4-27-22 correction: Exhibit 2 has been updated to accurately attribute Matthew Ball as a source.

It has taken 30 years since the term was coined in 1992, but big money has now moved into the metaverse—accompanied by big hype. Facebook, which changed its name to Meta Platforms, has promised to invest $10 billion in its Reality Labs operation this year. Microsoft is making a $70 billion bet on a metafuture with its planned acquisition of Activision Blizzard. Venture capital funds poured almost $25 billion into crypto-related investments in 2021.

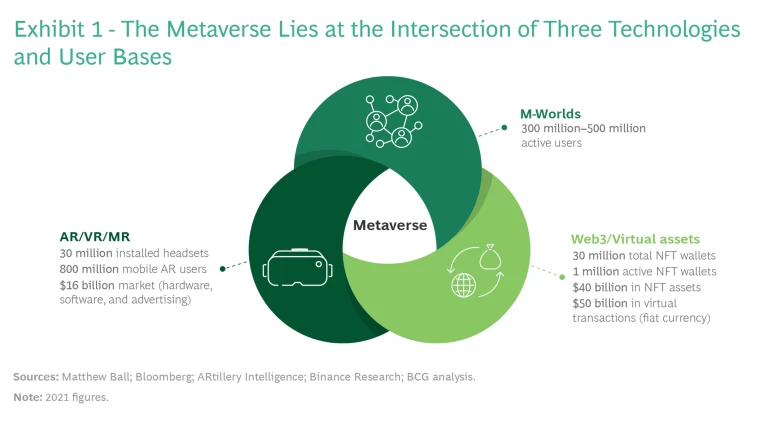

To understand the pull of the metaverse, it helps to think in terms of the distinct trends that are converging to create it. (See Exhibit 1.) Recall the release in 2007 of the original iPhone—a single device that brought together a camera, computer, mobile phone, and operating system. The technologies involved were not new; the revolution lay in their convergence and the resulting entrepreneurial stimulation of thousands (and ultimately, millions) of app developers, who set about finding ways to put the magical new tool to use.

In similar fashion, the metaverse is about the convergence of several developments, all of which involve step changes in technological capability:

- Metaverse worlds—m-worlds—are gathering hundreds of millions of active users thanks to the powerful computing capacity and mass-market availability of mobile phones, tablets, and PCs, as well as improvements in cloud services and connectivity (such as fiber and 5G).

- A mass market for augmented, virtual, and mixed-reality (AR, VR, and MR) headsets is growing fast, with devices such as Meta Quest 2 affordably priced and easy to set up and use.

- Virtual assets powered by an innovative Web3 technology stack are rising in popularity as objects to acquire and exchange.

As the convergence proceeds, it’s worth trying to untangle the hype from the likely reality and so gain a clearer view of where the potential value lies. (Remember that out of the ashes of the dot-com meltdown rose a global e-commerce market worth almost $5 trillion in 2021.) While any predictions of what the future holds will almost certainly be off-base, forward-looking companies may want to experiment with the new technologies and possibly invest in young metaverse players or emerging technologies in order to assess the potential of extended reality for their products, services, and operations.

Why the Metaverse? Why Now?

First, what exactly is the metaverse? For a word that’s thrown around a lot, precise definitions are hard to come by. As Eric Ravenscraft recently observed in Wired, if you replace “metaverse” with “cyberspace,” the meaning of the sentence will not change in 90% of cases.

Enthusiasts see the metaverse as the next generation of the internet, a virtual, interconnected reality seamlessly woven into our physical world. Thanks to AR and VR, the argument goes, real and virtual social, consumer, and business experiences will become intertwined. Gamers are already familiar with this notion—albeit usually in two dimensions—but games are only the beginning. Millions of users now gather at virtual 3D concerts, shop in virtual malls with virtual currencies, and own fully customized virtual homes. They have innovative virtual experiences, such as Travis Scott’s concert on Fortnite. They also participate in a sizable and growing virtual-asset economy, buying, selling, and creating goods such as clothing, real estate, art, and currency. In 2021, more than $40 billion was spent on nonfungible tokens (NFTs)—certificates of ownership of digital assets—according to the Financial Times. Goldman Sachs predicts “as much as an $8 trillion opportunity on the revenue and monetization side” of the metaverse. Morgan Stanley likewise sees an $8 trillion metaverse market—in China alone.

Others are more circumspect. While they don’t deny the attractions of decentralized finance and the internet iteration known as Web3—or the activity each has spawned—they point to the long history of financial bubbles. They also cite, as a good reason to hedge one’s bets, the absence of easy to traverse bridges between the world of cryptocurrencies and the “real” economy where fiat currencies rule.

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

Companies tap into the metaverse in a rudimentary way when they hold meetings using virtual-conferencing apps such as Zoom or Microsoft Teams. Indeed, much of the value of the metaverse may ultimately lie not in consumer but in business applications, such as virtual meetings and training sessions, new-product design capabilities, or the ability to give customers the experience of a virtual home or vehicle before buying a real one.

This is the view embraced by Microsoft’s CEO, Satya Nadella, who told the Financial Times in February, “You and I will be sitting on a conference room table soon with either our avatars or our holograms or even 2D surfaces with surround audio. Guess what? The place where we have been doing that forever . . . is gaming. And so, the way we will even approach the system side of what we’re going to build for the metaverse is, essentially, democratise the game building . . . and bring it to anybody who wants to build any space and have essentially, people, places, [and] things digitised and relating to each other with their body presence.”

Divergent views are hardly unusual when new technologies and models of business, finance, and commerce are rapidly taking shape and pushing against existing paradigms. But the metaverse is now starting to really come into focus. Let’s look at each of the three converging developments, and their associated technologies, in turn.

M-Worlds

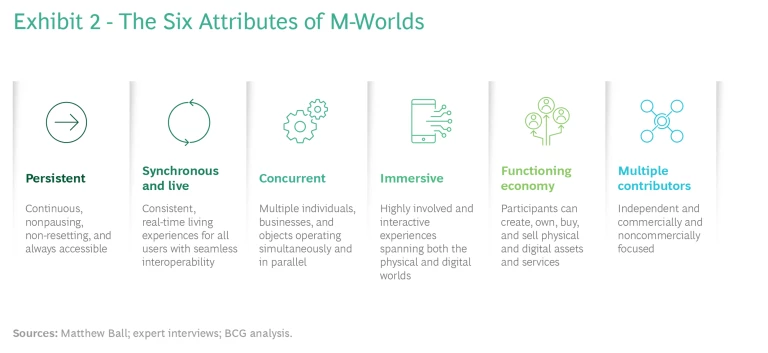

M-worlds are immersive applications that offer brands the possibility of reaching new audiences (notably, Gen Z users) in different ways. Able to run on mobile phones, tablets, PC browsers, and AR or VR headsets, they have multiple distinctive attributes. (See Exhibit 2.)

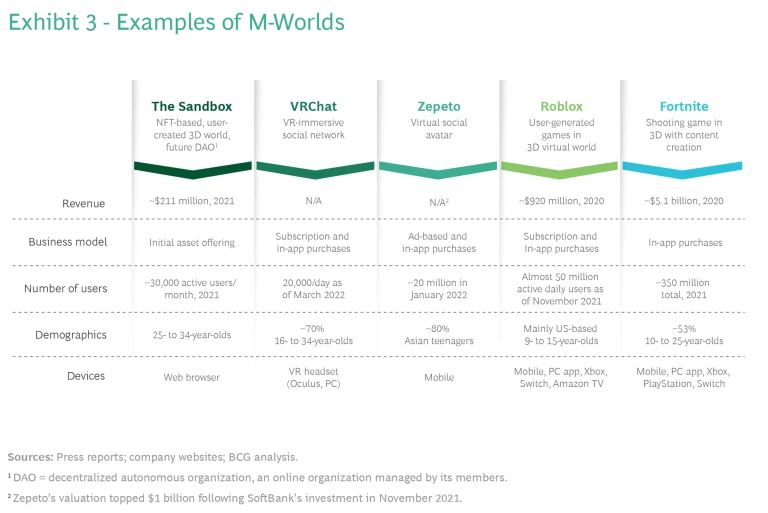

Each m-world is built to host its own virtual communities and content, and each has its own business model, rules, and user accounts. (See Exhibit 3.)

Many m-worlds began as gaming applications, but they have since added features and attractions. Fortnite, for example, is a 2017 shooting game that has progressively incorporated such features as virtual concerts and map creation tools. Roblox, a building and social game, already included most of the elements of an m-world by 2006, around the time Facebook opened its virtual doors to the public. Roblox now allows users to create their own games and to design, buy, and sell apparel, accessories, and other items for their avatars (users’ incarnations in the virtual environment). Roblox also hosts virtual events. The Sandbox and Decentraland, games designed to integrate with the Web3 stack, are attracting major brands in so-called initial land offerings.

M-worlds pursue multiple monetization models as they seek to build their virtual-asset economies. These include both traditional approaches, such as subscription, advertising, and in-app purchase models, and newer, metaverse-specific methodologies, including initial asset offerings, metaverse agencies, and advertising using metaverse-generated data.

The m-world landscape is evolving quickly with the arrival of major new platforms that will offer a better hybrid, two-dimensional plus AR/VR, experience. These include the following:

- Horizon Worlds from Meta, which will benefit from the tight integration of Meta Quest and Facebook properties

- Omniverse from Nvidia, which could be the first photorealistic m-world, bringing applications one step closer to OASIS, the imaginary metaverse in the movie Ready Player One

- Mesh from Microsoft, which will be integrated with popular Microsoft software such as Teams and leverage the company’s HoloLens 2 headsets

XR: AR, VR and MR

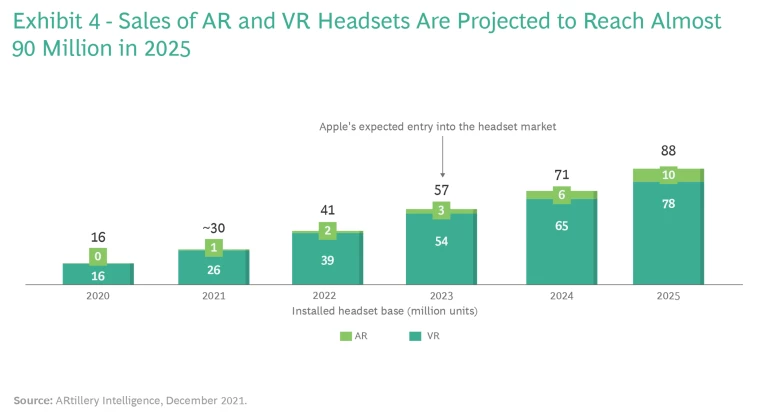

Technological advances in AR, VR, and MR (often referred to collectively as extended reality, or XR) are facilitating the shift from 2D to 3D by providing more realistic experiences and digital displays that are better synchronized with head movements. Indeed, surveys have found that the two biggest barriers to wider adoption of XR are the user experience and limited content, both of which are improving fast. Equipment costs also have fallen, and sales are projected to increase quickly. (See Exhibit 4.) Meta’s Mark Zuckerberg, speaking about Oculus, which has an estimated 35% share of the VR headset market, told The Verge in September 2020, “If we get to 10 million units active, then that’s kind of a critical magic number. At that point, you have a self-sustaining ecosystem.” At its current pace, Meta could reach this critical mass by mid-2022. And Apple’s expected entry in early 2023 could turn out to be the iPhone moment for AR and VR.

While the number of AR and VR users climbs, mobile AR, which leverages smartphone cameras and processing power to superimpose information on what the phone is seeing, helps bridge the transition. More than half of the 6 billion smartphones in use today are sufficiently powerful to enable mobile AR. In addition, the software development kits from Apple for iOS, and from Google for Android, can be extended to AR and VR development. According to research from ARtillery Intelligence, 800 million users actively use mobile AR, a number that it projects will grow to 1.7 billion in 2025.

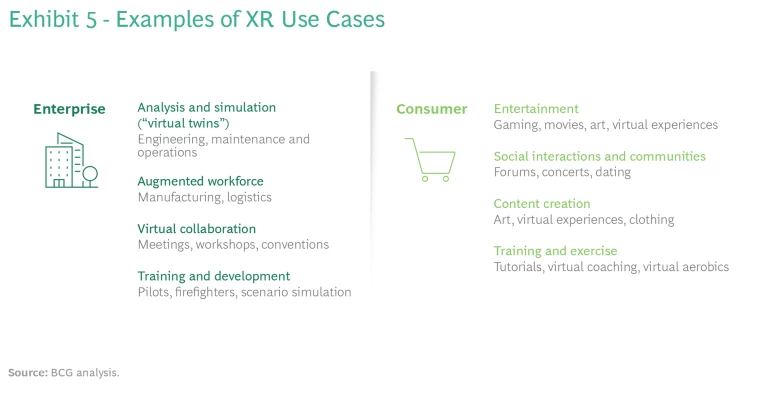

The use cases for AR, VR, and MR span consumer and business applications. (See Exhibit 5.)

A 2020 (prepandemic) survey conducted by law firm Perkins Coie, industry group XR Association, and venture capital firm Boost VC identified the top five sectors for immersive environments as health care , education , workforce development, manufacturing , and automotive . (See “New Automotive Realities.”) The most likely areas for business applications were employee training and workflow management.

Retailers such as Ikea and Tesco leverage the technology to augment the customer experience, while social networks, such as Snapchat, are promoting AR to boost engagement on their platforms. Boeing has announced that it will use VR at scale to engineer its next aircraft, powering an immersive digital twin of the product. Meta has developed a Quest application called Horizon Workrooms that makes VR technology easy to use and deploy in an enterprise context. At BCG, VR has become an integral part of our own internal and client collaboration in use cases that include practice area events, agile project management, R&D, client pitches, and the construction of virtual worlds with clients. We have connected team members in Horizon workrooms with team members in a physical space elsewhere and are now helping clients understand and implement these kinds of solutions.

New Automotive Realities

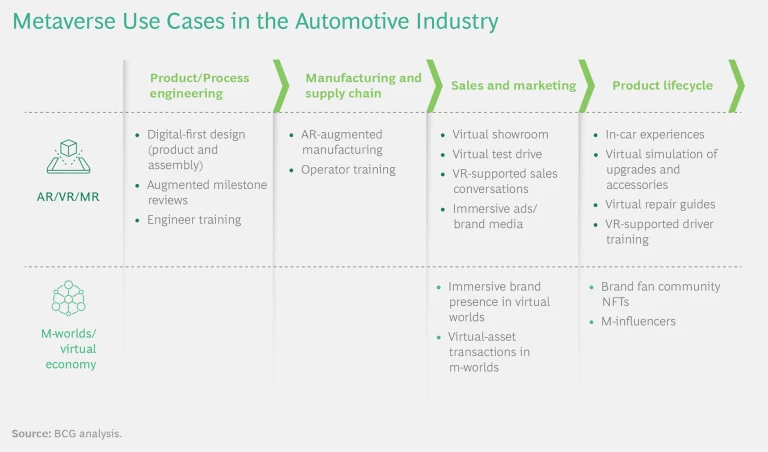

In the automotive industry, AR and VR are being used across the value chain from product and process engineering to sales and after-sales support and service. (See the exhibit.) OEMs and their major suppliers are adopting the technology in engineering and operator training to create virtual showrooms and test drive experiences, and to provide virtual repair guides and simulations of upgrades.

OEMs, especially in the luxury vehicle segment, are using m-worlds and Web3 technology to build immersive brand experiences and virtual assets tied to their real-world products. For example, Alpine, the racecar subsidiary of Renault, is releasing a virtual “hypercar” in five exclusive liveries using NFTs for proof of ownership.

For consumers, in addition to gaming, applications such as MultiBrush allow users to create 3D art in a VR environment. Movies such as Clouds Over Sidra, sponsored by the United Nations, have demonstrated the strong emotional power of the new medium, which can offer tailored experiences in which viewers feel immersed in the story.

Web3 and Virtual Assets

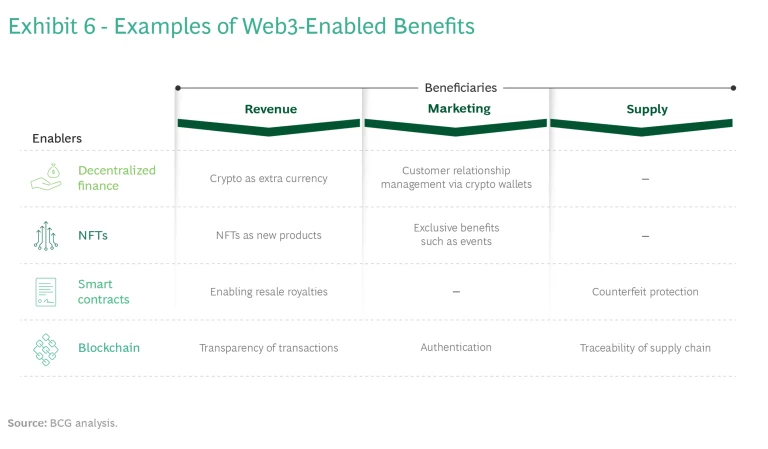

In the initial iteration of the internet (Web 1.0), users read or otherwise consumed digital content that publishers or others created. Web 2.0 allowed users to both create and consume content, but centralized networks continued to control (and make money from) its distribution. In the emerging Web3 iteration, users consume, create, and own content; the networks (and the money exchanged) are decentralized, with blockchain technology replacing centralized intermediaries and providing the trust that enables both consumption and exchange.

Web3 is still at an early stage but is already powering a vibrant virtual-asset economy that includes cryptocurrencies, NFTs, and smart contracts. (See Exhibit 6.) Venture capitalist Matthew Ball estimates that more than $50 billion in virtual goods were purchased in 2021 using “traditional” mobile or credit card processing on web-based applications or on app platforms, such as Apple’s App Store. There are some 30 million NFT wallets, including 1 million active wallets, which spent some $40 billion on NFT purchases in 2021.

Ever since Christie’s auctioned a JPG file by digital artist Mike Winkelmann, known as Beeple, for almost $70 million in March 2021, many companies, including a growing number of large players, have been experimenting with virtual assets, especially NFTs, with art and fashion in the lead. Sotheby’s has launched Sotheby’s Metaverse, a dedicated platform for digital collectors offering a selection of NFTs chosen by the auction house’s specialists. A collection by the digital artist Pak, the subject of Sotheby’s first NFT auction in April 2021, brought in nearly 3,000 new buyers and generated more than $17 million in sales.

To celebrate the 200th anniversary of the luxury brand’s founding, Louis Vuitton has launched Louis the Game, which integrates some 30 NFTs. Nike has acquired RTFKT Studios, a startup specializing in virtual footwear and collectibles. Gucci went digital in June 2021, auctioning a new NFT inspired by its autumn-winter collection. (The week-long auction reached a final price of $25,000, with proceeds going to UNICEF USA.) Burberry partnered with the Blankos Block Party game to introduce its first NFTs in August 2021. And in January 2022, Adidas and Prada brought the Adidas for Prada Re-Nylon collection to the metaverse in their third collaboration.

Companies in other industries are getting into the NFT act. To commemorate the return of the McRib for a limited time on its restaurants’ menu, McDonald’s launched its first-ever NFT promotion with ten individual McRib NFTs available to those who retweeted the brand’s invitation. More than 21,000 people responded within hours and nearly 93,000 had done so by early 2022. In a call with employees, Salesforce’s co-CEOs Marc Benioff and Bret Taylor said they were considering launching an NFT cloud, which would likely combine the company’s cloud tools with NFT technology. The US National Football League offered spectators at this year’s Super Bowl a free NFT specific to their section, row, and seat. Seven tokens were also available for purchase to commemorate the previous seven championship games in the 2022 host city of Los Angeles.

We expect Web3 and traditional financial approaches to coexist in the foreseeable future. For example, in the Roblox store, players can buy “robux” for real money, then use the in-game currency for asset purchases. (Just under 25% of the revenue goes to the creators of the meta-content, the most successful of whom make a living from their work.) Each m-world will choose a virtual or a fiat currency (or a combination), depending on user preferences, underlying platform policies (presumably those of Apple and Meta, given their likely future control of the installed base), Web3 technology advances, and local laws and regulations (such as China’s ban on cryptocurrencies). At the end of 2021, a total of approximately $90 billion in virtual and physical money was circulating on m-worlds, and this number was growing steadily, indicating the rising economic popularity of the metaverse.

The Metaverse Flywheel

The extent of convergence among the three metaverse technologies remains to be seen. (See “Will Metaverse Technologies Converge?”)

Will Metaverse Technologies Converge?

M-Worlds and AR/VR

A vibrant community shares social VR experiences on VRChat, and some upcoming major platforms, such as Horizon Worlds, are betting on this community to grow. Users accessing m-worlds via AR or VR enjoy an immersive experience with all the major headsets providing spatial sound and microphones enabling virtual presence. A condition known as cybersickness (nausea or dizziness caused by the difference between what the eyes see and the motion sensed by the body) has limited adoption at scale, but this is expected to be mitigated through low-latency tracking and rendering, as well as by gradual acclimation to the technology. In time, avatars will faithfully reproduce body movements and facial expressions, improving the experience of social interaction. For example, Meta Quest 3 is expected to feature inward-facing cameras that will enable the user's facial expressions to be projected onto avatars.

M-Worlds and Web3

The Sandbox and Decentraland both leverage Web3 technology, which facilitates interoperability between m-worlds (such as the ability to use the same NFT-proven asset on multiple platforms) and interoperability between m-worlds and the web (such as the ability to buy NFTs on “traditional” websites). The combination of asset creation capabilities and monetization opportunities is addictive for both creators and users, since they are all stakeholders. This convergence will likely attract a vibrant user community over time.

Time Will Tell

Certain m-worlds, such as The Sandbox, could fully converge, while walled-garden m-worlds with their own stores may converge only with AR and VR. In all cases, the convergence will be gradual, depending on headset penetration. The installed base is growing fast (about 26% a year), but it is starting from a small base. Even as it grows to a projected 88 million headsets in use by 2025, that is only a fraction of the 300 million to 500 million users who were already participating in m-worlds in 2021.

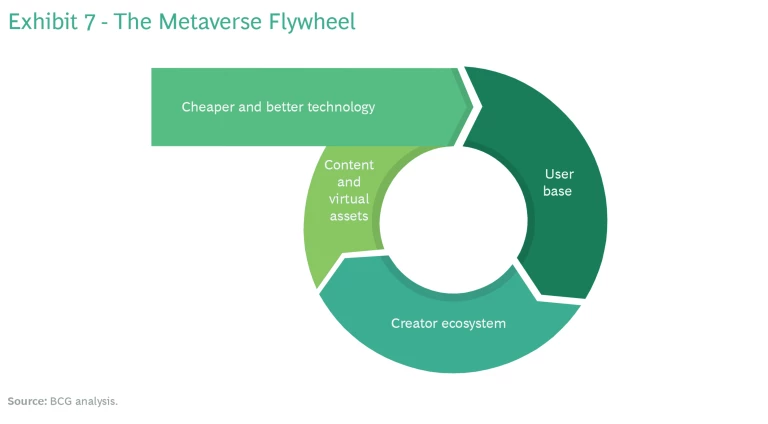

But we expect enough for a flywheel effect to fuel overall growth. (See Exhibit 7.)

Once the user base reaches critical mass, its scale will attract content creators, including both companies (such as gaming studios and media and consumer goods firms) and users themselves. More and better content, software, and assets will make the virtual worlds of the metaverse more attractive and will incentivize users to create and trade assets and cultivate relationships. The technology will improve with innovation and growing scale in the user base, attracting more users. Meta is actively feeding this flywheel by subsidizing Quest VR headsets (estimated at more than $100 per unit) and investing in studios and publishers to boost the content available on the Oculus Quest Store. In 2021, the store is estimated to have generated $1 billion in revenue, and Meta has been publishing highly immersive games such as Lone Echo 1 and 2 and Asgard’s Wrath since 2018.

A $250 Billion to $400 Billion Market Opportunity

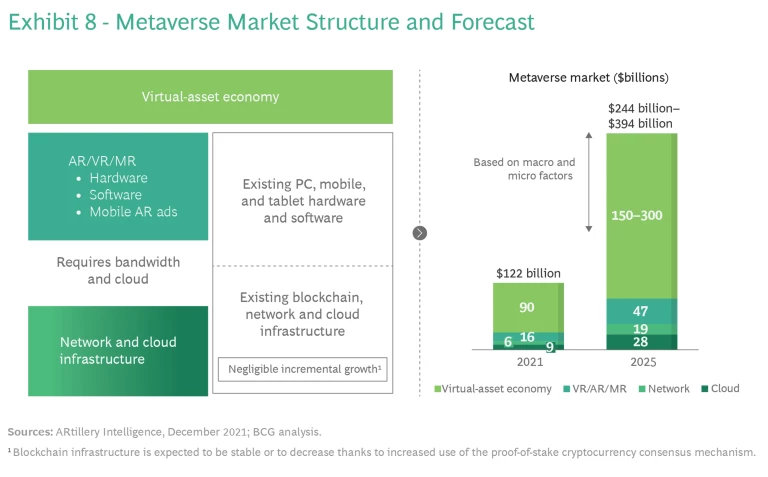

We project a total metaverse market of $250 billion to $400 billion by 2025. (See Exhibit 8.) It will have four major component parts.

The Virtual-Asset Economy. As the metaverse grows in popularity, virtual assets will gain in economic value and a growing number will be created by individual users and exchanged between users and companies. These assets will be owned either in Web3 decentralized infrastructures or in “walled gardens.” The former represented about 40% of the virtual-asset economy in 2021, the latter 60%. Because of the underlying volatility of these assets, we project that their transaction value will range between $150 billion and $300 billion by 2025.

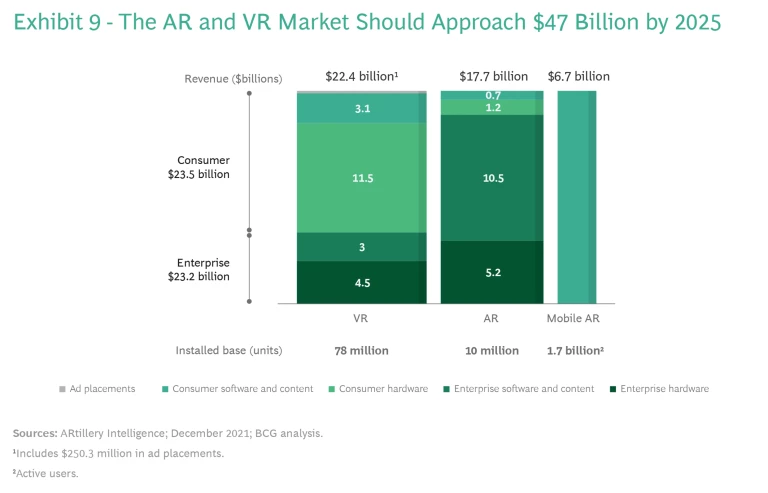

AR/VR/MR Hardware and Software. As the installed base grows, so will sales of AR and VR hardware, software, and applications and content, such as media. The hardware, whose bulk has been a barrier to wider adoption, is advancing quickly, with reductions in headset weight and size in each new iteration. Product roadmaps point to eventual design specs similar to a pair of eyeglasses. Near-term developments promise integration of eye tracking inside the headset, which will allow computing power to be focused exactly where the user is looking, saving on power at the periphery of vision. By 2025, this almost $50 billion market will be equally split between consumer and enterprise buyers, reflecting the productivity benefits stemming from AR/VR augmentation. (See Exhibit 9.)

Network and Cloud Infrastructure. AR and VR experiences will require a powerful cloud infrastructure. For example, Meta is building a supercomputer that is estimated to be 20 times faster than its current machines. “The experiences we’re building for the metaverse require enormous compute power (quintillions of operations/second!),” wrote Mark Zuckerberg. Meta Quest 2 features approximately 2K resolution per eye, and Apple’s headset is expected to reach 4K. But to match human vision, the technology will eventually have to reach 20K resolution. This will drive significant network requirements, both fixed (fiber and Wi-Fi) and mobile (5G and 6G). The metaverse may be what gives 5G a compelling value proposition.

Existing Information and Communications Infrastructure. The metaverse will be accessed through hybrid 2D screens (on mobile phones, tablets, and PC browsers) and AR and VR hardware. Web3 will continue to require a network of mining nodes to power the blockchain. We don’t expect the metaverse to drive a big expansion in the traditional infrastructure market, given the already high penetration of PCs and smartphones and the shift in most major Layer 1 blockchains from the proof-of-work consensus mechanism (which requires expensive mining hardware and electricity) to more efficient computing mechanisms such as the proof-of-stake mechanism (which greatly reduces these requirements).

Enter the Metaverse

The metaverse market that is taking shape offers a wide range of commercial opportunity to companies in multiple industries.

Technology, media, and telecom companies will benefit directly by providing technological enablers, such as 5G, next-generation Wi-Fi or broadband networks, and new operating systems, app stores, and platforms to foster more content creation.

AR and VR tools are being actively explored and used in industries ranging from health care to industrial goods . (BCG recently examined the top seven major trends for blockchain and distributed ledger technologies from the point of view of global banks.)

For consumers, there are plenty of motivations for entering the metaverse that extend well beyond gaming. These offer consumer-facing companies the opportunity to provide:

- New ways to shop, such as virtual storefronts, with virtual try-ons for both virtual and physical products

- Physical-virtual experiences or exclusive access to a brand’s events or concerts

- New ways to participate in m-worlds, such as co-creating assets and experiences, exchanging goods, or earning money

- New ways to interact with others, in communities built around particular interests or areas of exclusivity, for instance, or through experiences associated with the three previous examples

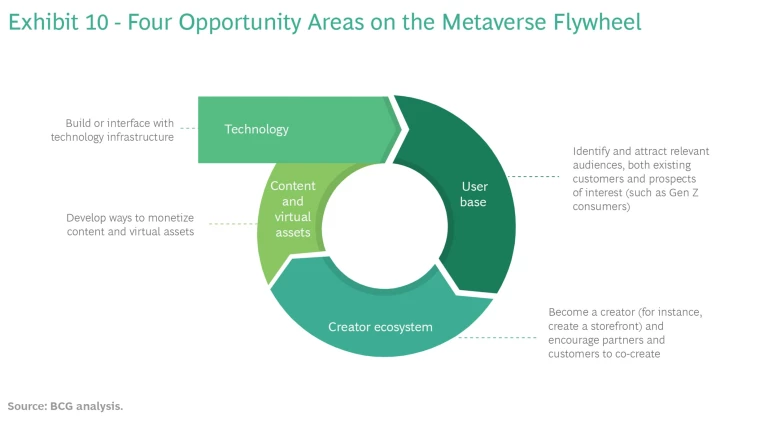

How to Start

Companies can start by familiarizing their organizations with the potential impact of the metaverse. A useful vehicle is an assessment of how the business may be positively or negatively affected by the convergence of the three trends described above: the rise of m-worlds; improvements in AR, VR, and MR; and the expanding use of Web3 assets enabled by blockchain. Companies can then choose areas of focus on the metaverse flywheel and potential use cases for their own efforts. Finally, they can decide whether to (1) become part of building this new infrastructure; (2) monetize content and virtual assets; (3) create B2B or B2C content, or even inward-facing experiences such as customer showrooms, virtual conferences, and remote collaboration solutions; or (4) attract relevant audiences, both existing customers and prospects of interest (such as Gen Z consumers). (See Exhibit 10.)

To develop initial use cases, leaders need to understand that these generally fall into three main categories: customer experiences, employee experiences, and industry/operational support. To increase their understanding of what the future could look like, companies should start with a targeted effort, choosing use cases in the category or categories that are most likely to deliver business value. They can then enable relevant parts of the organization to move into the virtual world, trying out small tests, measuring value, and expanding as their understanding and capabilities grow. (See “Experimentation and Familiarization.”)

Experimentation and Familiarization

- Buy headsets and organize demo sessions to gain internal traction.

- Bring together experienced and passionate people in loose teams that meet regularly.

- Collect use cases and create formats for brainstorming and capturing potential sources of value.

- Invest in prototypes

- Hire talent, including those with XR interest and experience in relevant metaverse fields.

- Make your interest public: communicate externally that the metaverse is on your radar and share what you are doing.

- Build partnerships: the metaverse will be an ecosystem, and there is longer-term value in starting to build connections now.

It pays to remember that as technologies mature, the development of new applications and use cases typically accelerates. Think about the short history of the internet itself, or mobile connectivity, or social media. The metaverse and the technologies driving its development are still young. But adolescence and full maturity may be only a few years away.

The authors thank their colleagues Erik Lenhard, Kaj Burchardi, Mark Zoeckler, Nuri Schömann, and Yannis Campo for contributions to this report.