Powerful trends are shaping a promising yet challenging decade for the industry.

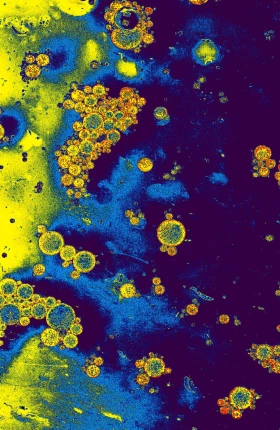

The pharmaceutical industry has a long history of scientific and technological breakthroughs that have greatly benefited human health and provided substantial rewards for investors. Among the material clinical advances have been a cure for hepatitis C, beneficial treatments for 838 rare diseases, and significantly improved survival rates and quality of life for several types of cancers. The successes keep coming: the US Food and Drug Administration approved 378 novel drugs in the 2010s alone. The capstone may have been the lightning-fast development of vaccines for COVID-19 and immunization of more than 5 billion people.

The industry’s success looks set to continue. Scientific and technological advances are filling an unprecedented pipeline of new treatments. But beware: this rising tide of innovation will also produce rip currents that will render the waters tricky to navigate. In a sea of proliferating yet unproven technologies, struggling healthcare systems , and shifting global competitive dynamics, companies will need to make stark choices, confront new complexities, and take on greater risks. All boats will not rise evenly. Even the largest companies will need to adapt; financial muscle and operational scale won’t ensure success.

Based on our work throughout the industry, as well as in-depth discussions with top experts assembled to help assess biopharma’s prospects, we identified 12 critical drivers of change that will contribute to a structural reshaping of the sector in the coming years. How these drivers will combine and interact remains to be seen. Our extrapolations are based in data and observable trends; actual future states will depend on the strategies companies choose in response. We offer these thoughts as a contextual backdrop to help industry leaders chart their courses through changing and turbulent waters.

Expect an Unprecedented Number of Approvals

The worldwide drug pipeline is richer than ever, and just as important, newly discovered assets are typically much better validated than previous cohorts. As a result, we expect an unprecedented number of breakthrough drugs to address—and sometimes cure—diseases that lack promising therapeutic options today.

Two factors point to a golden age of new drug discovery. First, massive amounts of investment are being funneled into biopharma R&D. Total spending has risen by 7% a year since 2015 to $230 billion in 2021, resulting in more early- and late-stage products in the pipeline than at any time over the past decade. At the same time, significant technological advances provide an unprecedented depth of biological insight as well as the ability to design precise targeting and optimized pharmacological agents.

Biotherapeutics now represent over half of worldwide pharmaceutical sales and one-third of all products in development.

Oncology continues to receive the lion’s share of funding, and many blockbuster launches are expected to address familiar indications, such as non-small cell lung cancer. But the expected impacts of these advances extend far beyond cancer. Many of the innovations will lead to breakthroughs in other therapeutic areas, where new modalities are also likely to provide new solutions. With hundreds of genetic treatments under development, we could see true and definitive cures for diseases such as hemophilia, type 1 diabetes, sickle cell disease, and several rarer disorders.

For biopharma companies, there is a caveat to this optimistic outlook. Many of these new drugs will address small patient populations. Big R&D investments will drive high prices for treatments, which will intensify the debate on drug pricing. This dynamic could challenge society’s willingness to share the financial burden of innovation when the results benefit relatively few. Indeed, we expect pricing issues generally to become a growing point of focus; more on this below.

New Modalities Bring Risks and Complexities Along with Opportunities

The very nature of drugs is changing. Past decades have armed drug developers with powerful tools for genetic and molecular engineering, which has expanded the pharmacological arsenal far beyond simple monoclonal antibodies and small molecules. This rich panoply of new modalities promises to unlock new targets, increase potency with fewer side effects, and in some cases even achieve definitive cures. Biotherapeutics now represent over half of worldwide pharmaceutical sales and one-third of all products in development. More than half of the biotherapeutics pipeline is filled with innovative modalities including gene therapy, cell therapy, CAR-T, and bispecific and mRNA treatments.

Not all the new platforms will prove successful, of course, but those that do will yield repeat breakthroughs that can span many diseases. Companies that move early will seize an intellectual property and expertise advantage. For incumbents, watching this technological revolution from the sideline is not an option, but neither is playing everywhere, even for the largest companies. This raises the importance of making thoughtful strategic bets in each disease and modality—and ups the ante on having an alliance and acquisition strategy ready to implement.

Operationally, new modalities bring their share of challenges because they don’t always fit into the well-oiled machinery that companies have built for small molecules and traditional biologics. At each stage of development and commercialization, the novel treatments require new approaches, tools, and expertise. These can include dedicated production plants, intricate supply chains , and complex quality control methods.

Some emerging companies building these new platforms will look to partner with incumbents on some products while retaining their core intellectual property. A few might grow into new industry leaders.

Early Development Timelines and Product Life Cycles Will Shorten

Today’s molecular and genetic-engineering toolbox dramatically reduces the time it takes to create a drug candidate. The technologies used to generate biological insight have also progressed dramatically. This combination suggests lower early-stage attrition and faster early development. These dynamics help explain the richness of today’s drug pipeline, but faster, more predictable drug design will also lead to shorter product life cycles, profoundly altering the competitive playing field.

Indeed, we can expect intense platform-to-platform competition as different modalities, or variations of the same modality, pursue the same biological target. Once a target is validated by an initial product, fast followers will come to market quickly, using the next generation platform or just a different platform that circumvents intellectual property roadblocks (see below).

Count on More Late-Development Bottlenecks and Delays

In contrast to the early stages, later-stage drug development will experience longer duration, higher cost, and greater attrition. The compressed early-development timeframe and the fast-follower dynamics will lead to more candidates initiating trials. As drugs target the same diseases with ever-smaller patient populations, competition for patient recruitment will intensify, slowing trials and increasing their cost. Already, more than 80% of trials fail to enroll sufficient participants on time, resulting in an extension of study and or additional study sites.

In the absence of pure generics or currently unforeseen innovation, markets will organize in stable niches around known targets and treatments.

The ability to negotiate these clinical bottlenecks will sort winners from losers and heighten the importance of best-in-class trial design and execution. Data science combined with expanding patient databases and the generalization of genetic profiling will improve recruitment and outcomes, but they won’t alleviate the competitive dynamics.

Despite an overall trend toward accelerated regulatory approvals, novel treatments will likely be subject to longer approval timelines. In the face of novelty, regulators worldwide can be expected to show extra caution, which will take the form of limited-use approvals accompanied by significant post-marketing requirements for manufacturers. New drugs will take longer to reach their full potential.

The Rise of Fast Followers

The longstanding model of multiyear periods of exclusivity for new drugs—followed by a wave of inexpensive generics—is coming to an end for multiple reasons. First, competition among hundreds of generic manufacturers has dramatically decreased the attractiveness of the model, and generic players’ appetite for risk-taking has diminished. Secondly, high costs, an absence of clear regulatory pathways for new modalities, and thick patent clouds are tall barriers for generics manufacturers.

Biologic blockbusters generally have more than 30 years of patent protection and often hundreds of patent applications. While chemically simple products will continue to see generic competition, a new crop of large and complex molecular entities is more likely to see another form of competitor—non-infringing fast followers. The new competitors’ entry will be facilitated by more predictable product development pathways for known targets and the likely emergence of distinct yet equivalent modality platforms. Ultimately, in the absence of pure generics or some form of currently unforeseen disruptive innovation, markets will organize in stable niches around known targets and treatments, similar to today’s flu vaccine market.

We can expect Chinese manufacturers in particular to actively participate in the fast-follower market, initially targeting their vast domestic market and progressively expanding to emerging markets, Europe, and the US.

A Broader Role for Biopharma in Patient Journeys

Biopharmaceutical companies will increasingly embed themselves in the full patient journey—from diagnosis to outcome—necessitating the co-development of diagnostic and digital solutions. Drug approval as well as reimbursement will become more dependent on the availability of companion diagnostic tools. Outcome-based pricing will require companies to develop adequate patient follow-up and outcome assessment approaches. The high one-time costs associated with new curative medicines may even trigger the need for new financing mechanisms for large out-of-pocket expenses.

Intensifying Competition for Scarce Digital Talent

Both the science and the business of biopharma are data rich and data driven. The most profound impact of more and better data will be in R&D: greater biological and medical insights and more powerful predictive models. The use of electronic medical records (EMRs) has become commonplace over the past decade, with more than 90% adoption among US providers. Genetic data is now inexpensive and ubiquitous.

Building strong digital and analytics muscles will be difficult for many pharmaceutical companies. The challenge involves more than placing a few data science graduates across the company; it requires shifting the overall talent mix over time. Given the general scarcity of digital and analytical talent, attracting these profiles, especially to big pharma, won’t be easy. Harder still will be offering long-term career paths and recognition systems, especially in R&D, which generally favors medical and biological skills.

Biopharma Risks Losing Control of the Clinical Narrative

The increasing availability of, and reliance on, real-world data and real-world evidence will challenge biopharma’s ability to control the clinical narrative. Thanks to the preponderance of proprietary clinical data in the past, the industry has largely been able to shape the narrative underlying how its products are prescribed and used. The coming decade will witness a proliferation, increase in quality, and reduction in cost of data from sources other than biopharma companies. At times, this will present opportunities for manufacturers. But other actors, such as providers and payers, will use such data to challenge and sometimes supersede the narratives proposed by biopharma manufacturers.

Traditional pharma companies that fail to upgrade their technical capabilities risk being wallflowers at the business development dance.

In this tug-of-war, companies will be disadvantaged by their lack of direct access to patient data and the limits that regulations put on their ability to communicate about their drugs. At a minimum, they will need make sure that pertinent data is generated and frame how it should be used for insights. In the best case, they will use data to reinforce drug positioning and messaging. In practice, this means that all new drugs will need to be backed by an extensive data-generation strategy that could involve genetic screening, companion diagnostics, and digital monitoring, among other factors.

Rising Stars and Fading Incumbents

Rapid shifts in technologies will spur the emergence of new industry leaders, while weaker traditional competitors will be outflanked. The advantage of scale alone is eroding due to the smaller “size” of products, a rich and mature outsourcing ecosystem, and expanded funding mechanisms. Venture funds are rapidly growing and creating supporting ecosystems around their investments. Deep-pocketed innovators will be able to delay, or even avoid, licensing or selling out to large players. As noted above, some pioneering platform companies will evolve into full-fledged industry leaders by licensing out some assets while retaining their core intellectual property.

At the other end of the spectrum, incumbents that fail to upgrade their capabilities risk being wallflowers at the business development dance. They will increasingly find that, while cash remains important, it is not enough by itself to make them attractive partners.

Escalating Pressures on US Drug Pricing

The US and its free-market model underpin the economics of the global biopharma industry. Despite recurring debates on drug costs, the industry has so-far avoided any extreme changes in US pricing mechanisms. The next decade could become harder to navigate, though. If the likely cornucopia of drug breakthroughs materializes, it would mean a significant increase in overall drug spending for all participants—consumers, payers (including Medicare and Medicaid), and company benefit plans. Will the US healthcare system accept that?

The issue is further complicated by a likely shift toward smaller target populations for treatments, the resulting increases in drug cost per patient, and the challenges of syndicating cost through insurance. Moreover, the US insurance system isn’t structured to manage the high one-time cost of the many curative medicines in development.

In addition, the unsettled US political environment and rising public sentiment—reflected on both sides of the Congressional aisle—suggest market interventions. An unprecedented number of legislative initiatives are being put forward. It’s impossible to predict where pricing questions will end up, but it seems certain that biopharma companies will need to be better prepared than ever to explain their pricing actions and advocate for policies that support continued innovation and market access.

A Central Role for US Providers

Providers will wield increased power and influence over drug adoption. The US provider model has evolved in recent decades as individual physicians, physician groups, and community hospitals have consolidated into large hospital systems. Today, these systems exercise significant commercial power from their scale and important regional political influence because of their critical role in local economies. Through direct and indirect employment, hospitals sustain approximately 11% of the US total job market, including more than 5% of jobs in all 50 states. Since the pipeline of innovative new products contains primarily physician-administered injectables, profits from pharmaceuticals are becoming increasingly important to health systems. Given their influence and incentives, providers will have a critical say in the adoption of new treatments.

Challenges to the Current Global Order

Biopharma is a global industry: companies sell essentially identical products everywhere around the world. To compete on this scale, they have developed worldwide scientific, supply chain, and market access capabilities. At the same time, the industry has concentrated around a few geographic centers, and a handful of locations in the US and Europe have attracted a growing share of activity .

Western industry leaders will face heightened challenges in delivering global access as new product launches involve more higher-price, lower-volume medicines.

Looking ahead, we can expect to see some dislocation of this model as well as the emergence of new industry centers. Rising geopolitical tensions will make the current global approach more challenging. Companies will need to adapt to the expanding global role of China and its government-directed effort to build an industry that competes—and wins—on a global scale. China’s biopharma sector has benefited from significant public and private capital investment, including about $40 billion a year raised by life-sciences venture and private equity funds. Local players have pivoted from producing generics to follow-on molecules—initially for their domestic market, but ultimately to compete with original brands. Companies are now investing in innovative products to compete on true novelty. For example, China’s share of the world’s early-stage pipeline rose from 2% at the beginning of the 2010s to 12% at the end of the decade.

Current Western industry leaders will face heightened challenges in delivering global access as new product launches involve more higher-price, lower-volume medicines. Unless innovators find ways to supply their drugs to lower-income countries, they will fuel the rise of fast-follower players and even attacks on their patent protections. One potential response could be Western innovators licensing new product variants to emerging country manufacturers.

Finally, changing international and US tax rules will reduce the attractiveness of some European bastions of the industry. These jurisdictions will need to rely more on the expertise of their work force, the richness of their ecosystem, and the strength of their innovators to maintain their positions.

Key Conclusions to Consider

Each company will plot its own path forward, of course, but here are five general conclusions from the above points that management teams and boards should take into account.

Strategy will matter. This is true across many dimensions. Take modality platforms, for example, which present both great opportunities and high risks. Companies cannot afford to forgo the risks by not acting; nor can they count on the right strategy emerging from traditional processes. New modalities don’t fit into the usual product and therapeutic area assessment models. Successfully investing in a new platform will mean going all in and being prepared to maximize its potential in a disease-agnostic fashion.

Complexity will challenge the industry’s operating model. Large pharmaceutical companies are typically seen as well-oiled, if somewhat monolithic, machines. Business development puts licensed assets on the R&D conveyor belt, and a process-based organization shepherds them efficiently through development and commercialization. However, the new breed of drugs, fragmentation of the industry’s global map, and more complex business models will require more flexibility and diversity in the traditional operating model.

Pricing and data dynamics will change the relationship of the industry to its market. Successful companies will evolve from drug developers and manufacturers to become healthcare providers that are involved in the patient journey from diagnosis to outcome. Every new product will require an accompanying data layer so that its effectiveness can be monitored throughout this journey.

The battle for talent will be a determining factor for winners and losers. Digitalization, new science, and new platforms will create an enormous need to expand and diversify the industry’s talent pool. Competition for certain types of scarce talent, in areas such as data analytics and new technical modalities, will be fierce.

The industry needs to plan for both success and backlash. A paradox of the next decade will be that the more successful the industry is in delivering the promise of science, the more likely it will feel the repercussions of success in the business environment. We will witness incredible medical progress but also increased tensions around such hot buttons as pricing and access. For example, a steady stream of successful genetic cures and their cumulative cost could easily become the trigger for price reform in the US. Similarly, industry success will increase the urgency of solving the limited access to breakthrough drugs for many patients around the world. In general, it will be wise for company planning purposes to assume more competition and less pricing flexibility over time.

The next decade will present many cross currents for the biopharma industry, forcing high-stake decisions. The magnitude and complexity of the changes will affect each player differently. The potential winners are likely already beginning to figure out what the coming changes mean for them—and what actions they need to take.

The authors are grateful to the members of the expert advisory panel whose thinking helped shape this article. They are Francis Cuss, former executive vice president and chief scientific officer, Bristol-Myers Squibb; Matthias Hukkelhoven, former senior vice president and head of global regulatory sciences, Bristol-Myers Squibb; Jeremy Levin, chairman and CEO, Ovid Therapeutics; Jim Meyers, CEO, IntraBio; and Craig Wheeler, President and CEO, Headwaters Biotech Advisors.