The floor has fallen out from under marketers. They need a bold new approach to measuring the impact of their efforts—and determining where to spend their organizations' dollars.

Is your company spending its marketing dollars effectively?

In the past decade, few companies have successfully measured the ROI of their marketing spending initiatives. Even fewer have managed to consistently measure and optimize their marketing spending across their organization. According to a recent Gartner study, marketing analytics influenced only 54% of marketing decisions in 2020. Although an increasing number of businesses have built lasting organization capabilities that facilitate consistently informed spending decisions, the vast majority have not treated this objective as a priority.

That’s a missed opportunity—and a growing problem.

Many companies drastically cut their marketing spending in response to the economic uncertainty of 2020, only to increase their budgets when the global economy began to recover. Meanwhile, pandemic-onset shifts in consumer behavior pushed e-commerce sales to new heights, straining preexisting forecasting abilities and reinforcing the need for stronger digital marketing efforts. In this environment, many marketers struggled to measure the impact of their spending adjustments. Looking forward, emerging privacy regulations and new web browser and mobile OS policies are diminishing marketers’ ability to capture data online in order to learn about consumer preferences and behavior.

These factors have considerably altered the context for businesses, which now require a faster, more comprehensive capability for making budget-allocation decisions. Thankfully, recent developments in AI and computing power are giving marketers stronger analytical capabilities and the ability to scale those capabilities across their organizations.

But effective marketing spending isn’t simply a matter of having the right technology. Transformative organization-wide change is critical, too.

There are substantial rewards, including sustainable competitive advantage, for companies that successfully measure the return on their marketing initiatives. We’ve found that combining effective human processes with data-driven capabilities yields a 10- to 25-percentage-point boost in marketing effectiveness , measured in EBITDA gains relative to marketing spending. Companies that make the right moves will see far greater returns and stronger marketing cultures.

Current Limitations

The pandemic, evolving consumer habits, and changes in data privacy regulations and policies have wiped the slate clean for marketers who are accustomed to relying on past trends and historical experience to guide their decision making. That approach was suboptimal to begin with, and is all but useless today.

Few companies have succeeded in building the resilient and holistic return on marketing investment (ROMI) capabilities needed in the current landscape. A study by MMA Global found that only 40% of marketers have a formalized measurement solution. Even those who have had some success in optimizing their spending decisions typically lack the agility to respond swiftly to a changing environment. The key obstacles to adopting up-to-date measurement processes are data integrity (cited by 89% of marketers, according to MMA Global) and organization buy-in (cited by 69% of marketers). Navigating uncertainty requires having agile processes, access to real-time data, and the latest tech capabilities.

Until recently, the relative ease of gathering data online and linking it to sales helped make executing and planning digital campaigns simpler than running nondigital campaigns. As emerging privacy regulations make it harder to track user habits and collect user data online, however, even digitally savvy companies face an urgent need to course-correct.

Challenges abound. One involves measuring the impact of point-of-sale and trade marketing activities, given that most trade marketers—unlike digital marketers, for example—don’t capture sufficiently granular and homogeneous data to support precise, like-to-like comparison. Another issue is the difficulty of measuring the full impact of campaigns designed to generate long-lasting brand equity. When it comes to sponsoring or endorsing activities, events, or iconic personalities, marketers struggle to quantify exposure and the resulting change in purchasing behaviors. Finally, the rise of omnichannel experiences has increased the need for holistic modeling and measurement capabilities that account for each marketing-funnel stage—from brand awareness to customer loyalty—and the entire customer journey.

Although many companies have tackled these challenges to some degree, only a few have done so in a scalable and consistent manner. Some have launched initiatives with local vendors that they can’t replicate in other markets. Others have tailored multiple solutions suitable to unique business contexts and decision-making processes, resulting in a wide range of measurement methodologies and inconsistent KPIs. This lack of alignment across channels and geographies yields disjointed (or mutually antagonistic) marketing performance assessments that hinder effective allocation tradeoffs across brands, channels, and consumer touchpoints. It’s easy to imagine an organization in which digital marketers track the short-term impact of reposts and clicks, brand marketers focus on awareness and consideration from surveys, and trade marketers focus on the impact of last-3-feet activities on store sales.

Something’s got to give.

Foundational Elements

A shared marketing language and effective analytical capabilities are the building blocks of a robust, sustainable ROMI program. But unlocking the full potential of such a program and creating a culture of marketing excellence require a carefully orchestrated change management effort that starts at the C-suite and permeates the entire organization. To stay competitive today and tomorrow, businesses must lay the groundwork across three critical dimensions: a shared language, the right analytical capabilities, and a change management effort.

A Shared Language

Does it make more sense to spend your marketing budget on one major event in France or on three smaller ones across the United States? Should you increase your TV budget, conversion campaigns on social media, or in-store display spending in Brazil? Does “traffic” mean the same thing to each of your teams?

Getting everyone on the same page is an essential—and often overlooked—first step in accurately measuring a company’s marketing return. Without it, initiatives aimed at measuring marketing’s impact quick devolve into the Tower of Babel. Establishing a companywide marketing taxonomy ensures proper alignment of marketing, finance, and sales teams at all levels and across markets, both from a granular, data-oriented perspective and in terms of broader strategy.

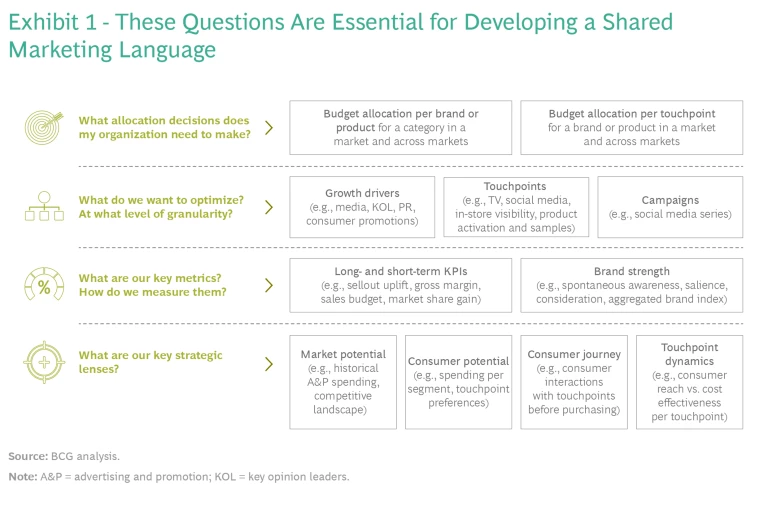

Identifying sound answers to discrete marketing questions requires standardizing measurement methodologies across markets, brands, and touchpoints. Firms that create a level playing field for analyzing their marketing spending will be better able to gauge the impact of contextual factors such as product categories, consumers, and the competition. (See Exhibit 1.)

A good starting point is to establish a common strategic lens and shared business logic for making allocation decisions. These can be based on such material business considerations as past performance, what the competition is doing, the potential to attract new consumers, and touchpoints and channel dynamics (online versus offline, new versus traditional media formats, and more). Aligning on key goals and outcomes early in the journey will ensure better engagement and employee buy-in, avoiding later-stage disagreements and misaligned initiatives.

From there, defining common optimization metrics and KPIs focused on ROI, sales uplift, or brand building will help different teams row in the same direction, aligning on and working toward hard-to-define goals. For example, marketers should conceptualize a financial metric that can serve as a cash-flow statement for measuring the function’s incremental contribution to the business. Likewise, building a more comprehensive marketing balance sheet will make it easier to account for—and ultimately, justify—investments that pay off over a longer term.

Once finance and marketing align on KPI definitions and tracking methodologies, they can establish optimization metrics such as category net sentiment, relative customer loyalty scores, and share of voice.

The Right Analytical Capabilities

When it comes to determining the efficacy of marketing and trade spending, most existing analytic capabilities—and some of the third-party organizations that provide them—fall short. Delivering a step change to your company’s ROMI efforts requires adopting new analytical capabilities to establish a marketing-spending model that is automated, holistic, transparent, scalable and consistent, and decision oriented. (See Exhibit 2.) We will examine each of these characteristics in turn.

Automated. For many companies, building a marketing-spending model is a time-consuming process based on manual data collection and cleaning that starts from scratch with each new exercise. Because these companies haven’t invested in the necessary marketing-resource and trade-promotion management tools, they may find it difficult to acquire sufficiently granular, high-quality, and up-to-date data. The cleaning process can be tedious, too, especially when marketers want precise data related to weekly spending and the execution of past trade marketing campaigns. Although a particular campaign’s cost may be readily available, for example, its precise live dates may not be.

Moreover, modeling is itself a slow and sometimes fickle process. Traditional approaches involve running many models and then selecting what appears to be most relevant among them—a questionable approach that is subject to bias. Further, altering the model in any way (such as by incorporating a previously unaccounted-for touchpoint or tweaking a hypothesis) can mean restarting the process from scratch. The complexity piles up with each new iteration.

To overcome these issues, organizations should build—or work closely with external vendors to establish—long-term capabilities that automatically track and collect the spending and execution metrics of various campaigns at an appropriate level of granularity. This entails compiling data on sales, volumes, prices, spending, and marketing activities in a much more systematic and harmonized way. Organizations should also set up automated processes to collect future data and ensure that it is aggregated and precisely labeled in accordance with their established taxonomies. Once they have the data, companies should use modeling techniques, such as probabilistic programming, that limit required manual steps. Google and Uber, for instance, have demonstrated the strengths of such Bayesian methods in measuring the impact of marketing efforts.

Holistic. It’s not enough for a marketing function to measure the impact of its media initiatives in a single region, business unit, funnel stage, or channel. An effective model for distinguishing impact and determining necessary allocation tradeoffs must account for all consumer touchpoints across markets in a way that captures 80% to 100% of marketing investments. For example, some brands might generate an easily measurable degree of sales impact through paid media. But what about the effects of special packaging, events, and promotions? Or coupons, discounts, and shelf displays? Or field-sales visits, inventory availability, and competitors’ moves?

A holistic ROMI solution should provide insight into all brands, touchpoints, channels, and audiences. It should shed light on a marketing initiative’s short-term effect on sales while also accounting for its impact on brand awareness and growth, as well as clarifying the role that different touchpoints play along the consumer journey. To stay competitive, marketers need a tool that can measure their activities’ potential to result in product cannibalization or, on a more positive note, halo effects.

Transparent. Marketing-analytics providers secure competitive advantage through proprietary black-box models that only they can understand. This tempts some marketers to follow the model based on their trust in the provider rather than in the model itself. Other marketers may resist making strategic or spending decisions based on information from an outside party’s model that they cannot understand. Allocation models must be transparent before they can be trusted—and they must be trusted before employees are willing to buy in. If users can see how a given metric affects allocation recommendations, for example, they can make the case for changing inputs accordingly. Companies should therefore aim to create transparent, adaptable models that invite user input.

Probabilistic programming techniques are again useful in this regard. Bayesian models allow organizations to combine data and human intuition consistently, rigorously, and transparently. Armed with these models, marketers can determine which of their beliefs (such as the efficacy of promotional spending on one brand versus another) the actual data supports, and then can more accurately gauge the level of risk associated with a given allocation decision. This is especially critical in low-data contexts, which marketers often encounter. Crucially, marketers are limited by their lowest data inputs, and these may be even sparser than they realize. Having access to three years of consumer data on a given marketing channel might seem informative, but if the company gathers certain measurements once a week, the resulting data trove amounts to only 156 points.

When a model runs on low data, the question isn’t when the model will fail but where it has already failed. Probabilistic programming models shed light on this question, making it easier for businesses to set guardrails instead of blindly following untrustworthy recommendations.

Scalable and Consistent. Anyone involved in a ROMI initiative should aspire to consistently track the impact of marketing on an entire portfolio across all touchpoints and markets. A lack of homogenous data can stand in the way of achieving this goal; but for companies that rely on local measurement tools, comparison remains a challenge even if the data exists. One solution is to internalize their capabilities—or work closely with a vendor capable of serving the entire organization in a methodologically consistent way—to refresh the model multiple times in the course of a year. This practice yields significant benefits, including greater cost efficiency and truly data-driven decision making. Once again, probabilistic programming models have shown that they can outperform alternative modeling techniques on scalability.

Decision Oriented. Marketers that work with external agencies to measure ROMI often end up with a merely descriptive profile of their performance—perhaps learning that their companies overperformed on Twitter or that one campaign gained more attention than another. Such insights all too rarely lead to action or help in making tradeoffs and quantifying the impact of changing portfolio-level allocations. Marketers need clarity about how to optimize allocation budgets in light of specific goals (such as increasing volume, sales, or profit) and business constraints (such as overall budget available).

A decision-oriented model and user interface allows marketers to answer what-if questions such as, “What do I gain if I reallocate promotional spending from one brand’s TV budget to another brand’s digital budget?” Equipped with this information, they can run best-case allocation scenarios and redirect money that shouldn’t be left on the table. This model also builds trust among teams that see the impact of their spending decisions, leading to wider adoption. Advances in mathematical optimization enable companies to build end-to-end ROMI capabilities, including this indispensable scenario-planning function. Whether owned internally (which is often ideal for achieving consistency) or externally, the model should remain highly customizable, fit for purpose, and easily deployed in house. Marketers have the greatest chance of realizing continued success if they can make smart allocation decisions themselves, without the biases or limited perspectives of third parties.

Building analytic capabilities with these principles in mind will serve marketing organizations in ways beyond simply measuring their effectiveness. With this foundation in place, marketers can also decrease marginal costs when building new capabilities, such as measuring and modeling customer lifetime value or customer acquisition.

A Change Management Effort

Our experience suggests that a typical transformation to reshape how a company’s marketing function measures impact and allocates budgets requires a 10-20-70 effort: 10% effort on models, 20% on data and technology, and 70% on managing the change itself. Many ROMI initiatives fall short of their full potential because they focus exclusively on models and technology. But a new operating model and a carefully orchestrated approach to change are required at the global and local levels to embed data-driven decision making. Often, a new team structure is necessary, too.

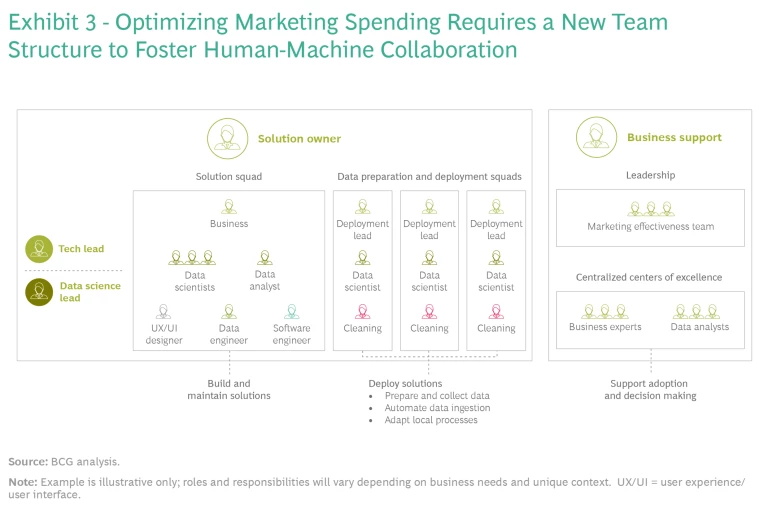

Organizations should build a centralized, cross-functional team composed of data scientists, machine learning engineers, user experience experts, and others to design and maintain their new solutions. (See Exhibit 3.) In some cases, organizations must hire new talent to fill these positions. They should establish centers of expertise that will be responsible for aligning processes and supporting broader adoption across markets. Finally, they will need to establish temporary deployment teams to roll out the solution in new markets.

Three Essential Principles

As is the case with most transformations, this type of major change effort spans multiple processes and many parts of the business. Although specific needs will vary from one company to another, we have found that three principles are essential to a successful journey.

Gain full support from the top. Building smarter marketing capabilities across the organization requires alignment at the highest level and strong leadership engagement. It’s tempting to assume that senior executives focus on the same business goals. But often they hold different objectives—such as expanding market share, growing brand equity, or increasing sales—that require different and sometimes disparate strategies, leading to competing ideas about spending priorities. Aligning senior leaders on a broader marketing vision is essential to measuring the organization’s progress along the journey.

Achieving success on a change journey also depends on having an explicit shared commitment to build momentum. Technical snags, arguments among lower-level decision makers, and other organizational challenges are common when an organization attempts to reshape itself for marketing excellence. The key to success in these situations is to avoid getting bogged down by day-to-day decision making or becoming too cautious to have an impact. Senior leaders must be willing to make quick decisions and stay focused on the bigger picture rather than on minutiae.

Inspiring the organization is critical to this effort. Executive sponsorship is necessary to unite teams and markets and to generate buy-in across the organization. And although many budget allocation decisions occur at the market or brand level, the biggest impact comes from a cross-brand or cross-portfolio approach. The top-down strategic perspective of chief marketing officers and chief sales officers, for example, is invaluable for determining the necessary spending tradeoffs at the brand or channel level and for streamlining the approval process.

Start small and generate quick wins. The best way to build and sustain momentum for a broad change effort is to adopt an agile mindset, moving quickly with a value-focused approach to building the solution. The goal in launching a new smart-marketing allocation program shouldn’t be to deliver a polished product, but to prove the business case for new capabilities as they emerge. Companies should start by working toward an MVP (minimum viable product) that they can deploy in a handful of relevant markets. To ensure the viability of their MVPs and to fine-tune them as needed, the product team should assess available data, review the data model, define data management, build model and scenario-based tools, assess budget implications, and codify changes needed in the operating model.

After deploying the MVP and using it to make allocation decisions, the product team should compare the MVP’s performance to the results of older approaches and prior allocation decisions. Showcasing the MVP’s capabilities to local and global teams, once its processes and tech platforms are sufficiently scalable to handle multiple markets, will generate buy-in and encourage other markets to join the initiative.

Maintain the pace. Once the MVP has performed in pilot markets and started to prove its value, businesses can accelerate the broader transformation effort to wire lasting change across the organization. The product deployment team should focus on coaching and upskilling marketers through an entire allocation cycle so that local marketers can see what it takes to deploy the new solution. On-the-ground marketing professionals should learn how the tool works and see it used in the budgeting process before refreshing the model and incorporating new data into it for a new cycle. Once the initial cycle is complete, the deployment team can move on to a new market. In parallel, IT teams can set up long-term infrastructure, data feeds, and governance models—based on design choices validated by the MVP—to sustain the solution in the future.

Looking Ahead

Marketers today are operating at a critical juncture. Teams responsible for measuring the impact of their efforts and making tough budgeting decisions on that basis must feel as though the floor has fallen out from under them. And in many ways, owing to constantly evolving consumer habits, new market dynamics, and widespread uncertainty, it has.

Creating and maintaining competitive advantage over the long term will require a flexible yet comprehensive approach to allocating marketing dollars—one that can adapt to the vicissitudes of a constantly changing landscape. Businesses that put in the work now will be able to emerge from the pandemic in a position of strength, ready to deliver sustainable growth.

The authors would like to thank Lucie Allain and Arnaud Bassoulet for their significant research and contributions to this article.