world. Although investors to date have often overlooked asset-based digital tokens, these elements will be increasingly important in financial portfolios. Whereas the worth of an ICO token depends on its traded value as a cryptocurrency, asset-backed tokens are linked to a separate, noncryptocurrency source of value. So far, most of these assets fall into one of four groups:

- Security Tokens. These tokens represent actual shares of stock in a regular business or a similar financial asset, bought and sold through blockchain-based transactions. Originally companies used them to raise capital in a process called a security token offering (STO). Now companies issue them and investors trade them as proxies for company shares. A digital ledger tracks the token’s transfer from one owner to another, for the life of the company. In contrast to ICOs, which tend to follow decentralized business models and trade with other cryptocurrencies, security tokens are typically traded like an ordinary security. Among the companies with successful security token programs are the Austrian restaurant chain L’Osteria (which raised €2.3 million in 2020), the German lending company Bitbond, and the social impact investment app Lottery.com.

- Real Estate Tokens. These asset-based tokens are just now emerging in the financial services sector, following on the heels of online mortgage brokering and peer-to-peer lending. Property owners create real estate tokens as digital representations of physical-world properties, usually land or buildings, and the value of the tokens adds up to the total value of the assets. A digital ledger accounts for all the property included in the portfolio. Some countries, including Sweden, are experimenting with putting their national land registry systems on a blockchain.

- Stablecoins. This form of digital currency has moved beyond ICOs. The most prominent and successful stablecoins are tokens backed by financial assets: either fiat currencies or investment instruments of another sort. The company that offers the coin holds the asset. For example, the firm Circle has introduced a stablecoin it calls the US Dollar Coin (USDC). For every dollar’s worth of USDC that Circle issues, the company holds a traditional dollar. This gives the offering stability, compared to more volatile cryptocurrencies that lack fiat currency backing.

- Utility Tokens. Although these instruments originated as a product of ICOs, companies are now adapting them to functions besides raising capital, such as to commitments for discounts or future benefits. An airline utility token can guarantee the owner a seat at a certain price. A sports team utility token can give the owner rights to attend games or even to participate in decisions about who will play. A ride-sharing utility token can enable the owner to reserve rides in a collectively owned vehicle or weeks of occupancy in a collectively owned timeshare. By purchasing the token, the investor gains the option to participate in designated activities within the confines of the token ecosystem.

Owners of all four of these token types can trade them on secondary markets. The tokens’ greatest value potential comes from the flexibility of the blockchain that tracks their activity. This enables applications that otherwise wouldn’t be possible. For example, airline or retail loyalty programs set up as utility tokens can shift award parameters on a moment’s notice, provide awards to particular groups of customers, and facilitate intricate transactions. A blockchain-based utility token system can fully automate the transfer of frequent flyer miles from one person to another—a task that many control-based systems cannot easily perform.

There are many examples of successful blockchain-based token programs. The US technology firm Nebulous, based in Boston, uses tokens to broker data storage capacity on cloud computers through its Siacoin platform. The Swiss firm BrickMark and the German Fundament Group have listed real estate tokens. American Express and the wholesaler Boxed started a test run of a blockchain-based loyalty program in 2019. And in 2018 Singapore Airlines converted its frequent flyer program to a miles-based token system, which the airline refers to as “the world’s first blockchain-based airline loyalty digital wallet.”

Tokens have several benefits compared to non-blockchain-based programs. Their access cards cannot be lost or stolen, and the system is less vulnerable to leaks of personal information. Owners can convert tokenized assets into other forms of currency, or trade them in real time, with a comparatively low transaction cost. Token opportunities used to be limited to accredited institutional investors, but today the barriers to entry are lower. For example, in some regulatory regimes, asset owners and developers can market their products to retail investors as well as to institutions. In short, tokenization brings a new level of liquidity and transparency to domains such as real estate and portfolio management.

Trend 4: Nonfungible Tokens (NFTs)

Although they are technically a form of digital token, NFTs have a critical distinguishing feature: each token represents a unique entity. These underlying items—typically collectibles such as handmade luxury goods, signed works, and (especially) digital artwork—are nonfungible in the sense that they cannot be exchanged for identical counterparts. After all, there is no identical counterpart to an artist’s or craftsperson’s visual creation.

An NFT uses blockchain to manage verification of a particular item’s provenance, which is typically a fraught endeavor for nonfungible assets. Websites such as Rarible.com and OpenSea.com maintain protocols in which collectors or creators register their assets, describe the work, and designate how it can be sold (for example, by direct transaction or at an auction). Prospective purchasers must use a digital wallet equipped for cryptocurrencies. Many such wallets use the Ethereum platform, where sellers have offered a large number of NFTs. Another way to create NFTs is by coding a smart contract directly, rather than employing a service to handle the coding on the creator’s behalf. As standards emerge for this type of exchange, NFT use is on the rise; the website NonFungible.com recorded sales of more than $2 billion in the first quarter of 2021.

The value of an NFT reflects the value of the asset associated with it, but that asset does not necessarily include the artwork itself. For example, an NFT may convey ownership of a large digital collage that the artist has designed for display on large video screens. The artist or another manager may control the copyright (denoting where and for how long it can be shown), while the NFT owner controls the rights for sale. If an NFT becomes too expensive or unwieldy for the vast majority of people to buy or sell, the owner can break it up into parts. Many people can own a fraction of the whole investment and thus participate in the growth of value associated with that work.

In the short time that they have existed, NFTs have opened opportunities for many artists and collectors, expanding the global audience of potential buyers. They have democratized access to investment in artworks—a trend that may continue as NFT marketplaces proliferate. And perhaps for the first time in art history, they make it possible for the original maker of a work to benefit from its resale every time the piece changes hands. An NFT’s creator can require in the blockchain-based terms of the NFT’s smart contract that the original artist receive a specified portion of the secondary market proceeds. Prominent artists with NFT work include Beeple (digital artist Mike Winkelmann), who sold his collage Everydays: The First 5000 Days at Christie’s for $69 million in 2021. Prominent collectibles include CryptoPunks, one of which Visa purchased for $150,000, and baseball and basketball cards, sold as NFTs by Topps in partnership with major league baseball and basketball players.

Trend 5: Central Bank Digital Currencies (CBDCs)

Central banks around the world are contemplating creating their own digital currencies as a way to counter the decreasing use of cash and the rise of private cryptocurrencies. Because a country’s central bank issues this digital form of exchange, a CBDC is not purely fiat money. Instead, it represents a liability against the country’s holdings, verified through a blockchain-based technological system.

Although no central bank has yet publicly released a CBDC, several are developing concepts and testing specific functionalities. For example, Sveriges Riksbank, the central bank of Sweden, is developing a digital currency called the e-krona, and commercial banks will be involved in the next testing phase. The People’s Bank of China, which is that country’s central bank, is exploring blockchain at the issuance layer of its digital yuan pilots. It is also working on a shared project with the Bank of Thailand and the Hong Kong Monetary Authority to simulate the use of this CBDC for cross-border payments.

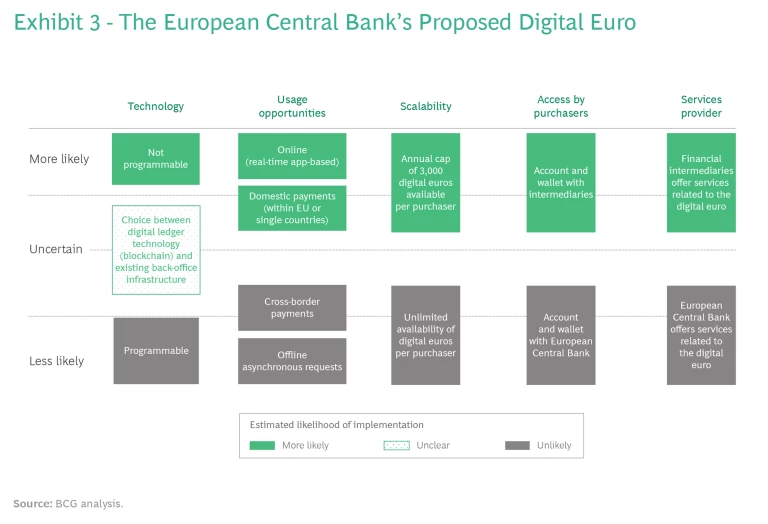

In July 2021, the European Central Bank (ECB) announced that it is undertaking a digital euro project, in which it will devote at least another two years to investigating alternative designs. For example, there may be privacy-related restrictions, or limits on the type of services offered, and specifications for low carbon release from the associated data-mining processes. Several possibilities are currently under consideration for the design of the digital euro, announced in July 2021 by the ECB as a project under investigation. (See Exhibit 3.)

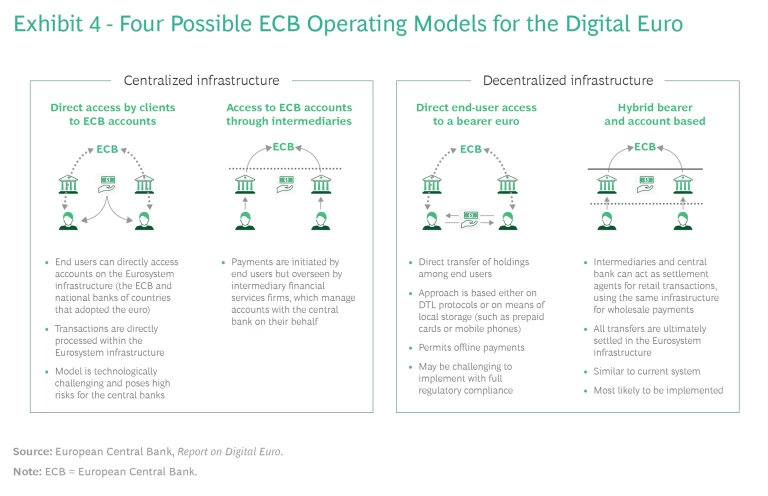

In addition, the ECB is reportedly considering at least four possible business models, all of which could use blockchain as an underlying technology. (See Exhibit 4.)

When they are released, CBDCs will provide several societal benefits. For example, they will support the further digitization of the world’s economies, making it easier and more efficient to monitor digital transactions and analyze economic data. This will raise trust in digital currencies generally and reinforce the role of central banks as independent market participants with no commercial interest related to the possible use (or misuse) of individuals’ data. Unlike central banks, companies such as Google—which are now introducing digital currency prototypes—have commercial interests that make it harder for them to act as trusted participants. Moreover, when a central bank directly issues a digital currency, concerns about counterparty risk (the possibility that a participant might default on payments) can be minimized or eliminated.

Trend 6: Decentralized Finance (DeFi)

The trend toward decentralized finance encompasses a broad range of emerging cryptocurrency products for lending, investing, staking claims, and creating mortgages. Such products have greater adaptability and more potential uses than smart contracts or tokens do. DeFi products may take many forms, but all of them have several common features. They transform traditional financial products into new variants that don’t require an intermediary; they enable peer-to-peer trading, so transactions don’t have to go through a bank or other overarching entity; and they rely on smart contracts to monitor activity and establish the transactions’ integrity.

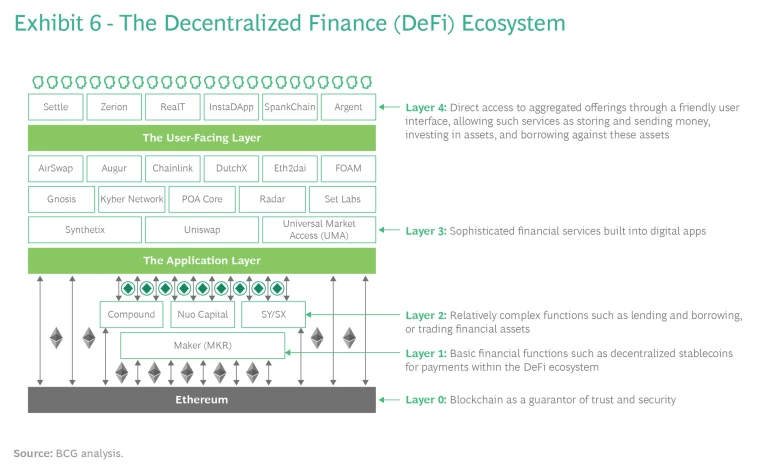

The DeFi market is expanding rapidly, and DeFi innovations emerge continually. There is also a movement toward modular DeFi offerings that combine decentralized applications (dapps) and protocols like Lego blocks, using smart contracts as connectors, similarly to specified APIs in traditional IT systems. So far, nearly all DeFi projects have been built on Ethereum, making it the standard blockchain for most dapps.

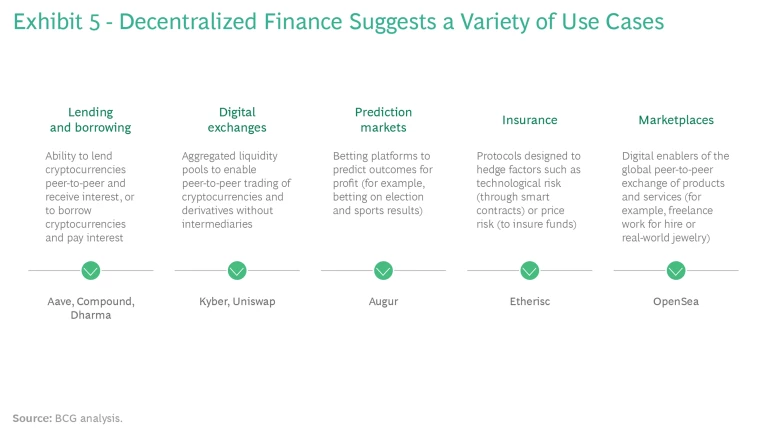

Many current use cases for DeFi involve pooling or dividing investments in innovative ways. (See Exhibit 5.) For example, liquidity pools combine several investment funds in one smart contract, all sharing a single blockchain. This permits liquidity mining (algorithmic distribution of new tokens to users) and tranching (division of financial products into risk categories). DeFi also enables small-scale businesses or individuals to stake transactions (a process similar to currency mining in its use of computer time to verify activity) or to hedge against risks (for example, by rapidly moving financial assets among protocols or pools, a process called yield farming).

One notable form of DeFi is the decentralized autonomous organization (DAO)—a collective investment vehicle that allows small-scale investors to join in rarefied opportunities, such as VC funding cycles, that would ordinarily be closed to them. After the initial funding round, DAO participants collectively determine their subsequent capital allocation and other governance-related issues. At a DAO’s design stage, participants code relevant guidelines and structure into a smart contract, which organizes the management of the DAO’s subsequent activities.

The benefits of DeFi to investors include potentially higher returns, expanded access to financial services (especially for the unbanked population and those in underdeveloped countries), fast and efficient transactions, greater flexibility and innovation, open-source code (for shared adaptation), general interoperability with other systems, and the automation of many business processes. DeFi also facilitates innovative types of cross-chain or crypto-backed coins, including digital tokens, and other offerings whose prices are pegged to other financial instruments, cryptocurrencies, or commodities (including gold).

The DeFi business ecosystem consists of multiple layers of activity, each of which has attracted offerings from many companies. (See Exhibit 6.) Some of these companies have become known as market leaders. Among them are Uniswap, Compound, and MakerDAO, all based on the Ethereum platform but focused, respectively, on trading tokens, lending and borrowing, and managing currency.

Trend 7: Robo-Advisory Services

Perhaps the greatest opportunity for banks in the cryptocurrency domain involves expanding their current financial consultancy services to cover blockchain-based products as well. The need for real-time automated financial guidance driven by data and analytics, will almost certainly grow, offering support in a fraction of the time needed for a human response. Robots and automated software applications use algorithms or AI to monitor cryptocurrency activity, detecting signals that indicate good opportunities to buy or sell, and communicating them to the investor or holder. This enables active and smart management of the portfolio as well as program trading, with the robo-advisor set up to trigger certain buy or sell decisions.

Most current robo-advisors were developed in the US or China, and it is as yet unclear which systems or companies will be market leaders. In the past, low-capital investors often used robo-advisors as an alternative to index funds. This could make them a great fit for cryptocurrencies, whose coins are often divided into fractional parts with shared ownership. Examples of robo-advisors with cryptocurrency offerings include Makara, in the US, and Empirica, available only to institutional investors, hedge funds, wealth management firms, and similar enterprises.

Where in the World Is Cryptocurrency Flourishing?

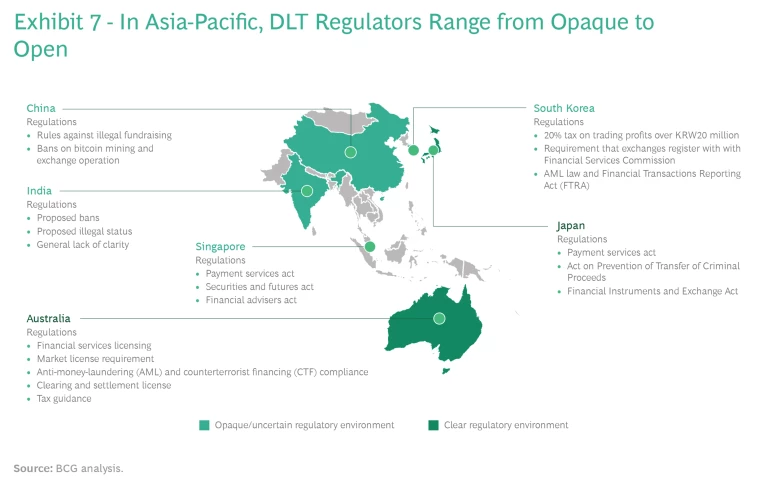

On every continent, cryptocurrency work is increasing in range and intensity, for fintech in general and for digital ledgers in particular. Currently, the Asia-Pacific region remains at the forefront of experimentation and activity. Six countries have been particularly active: China, Japan, South Korea, Singapore, India, and Australia. Because of their support for DLT innovation, these countries are also role models for Europe and the US. (See Exhibit 7.)

China is a vibrant center of digital ledger technology and among the most heavily regulated. Binance, OKEx, and Huobi, all founded in China, are the world’s top three cryptocurrency exchanges by total global volume, totaling close to $100 billion in 24-hour spot and derivatives volume. The Chinese government has recently sanctioned a blockchain-based service network, which has connections to hundreds of blockchain software developers through 18 networks and plans to incorporate 30 more networks. In addition, the People’s Bank of China is launching digital currency pilot tests. Through these efforts, China aims to help its blockchain development continue to flourish.

At the same time, the Chinese government has stepped in decisively to regulate Bitcoin and other privately issued currencies. As early as 2013, China’s central bank barred financial institutions from trading in Bitcoin or using it as a currency. The reasons it cited for instituting this prohibition were to prevent money laundering and to help ordinary investors avoid risk. It is now a criminal offense to publicly offer blockchain-based investment opportunities—including ICOs, initial exchange offerings (IEOs), and STOs—without regulatory oversight. Reiterating this ban in 2017 and 2021, the Chinese government has also adopted strict rules that prohibit bitcoin mining and the use of cryptocurrencies to raise capital.

These rules have effectively shut down the creation of privately owned digital currency in China and have prompted some companies, including Binance, OKEx, and Huobi, to relocate their headquarters outside China. (All three still maintain physical locations in the country, however.) Even so, China’s cryptocurrency ecosystem continues to grow, with sustained interest from retail and institutional investors and from the technical community. Beijing-based firms such as Bitmain and MicroBT still produce advanced application-specific integrated circuits (ASICs): hardware particularly well suited to digital ledger technologies.

Historically, Japan has had an enthusiastic but tumultuous relationship with cryptocurrency—suitably so, since the unknown creator of the original blockchain algorithm chose the Japanese name Satoshi Nakamoto as his pseudonym. In the earliest days of cryptocurrency markets, Japan’s Mt. Gox exchange was responsible for 70% of trading in Bitcoin. Today, many Japanese retail investors maintain cryptocurrency positions.

After news that Mt. Gox had been hacked became public in 2014, Japan’s Financial Services Agency (FSA) intensified its oversight of cryptocurrency exchanges, requiring them to obtain licenses to operate in Japan and to adhere to anti-money-laundering rules. The FSA has stipulated that all cryptocurrencies must by held by a regulated bank or trust company, and it has proposed a rule requiring exchanges to identify their participants to the government. In the wake of these developments, some exchanges in the country have created a self-regulatory body called the Japan Virtual and Crypto Assets Exchange Association.

Because Japanese regulations tend to protect investors while favoring blockchain-based activity, a robust cryptocurrency system has developed in the country. Coincheck, one of Japan’s largest exchanges, operates a fully functional NFT marketplace, and the Japan Cryptocurrency Business Association, a self-regulatory body, has issued guidance on the proper treatment of NFTs. For its part, the Bank of Japan recently issued a review detailing the benefits and risks associated with DeFi, an indication that regulators are well aware of the topic and want to realize its benefits.

South Korea has an ardent retail audience for cryptocurrency and has one of the highest concentrations of cryptocurrency investors in the world. Although foreigners cannot trade on South Korea’s cryptocurrency exchanges, historically those exchanges’ cryptocurrency prices have been significantly higher than global average prices.

Recently, South Korean regulators have proposed stricter measures, including a tax increase to 20% on gains from cryptocurrency trading, and new laws governing financial transaction reporting that aim to prevent scams and fraudulent ICOs. At the same time, the Korean central bank has announced that it is developing a CBDC and a decentralized identification platform. Some of the largest payment applications in South Korea, including Chai and Kakao, have already integrated blockchain and tokens into their operations.

Singapore tends to attract significant capital and many large investors due to its favorable and transparent regulatory environment. The Monetary Authority of Singapore, the country’s primary financial oversight body, handles most of the regulation of cryptocurrencies and digital assets. Singapore does not levy capital gains taxes on digital assets, but it taxes some cryptocurrency transactions and licensed ICOs, and it also licenses cryptocurrency exchanges.

India has an estimated base of 15 million crypto investors with holdings that total ₹100 billion (more than $1.3 billion). For this reason, global cryptocurrency exchanges actively seek entry into the Indian market. But they face an uncertain welcome, as government regulators have proposed making the technology illegal. In 2018, the Reserve Bank of India prohibited banks from dealing with or providing services to “any individual or business entities dealing with or settling” virtual currencies. Many cryptocurrency-native companies folded during the ensuing two years, until the Indian Supreme Court overturned the prohibition.

On the pro-blockchain side, 15 Indian banks recently founded the Indian Banks’ Blockchain Infrastructure Company, which intends to issue letters of credit on a DeFi platform. Total investment in Indian cryptocurrency and blockchain startups has grown tremendously in recent years, reaching approximately $95 million in 2020. If Indian regulations permit banks to continue to pursue blockchain-based initiatives, such investment could increase massively.

Australia has taken a proactive regulatory approach, with enforcement offices providing clear guidance on DLTs. In 2014, the Australian Tax Office established cryptocurrency transactions as barter, exempting them from capital gains taxes up to a certain limit—and even from goods and services taxes under some circumstances. Additional rules and regulations apply to exchanges, cryptocurrency miners, and transaction processors.

In Europe, Malta and Switzerland have gone farthest in opening their doors to cryptocurrency and DLT applications. Both have released clear regulatory frameworks to support development of the burgeoning industry. Most other countries in the region—including Italy, Spain, Austria, and the UK—have not yet enacted regulations governing participation in the industry. More broadly, EU member states are in the process of solidifying a continental regulatory framework, called Regulation on Markets in Crypto Assets (known by the acronym MiCA). The ECB has indicated an interest in instituting an EU-wide CBDC.

The US takes a similarly varied approach. Regulations range from New York’s acceptance of the BitLicense—a set of stringent regulatory requirements for crypto companies operating in the state—to Wyoming’s looser protocols, which aim to attract cryptocurrency and blockchain companies to the state. At the federal level, much remains uncertain, although regulators in the Biden administration have vowed to bring clarity to the space.

Taking DLT to the Bank

The trends described in this report are all emerging. Banks have the opportunity not just to offer products and services, but also to define parameters related to them. For example, as a response to concerns about climate change and carbon emissions, banks can join the movement toward more energy-efficient crypto generation protocols.

One clear potential role for banks is to facilitate the trust that commercialization of DLT requires. Security and verification are embedded in the decentralized technology, but exchanges of value require a different form of oversight—one designed to ensure that offerings include necessary user protections. This role that can’t be fully automated, because it involves a client or customer focus: building relationships in which the bank functions as an honest broker in a relatively disorganized domain.

Most financial services organizations will develop a mix of blockchain-based product and service offerings that is appropriate for their particular strategy and customer base. For instance, traditional banks could provide overall strategy, applying what they know about competitors, customer acquisition, integrated services, and back-office strategy to decentralized finance. They could build custody-related services, develop tokenization strategies, and perhaps establish platforms related to crypto or DeFi. In addition, they could provide tailored banking services to crypto companies, or trading capabilities to capital markets. Perhaps the most obvious use of blockchain would be as an integrated component of the banking back office— settlement systems, payment transfers, CBDC, and so on. And finally, it could help make risk and compliance less of a cost center and more of a strategic partner.

For challenger banks and fintech companies, blockchain could become an essential part of risk and compliance operations. It could also enable new growth products, such as superapps that bring new forms of payment and trading into daily life. Payment companies could establish partnerships with merchants to onboard crypto-related systems, and they could use blockchain for risk and compliance issues. They may also face an existential issue, if other services use crypto as a way to circumvent their conventional card and mobile payment approaches.

Asset managers, sovereign wealth funds, and institutional investors may find decentralized finance an effective way to manage partnerships, custodianships, and vendor relationships with greater flexibility and at lower cost. Corporations in other industries are beginning to manage their financial operations with blockchain, too, setting up tokens and NFTs that are closely related to their industries.

Ultimately, all of these actors, and more, will be well served by life on the distributed ledger frontier. At BCG, we have already seen this among the companies we work with and observe. The reason for a company to get involved with DLT now is not just to guard against upstarts. It is to enable the company to build the capabilities and the judgment to become an upstart itself, within its established business, and to wield blockchain and DLT effectively when they become standard operating practice. The operational and customer-facing opportunities are great enough that this could happen within a few years.