Constant, enhanced connectivity—at less cost and with more capabilities—allows companies to offer new products and services that drive growth and create customer value.

In the not-too-distant future, a farmer won’t start the day by climbing into a tractor. She’ll start by logging on to a laptop and overseeing a fleet of tractors and other equipment, all operating autonomously. If one tractor encounters something unexpected, it will signal the farmer, who can take over and operate the machine remotely until the path is clear and the tractor can resume autonomous operations. Throughout the day, the machines will communicate with one another and send data back for analysis—all to help the farmer increase crop yields, minimize the use of fertilizers and pesticides, and improve overall performance.

Leaders of industrial goods companies trying to identify their next steps in innovation need to look in one direction: up. Space is creating unprecedented value for customers and companies. In particular, satellite communications (satcom) technology is at a tipping point in both cost and coverage, opening different ways for industrial goods companies to offer new products and services that drive growth and create customer value. Leading companies in some industries, such as agriculture and automotive , are rolling out new satellite-enabled services, and other industries—including logistics, construction, energy , and mining—will soon follow. By capitalizing on constant connectivity from space, companies can enable solutions such as autonomous operations, continuous data transfer and processing, and machine-to-machine communication. They can also generate new insights from data, improve operations, deliver a better customer experience , and distribute products and services in new ways.

The keys to success in leveraging satcom include prioritizing use cases, determining technical requirements, and deciding whether to buy connectivity from existing providers or create a bespoke service more in line with a company’s own needs. Industry leaders can and should push the satcom market to deliver integrated connectivity solutions provided by different satellite systems and different orbits linked through a single universal—and affordable—terminal. The satcom market is moving in this direction today, but not at the pace needed to unlock the full value of emerging use cases for industrial companies.

Why Satellite Connectivity Now?

Much of the world already relies on space to some degree. For example, individuals may use global navigation satellite systems, such as GPS, for geolocation or watch satellite TV accessed through a dish. Common app-based services, such as Uber and DoorDash, derive basic functionality from commercial geolocation platforms. Some may even purchase earth observation imagery for monitoring purposes. Yet few take full advantage of satellite technology, let alone integrate those satellite capabilities into their business models to unlock value for customers and generate new revenue.

In the coming decade, the number of satellite-based applications is poised to increase dramatically.

Satellite connectivity offers continuous coverage regardless of geography—in deserts, across oceans, on mountaintops, and in remote rural areas. In the coming decade, the number of satellite-based applications is poised to increase dramatically, with the space economy projected to grow from $416 million in 2020 to more than $1 trillion by 2040. Of that total, the biggest chunk will be operations and services—the solutions that companies on the ground can provide with satellites—which will nearly triple, going from $241 billion in 2020 to $687 billion in 2040.

Several reasons explain why satellites are becoming a realistic option for industrial companies. One is the technological evolution of the satellites themselves: different orbits offer different capabilities. In the past, most satellites were geostationary (GEO). GEO satellites operate at altitudes of approximately 22,000 miles and orbit in sync with the earth’s rotation, providing continuous coverage to the same ground location. For example, a GEO satellite covering New York City will always be in the same position to service customers there. GEO satellites have long supported technologies such as TV broadcasts, weather forecasting, and satellite phone communications, which have been expensive and limited to specific applications until now. What’s more, these satellites’ capabilities are advancing rapidly, enabling them to meet connectivity needs of the mobility market to include commercial airlines, shipping, and more.

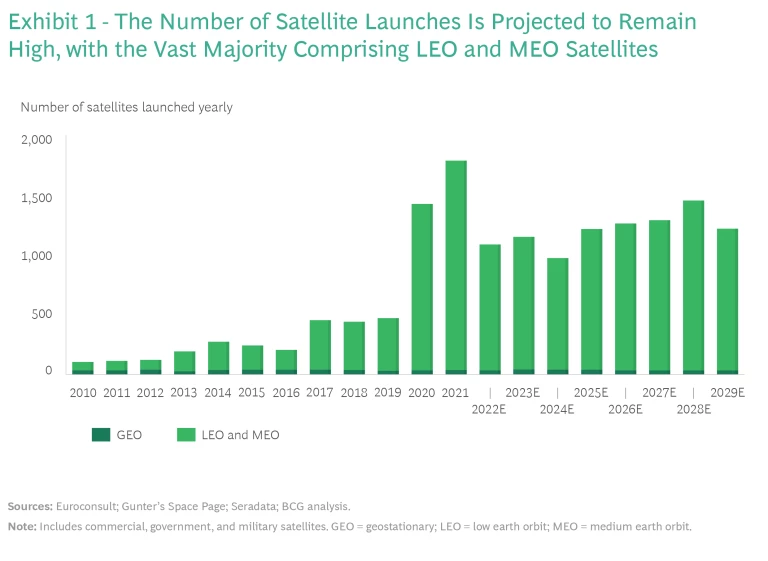

At the same time, new kinds of satellites are becoming a viable option for industrial companies There are two main types: low earth orbit (LEO) satellites, which operate 100 to 500 miles above the earth’s surface, and medium earth orbit (MEO) satellites, which operate roughly 3,000 to 7,500 miles above the surface. LEO and MEO satellites do not remain over the same spot above earth, instead orbiting much faster than the earth’s rotation. They are less expensive than GEO technology—both in terms of the satellites themselves and the cost to launch them—but many more of them are required to provide continuous coverage. These constellations are being launched at a record pace, and more are coming: from 2020 to 2029, the number of annual satellite launches will increase to about five times more than in the previous decade, and 90% of those will be smaller LEO and MEO satellites, also known as smallsats. (See Exhibit 1.)

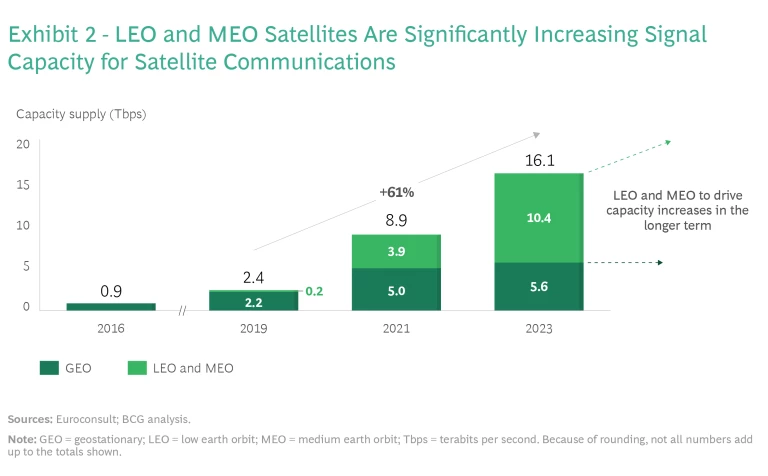

Because of these developments, existing industrial applications are more robust—capitalizing on imaging and observation and more precise location data—and new applications are emerging. The segment with the most promise is connectivity via satcom, including broadband data services. By 2023, total satcom capacity will increase more than tenfold, and the bulk of that will come from LEO and MEO satellite systems. (See Exhibit 2.) Each satellite constellation will have greater potential bandwidth and lower latency. And prices for customers will continue to fall as a result of increased competition.

LEO satellites have a shorter operational lifespan than GEO satellites, needing to be replaced about every five years, which means that new designs will keep pace with advances in communications technology and customer needs. LEO satellites also offer faster data speeds and greater capacity; current designs can provide bandwidth close to 3G, but future designs will close the gap with terrestrial networks to include enabling 5G and beyond.

Currently, terrestrial mobile telecom networks are cheaper and faster than satellite-based connectivity through LEO networks, but they are generally limited to locations with high population density, and there can be gaps in service—particularly in areas with very heavy usage and during disruptions due to natural disasters. Satellite-based communications, in contrast, are truly global, with coverage spanning rural areas, deserts, oceans, and other remote environments. Moreover, satcom can provide redundancy to terrestrial networks. And satellite providers are starting to close the gap in terms of bandwidth and cost.

Another shift is the convergence of technologies. Currently, each type of satellite technology (GEO versus non-geostationary) requires a dedicated terminal to send and receive signals. For example, if a logistics company wanted to outfit a fleet of 500 trucks with both GEO and LEO satellite connectivity, it would need to install independent GEO and LEO terminals—each of which costs thousands of dollars—in every truck. However, suppliers are actively working to develop multiorbit terminals, and soon a single device will provide connectivity across different satellite systems—along with terrestrial mobile coverage—and switch seamlessly between different data signals. The future is not just multiorbit but also mobile, with terminals that allow cars, trucks, boats, planes, and tractors to be connected all the time, regardless of where they’re operating.

Constant Connectivity Enables New Applications

The main advantage of satcom is constant, enhanced connectivity—a step up from terrestrial mobile telecom networks, which have gaps in coverage, particularly in remote areas. Initially, this continuous coverage enables satellites to serve as a backup to current mobile services and to provide coverage in unserved areas, such as over oceans and in rural locations.

But as capacity grows and costs come down over time, satcom will provide constant connectivity on its own, and the differences between terrestrial telecom and satellite-based connectivity will narrow. Companies will be able to bundle data from different sources, run analytics against that data, and unlock new insights—and value—for customers. In that way, satcom will enable a wide range of new use cases, particularly in industries with connected vehicles, such as agriculture, automotive, mining, and construction.

Specifically, the following use cases become most relevant for those industries:

- Improved Operations. Companies can oversee round-the-clock operations across dispersed locations and gain real-time access to business intelligence. Currently, even connected devices are connected only some of the time, when they have access to mobile telecom service.

- Fleet Optimization. Companies can track assets worldwide and use data-driven products and services, get enhanced information on the performance of their products, and apply such use cases as predictive maintenance.

- New Use Cases and Ways to Create Value. Worldwide connectivity allows companies to expand the geographic reach of their products and to roll out new premium services, such as business intelligence that relies on data analytics.

- Enhanced Customer Experience. Companies can be more attentive to customer-owned or -operated assets, respond faster to emerging issues or concerns, and provide such value-added services as enhanced entertainment options.

In sum, connectivity creates value. For applications requiring continuous connectivity, satcom increasingly needs to be part of the solutions mix.

How to Start Leveraging Space Connectivity

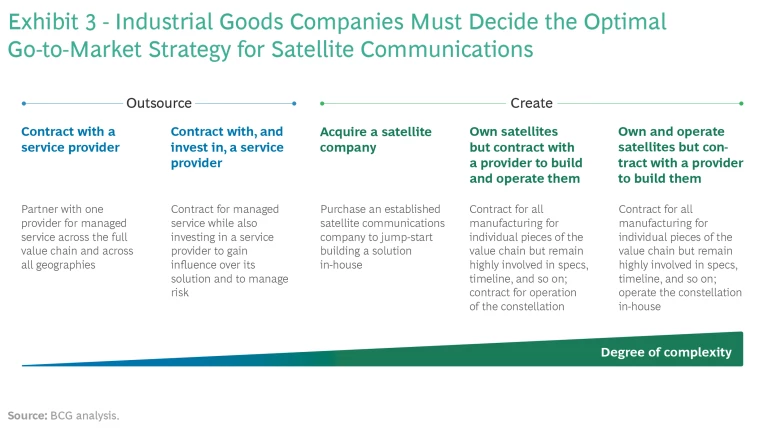

The current satcom evolution is creating opportunities for industrial companies to both shape the direction of future innovation and accelerate the creation of new value for their customers. Leading players are already exploring different business models for satcom solutions. The most straightforward option is for companies to buy connectivity as a managed service from existing providers. At the more complex end of the spectrum, companies design, build, launch, and operate their own satellites or constellations. Between those two poles of outsourcing and creating lies a set of more nuanced options. (See Exhibit 3.) To determine which approach is best, companies need to first determine their actual needs and consider the pace of technology for space-enabled connectivity.

Define known and potential use cases for satcom, along with their underlying technical requirements. As noted above, the continuous connectivity that satcom provides can help companies better accomplish existing use cases—by filling in the gaps with terrestrial mobile coverage—and unlock future new cases. Each use case will have specific requirements in terms of speed, latency, coverage, and other technical aspects. (See the sidebars “Satcom on the Road” and “Satcom on the Farm.”)

Satcom on the Road

Satcom on the Road

Satellite-based connectivity can augment mobile networks to offer seamless connectivity even when land-based signals drop or become otherwise unavailable. In that way, it enables automakers to offer a wider range of applications, including autonomous driving, in-car entertainment, enhanced safety features, theft prevention, and predictive maintenance.

Enabling connectivity at this level will require overcoming some technological challenges. One is the vehicle terminal—the antenna that sends and receives data. Most existing terminals don’t support both land-based mobile networks and satcom. They are also too big and too expensive and consume significant energy (which rules them out for electric vehicles). In addition, increasing data volumes from the broader array of applications will require that some of the computation happens in space, rather than in the vehicle.

One well-publicized example is Porsche (associated with Volkswagen Group), which is pursuing a long-term strategy to leverage satcom connectivity in its vehicles. Porsche has a dedicated satcom team and holds an investment in Stellar, a European space company focused on providing connectivity for mobility applications.

Based in Paris, Stellar aims to standardize and industrialize the value chain for satcom specifically in order to support automotive applications by 2025. In addition to Porsche, Stellar has teamed up with other OEMs and is developing its own LEO constellation—along with the world’s first hybrid terminal, which can switch transparently between land-based 5G and satellite connectivity while still meeting automotive safety standards. Stellar will also have edge-computing capabilities, which reduces signal latency and will support new automotive applications, such as autonomous driving, along with hybrid roaming capabilities to supplement terrestrial mobile service.

Satcom on the Farm

Satcom on the Farm

Connectivity is a critical component of precision agriculture and other digital solutions in the industry. Currently, 3G is sufficient to meet most connectivity needs of the agriculture sector, but mobile service can be unreliable in some regions. For example, up to 25% of US cropland is not covered by 3G terrestrial connectivity or other cellular options, such as 5G or LTE. In other markets, such as Brazil, more than 50% of cropland lacks cellular connectivity.

For this reason, John Deere is pursuing a cutting-edge satcom solution as part of its overall digital transformation. This broader transformation leverages data, AI, and connectivity to help farmers optimize yields, costs, and sustainability. Satcom will enable farmers to operate a connected fleet regardless of terrestrial mobile coverage. It is expected to unlock billions of dollars in annual value for John Deere–supported farmers in the US and Brazilian markets alone, with strong potential for additional value creation in other markets.

Initially, the company will use satcom to fill in the gaps in terrestrial coverage to support existing use cases. In the future, however, the technology can support more advanced applications for smart agriculture to include autonomous farming. In that way, a hybrid satcom solution has the potential to transform every aspect of agriculture, from productivity to maintenance, around the world.

Assess the potential value to be unlocked. Each application requires a business case that clearly assesses the increased value of continuous connectivity from satcom compared with terrestrial options. By aggregating all use cases, companies can determine how much net present value they can unlock by investing in satellite technology.

Determine the current and future landscape of connectivity options. Next, companies need to understand the various options for connectivity. That process includes terrestrial, GEO, LEO, and MEO options. For all technologies, companies need to project and anticipate the planned rollout of new capabilities, including terminals and costs.

Assess whether current or forthcoming satcom offerings will be sufficient. In many cases, companies can purchase satcom connectivity as a service from existing providers. Even if current and near-term planned offerings do not quite meet all the technical requirements for a given application, companies can devise ways to narrow the gap by adjusting the applications they offer customers to align with evolving technology. Bolder companies can even push satellite companies to make changes—for example, by bidding out capability requirements that include specific technical changes.

Where applicable, design a new solution or retain operational control—or both. In situations when current offerings aren’t close to meeting the technical requirements for a given use case, a company may decide that the best path forward is to design, build, launch, and possibly operate its own constellation of satellites. It can alter any specific design parameters—such as the size and shape of terminals and antennae, bandwidth, and latency requirements—that a company requires. This approach is significantly more complex and costly than buying connectivity from an established provider, and it will likely require partnering with existing companies in the space industry. It also creates potential new revenue streams—for example, a company that operates its own satellites could opt to sell excess capacity to others.

Whether outsourcing or creating a solution, future proof the investment by considering a hybrid strategy across satcom technologies. Regardless of whether a company buys a satellite connectivity service or creates its own—or some intermediate step along that spectrum—the ultimate result will likely be similar. Companies will rely not on any individual category of satellites but on a multiorbit hybrid—GEO, LEO, and MEO satellites (plus terrestrial mobile where appropriate) all integrated into a single universal terminal, with software that can switch back and forth among the options to ensure continuous coverage. By doing so, companies can spread their bets across multiple technologies, preserving their options regardless of how satcom solutions evolve in the future.

As industrial companies undergo digital transformations , they unlock new use cases and applications that rely on data—but without continuous connectivity, some applications are worthless. This is particularly true for mobile platforms (cars, trucks, tractors, boats) and for companies operating in remote regions where terrestrial mobile service is spotty or nonexistent. As satellite technology advances, satcom-enabled connectivity fills connectivity gaps to improve existing applications. Moreover, satcom unlocks new applications as well.

Most industrial companies are still in the earliest stages of integrating satcom capability into their supply chains. Yet, leading players understand the potential and can benefit from first-mover advantages in their respective market segments. Connectivity creates value, and satellites are the future of connectivity. For industrial companies, that future starts now.