New regulations are pushing farmers and their suppliers to adopt environmental practices. Traditionalists see this as a disruption, but leaders will treat it as an opportunity.

Around the world, agriculture is shifting to more sustainable practices. The change is due to consumers' growing awareness of the industry’s environmental impact and growing preference for more sustainable food, as well as to new regulations such as the European Union’s Farm to Fork (F2F) Strategy. For producers of agricultural inputs like seed, fertilizer, crop protection products, and machinery, these rules may seem like a major disruption to their business. Indeed, much of the discussion to date has focused on the negative impact of the new regulations.

We recently analyzed the European agriculture market and found that demand in some product categories are, in fact, likely to shrink. But the market overall remains attractive, particularly for companies that invest in innovation leading to new offerings that enable sustainable farming practices. Perhaps the biggest shift these companies will need to make is from business models that emphasize selling products to models focused on selling solutions. That will be quite a change for many agribusinesses. But those that embrace this mindset will not only improve overall sustainability in the agriculture sector but also help protect—and even grow—their business.

New Regulations for a Greener Industry

Europe’s agriculture industry operates about 10.5 million farms and employs almost 9.5 million full-time farm workers, generating about $500 billion in gross value in 2020. The region exports about $210 billion in agricultural goods annually, making it an important global supplier. At the same time, agriculture is the third-largest emitter of greenhouse gases, not only in Europe but globally (after power generation and road transport). Roughly 18% of emissions come directly from agriculture and related land use.

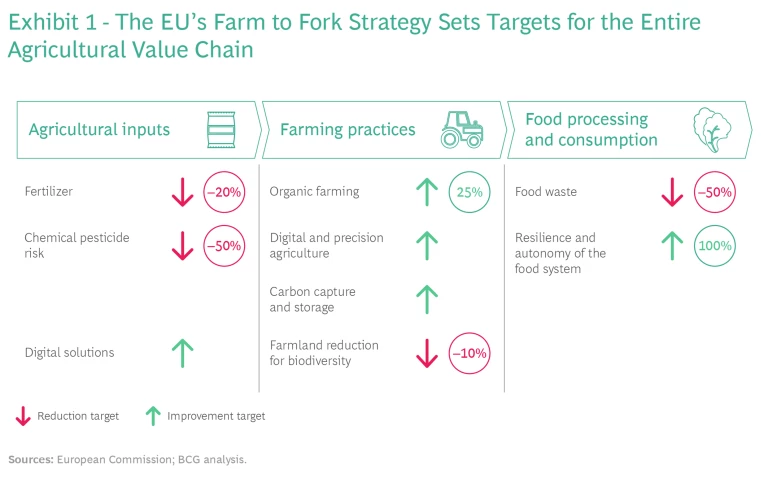

To improve its environmental performance, Europe has become a front-runner in sustainable agriculture. The EU has the strictest rules regarding the use of inputs such as fertilizer and crop protection products. But more changes are coming—specifically, the European Green Deal and, in particular, the F2F policy, with measures aimed at mitigating climate change and reducing agriculture's environmental impact. These initiatives aim to reduce the risk from chemicals, upgrade farming practices, and promote organic farming, biodiversity, and sustainable food consumption, among other goals. (See Exhibit 1.)

Farm to Fork will have an impact beyond Europe's borders. Given global trade flows and the continent's position as a large, attractive market—and a leader in terms of sustainability—developments in European agriculture affect the industry worldwide. Global producers that want to import agricultural products into Europe will need to adhere to EU standards. Moreover, most regions that do not yet have the same level of environmental regulations in place are moving in that direction.

Some studies on the potential impact of F2F have raised concerns about a decline in agricultural productivity—and a resulting rise in

food prices

and decline in the standard of living for vulnerable groups. Studies from the US Department of Agriculture, the Joint Research Centre of the European Commission, and several universities all paint a pessimistic scenario of the industry’s future under F2F regulations.

An Opportunity, Not a Threat

We have a different view. BCG research suggests that these analyses do not sufficiently reflect the results of innovation in agriculture technology, cropping inputs, and agronomic practices. They also underestimate the ability of farmers to adjust their operations to satisfy the new rules. And some analysts have misinterpreted the requirements. For example, F2F calls for a 50% reduction in risk from crop protection products, which has been read as a 50% reduction in the volume of pesticides used. That is not the case.

The F2F rules clearly present challenges. All stakeholders—the agriculture industry, farmers, distributors, commodity processors, and food producers—will need to review and redefine their value propositions and better position their products on global markets in light of ever-increasing consumer requirements for sustainable and healthy food. (See the sidebar.)

Recommendations for Agriculture Industry Stakeholders

Farmers. Farmers will need to adapt their agronomic practices, investing in new service offerings and technologies—such as precision farming solutions—and deploying new product types like biological substances and novel seeds and crop traits. Given the complexity of these new products and practices, some farmers may need to pay more for professional agronomic advice and technical services. In addition, they will need to understand new funding options, such as subsidies that hinge on implementing more sustainable practices.

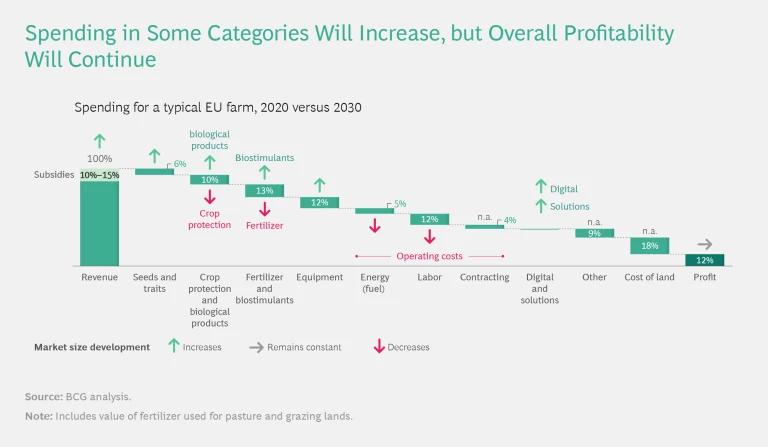

Our P&L analysis indicates that product and service innovations from agricultural-input suppliers can enable farmers to operate more sustainably while maintaining their profitability. These new inputs and services do entail new costs, but at the same time they reduce costs in other areas, such as machine and labor expenses and the costs associated with conventional inputs. (See the exhibit.)

Policymakers. Government ministries and other policymakers need to strike the right balance among legislative requirements, financial incentives such as subsidies, and investment support. In doing so, they can help farmers maintain their profitability during the transition to sustainable practices. In addition, to further boost adoption of new technologies and tools, governments—via local entities such as chambers of agriculture—can offer training to farmers.

Food Wholesalers and Retailers. The food industry is the linchpin between the agriculture industry and consumers. It can spur change by providing consumers with sustainably produced food and convincing them to accept potentially higher prices. It can also set secondary standards (regarding crop protection application levels, for example, or fertilizer usage per hectare) and push to increase efficiency in the value chain (such as through the use of advanced packaging to reduce spoilage). In these ways, food wholesalers and retailers can steer the entire value chain toward more sustainable practices and the adoption of supporting technologies and products.

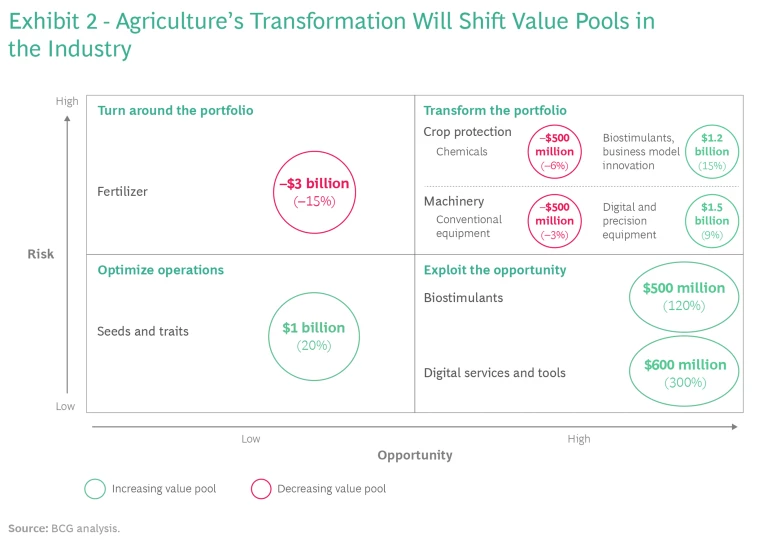

But these new requirements represent an opportunity, not a threat—particularly for fast movers that can adapt their business models and their understanding of the market to the new reality. According to our analysis, the changes mandated by F2F will shrink some value pools and expand others. (See Exhibit 2.) The challenge for agricultural suppliers is to adjust their portfolios in the right way.

Shifting from Volume to Value

For agricultural-input manufacturers, success requires a shift in focus away from sales of products to sales of solutions. For decades, farming assumed a nearly linear relationship between the use of inputs like fertilizers and the productivity of a given field. But now, growing awareness of the environmental impact of chemicals is requiring farmers to maximize output per hectare using lower chemical volumes. Accordingly, input manufacturers need to rebalance their R&D efforts away from conventional product innovation and toward digital tools, new biological products, and integrated solutions that help farmers achieve better results.

Digital Tools. New digital and precision agriculture technologies can help farmers generate better results while reducing the amount of chemicals used. For example, the latest tools enable consistent planting of seeds at the optimal depth. Similarly, pneumatic spreaders can deploy fertilizer more precisely than conventional spreaders, which simply blanket the entire field. Crop protection software helps manage pests and disease, some employing cameras to differentiate between weeds and crops so that products can be applied exactly where they are needed. As a result, herbicides can be better targeted while volumes are reduced by as much as 70%. Modern mechanical weeding robots that likewise use digital imaging can also dramatically reduce soil compaction.

Seed Innovations. Developing novel seeds and crop traits through proven methods like breeding and hybridization, and through new technologies like genome editing, can generate crops with advantageous characteristics. For example, crops designed to be more resistant to stress can thrive in harsher conditions of lower rainfall and greater heat (or flooding). They can also be designed to be more resistant to pathogens like aphids—reducing the need for crop protection products.

Biological Products. Input manufacturers can develop new products that enable farmers to maintain productivity levels using more environmentally sound practices. For example, leaching inhibitors help ensure that fertilizer remains on the field for crop uptake rather than contributing to nitrate emissions. Biostimulants can increase the efficiency with which crops consume nutrients by facilitating plant uptake or availability in the soil. Biocontrol substances, such as microbials, beneficial insects, or plant extracts, can play a significant role in helping to control pests and diseases. Although biological products will never wholly replace synthetic crop protection and fertilizer products, the combination of digital tools, mechanical components, biocontrol substances, and chemical substances used in integrated pest management will be able to protect crops while reducing the use of chemical controls.

New Formulations of Conventional Products. Input manufacturers can develop slow- or controlled-release fertilizers, which make nutrients available over a longer period while preventing leaching and groundwater contamination. These approaches allow farmers to reduce the use of fertilizer without meaningful losses in yield.

Compliance with the Farm to Fork targets is not optional. To achieve them, the European agriculture industry will need to transform. Some companies may resist change, but that is the wrong approach. Overall, spending on farm inputs will continue to grow under F2F, as growers make needed investments in novel and sustainable technologies and solutions. Meanwhile, value pools will shift from conventional product sales toward monetized services and solutions, as well as toward biological inputs that help farmers improve yields and quality. That represents a new way to operate for most agricultural-input manufacturers, but it offers market share gains and economic benefits to those that lead the transformation. Winners that embrace the needed changes and the opportunity to become leaders in sustainability will succeed in defending and even growing their business.

The authors acknowledge the contributions of their colleague Sabeth Neumann to this article.