Pharma has invested billions in cell and gene therapies. Gene editing is making a case for more of this funding, but companies need to understand what they're investing in and why.

In recent years, pharma has turned significant R&D attention and investment to cell and gene therapies —for the good reason that these innovations hold the potential for transformational treatments for patients who were previously beyond the industry’s reach. Reports put private funding at almost $68 billion in 2021. One cutting-edge technology—gene editing—has thus far received only a sliver of this funding (which GlobalData’s Pharma Intelligence Center pegs at $1.3 billion in 2021), but it looks like that's about to change. CRISPR gets much of the attention but is only one of multiple technologies under development. Investment has been growing quickly from its small base, and gene editing has attracted the interest (and investment) of industry leaders such as Pfizer, Roche, and Allergan and has even received financial backing from tech giant Amazon.

The reason is as simple as the technology is complex. While first-generation gene therapies work by adding a gene to the patient’s cells, gene editing “fixes” the broken gene itself. This innovation has enormous potential for multiple therapeutic areas, such as oncology, hematology, genetic disorders, and metabolic diseases. Indeed, the promise of gene editing is such that large pharma companies—while making major strategic and financial decisions in the broader arena of cell and gene therapies—should also be developing specific plans for gene editing. Here are the factors they need to consider.

Big Benefits from Rapid Development So Far

Cell and gene therapies are demonstrating their transformative potential, with multiple treatments receiving regulatory approval and many more in development. Viral-vector gene therapies, which enable “missing” genes to be expressed using a supplemental copy, are a major advancement in treating genetic diseases. Gene editing takes a step further by changing the underlying genetic sequence, offering the possibility of improvement or even cure for patients who previously had little hope. In contrast to gene therapy, edited genes offer a potentially durable therapeutic effect, since correcting the underlying defects can cure the condition, whereas the effects of gene therapy products can wane over time. In addition, gene alternation at targeted locations reduces the risk of oncogenesis.

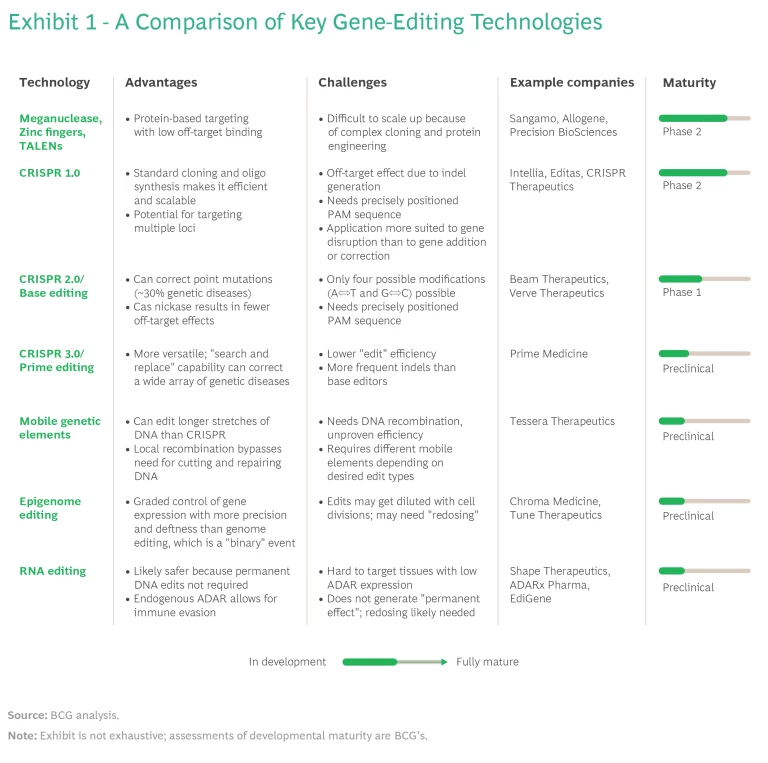

The early gene-editing tools, zinc fingers and TALENs, showed considerable utility and are still in use today, but their adoption as therapeutics was slowed by the complexity of creating and producing them. The discovery of CRISPR-Cas, which is based on a targeted antiviral defense system used by bacteria, has greatly accelerated the pace of development for gene-editing therapeutics.

The first human trial of the CRISPR-Cas gene-editing tool in the US started in 2017, and since then the field has taken off. Some 40 companies are currently active, and more than 200 programs focus on the therapeutic uses of gene editing. The vast majority of these use CRISPR-Cas. Other editing platforms include zinc fingers (Sangamo), TALEN (Cellectis/Allogene), ARCUS (Precision BioSciences), mobile genetic elements (Tessera), and ADAR for RNA editing (Korro Bio, EdiGene, Wave Life Sciences).

The rapid strides in CRISPR-based approaches have significantly expanded the toolbox as more advanced CRISPR iterations have led to different types of gene alteration—replacement, insertion, single-base modification, and gene writing—and enabled the fine-tuning of gene expression without the need for permanent changes. Together, these techniques can target and potentially cure a wide variety of genetic diseases that are not addressable with current viral-vector gene therapies or first-generation CRISPR-Cas tools. (See Exhibit 1.)

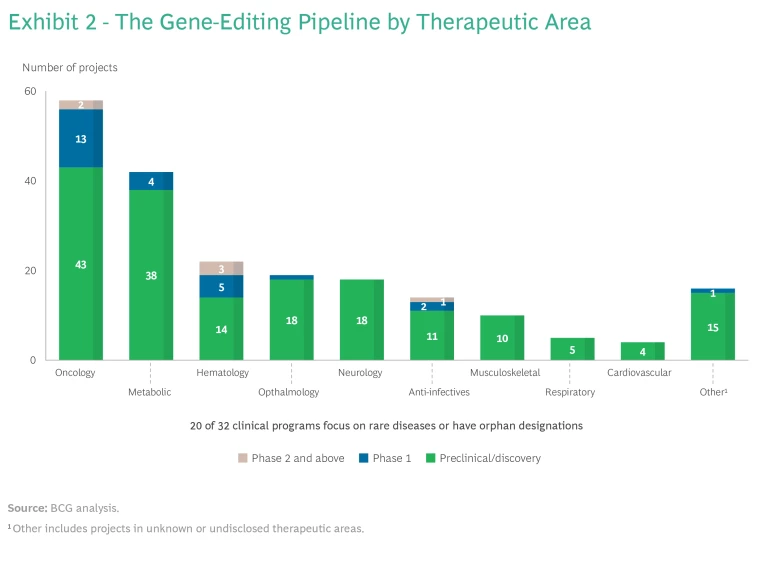

Gene editing is still nascent, with about 85% of programs in the discovery or preclinical stage, and 20 out of 32 programs have orphan disease designations. (See the sidebar, "Where Gene Editing Activity Is Focused.")

Where Gene Editing Activity Is Focused

Where Gene Editing Activity Is Focused

- Ex Vivo. CRISPR Therapeutics' and Vertex Pharmaceuticals' exagamglogene autotemcel (exa-cel), formerly known as CTX001, is the most advanced ex-vivo clinical asset in development for beta thalassemia and sickle cell disease. It has an anticipated 2023 launch.

- In Vivo. Intellia Therapeutics' NTLA-2001 is the clear frontrunner among in-vivo products. It has shown durable reduction in serum transthyretin levels in an ATTR amyloidosis Phase 1 trial. More mature clinical data is expected in the second half of 2022.

- Next-Gen. Verve Therapeutics' VERVE-101 is a single-course base-editing treatment that turns off the PCSK9 gene to treat heterozygous familial hypercholesterolemia. It entered clinical Phase 1b trials on July 12, 2022. Beam Therapeutics' BEAM-101 is likely the first base editor (CRISPR 2.0) to enter human trials in 2022 for treatment of beta thalassemia and sickle cell disease.

So far, oncology, hematology, metabolic disease, and ophthalmology are the four most active therapeutic areas. (See Exhibit 2.) This may be because of the opportunity for ex-vivo manipulation in oncology and hematology, and relatively easier in-vivo delivery to the liver and eye using lipid nanoparticles and adeno-associated virus vectors, respectively. Gene editing has become the leading gene therapy in oncology on the strength of next-generation CAR T-cell innovations.

Looking Ahead

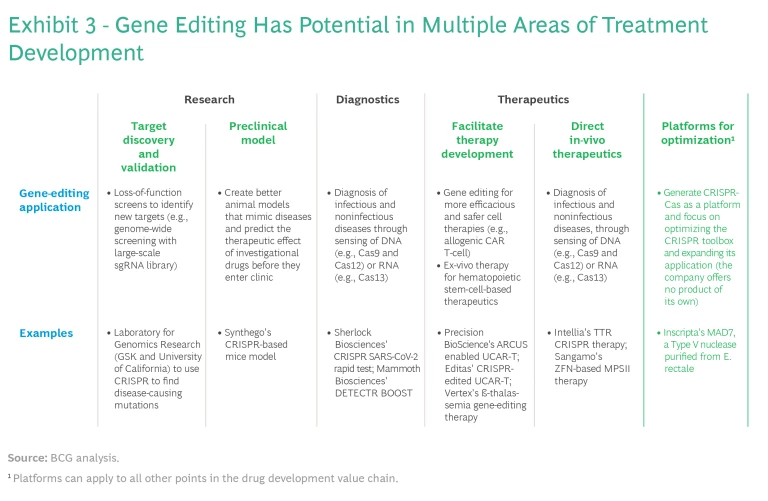

Much of the excitement surrounding gene editing, especially CRISPR-Cas, is based on the potential for curative treatments, and rightly so. Several therapies have shown highly encouraging results for such conditions as transfusion-dependent beta thalassemia, sickle cell disease, hereditary ATTR amyloidosis, and hereditary angioedema, for which patients have few, if any, treatment options. Gene editing has multiple applications across the entire drug development value chain, including research, diagnostics, and therapeutics. (See Exhibit 3.) There may also be an opportunity for companies to build out CRISPR-Cas as a platform and focus on optimizing the CRISPR toolbox for use by others, expanding the application of the technology without offering any product of their own.

To be sure, as is the case with any emerging technology (especially in life sciences), serious obstacles need to be overcome. As we discussed last year in our

interview with Peter Marks

, director of the Center for Biologics Evaluation and Research at the US Food and Drug Administration, these involve:

- Efficacy: Establish clinically meaningful endpoints for improvement. These are not now well defined in many rare diseases.

- Safety: Resolve lingering questions about the durability and long-term safety for recipients.

- Delivery: Determine how to package and deliver different components (such as Cas, sgRNA, or template DNA) to the right tissue. This is the biggest remaining technical challenge, and overcoming it is critical for in-vivo products.

- Pricing and Reimbursement: It remains to be seen how the market handles multiple curative drugs targeting the same patient population and how companies differentiate themselves when it takes years to establish the durability of therapeutic effect and to understand the true value for patients and payers.

You Need a Strategy

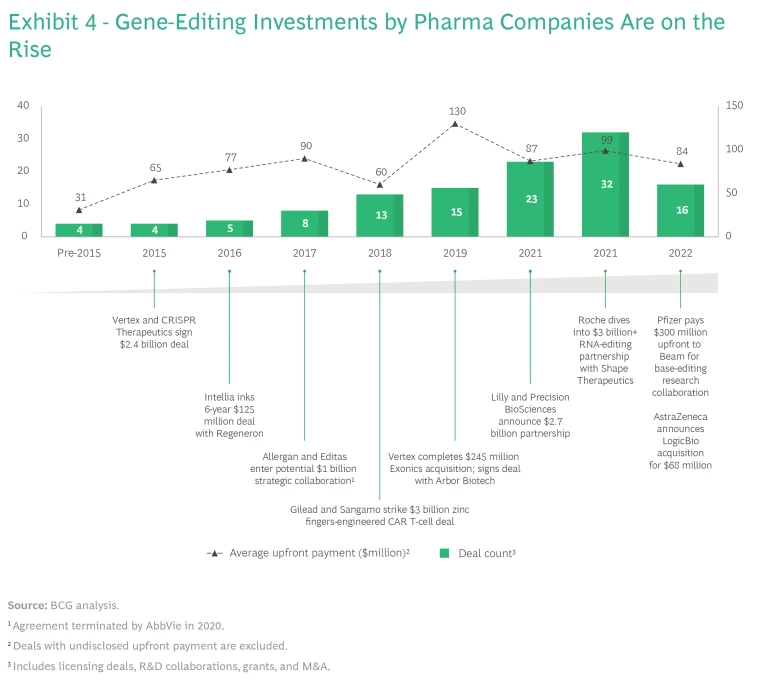

Gene editing has a lot of momentum. Since 2019, companies in the field (mostly startups) have cumulatively raised more than $5 billion in venture capital and private equity investment. A few have had record-breaking IPOs. Given the advanced technology and sophisticated know-how involved, we are starting to see large pharma companies explore corporate venture capital investments, R&D collaborations, and asset-licensing deals. (See Exhibit 4.) The number of transactions has risen sharply in the last four years, with average upfront payments reaching almost $100 million in 2021.

Given the potential, we believe all pharma companies need a gene-editing strategy, investing toward one (or more) of three ends: a new drug discovery tool, new therapeutics, and a defense against disruptors.

Drug Discovery Tool. Large pharma companies can use gene editing as a tool to accelerate development in their existing portfolio. For example, first-generation CAR T-cell players such as Gilead and Bristol Myers Squibb want to remain at the forefront of innovation in cancer cell therapies. The Gilead–Sangamo (2018) and BMS–ArsenalBio (2022) partnerships support this goal. Gilead partnered with Sangamo to use zinc finger nucleases technology to create off-the-shelf CAR T-cell therapies to cement its position in this space. BMS is partnering with ArsenalBio to develop logic gates and gene expression controls for programmable cell therapies in solid tumors.

Therapeutics. Gene editing can be leveraged as a direct therapeutic and as a means of diversifying a company’s capabilities and pipeline. For example, Vertex, the market leader in cystic fibrosis, has been one of the most active gene-editing deal makers, with collaborations with CRISPR Therapeutics, Mammoth Biosciences, and Arbor Biotechnologies intended to diversify its portfolio beyond small molecules. Vertex is well positioned to meet the commercial challenges, given its decades-long experience in rare diseases. Regeneron, one of the most successful antibody platform-focused biotech companies, with ten approved or authorized biologics in the last decade, is developing capabilities beyond traditional biologics through a partnership with Intellia Therapeutics, which uses the CRISPR gene-editing system. Novartis likewise has a partnership with Intellia, through which it secured rights to use CRISPR for its CAR T-cell program; the two companies have also agreed to work together on using CRISPR for stem cell and sickle cell diseases.

Defense Against Disruptors. Developing gene-editing capabilities can help incumbent companies build barriers against market disruptors. Eli Lilly, a leading diabetes player, is partnering with Precision BioSciences to use the latter’s ARCUS platform to develop in-vivo therapies in multiple indications. The initial focus is muscular dystrophy, but the partnership includes five other (undisclosed) targets, likely metabolic diseases. This approach should help Lilly safeguard itself against potential disruptors in diabetes and metabolic diseases by investing in genetic medicines, which now account for more than 20% of its non-oncology research portfolio.

Recent advances in technology and early proof-of-concept data in clinical trials make it imperative for pharma companies to explore gene editing. But before they invest, they should make sure they understand the nuances of the market and the scientific, regulatory, and commercial considerations involved. Lessons from the development paths of cell and gene therapies can help them navigate the technical, regulatory, and reimbursement challenges in this exciting new field.