To become leaders in the field, biopharma companies must understand unmet needs and evolving standards of care and make greater use of real-world evidence.

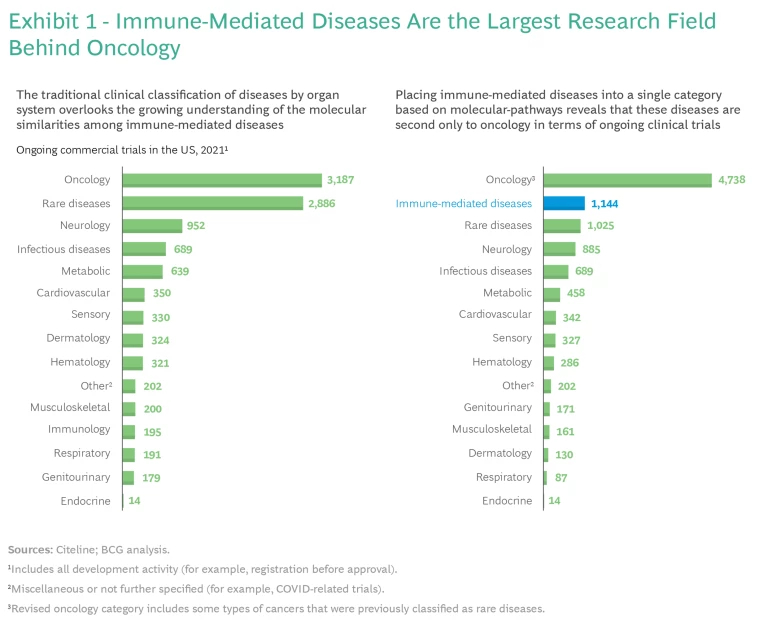

Innovative therapies that target immune-mediated diseases have emerged as one of the fastest-growing fields in clinical research, second only to oncology in terms of ongoing clinical trials. The surge in interest is fueled by advances in the scientific understanding of the pathways that drive immune-mediated diseases and the immunotherapies that alter those pathways.

Inspired by therapeutic advances in oncology, some players are starting to view therapies for immune-mediated diseases as the next growth area for pharma companies. Competition is still, on average, less intense than in oncology, but we expect that pharma companies will seek to build on their successes to date.

A BCG study aimed to further such efforts by developing a comprehensive view of immune-mediated diseases. The study focused on understanding unmet needs and the evolution of standards of care for prominent diseases. To support our analyses, we developed a methodology to assess and compare unmet needs across diseases. (See “The Scope of the Study.”) We also built a machine-learning algorithm enabled by natural language processing to detect weak signals in clinical R&D that may be harbingers of major advances.

The Scope of the Study

This focus allowed us to identify unmet needs and how standards of care are changing for the most common immune-mediated diseases. In a future phase of the study, we may expand our analyses to include tertiary immune-mediated diseases (such as organ rejection and graft-versus-host disease), as well as the remaining secondary immune-mediated diseases.

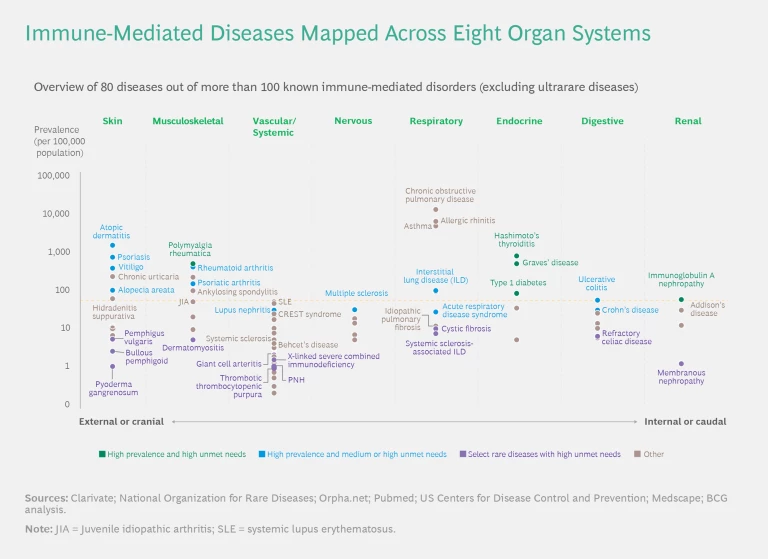

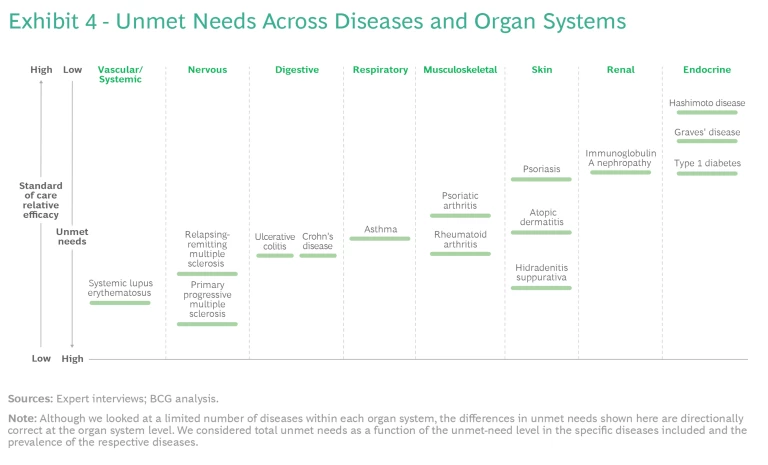

We mapped the diseases in the study across eight organ systems. (See the exhibit below.) Many of these diseases can cause symptoms in more than one organ system, so—in line with clinical practice—we classified them according to the dominant system involved. For each organ system, we mapped the disorders according to their prevalence. We arranged the organ systems by their anatomical location.

The findings highlight important differences among immune-mediated diseases with respect to unmet needs, the evolution of standards of care, and the level of clinical activity. Crucially, we found that leading companies are refining their clinical-trial strategies by better understanding the molecular similarities among clinically distinct diseases and analyzing real-world data to gain insights into the performance of mechanisms of action (MoAs) currently on the market.

The Market Landscape

For many years, oncology has been the primary focus for pharma companies and research institutions. The significant advances in disease understanding and new modalities have changed the treatment landscape, requiring companies to rethink their end-to-end commercialization process . Researchers’ recognition of the similarities among the molecular pathways involved in the pathogenesis of different diseases has had a particular impact—for example, in treating neuroendocrine tumors. The potential of molecular pathways as disease-agnostic targets is profoundly affecting development approaches.

We placed the immune-mediated diseases in the study into a single category based on the rapidly evolving understanding of human immunology at the molecular level. This reclassification revealed that these diseases are now in second place behind oncology as a focus for biopharma companies and the research community. (See Exhibit 1.)

Our analysis found that there were more than 1,100 ongoing clinical trials involving immune-mediated diseases in the US in 2021. Expanding interest in this field is likely due to increased knowledge in several areas:

- The Scope of Immune-Mediated Diseases. The medical community has recognized that the immune system is involved in many different diseases beyond the typical remit of immunology—in immuno-oncology (for example, B-cell malignancies), infectious diseases (most notably, COVID-19), and neurological disorders (for example, narcolepsy, multiple sclerosis, and early stages of neurodegenerative diseases).

- The Similarity of Molecular Pathways Across Diseases and Organ Systems. Many MoAs launched in the past decades have demonstrated efficacy across a variety of diseases and organ systems.

- The Potential of Advanced Therapies to Address More Diseases. Improvements in efficacy, safety, and convenience of targeted therapies have unlocked the potential to use them in a broad range of diseases—for example, in dermatologic diseases such as hidradenitis suppurativa and atopic dermatitis.

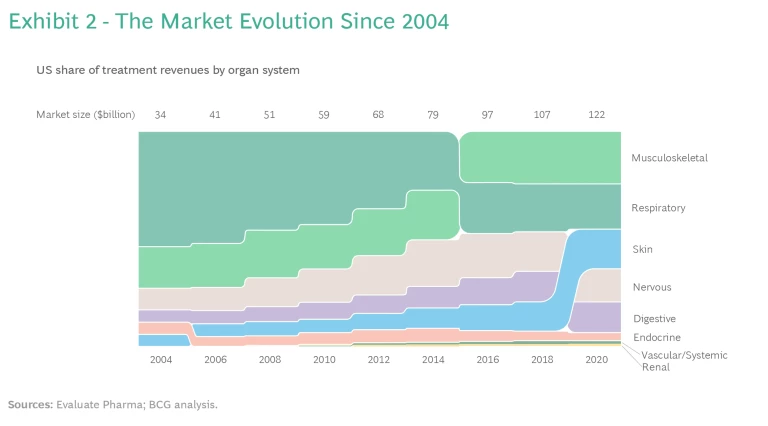

Breakthrough scientific advances have promoted substantial growth in the US market for immune-mediated disease treatments, from $35 billion in 2004 to $120 billion in 2020. (See Exhibit 2.)

The share of revenues associated with treatments for musculoskeletal, nervous, and digestive diseases has gradually increased, but recent advances in treating skin-related diseases have boosted revenue share with respect to those as well. We have seen less change in revenue share from treatments for endocrine, renal, and vascular and systemic diseases.

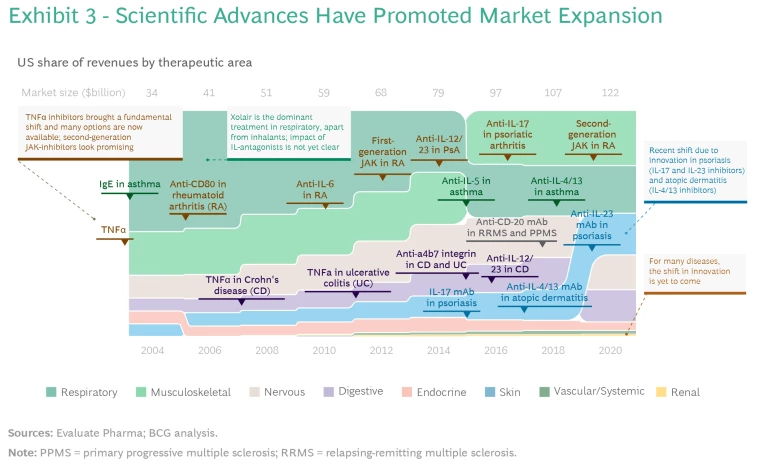

The overall market has expanded as a result of several approvals of new MoAs in different therapeutic areas. (See Exhibit 3.)

- TNFα-inhibitors brought a fundamental shift in the early 2000s and introduced the idea of a broad-acting MoA that can be effective in many different diseases.

- IL-12/23 antagonists were the next MoA demonstrating efficacy across multiple organ systems, achieving approvals for the treatment of psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis.

- IL-17 and IL-23 inhibitors have sequentially introduced two additional shifts in the treatment paradigm—most important, promoting superior efficacy in skin-related indications, especially psoriasis. Development activity points to the potential for approval beyond these diseases.

- IL-4/13 inhibitors for the treatment of atopic dermatitis have demonstrated that systemic biologics and immunotherapies can be used for diseases not typically considered candidates for treatment by these MoAs.

- The first generation of JAK-inhibitors improved treatment for some patient populations (mainly in rheumatoid arthritis), but their use was limited, primarily owing to safety concerns. Because this group of molecules has a very broad-acting mechanism with potential applications across a multitude of diseases, the second generation of JAK-inhibitors holds promise for greater overall impact.

- The use of PDE5-inhibitors has had a smaller impact across a range of diseases compared with other new MoAs. However, the success of this molecule exemplifies the importance of a good safety profile even in the absence of superior efficacy. This facilitates expansion into other disease areas and lowers the threshold for physicians and patients to switch to the therapy. It also makes PDE5 a candidate for use in combination treatments.

These advances have significantly improved treatment efficacy for some diseases compared with the standard of care. But there remain significant unmet needs with respect to many diseases and organ systems.

Exploring Unmet Needs

Because of the similarities in the molecular pathways of different immune-mediated diseases, an understanding of unmet needs across diseases is helpful in identifying the evolution of standards of care and treatments. We developed a methodology to capture the different dimensions of unmet needs and selected a set of diseases to test and validate our results. (See “Methodology to Assess Unmet Needs.”)

Methodology to Assess Unmet Needs

Understanding unmet needs in immune-mediated diseases requires acknowledging that standards of care and treatments have evolved differently than in oncology, where efficacy generally trumps all other factors. Most immune-mediated diseases are chronic and not immediately life threatening. As a result, treatments are usually evaluated over longer periods and the relevance of safety increases. Additionally, given the chronic nature of immune-mediated diseases and the frequency of treatment, convenience plays a role in defining unmet needs. The impact of the benefits of safety and convenience varies across immune-mediated diseases. Their relevance relative to efficacy increases in the case of less severe diseases, where the focus is on disease modification and quality of life rather than on preventing or delaying death.

Although efficacy plays a role in immune-mediated disease treatment, demonstrating efficacy does not, by itself, justify switching treatments. The long duration of treatment means that a change is justified only if the improvement in efficacy is significant compared with the standard of care. One therapy may, on average, be superior to another, but there can be great variability among individual patients.

Our analysis found that unmet needs have been reduced significantly for some immune-mediated diseases, while for many others they remain relatively high. Exhibit 4 shows a selection of well-studied diseases. The level of unmet needs is primarily driven by an insufficient understanding of the biology of a given disease rather than the amount of clinical-research activity. However, some diseases have attracted more attention than others.

Competitive Dynamics and R&D Focus

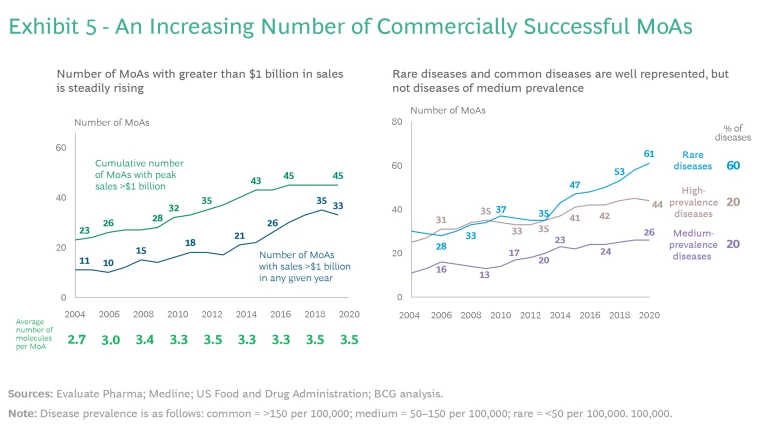

The number of MoAs with greater than $1 billion in sales is steadily rising. (See Exhibit 5.)

To understand how the competitive dynamics have evolved as the market has grown, we systematically reviewed approved MoAs across all known immune-mediated diseases since 2000. We identified four trends that are important for companies to consider.

- Decreasing Development Time. Companies are developing follow-on indications faster, and more efforts are conducted in parallel.

- Increasing Competition In-Class and Out-of-Class. Competition to address specific diseases is coming not only from “in class” molecules that share the same MoA but also from “out of class” molecules that have different MoAs. Thus, when assessing the evolution of the standard of care for any given disease, it is important to understand in-class and out-of-class competitive MoAs.

- Crossing Over of MoAs from Other Therapeutic Areas. Although most of the MoAs being tested were originally explored in immune-mediated diseases, an increasing number have crossed over from oncology and infectious diseases.

- Underrepresentation of Diseases of Medium Prevalence. As shown in Exhibit 5, most new MoA approvals are concentrated in more common immune-mediated diseases (prevalence of more than 150 per 100,000) and in rare diseases (prevalence of less than 50 per 100,000). There has been less focus on diseases with a prevalence of 50 to 150 per 100,000.

To explore whether these trends related to late-stage development and approved MoAs are also reflected in early research, we built a comprehensive knowledge platform and tool based on natural-language-processing-enabled machine learning. We used these to detect trends in early research related to specific MoAs and diseases and in how researchers are seeking to use MoAs to treat diseases.

We found that researchers are exploring known and proven MoAs in multiple immune-mediated diseases across different organ systems. However, as we observed in the case of late-stage development and approved MoAs, the new MoAs under consideration tend to be focused on more prevalent diseases or on diseases with greater unmet needs. In addition, researchers are exploring MoAs for indications beyond immune-mediated diseases—for example, cancers and infectious diseases.

These findings indicate that clinical practice could provide many insights for research and clinical science to build upon. Such insights hold special promise for immune-mediated diseases, where epidemiology has proven that there is a higher probability of comorbidities—that is, two or more immune-mediated diseases occurring in the same patient.

Real-world data has untapped potential to systematically integrate insights from clinical practice with R&D. As molecule development strategies, including indication expansion, become more crucial for capitalizing on the competitive dynamics described above, biopharma companies can use weak or early signals to inform clinical trials. To date, few integrated real-world datasets or platforms exist for immune-mediated diseases, and companies are still grappling with specific challenges related to real-world data. However, past success stories, such as TNF-α inhibitors, have shown the value of applying a holistic and disease-agnostic perspective to a molecule when sequencing indications.

Questions to Consider in Defining Strategies

Pharma companies can use the following questions to guide their clinical R&D strategies for immune-mediated diseases:

- What is the best approach to characterizing unmet needs across the spectrum of immune-mediated diseases?

- How should we adapt our development and commercial strategies (especially indication sequencing, including pace and timing) to account for emerging trends and findings?

- How can we be better informed and probe the signals that emerge from clinical-practice experience?

- How can we personalize and individualize care for patients with immune-mediated diseases, as is done in oncology with genetic profiling and genetically targeted therapies?

- What impact will combination therapy have on immune-mediated diseases?

- How can we organize ourselves to focus on diseases as well as MoAs?

Immune-mediated diseases are becoming an increasingly important field in clinical R&D. Researchers are only now starting to scratch the surface when it comes to understanding and treating these diseases. For biopharma companies, gaining a strong competitive foothold requires characterizing unmet needs and understanding the factors driving the evolution of standards of care. To become leaders in the field, they must leverage real-world evidence in order to integrate insights from clinical practice into their R&D decision making.

In the next article in this series, we will explore how companies can use archetypes of diseases with different patterns of evolution in standards of care to define their strategies