What does the airline retail revolution mean for leaders? Transformation is needed—and opportunity awaits.

This article is the second in a series, coauthored by BCG and the International Air Transport Association, on the airline industry’s transition from revenue management to offer management—a new approach to retailing products and improving the customer experience.

An airline retail revolution is underway. To retail their products differently, carriers are transitioning from revenue management to offer management . This journey entails an organization-wide transformation, though, and airlines are finding that they have to build new teams and capabilities, reconfigure their processes, and adapt their employees’ roles, responsibilities, and ways of working.

Making this transition constitutes a big leap for carriers, but it can boost top-line growth and significantly improve customer engagement and satisfaction. (See “The Airline Retail Revolution.”) Those who move the fastest and most effectively will lead the industry.

The Airline Retail Revolution

The Airline Retail Revolution

The International Air Transport Association’s New Distribution Capability (NDC) has played a major role in making this advancement possible. Supported by the travel industry, this new data transmission standard, combined with the progress in artificial intelligence and machine learning, is modernizing the way airlines’ products are sold to travel agents, businesses, and consumers.

While many of today’s existing distribution systems compare airlines mainly on price and schedule, the NDC enables carriers to provide a wider variety of products, greater pricing transparency, and real-time evaluation of shopping requests. Airlines are increasingly aiming to generate and sell contextualized offers—products that are customized and priced in real time—and combine ticket fares with ancillary products, such as in-flight meals and priority boarding. Savvy carriers are focused on customer lifetime value and recognize that the ability to retail at the level of the individual customer is essential to their long-term success.

It’s no longer necessary nor advantageous for the industry’s players to be bound by discrete pricing models, static offers, and other legacy features. The ability to provide the right product mix at the right time and price across all distribution channels is the backbone of the airline retail revolution—and it represents a tremendous opportunity for airlines and their customers.

To better understand airlines’ progress, we recently interviewed and surveyed senior and C-level leaders across full-service and low-cost carriers around the globe. The leaders included chief commercial officers, as well as heads of offer management, revenue management, ancillary products, distribution, and inventory teams. Collectively, we spoke with more than 40 leaders from over 25 airlines. These carriers account for more than 40% of global revenue passenger kilometers and over $340 billion in revenue.

Our conversations yielded critical insights into the steps airlines are taking, the challenges they face, and what it will take to overcome them. There’s a lot to consider, but one priority is crystal clear: CEOs should be ready to mobilize their organizations immediately and be ready to lead through the retailing transition.

Current Ambitions

Industry watchers often assume that the companies transitioning to offer management know where they are headed. But many leaders say managers and employees do not have a full understanding of what they are trying to accomplish and how to get there. One likened the effort to bringing a big group together to solve a large puzzle. Further complicating matters is the fact that no airline has made enough progress to serve as an example for others to follow.

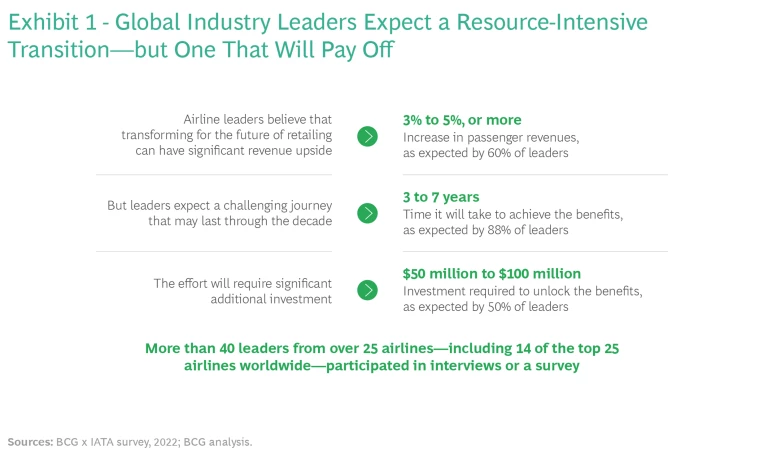

Nevertheless, leaders across the industry remain ambitious about the airline retail revolution. The general consensus is that the required organization-wide transformation will be worth the effort, even if it takes time. Among the leaders we spoke with, nearly 90% expect the transformation to take three years, at least. (See Exhibit 1.) About half expect their distribution-cost savings to be at least 25%, and some even believe that by changing their overall approach to retailing, they can eliminate distribution fees entirely. A majority believe that their passenger revenues will grow by more than 3%, and the most hopeful anticipate that they will exceed 5%. BCG’s analysis suggests that will be the case.

Early Progress

While most airlines around the world are trying to improve their retailing capabilities, some are moving faster than others. Our research suggests that airlines are either acting quickly to be among the first movers or adopting a wait-and-see approach. Those in the latter category are hoping for a firmer proof of concept before committing significant resources. They believe that the whole industry must move in the same direction before any real value can be extracted. Even the most advanced airlines can’t get very far by themselves, the argument goes, because of their dependence on interlining, legacy pricing processes, codeshare agreements, and third-party partners and providers with limited retailing abilities.

Some early movers have already seen savings of as much as 50% in distribution costs.

Early movers—which have dedicated teams and investments to jump-start the journey—are already seeing positive results. Most have come in the form of distribution-cost savings, which have been as much as 50% for some airlines. Additionally, a few carriers have already felt a greater impact in terms of revenue uplift, which generally takes more time to realize. They have seen passenger revenue per available seat kilometer (PRASK) increase by 1% or more.

By and large, early movers (most of which are based in Europe or the Middle East) have focused their initial efforts on improving their technical capabilities. Some are relying on external vendors; others have acquired custom-made systems or developed technology in house. Regardless, having access to enhanced technical capabilities has allowed them to do the following:

- Transform product distribution. First movers are adopting the International Air Transport Association’s New Distribution Capability and shifting traffic to direct channels. This standard is making it easier to collect customer data; ultimately, it can help distribute richer products. These airlines are also implementing new commercial models with distribution partners to potentially reduce booking fees and offer a wider variety of bundles and personalized offers. Some have already entered into new agreements and seen their distribution fees drop to nearly zero.

- Enhance pricing models. Early movers are offering dynamic bundles—instead of standalone fares and ancillary options—and continuous pricing. This improvement is enabling them to shift away from fares tied to reservation booking designator systems—a change that allows carriers to more precisely price according to customers’ willingness to pay for a specific product.

- Leverage data and technology. First movers are learning more about what matters most to customers. For example, one leader who we interviewed confirmed early in the pandemic that flexibility and insurance, not bargain prices, were what mattered most to customers.

Still, even among industry leaders, these efforts have been uneven. A carrier that dedicated funding and resources to getting comfortable collecting customer data will start offering new retail bundles in the next three to six months. However, other airlines are still trying to figure out how to upgrade and consolidate legacy systems. One carrier had to modify more than 200 systems to implement its new cabin product, according to an executive. Another executive’s “eyes were opened” to the retail constraints imposed by old systems.

Technical capabilities are critical, and we expect most players to continue making progress on this front. Nevertheless, our experience suggests that leaders should be mindful of the 10-20-70 rule of thumb: to achieve success, focus 10% of the company’s attention on algorithms and data science, 20% on technology, and 70% on people, processes, and organization considerations.

Reshaping the Organization

Making the most of an organization-wide transformation will require a carrier to become a bionic organization —one that combines the best of its human expertise with the latest technology. To reach this end state, an airline’s leaders will have to address many questions regarding capabilities and the structure of the organization given its starting point and unique context. For example: Who should sponsor the transformation? Which new functions and role types will be required? Who owns these new capabilities, channels, and data? Where should they sit within the broader organization —and how do they work together? What new processes are needed to support them?

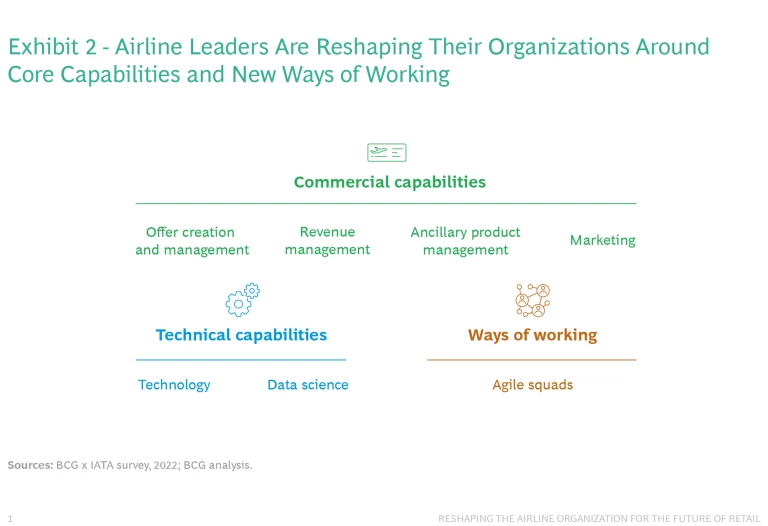

The carriers that have already made progress have shared that they are determining where teams should sit on the basis of their company’s context, and it’s clear that no one-size-fits-all approach exists for codifying these capabilities in the organization chart. But these leaders generally agree on which capabilities are needed for the future of retail. In addition, they are beginning to organize their teams around commercial and technical capabilities, and they are adopting new ways of working. (See Exhibit 2.) The following isn’t an exhaustive list; rather, it includes some of the key competencies that airline executives are focused on today.

Offer Creation and Management. Some airlines are building a dedicated team to create and price bundles, real-time contextualized offers, and other products and services and to sell them to the most relevant customer segments. Such offer creation and management teams are evolving their traditional pricing practices and developing a stronger data-driven customer focus and product orientation.

But questions remain. Airlines are asking where they should place the offer creation and management team within the organization. Nearly 50% of the leaders interviewed and surveyed said that this team should be part of the existing revenue management function. Others think that offer creation and management should stand alone as its own function. In both cases, though, leaders are asking themselves which skill sets are needed (should they be related to data science or marketing, for example), which synergies can be unlocked, and how existing pricing and revenue management processes will be affected by the transition.

Revenue Management. Regardless of whether airlines are planning to assemble a distinct offer creation and management function, they are still considering what a retail transition means for their current revenue management function. It is poised to evolve from ticket revenue optimization (based on fixed capacity) to total revenue optimization. Indeed, our conversations suggest that revenue management teams will have an expanded and more prominent role in the next few years, though many leaders are still determining what the new roles for pricing and inventory management teams will be.

Most leaders agree that revenue management teams will increasingly have to orchestrate data analytics and customer insights to support offer creation. Because of their established position at many airlines and strong understanding of demand and price elasticities, in many cases these teams are best poised to help the organization realize its retail aspirations.

Ancillary Product Management. In recent years, many airlines have assigned the responsibility for managing and pricing ancillary products to the e-commerce function. As leaders increasingly realize the value of ancillary products and holistic offers, however, they are asking themselves where the ancillary product team should sit.

Many leaders are discovering that ancillary product responsibilities should be part of the revenue management function. This placement makes it easier to determine the right pricing strategies for bundles and other dynamic offers and to maximize revenues as part of a broader retailing strategy.

Marketing. The success of offer management relies in no small part on an effective marketing function and company-owned marketing channels. Marketers have a critical role to play in helping their organization get closer to its customers. Using personalized communications, loyalty programs, and social media, for example, marketers can create opportunities to engage outside the traditional booking funnel. Rather than focusing on products and pricing, marketers should leverage customer data platforms and customer resource management tools to distill insights that make it possible to generate personalized offers to the right individuals at the right time.

Technology. The future of airline retailing depends on increasingly complex digital, IT, and technological applications that need to work seamlessly.

Some airlines are decentralizing their technology capabilities across the organization, moving technical talent to functions such as revenue management and marketing. Situating experts in different functions allows carriers to connect the dots among business objectives and move with greater speed.

Other carriers are taking the opposite approach and building a centralized technology function that assigns talent to other functions as needed. Many of the companies moving in this direction are focused on extracting customer insights to feed offer creation. Having a centralized technology function also makes it easier to direct investments, integrate systems, and ensure clear decision rights. The drawback is that members of this centralized function are less exposed to the specific needs of other functions and their business objectives.

Data Science. Few airlines have a data science function in place, a situation that will inevitably have to change as leaders look to implement AI, machine learning, and other technologies that enable more sophisticated personalization and offer-creation capabilities. Taking a customer-first approach to retailing depends first and foremost on understanding the customer, which in turn depends on the extraction and deciphering of data. This makes it possible to determine customers’ willingness to pay, price elasticities, and nuanced product choices.

Agile Squads. Most of the leaders we spoke with recognize that the future of airline retailing depends on enhanced collaboration among functions—and a concerted change management effort to accomplish that goal. A handful of airline leaders are therefore establishing and empowering cross-functional agile squads: project-based teams that operate autonomously and adopt new ways of working to experiment and achieve quick wins.

Some leaders are empowering cross-functional agile squads because they recognize that airline retailing depends on enhanced collaboration.

Several global players have successfully deployed such squads—which include experts from revenue management, IT, distribution, and other parts of the business—to oversee the carrier’s broader transformation. In some cases, the commercial leadership team reviews the squads’ progress monthly and updates senior leadership three or four times annually.

Addressing the Challenges

To successfully implement a company-wide transformation, airlines must also address a few interconnected challenges.

The Battle for Talent. Like many companies, airlines are struggling to hire and retain the people they need—namely, data scientists, technologists, and individuals with the critical commercial skills—to stay competitive. Almost all the leaders we spoke with said that they are losing potential employees and current ones to higher-paying sectors and startups that offer well-defined and appealing career paths. Losing recently hired employees to other employers is especially disheartening. Given the long-term nature of a transformation, keeping employees for two to three years, at least, is essential to ensuring continuity in the change effort.

As a director of revenue management put it, “We have good data and programmers. But it’s difficult to find out what we should charge for new products. How do you combine experience with analytics?” Even those airlines with access to the right data and technical capabilities require people who can use their skills to develop effective retail capabilities. All of this poses a sizable challenge for human resources, as well as learning and development functions. Solving it will require a step change.

Legacy Mindsets. When we asked about the challenges airlines face in trying to advance their retailing capabilities, most leaders ranked their organization’s resistance to change as the greatest hindrance.

Legacy mindsets are stymieing the move to a new commercial approach. Organizations strongly resist thinking of themselves as digital retailers that operate in a world driven by e-commerce. Employees also pushback when asked to adopt new ways of working.

Leaders should therefore focus their attention on building cultures that embrace a test-and-learn approach, growth, and adaptation.

Lack of Top-Down Inspiration. Only 40% of airline transformation programs are led by the CEO. That means many carriers are missing a big opportunity, considering the potential value and chance to edge out the competition.

To successfully carry out their retail aspirations, airlines need a structured vision. CEOs are in the right position to set the context and drive change. An area where the CEO’s involvement is invaluable is getting buy-in across the organization. They are uniquely positioned to set ambitious targets and build a roadmap to success. But above all, they can inspire teams to embrace this opportunity. CEOs can also empower teams to act on this transformation, directing the needed investments, resources, and decision rights to effect change.

Achieving a Customer-First Mindset. Customer centricity lies at the heart of offer management. Moving in this direction requires airlines to understand what matters most to their customers and to implement the organization structures , systems, and ways of working required to deliver accordingly. Customers will quickly notice which airlines are able to offer them the widest selection of products and services, and they’ll inevitably move away from those airlines that are less able to meet their needs.

It may seem like the early days of this retailing transition, but the window of opportunity is narrow, and laggards will lose out if they fail to act. The gap between forward-looking and traditional organizations will continue to widen.

From a long-term perspective, few items are as worthy of being at the top of a CEO’s agenda as the transition to offer management. Undertaking the transformation required—one of extensive breadth and depth—is no small feat. But those leaders who act boldly, make the needed investments, and instill the right accountability and mindsets across their organization will find themselves in a materially better position than the competition.

We would like to thank the leaders who participated in our interviews and responded to our survey for sharing their insights, which were critical to the creation of this article.