By combining human know-how with technology, data, and advanced analytics, energy networks can predict potential failures, optimize asset performance, and reduce the time to deploy.

Over the past several years, many energy network utilities have sought to apply the power of data and digital technologies to asset management. Some of these attempts have been successful. They have increased network reliability while reducing total maintenance costs by 15% to 25%, optimized design projects to achieve the same or better outcomes while costing 50% less, and cut power losses that arise from technical issues by 15%.

But many energy networks have struggled to progress at speed and capture value from their investments. Three factors hinder their advancement: poor data quality, complex and intertwined legacy IT and operations technology systems, and difficulties modifying how networks make and execute daily asset decisions. As a result, these companies are facing falling demand, an increase in off-the-grid energy sources, and, potentially, deteriorating revenues.

Energy networks can blunt the impact of these trends. By taking a bionic approach to leveraging

advanced data

analytics and applying digital technologies, operators can significantly improve how they manage their most critical assets.

What’s Different About Bionic Energy Networks

Traditionally, energy networks think holistically when designing an asset management system, creating comprehensive blueprints and documentation that meet the specifications of the International Organization for Standardization. This approach often leads to a lot of time and money spent on cleansing data, testing technologies, and building new IT systems . After three to five years, many of these companies haven’t achieved the expected improvements in asset management.

Bionic energy networks take a different approach. They bring to bear human expertise along with best-in-class technology to improve asset decision making. These companies do not attempt to replace their people’s expertise with a black box that uses artificial intelligence (AI) . Instead, they combine human know-how with technology, data, and advanced analytics to create optimal decision models and build decision-making capabilities.

First, bionic networks prioritize a small number of specific business outcomes that are critical for the network and imagine ambitious targets. For example, a network may decide to reduce spending on transformer maintenance by 20% to 30% while improving network reliability, or it may target halving overhead operating expenses without increasing asset risk.

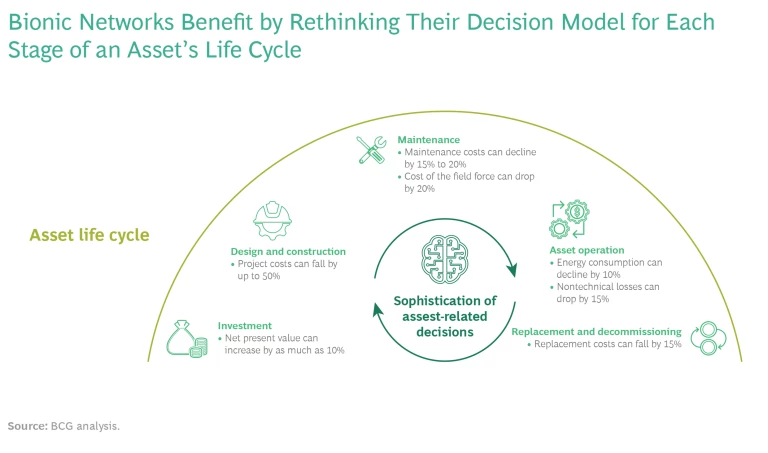

Second, for each asset needed to achieve a business outcome, bionic networks rethink and rebuild the decision model used for each stage of the asset’s life cycle: investment, design and construction, maintenance, asset operation, and replacement and decommissioning. This effort involves identifying the specific data, analytical techniques, and technology enablers. When companies leverage granular asset data and advanced analytics to make decisions across their assets’ life cycles, they have the capability to make the most optimal decisions and have reached a level of asset management maturity that BCG calls 4.0. By making optimal decisions, networks can cut field force costs by 20%, reduce nontechnical losses by 15%, and lower replacement costs by 15%. (See the exhibit.)

For example, it’s useful to rethink and rebuild a decision model that predicts when an asset will need maintenance. The model can help networks optimize the tradeoffs between multiple variables: the criticality of the asset, the economic impact of the decision, the ways that the asset can potentially fail, and the availability of the data needed to monitor the asset. A predictive model may make sense for transformers in grids and gas pumps in gas pipelines because those assets play a critical role in business results.

Third, bionic energy companies bring together multidisciplinary teams to iteratively build new capabilities that are needed to optimize the decision models. Led by representatives from the business side of the company, these teams focus on creating value quickly and improving the experience for the teams and customers. They deploy advanced analytics and AI to optimize decisions for assets at each stage of their life cycles. The teams build capabilities not only in the areas of data science and human-centered design but also in leadership skills. Companies ensure teams’ success with persistent funding models and governance support.

Fourth, bionic energy networks identify and implement the right technology enablers—for example, cloud-based infrastructure, data platforms, and digital user interfaces—that are required to achieve each specified business outcome.

Fifth, to maximize the business impact and return on investment, bionic networks change their operating model and business processes. For example, when real-time transformer monitoring is implemented in an asset control center, it requires redefining the asset maintenance plan and developing processes that enable asset management teams to send work orders to field workers in short time frames.

Asset maintenance, operation, and replacement decisions can all benefit from the bionic approach. With the help of algorithms, networks are better able to predict potential failures, prioritize inspections, optimize asset performance, and reduce the time to deploy.

For example, an electricity network wanted to significantly reduce the amount of money it spent on maintaining and replacing transformers. A cross-functional team reviewed the overall decision model and identified typical failure modes and the data required to optimize decision making. The team used computer vision and text mining to extract additional data, which was then fed into an advanced analytics predictive model. The team also redefined the business processes and employees’ roles and responsibilities, codesigned digital interfaces, and trained workers to apply the new model. Overall, these efforts—from running the diagnostic to developing new ways of working—reduced total expenditures by more than 20%. And they took less than eight months.

How to Start Building Bionic Asset Management Capabilities

Networks should first determine the business outcomes they wish to achieve and prioritize them. Companies should then chart a journey to bionic asset management.

Where to Go. Which areas offer the largest potential for improvement, considering the current asset management maturity level, spending levels, and cost-reduction opportunities? On the basis of this assessment, companies can prioritize a few business outcomes and define the actions and time frames needed to achieve them. Identifying the use cases, communicating the business ambition, and maximizing the return on investment will all be critical to succeeding.

How to Get There. While technology is undeniably important, companies that achieve bionic outcomes typically focus 70% of their effort on people capabilities and business processes, only 20% on technology, and 10% on algorithms. When it comes to asset management specifically, energy networks should take these steps:

- Review and reimagine the decision models used for asset investment, operation and maintenance, and replacement. Networks that use advanced analytics can develop the insights needed for more-informed asset decisions. And having an understanding of real-time asset health and of the potential impact of asset failures can significantly improve a network’s ability to maintain and replace assets.

- Assess the need to evolve the operating model. To engineer a transformation that captures the most value, companies need to review business processes end to end and make corresponding changes to the operating model. That will allow them to effectively integrate new digital technologies via drones, sensors, and automating equipment such as digital substations.

- Set up an asset control center. Companies also need to set up a control center that’s equipped with a real-time dashboard and a decision-making engine. The technology not only enables predictive maintenance but also allows asset managers to run simulations that will reveal the best strategies for maximizing asset availability and yields.

How to Accelerate the Pace of Change. Networks should pilot a decision model with the data on hand and make changes as needed. To accelerate the pace of change, it’s critical to ensure that the organization adopts the new digital capabilities and ways of working.

Companies do not need to apply every newly developed decision model to every asset class. Deploying a new model takes resources and effort. Thus, there needs to be a clear business case and a sizable business outcome for every initiative that’s undertaken. Bionic companies focus on building the capabilities that can best drive the desired business outcomes. That means boosting only some capabilities to a 4.0 maturity level.

As it becomes increasingly critical to optimize decisions across the asset life cycle, business outcomes should drive the implementation of advanced analytics and digital technologies. This approach will likely require many energy network companies to rethink their digital strategies, but good asset management will depend on it.

The authors thank their former colleague Javier Argüeso for his contribution to this article.