Globally, financial institutions (FIs) are spending billions of dollars every year pursuing digital transformation. But there are vast differences in how they invest in this transformation—and the returns on those investments. We calculate that if all FIs worldwide were to reach the highest level of digital maturity, they could collectively grow revenues by $100 billion per year for the next decade.

To develop a more nuanced understanding of this landscape, we leveraged the BCG Digital Acceleration Index study to analyze nearly 250 FIs from Asia, Europe, and North America to answer a fundamental question: Does having a digital strategy in place improve performance?

Our findings were unequivocal. The best performers are those that establish a clear digital strategy from the outset to guide their efforts. Their investments have resulted in higher revenue and earnings as well as lower overall costs compared to competitors. This finding might have been somewhat expected. What was unexpected, however, was the poor performance of financial institutions that pursue digital initiatives without a guiding strategy—even compared to those that aren’t pursuing or have just begun digital initiatives. These companies need to take immediate steps to course correct.

The Five Archetypes

Some FIs are clearly at the forefront of digitization, scaling their digital initiatives and reaping the benefits. By leading with a strong digital strategy, they attract, retain, and inspire talent—and have the right guardrails in place for sound, consistent decision making. But many FIs are developing digital in a more scattershot manner. They have launched individual digital initiatives without a strong digital strategy. Thus, they have difficulty scaling these initiatives, which often atrophy over time before value can be created. These findings hold important lessons for those just beginning their digital transformation journeys.

FIs that launch individual digital initiatives without a strong digital strategy have difficulty scaling and creating value from them.

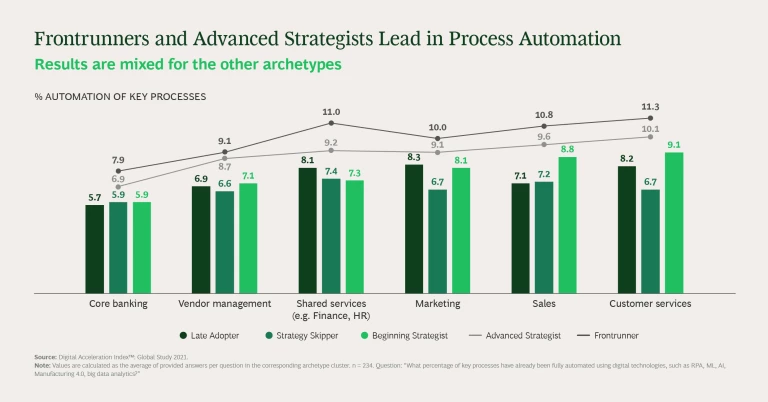

As part of our research, we identified five FI archetypes—Frontrunners, Beginning and Advanced Digital Strategists, Digital Strategy Skippers, and Late Adopters—and conducted a detailed statistical analysis of their performance across a range of performance metrics. The archetype classifications are based on levels of digital maturity using the BCG Digital Acceleration Index in the areas of digital strategy, employee capabilities, technology, and outcomes.

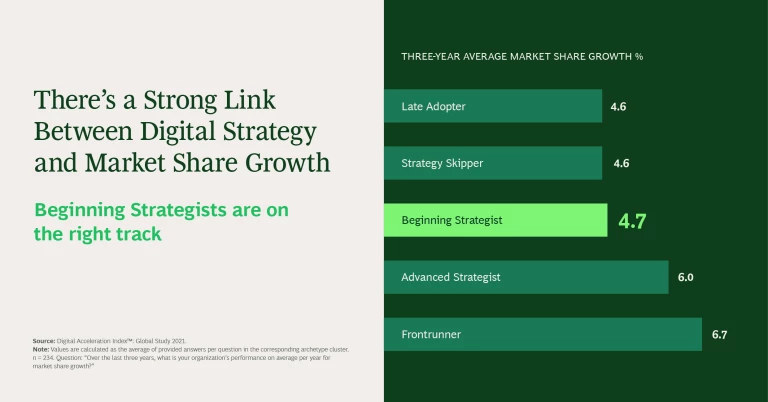

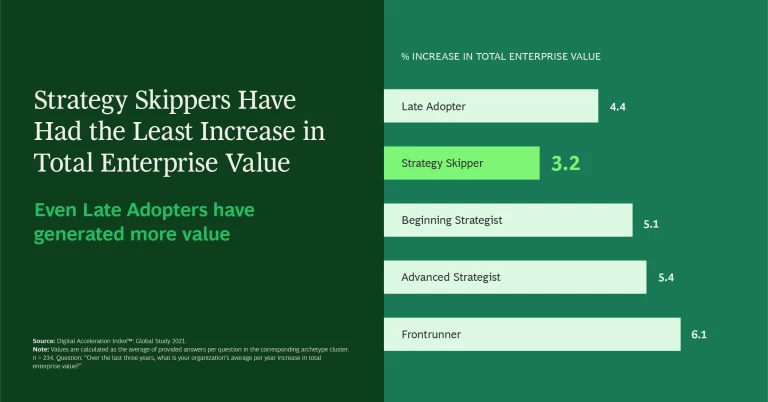

What’s especially striking from our findings is that even though Strategy Skippers are committed to moving fast and investing in digital technology and employee capabilities, they consistently place fourth or fifth across a range of important performance metrics (see slideshow). For example, over the past three years, Strategy Skippers grew their market share by an average of 4.6% per year, while Advanced Strategists and Frontrunners grew their market share by 6.0% and 6.7%, respectively. Similarly, over the same period, Strategy Skippers grew total enterprise value by an average of 3.2% per year, while Advanced Strategists and Frontrunners grew total enterprise value by 5.4% and 6.1%, respectively.

Let’s take a closer look at each archetype.

Frontrunners. In terms of digital maturity, the Frontrunners are clearly best in class and are far superior to their competitors in all areas. They have a clear digital strategy, and their leadership is fostering cultural change. Instead of making digital decisions silo by silo, which impedes consistent implementation, they make decisions designed to get buy-in from the entire organization, thus accelerating implementation. Frontrunners have a pool of talent capable of executing digital projects, they have scaled a first wave of data analytics and AI use cases, and they have strong cybersecurity capabilities. Some of them even aim to become tech companies themselves.

Compared to other archetypes, Frontrunners (which accounted for 23% of the surveyed institutions) perform exceptionally well across multiple performance metrics, including market value and growth performance, impact of digital initiatives, and levels of process automation. The bottom line is that being a Frontrunner pays off handsomely. Geographically, Frontrunners are more common in Asia and less common in Europe and North America. For example, 31% of FIs in Asia are Frontrunners, yet just 18% of European FIs have reached this level of digital maturity. This is most likely due to Asia having a generally younger, more digitally oriented customer base and an ecosystem of disruptive platform players (e.g., Tencent, Alibaba, and JD.com) creating growth opportunities.

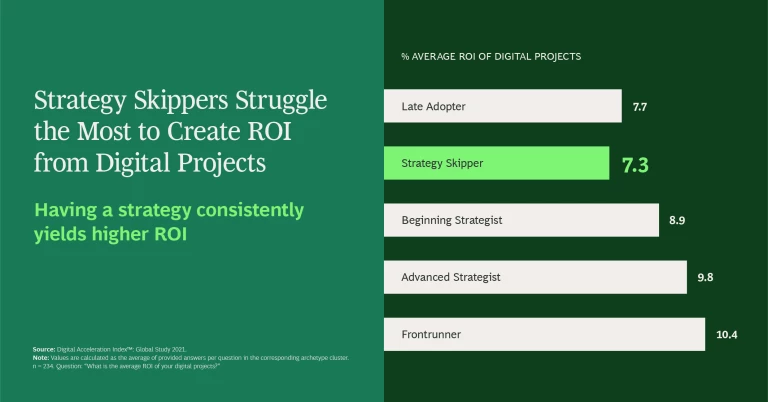

Digital Strategists. We divided this group into Beginning Strategists (16% of the total) and Advanced Strategists (26%). Not surprisingly, Advanced Strategists perform better, but both groups are catching up to the Frontrunners. They place a special focus on digital strategy and clearly prioritize it. At Beginning Strategists, the top management lives the digital vision and has aligned digital priorities and the road map within the business units. By comparison, management teams at Advanced Strategists have instilled a digital mindset, and the company’s digital priorities and roadmap are aligned across global business units. Advanced Strategists perform particularly well in terms of ROI of digital projects. Indeed, they are hot on the heels of the Frontrunners, with Beginning Strategists following fairly close behind.

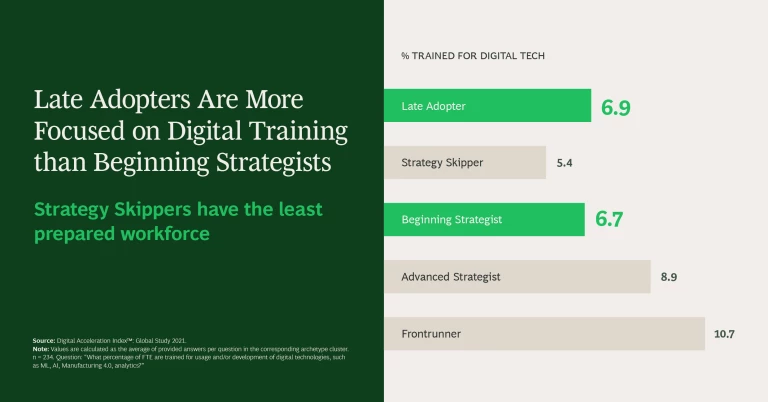

Strategy Skippers. This group (16% of the surveyed group) has largely bypassed defining a digital strategy and instead immediately began investing in digital technologies and employee capabilities. They implement digital use cases opportunistically, often without a clear business rationale. Lacking a target picture to guide them, Strategy Skippers can’t effectively scale their efforts.

Even though their digitization efforts focus on rapid skill building (agile ways of working, etc.) to unlock the value of enterprise use cases, they perform poorly across a range of metrics. They consistently trail both groups of Digital Strategists and often Late Adopters as well. They suffer significantly from below-average increases in company value and an extremely low ROI for digital projects. Strategy Skippers are relatively more common in North America and Europe and less common in Asia.

Late Adopters. As the name suggests, Late Adopters (19% of the surveyed group) have relatively low digital maturity scores at all levels. Some have begun their first digitization activities in the areas of virtual teaming, digitization of service operations, data strategy, and governance. Like the Strategy Skippers, Late Adopters underperform Frontrunners and Digital Strategists in numerous KPIs. For example, over the past three years their market share growth has averaged 4.6% per year, compared to 6.7% for Frontrunners. Late Adopters are found with above-average frequency in Europe, where 25% of FIs are Late Adopters. In Asia, just 13% fall into this category.

The Path to Digital Maturity and Success

The connection between a well formulated digital strategy and outstanding performance makes intuitive sense. By starting with a clear digital strategy, a company can better align digital initiatives with the FI’s overall strategy and target state, ensuring that customer and employee value are the top priority of the digital transformation. Our analysis gives statistical backing to this intuitive connection. We estimate that if all FIs worldwide were to reach the same level of digital maturity as Frontrunners, they could collectively increase revenue by as much as $100 billion each year over the next decade. That would account for about a third of the expected global revenue for FIs.

Companies that start with a clear digital strategy can better align digital initiatives with their overall strategy and target state.

This insight has significant implications for Late Adopters that need to get their digitization underway, and for Strategy Skippers that desperately need to course correct given that their current approach to digitization is yielding such poor results.

Possible next steps for Late Adopters include:

- Define and continuously develop a digital target picture (jointly by business and IT) that serves as a North Star for all teams in the organization. This target picture should include use cases and the capabilities and technologies necessary to bring those use cases to life.

- Create a holistic, companywide roadmap that, in an iterative fashion, brings the organization ever closer to the target picture. This is accomplished by prioritizing data-driven use cases that bring measurable business value and investing in employee capabilities—including their ability to implement new, modular technologies.

- Ensure that investments in employee capabilities include establishing and empowering digital leadership roles, expanding the capacity of digital talent, and implementing agile ways of working. Only with the right upskilling programs can companies drive adoption of data capabilities to the fullest extent and ultimately scale data and AI use cases.

- Keep a hyper focus on value and outcomes—and establish a Value Management Office that owns the digital target picture and roadmap and ensures that all use cases adhere to them.

Possible next steps for Strategy Skippers include:

- Assess if employee capabilities and digital technologies are sufficient to accomplish current initiatives.

- Ensure business teams (not solely IT) define the digital strategy and target picture.

- Determine if existing initiatives for employee capabilities and technology fit into the target picture, make the necessary adjustments, and then implement a digital transformation roadmap that focuses on value and positive outcomes.

It’s revealing that Strategy Skippers, despite their commitment to investing in digital technologies and digital employee capabilities, perform so poorly—often on par with Late Adopters. Fortunately, Strategy Skippers can course correct by pausing their current initiatives, focusing on the definition of their digital strategy, and then aligning those initiatives to that strategy. Meanwhile, Late Adopters can use the example of Frontrunners and Digital Strategists to set a promising course for themselves from the start. Both groups must make bold decisions, but it’s worth undertaking given the huge amount of revenue potential at stake.