Rather than continue with slow development cycles and radical innovation, the industry must flip the script and focus on getting incremental improvements into the market quickly.

The global aerospace and defense (A&D) industry can produce astonishingly advanced airplanes and other complex equipment, but it routinely fails to develop those programs on time, on budget, and in line with projected performance. The problem is not new, but it is getting worse and now constitutes a full-fledged crisis of execution. We believe the solution is to focus less on capabilities and technical complexity and more on program speed—locking in a delivery date as a fixed entering argument and then designing other parameters around that goal.

This approach represents a radical departure for the industry, where companies have significant institutional inertia and deeply established ways of working. Success requires that firms rethink key processes and focus more on incremental improvements and steady production flows rather than costly, risky innovations. If it can do so, the industry will get new technologies into the market faster and improve its financial performance. Defense contractors see additional profound benefits—greater value to taxpayers, increased readiness, and armed forces that are better equipped to compete against adversaries.

It is long past time to improve.

A Crisis of Execution

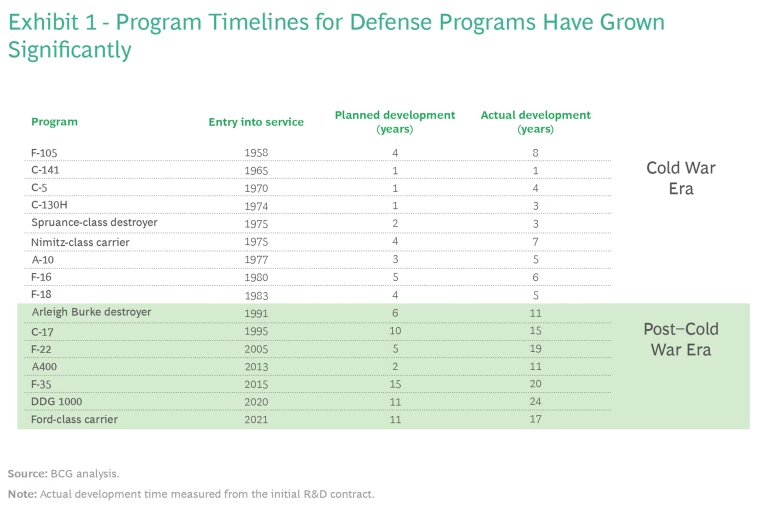

In the last 30 years, both commercial and defense programs have increasingly exceeded their projected timelines. Longer-than-expected delivery has resulted in budget overruns, customer dissatisfaction, and aircraft designed for market and combat conditions that have already passed. During the Cold War, defense programs including both aircraft and ships typically took about five years to develop, but since then the typical program timeline has expanded to 20 years. (See Exhibit 1.) The F-35 has been in development since 1995—a child born when the project started would have graduated college by the time the aircraft was finally deployed in combat.

The same is true for commercial projects. The Boeing 787 took seven years from when the program was initially announced to when it entered service—twice as long as the initial timeline—and early models were still overweight and experienced performance issues. The challenge is not limited to OEMs. Pratt & Whitney’s geared turbofan engine was late to market and lagged the development of the Airbus A320neo. And when it did arrive, the turbofan had service issues with seals, turbine blades, and combustors (among others).

Delays in getting new products into service are the most critical issue affecting the A&D sector, and they carry significant costs.

These delays in getting new products into service are the most critical issue affecting the A&D sector, and they carry significant costs in both financial and operational performance metrics. (See “The Price of Poor Execution.”) The delays stem from a number of root causes.

The Price of Poor Execution

- Delays in new programs entering operational service lead to corresponding delays in cash flow, excessive engineering costs, and lost market share to competitors, all of which undermine the business case for those programs.

- In the defense sector, the mission profiles that a program was originally meant to fulfill may have changed, sometimes rendering it obsolete and making it vulnerable to spending cuts. In fact, this challenge can be self-sustaining over time. As ships and aircraft take longer to develop, the legacy products they were meant to replace spend more time in service. Increased maintenance costs reduce the military’s ability to invest in new systems to meet emerging threats—a bad cycle.

- In the 1960s, aerospace employees might work on ten programs across their career, building valuable skills and learning lessons they could take with them to the next project. Today many employees will be lucky to experience a handful of programs, and many will only see a specific slice of the project—either development, production, or aftermarket—but rarely the entire lifecycle. This hurts the development of talent and makes the industry less attractive than other sectors with faster cycles.

Designs That Rely on Immature Technology. Firms tend to reach for disruptive, risky innovation based on technology that may not be ready for production—and they sometimes bundle multiple innovations into a single program. The Boeing 787 included composite materials, an all-electric design, new propulsion, and a cabin designed to be more comfortable for passengers, with increased pressure and humidity. The Airbus A400M incorporated new engines, more composite materials, and counter-rotating propellers. Any one of these emerging technologies adds complexity; combining them all simultaneously makes execution on time and on budget less likely.

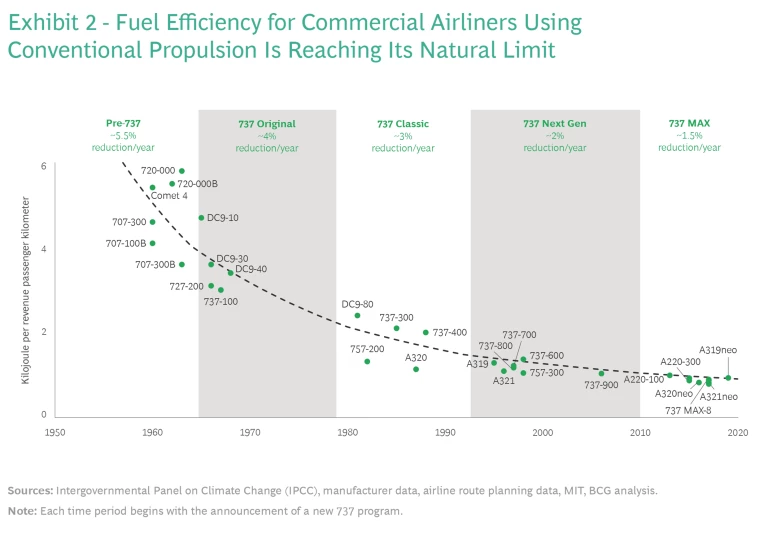

This tendency to reach for immature technology is driven largely by the fact that major advances in performance are getting harder to achieve. For example, the fuel efficiency gains for single-aisle commercial aircraft have been slowing over time as they approach the natural limits of current designs. (See Exhibit 2.)

Software Advancing at Faster Rates. Software is central to modern aerospace and defense platforms, but software development is not a core capability at many OEMs. In addition, companies in other industries can roll out beta versions of software with known flaws and then refine over time, but the stringent safety requirements in the A&D industry require much greater initial reliability. Technology companies can also shorten product cycles by simply upgrading the software rather than reengineering hardware. However, in the aerospace industry, software has become another key element of the development process, increasing overall program length. Moreover, as AI and Internet of Things solutions proliferate for both defense and commercial firms, the software challenge is likely to grow.

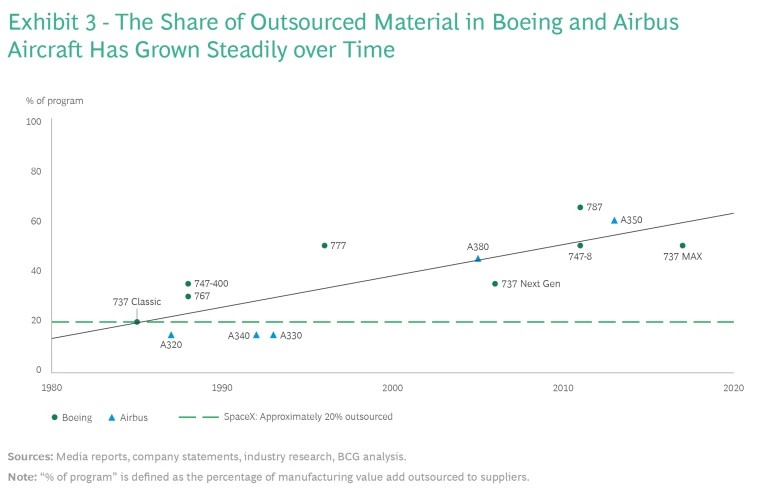

Increased Outsourcing. A desire for asset-light business models has led to more outsourcing among major A&D players. (See Exhibit 3.) This reduces the development costs borne by the OEM and can spread the financial risk of a new program, but it introduces friction and complexity, in part because aerospace and defense suppliers often face little meaningful competition, but also—and maybe more importantly—because it requires stronger collaboration on more complex topics, as increased outsourcing means wider responsibility for a supplier at the system-integration or architecture level.

Most components require large nonrecurring costs (NRCs) to produce. For example, one-time expenses like tooling, R&D, capital equipment, engineering, and testing can comprise the majority of the cost to produce given parts, modules, or systems, limiting the number of potential suppliers that can compete to produce them. For some commodities, this can create a lack of competition, giving suppliers pricing power in dealing with OEMs and making them potentially less responsive in hitting schedules and quality targets. Other commodities require interpenetrated relationships and responsibilities, necessitating more collation, more data exchanges, and joint assessment of the impacts of trade-offs or requirement changes: a so-called “risk-sharing partnership” model that still needs to be fine-tuned to ensure alignment and effectiveness in the relationship between a prime contractor and a design-and-build vendor with a wide accountability.

In addition, prime contractors have sometimes outsourced work to suppliers that have less-established track records—leading to quality issues, which in turn extend timelines and cause budget overruns. Although financial risk can be spread across the supply chain, the reputational risk of a delay accrues to the OEM, and it is that company that must settle with customers if things go wrong.

Legacy Project Management. Even as other industries have shifted to agile product development , the A&D industry still relies primarily on traditional methodologies built around a series of milestones that must be achieved in order to advance development. This waterfall timeline is an outcome of decisions made early in a program’s development—many of which have unclear implications on the time to market.

Although companies are comfortable with this approach, it takes a long time to plan and set up, and it prevents programs from reacting to changes in project requirements or technology. Moreover, waterfall planning is artificially reassuring to program managers: it provides the feeling of control by focusing attention primarily on intermediate milestones and KPIs rather than affording actual control of the overall program timeline.

Changes to Performance Requirements in the Design Process. A complicating factor of waterfall management is the struggle to maintain performance requirements—for example, the maximum speed, altitude, and range of an aircraft. Very often, those requirements are set at the beginning of a project, but they change over time—for example, customers may change their minds, or the interface of different technologies may require one parameter to be prioritized over another. The end result is an extremely inefficient, overly iterative design process.

A New Approach Centered on Program Timelines

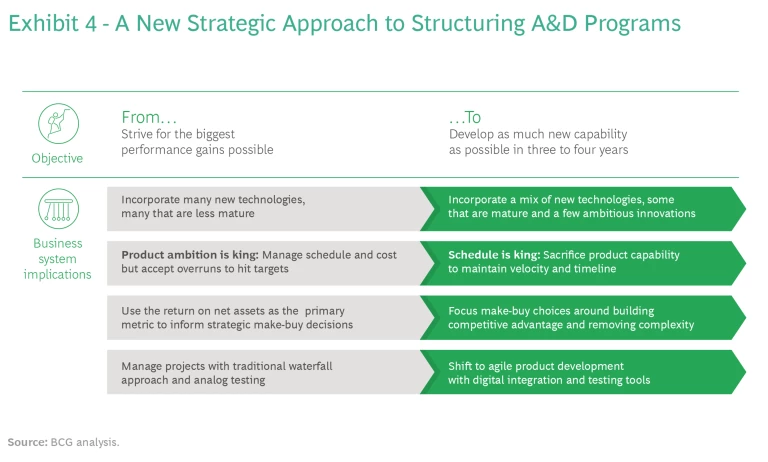

The A&D industry can no longer accept the traditional approach to project development. Instead, it must transform to a new approach that starts by setting the timeline—typically three to four years—as a nonnegotiable principle, with the subordinate goal of improving performance as much as possible in a given airframe during that period. The schedule needs to become the primary metric of performance, in tandem with safety standards. (To be clear, some situations in the industry will still call for a traditional approach to program development to capitalize on the potential—or requirement—for new capabilities.)

The A&D industry must transform to a new approach that starts by setting the timeline as a nonnegotiable principle.

Several innovative new market entrants are already applying this approach. (See “SpaceX: An Example of Speed in Action.”) As Exhibit 4 shows, prioritizing timelines will fundamentally reset the way the industry manages new programs, with cascading implications across all aspects of the process. Specifically, companies that want to center program development around fixed, shorter timelines must take the following steps.

SpaceX: An Example of Speed in Action

Additionally, SpaceX does not outsource nearly as much as other aerospace firms, buying only about 20% of its materials from its suppliers, rather than 50% or higher, as many other commercial OEMs do. This gives SpaceX more control over key technology and reduces complexity in operations, allowing the company to be nimbler when bringing new products to market.

Finally, SpaceX has used an agile approach to its rocket development, along with digital design tools that improve collaboration, save costs, and increase speed. These tools allow SpaceX engineers to work collaboratively and quickly identify interdependencies among engineering teams. The company can develop rapid prototypes and test mockups at low cost earlier in the design cycle—a contrast to the development programs of many A&D incumbents, which are based on exhaustive analysis and design followed by tests of full-scale products later in the design cycle.

Focus on incremental advances. Rather than launching ambitious new airframes and platforms, the bulk of development should shift to building derivatives of existing programs or incorporating incremental improvements into established products using more modular designs. This approach has the advantage of preserving and building on embedded learning, which is hugely important to cost-effective aerospace programs. Mature programs are far down the learning curve and have attractive cost positions, which makes them advantageous to the OEM’s margins and customers’ pocketbooks.

Wholly new designs should focus only on the most disruptive technology—such as the incorporation of hydrogen-powered engines or new airframe architecture.

Rely more on established technology. Instead of building a lot of emerging technology into designs—and hoping that it will be market-ready in time—firms can mix more mature solutions with others that are less so. The priority for critical systems should be safer bets, and firms can design programs with the flexibility to integrate more cutting-edge technology if it becomes available—and leave it out if not.

For example, the next generation of commercial aircraft will likely have different fuselage architectures that improve aerodynamics and increase passenger capacity. An initiative could adopt this architecture but retain the legacy airframes’ internal aircraft systems (electronic and avionics components) to minimize technical risk. As the new architecture proves itself, subsequent models could incorporate enhancements to the internal systems. A key factor in this approach is to make designs modular and flexible so that airframes and systems can be upgraded independent of each other while still being compatible over time.

Shift to an agile development approach. Traditional program management starts by defining capabilities and essentially lets the timeline float based on meeting those goals. In contrast, agile program management sets the timeline as a nonnegotiable constraint and challenges firms to accomplish as much as they can within that period. Companies don’t need to make a wholesale shift to agile—they can apply the best elements of traditional program management while still incorporating the key elements of agile: a customer focus, orientation around outputs, adaptability in the face of uncertainty, and empowering teams.

Digitize the design process. Companies can also rely more on new, proven design tools—such as digital twin simulations, digital design software, and model-based systems engineering—to accelerate the design and development process itself. For example, the construction, testing, and analysis of physical prototypes can consume a significant amount of time during the design stage. By digitizing that process and relying instead on virtual simulations, teams can make much faster progress.

Rotate talent. A&D firms should deliberately rotate teams of experts to build experience and increase their exposure to multiple programs. Shortening the average aerospace project will give engineers and staff the opportunity to take their lessons learned to the next project and work smarter from the start. This will make the next program go faster, creating a virtuous cycle that allows even greater program speed and more career development opportunities. In our discussions with industry professionals working on underperforming programs, the fact that many people on program teams had never seen a successful program firsthand was frequently cited as a major challenge.

Shortening timelines will give engineers and staff the opportunity to take their lessons learned to the next project and work smarter from the start.

Streamline supply chains. Aerospace prime contractors should reduce supply-chain complexity by vertically integrating to develop more systems in-house—specifically those that are critical to the technical performance of the final product or where high NRCs require a single source of supply. Producing these components in-house will reduce friction across the supplier network and protect the biggest profit pools for the OEM. For components that can support multiple vendors, outsourcing should still be the primary strategy, as it fosters competition in both price and performance.

In situations where OEMs do not have the needed capabilities to bring production in-house, they should work closely with a small number of proven technical collaborators. For example, GE and Safran Aircraft Engines are long-standing partners and can coordinate smoothly across company boundaries. When key components are outsourced to sole-source suppliers, OEMs should structure arrangements to align incentives and reduce any friction that could slow development and production. Joint ventures or revenue-risk-sharing partnership agreements can lead to more productive relationships with critical suppliers.

The Economics of Fast Development

Shifting to fast program development won’t be easy, but it can yield significant financial gains across several areas:

- Shorter R&D Periods. R&D entails expensive engineering labor; every additional month in this phase leads to increased costs and delays positive cash flow. Programs that get to market sooner can save years of engineering costs.

- A Shorter Learning Curve. The first several units of a new program typically lose money as costs exceed the sales price. Incremental programs take advantage of lessons learned from earlier projects and reduce the cost of the first unit, increasing the speed at which positive cash flow is achieved for the program.

- A Faster Path to the Aftermarket. A large proportion of profit in aerospace programs comes through aftermarket services and parts. The sooner products get into customers’ hands, the sooner profitable aftermarket sales can begin.

- Minimized Friction in the Supply Chain. When programs take too long to develop, performance requirements can change for the prime contractor. These cascade back upstream in the supply chain, leading to contract disputes, renegotiations, and often litigation—destroying value for the entire industry. Shorter programs increase the odds that requirements won’t change and that suppliers and the OEM can collaborate to meet a fixed objective.

- Fewer Operational Problems When Aircraft Go into Service. Less-mature designs lead to an increased risk of problems once the aircraft begins flying. In those cases, OEMs are responsible for rectifying the issue and compensating customers, which ultimately saps profits. Relying on incremental innovations and upgrades to existing platforms reduces these risks and leads to more reliable performance for the aircraft and more reliable cash flow for the program.

The global A&D sector is in a full-fledged crisis of execution, but we believe there is a clear solution. By focusing more on program length and incremental improvements to existing designs, the industry can dramatically improve the way it gets designs into market. Doing so will lead to better operational performance for aircraft and better financial performance among A&D players. This may seem like a radical change for a long-established industry, but we believe it’s necessary—in fact, it’s long overdue.

The authors thank Jack Spasiano and Matthieu Ertaud for their contributions to this report.