This is the first in a series of articles highlighting how deep tech—the problem-driven application of advanced technologies to address large-scale issues—can help deliver superior value and growth while enabling companies to achieve their goals. Here we examine why deep tech will almost certainly be part of your company’s future.

For most companies, the question of whether advanced technologies will disrupt their business is a matter of when, not if. A corollary question for incumbents is whether they will be drivers or casualties of the changes these technologies will enable.

There are plenty of reasons why deep tech is starting to make deep inroads. One of the biggest and most immediate is the global push for more-sustainable business practices. We know that in many industries, true sustainability (net-zero emissions, for example) cannot be achieved without the help of new technologies. We also know that moving early as a new technology trend emerges can create enormous value (witness Tesla taking on electric vehicles or Pfizer, BioNTech, and Moderna investing in RNA vaccines).

As our colleagues recently pointed out in Fortune, the number of startups disrupting the long-standing competitive advantage conferred by scale is growing fast. Backed by the rapid growth of high-risk venture capital funding, small companies often win by focusing on solving critical, large-scale problems and exploiting a combination of maturing digital technologies (such as AI and cloud computing) and emerging physical technologies (synthetic biology and architected materials, for example). This convergence is the essence of deep tech innovation.

Little surprise then that a growing number of big-name venture capital investors are shifting their focus from software to deep tech, attracted by the prospect of solving the biggest challenges facing the world while making money doing it.

BCG and Hello Tomorrow have estimated that venture capital funding for deep tech startups increased from $15 billion in 2016 to more than $60 billion in 2020. In the first eight months of 2021, venture funds put $77.5 billion to work in advanced tech startups, according to MIT’s venture firm, The Engine.

A growing number of big-name venture capital investors are shifting their focus from software to deep tech, attracted by the prospect of solving the biggest challenges facing the world while making money doing it.

For incumbents, waiting on the sidelines to see which technologies, or combinations of technologies, develop high-impact applications is not a practical option. They will find themselves playing catchup. Any existing business that has set ambitious goals, such as improving sustainability or building resilience, will need to incorporate one or more deep tech solutions sooner rather than later. This includes companies that produce a physical product or that support a business that produces a physical product, especially if they have made net zero commitments to their customers and shareholders.

But deep tech presents established companies with a twofold challenge. Evaluating the potential of advanced technologies is tough, and finding a winning combination of market need and emerging technology that meets it is harder still. Even the most successful venture capitalists place more losing bets than winning ones.

Here’s our guide to how CEOs can size up the relevance of deep tech for their own organizations.

Identify the Opportunities

A good way to start is by taking a page from the startups and adopting a problem-centric approach. Rather than focusing on the individual technologies themselves, it can be more productive to think about the major needs and problems in business and in the economy that emerging technologies could solve. Venture capital investor Mike Maples calls this “backcasting”: starting from an imagined future state and working backwards to envision how to get there.

The think tank RethinkX has used this approach to illustrate what a global economy based on sustainable energy systems, food production, and mobility could look like in 2035. Its work highlights the idea that technology-driven changes in agriculture or mobility would ripple throughout the global economy, improving sustainability while fundamentally altering value chains and disrupting incumbent systems and players. For example, a switch to proteins manufactured with precision fermentation (a “microbrewery” for cell-based meat) and vertical farming radically changes the requirements for water usage, shipping, and energy.

Since combating global warming is one of the biggest challenges we face, we analyzed the opportunities for deep tech solutions in six sustainability-related areas.

Sustainable Buildings and Materials. Construction and buildings account for 38% of global energy- and process-related emissions, with 10% coming from materials and construction and 28% from energy related to building operations. What if building materials could be sustainably produced and finished structures offered superior functionality such as enhanced energy efficiency and self-healing? Emerging materials and production process technologies now offer paths to this sort of performance. New intelligent building systems that integrate advanced sensors, smart materials, edge computing, and AI can reduce energy consumption. Making these changes at scale requires reimagining current construction systems for raw materials and components and retrofitting older residential and commercial structures.

Clean Energy Systems. The expanding adoption of sustainability targets is forcing a gradual transformation in energy generation, storage, and distribution. Three quarters of all greenhouse gas (GHG) emissions come from energy generation, and about 85% of current global energy generation uses fossil fuels. What if we could have abundant, clean energy at any time? Energy systems are rapidly evolving as advances in integrating new power sources, materials, batteries, sensors, and AI enable new opportunities for local and modular generation, storage, and real-time adaptive power distribution. As solar and batteries penetrate more markets, we are also seeing new production and distribution models emerge, from dynamic demand response to distributed microgrids, that challenge the dominant paradigm of power plants and distribution networks.

Efficient Mobility. Roughly 16% of global GHG emissions are transportation related, with 30% of the transportation total coming from freight, 12% from road vehicles, 2% from shipping, and 2% from aviation. Electrification and decarbonization, as well as advances in AI and autonomous vehicles, will present both existential risk and big opportunities for disruptive growth for players throughout the transportation and shipping sectors. For example, what if the value chains for logistics and transportation were unbundled and reimagined? Could improving battery chemistry and performance, coupled with advancements in AI and sensors, radically reshape transportation and logistics? Could today’s mix of manned air, rail, and road (trucking) be transformed into a more efficient autonomous distribution and delivery system, involving everything from e-bikes to self-driving long-haul trucks? The slow build-out of EV charging infrastructure and the lack of success so far with drone delivery highlight that simply introducing a new technology will not lead to radical change.

Sustainable Manufacturing and Materials. Eight global supply chains, including food, construction, fashion, electronics, and mobility (and the energy they consume), account for 50% of all emissions, with raw materials extraction and refinement responsible for the majority of CO2. What if it were possible to combine upcycled materials and biomass to displace nearly all virgin materials? What if flexible, localized manufacturing facilities could achieve comparable economies of scale to those of large plants? These changes would accelerate the current restructuring of global supply chains, create ripple effects on logistics, and potentially generate substantial positive social impact. It’s starting to happen: emerging materials and synthetic biology platforms are being integrated into new manufacturing systems and offer the means to break through long-standing tradeoffs involving efficiency, scale, resilience, and sustainability. Still, existing value chains encourage drop-in substitutions that must compete on price and performance instead of unlocking new use cases and functionality.

Green and Efficient Agriculture. Animal-based foods account for nearly 60% of agricultural GHG emissions, and as income levels rise, demand for these foods is projected to increase by 70% by 2050. Productivity in plant-based agriculture also needs to rise by 50% if we are to grow enough food to feed the projected global population in 2050. At the same time, the agriculture sector must reduce emissions by 70% to meet global warming goals. What if a combination of regenerative agriculture and synthetic biotechnology could work together to address both issues? Emerging technologies that improve and personalize nutrition, produce protein more sustainably, improve plant yields, and reduce food waste may offer ways to rethink the global agriculture system, but they will also require a reimagination of the value chain from farm to table that is on par with the Green Revolution of the 1960s.

Clean Water and Sanitation. Some 3.2 billion people today live in areas with water scarcity or shortages, and by 2050 water demand is expected to grow by 55%, particularly in the developing world. In semi-arid climates, such as parts of California, drought coupled with increasing demand from agriculture, industry, and population have outstripped conventional supply options. Advances in desalination, materials science, and synthetic biology may offer ways to unlock both positive social impact and commercial value. But as current debates over desalination in southern California illustrate, systems for water usage, distribution, and storage, and issues related to brine or salt discharge, must also be considered, even if desalination were free and energy plentiful.

Sizing the Opportunities

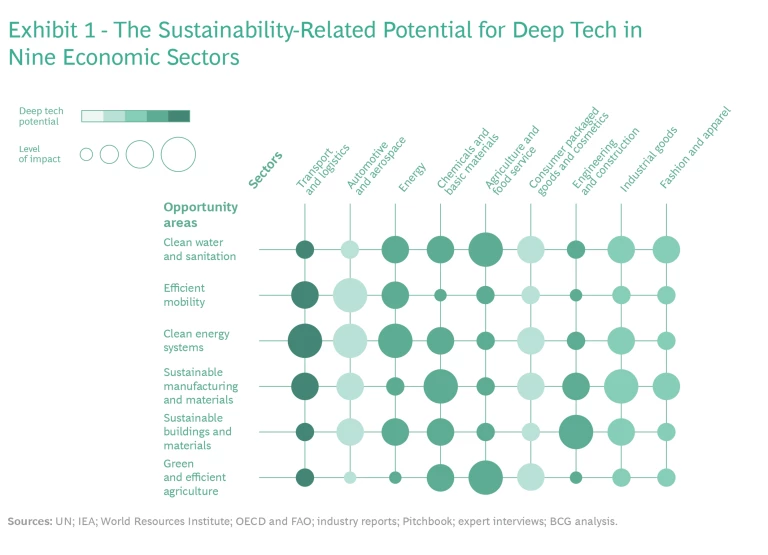

We estimated the total market size of these opportunities in nine relevant economic sectors: transport and logistics, automotive and aerospace, energy, chemicals and basic materials, agriculture and food service, consumer packaged goods and cosmetics, engineering and construction, industrial goods, and fashion and apparel. Since each opportunity area has a different degree of impact in each sector, we used an application-centric view to size the potential value that deep tech can create, integrating the size of the sector, the relevance to sustainability, and the potential for deep tech to resolve (or otherwise alter) tradeoffs in profitability and sustainability. (See Exhibit 1.) The full potential impact in each sector may not be immediately apparent because systems have interdependencies; a deep tech-catalyzed change in one sector may ripple into many others.

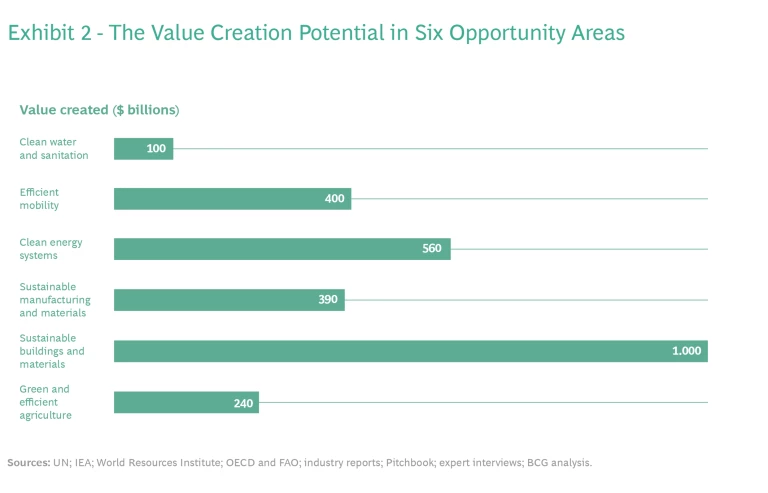

When we assumed only relatively simple technology substitutions in existing value chains (such as swapping out an internal combustion engine for a hybrid equivalent), we identified new revenue streams totaling $123 billion. But when we included identified systemic changes in energy, mobility, and the built environment, we found new revenue streams totaling as much as $2.7 trillion. (See Exhibit 2.)

Take the example of clean energy systems and the potential of realizing nuclear fusion at scale. Multiple ventures (among them Commonwealth Fusion Systems—which recently closed a $1.8 billion funding round—General Fusion, and Helion Energy) are gaining increasing visibility in the power generation sector as they bring together advances in materials design, AI, and modeling. In February 2022, a big breakthrough in energy output at the Joint European Torus facility in the UK caught worldwide notice.

If one or more companies are successful in realizing fusion, this will bring about systemic change to multiple industries, including manufacturing, shipping, and building construction, to name a few. Not only will the energy and power sectors undergo fundamental disruption and transformation, the availability of cheap, abundant, portable, and sustainable energy will quickly lead to major disruption, counterintuitive outcomes, and transformation in numerous other opportunity areas. These could include clean water and sanitation (desalination would become much more economically viable) agriculture (inexpensive irrigation would be a reality), manufacturing (aluminum production would no longer generate 2% of global GHG emissions because of the shift from coal), and transportation and mobility (hydrogen would become a much more viable fuel source). All of which would be game-changing impacts for companies around the world and across the global economy.

Companies that assess opportunities accurately can jump ahead of the disruption new technologies will cause and become disruptors themselves. Unilever is partnering with food technology company ENOUGH (formerly 3F BIO) to use ENOUGH’s zero-waste fermentation process to expand Unilever’s range of plant-based meat alternatives. Ten major airlines in North America, Europe, and Asia have joined BCG in the Aviation Climate Taskforce , a global coalition that seeks to accelerate breakthroughs in the emerging technologies that can help the industry achieve net-zero emissions. These initiatives share a common approach of deconstructing value chains and rebuilding them around new opportunities enabled by technology.

Unlocking Value with Deep Tech

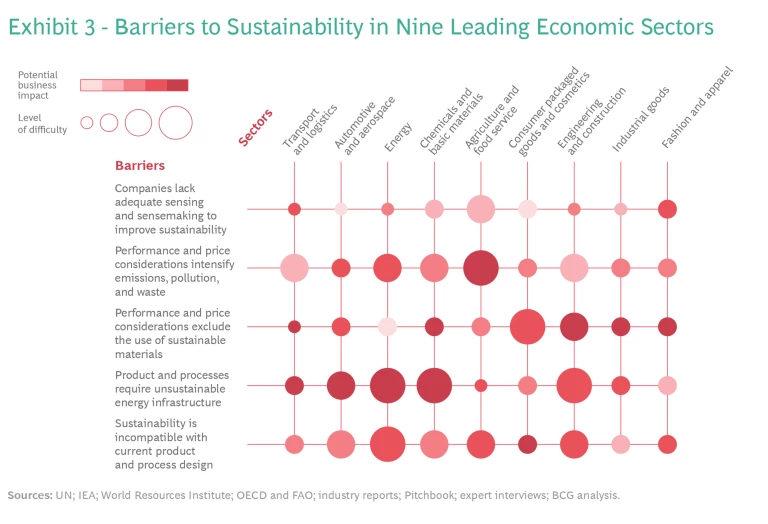

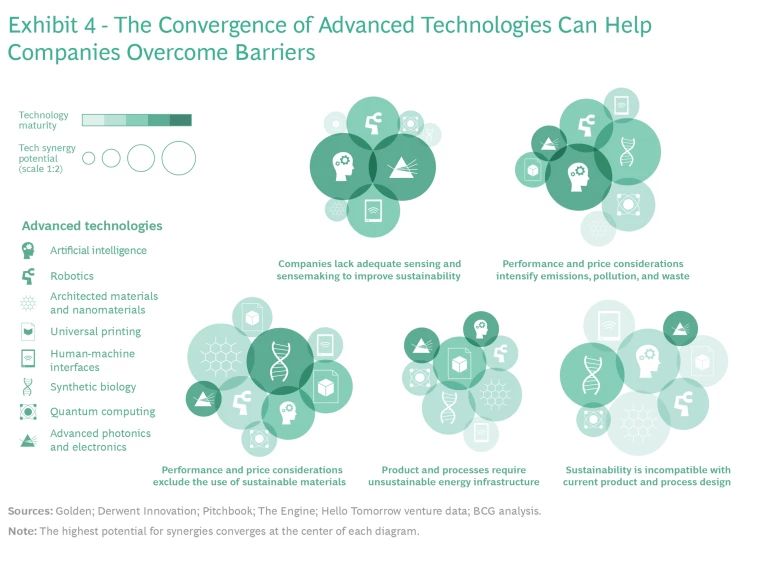

Each of the nine economic sectors we highlight has big technological, economic, and structural barriers to the adoption of sustainable business practices. (See Exhibit 3.) Actions in every sector have an impact on other parts of the system, which leads to further constraints that limit the opportunity for sustainable growth and value. For example, product performance and price considerations impede the reduction of emissions and use of sustainable materials all along the value chain, from sourcing to manufacturing to shipping and distribution. Manufacturing processes require unsustainable energy infrastructure and use, and sustainability goals are incompatible with current product or process design.

Thus, the biggest innovations are likely to come not from a single technology but from the convergence of multiple technologies that remove a barrier or resolve a long-standing tradeoff. As we outlined above, the underlying technologies are increasingly accessible, available in numerous forms, and evolving rapidly. Anyone today can buy a drone or a 3D printer (and the relevant software), there is a growing “DIY bio” movement, and AI technology is increasingly accessible through “low code” or “no code” tools. Rising accessibility is complemented by the development of a venture incubation and acceleration infrastructure that facilitates rapid experimentation. For example, venture capital firm SOSV provides vertical ecosystems that give startups access to expertise and infrastructure to help accelerate prototyping and testing. Many can often be rapidly distributed via networks.

Recent academic work has shown these “granular” technologies mean faster learning, lower investment risk, less complexity, and higher returns on innovation

Some companies are already using converging technologies to remove barriers and open doors to substantial value creation. (See Exhibit 4.) John Deere, for instance, is applying a combination of sensors, data from the Internet of Things, and AI to improve the performance of its agricultural equipment products, helping cotton farmers save nearly $50 an acre in production costs and reducing herbicide usage with a new data-based business ecosystem. In the process, Deere and others have sparked a revolution in “precision ag.” IBM’s RoboRXN autonomous lab combines AI, robotics, and cloud computing into a new approach for materials discovery.

Four Levels of Deep Tech Ambition

In a series of papers in 2015 and 2016, energy and climate scholar Arnulf Grubler and his coauthors posited four levels of technological change, in order of the complexity of the technologies involved and the ability to scale the solutions they

- Tech Substitution. These changes, drop-in replacements for technologies in an existing system, involve one or more technologies that can scale fast (within a few years) but are generally incremental in terms of impact. Speed to scale depends on technology discovery and maturation.

- System Upgrade. This involves improving an existing system, with moderate potential for change and adding value. Examples include building cars around sensors and software or adding solar panels to houses. This level also involves limited complexity and fairly rapid scaling, which is limited only by capital availability, the ability to integrate, and product release cycles.

- System Transformation. This refers to altering the system with higher potential for value. Examples would be constructing a charging network for EVs or designing a smart grid that includes the capabilities for power storage and local solar. Complexity and time to scale increase at this level; a 5- to 20-year time frame is not uncommon given the need to manage interfaces and build a development stack shared across the ecosystem.

- System of Systems (SoS) Transformation. This level of change entails building an SoS infrastructure. It involves rethinking, redesigning, and then implementing an entirely new approach to a core capability or need, such as electrifying the entire automotive sector and modernizing the power grid at the same time. Institutional and societal adoption require time; historically SoS changes have taken 20 years or more, although digital adoption has moved faster.

The four levels of systemic change provide a useful means for assessing both market and growth potential—and the viability and impact of deep tech ventures. What are the leverage points that unlock value in a system? Is a new venture aspiring to address one or a few of these, or is it making a system play that encompasses all touchpoints?

While deep tech ventures can rapidly prototype drop-in or upgrade technologies using ecosystem infrastructure, scaling up to systemic impact can be more challenging. Most innovations—and the technology ventures that build on them—start small, with a narrow focus on the first two levels of tech-driven change. Some young firms benefit from distributed manufacturing, but others—such as materials ventures, which integrate into existing value chains—need access to corporate testing and production infrastructure to have a real effect. Large companies are used to operating in multiple markets, and many have coordinated higher-value networks or SoS-level change. Those businesses have an opportunity to redefine systems and create sustainable business models.

In the digital realm, Google started as a search engine, and Facebook started as the operator of a social media platform. Amazon famously began as a bookseller, an infinitesimal part of its business today. It was only as these companies grew in size and sophistication that they broadened their horizons to encompass adjacent (and more distant) markets and complementary technologies—and sought to advance more systemic levels of change. Similarly, Tesla started with electric vehicles but has moved into mobility and energy storage and distribution.

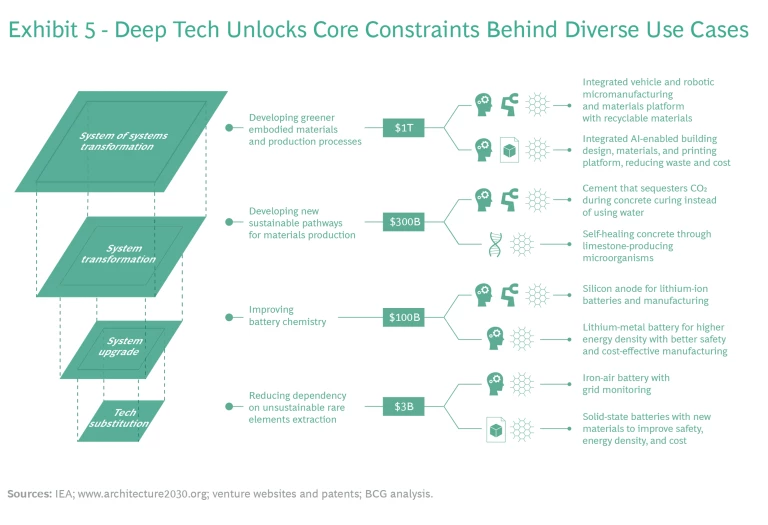

Advanced technologies that work together in multiple industry verticals at different levels can help surmount the price and performance considerations that hold back greater use of sustainable materials. (See Exhibit 5.) The combination (in varying forms) of architected materials, synthetic biology, robotics, universal printing, and AI, among other technologies, make possible improvements in sustainability ranging from capability-expanding materials substitution (such as SiFAB’s next-generation silicon anode for batteries ) to systemic change in manufacturing processes (such as Arrival’s use of recyclable plastic body panels integrated with robotic vehicle manufacturing).

Rapid innovation cycles built around increasingly accessible technologies create urgency for business. Startups (and well-established companies) in the fast-growing alternative protein industry are employing a full collection of advanced technologies, including synthetic biology, AI, robotics, and 3D printing, to create new foods with high consumer appeal and low climate impact. Many believe these products, which are less than a decade in the making, have the potential to realign the food sector around new raw materials, products, and processes.

How to Start

Digital technologies initially constituted a systems upgrade—a new way to distribute, consume, and manipulate data. They morphed in short order into a full SoS transformation of how we live, work, and interact, with systemic impact throughout virtually every sector of the economy. Many well-established companies were completely overtaken; others are still wrestling to adapt.

The combined physical and digital nature of deep tech innovation—and the convergence of multiple technologies to drive systemwide change—means incumbents have a better opportunity to get involved early and shape how that change takes place.

Deep tech promises changes that are equally—or even more—far-reaching, but with a critical difference for incumbent companies.

The combined physical and digital nature of deep tech innovation—and the convergence of multiple technologies to drive systemwide change—means incumbents have a better opportunity to get involved early and shape how that change takes place.

In forthcoming pieces in this series, we will outline in more detail how traditional companies can play in deep tech and the strategies they’ll need to be successful. For now, forward-looking CEOs should ask themselves the following questions:

- How can we reimagine our future products or services, operations, and supply chain to create great customer experiences and growth sustainably?

- Working backwards from that future, how might emerging technologies overcome constraints or alter the value chain?

- What are our unique capabilities to define structural incentives, mitigate risks, resolve key frictions, or provide synergistic capability to a partner?

- Which other companies, venture funds, or deep tech startups are actively attacking common constraints to sustainable growth that are similar to the ones I face, and what approaches are they taking?

- Is our R&D organization and corporate venture arm taking a strategic, knowledge-centric, and systemic perspective to creating and preventing disruption?

Remember that the rapid innovation cycles built around increasingly accessible technologies mean that disruptive capabilities develop more quickly than ever before. This adds urgency to the related question of whether companies want to be the cause or the victim of disruption.