Only companies that create ecosystems can count on their IT service providers for innovation, a new BCG global survey reveals.

Outsourcing innovation, particularly for digital capabilities and processes, may be critical for survival, but it isn’t easy to generate results by doing so. As business comes to grips with the growing role of digital technologies in creating and capturing value— a lesson driven home by the COVID-19 pandemic —it’s turning to IT service providers to create novel digital products and processes, in addition to developing them internally.

This development marks a departure from the way many companies have worked with IT service providers in the past, when they based outsourcing decisions mainly on efficiency-related parameters such as reducing costs or accessing the skills they needed. In spite of this shift, the results have proven to be illusory. According to a recent IDC study, only one in ten companies is satisfied with the outcomes service providers deliver.

To get the best out of IT service providers, CDOs and CIOs are realizing that they need to find novel ways of engaging with them. Rather than focusing on individual providers, market leaders are learning to organize and orchestrate ecosystems of service providers. These vendor innovation ecosystems (VIEs) not only provide access to the latest technologies, specialized capabilities, and deep expertise, they also offer faster times to market, increased flexibility, and greater accountability. Deploying VIEs can insulate businesses from the “not invented here” syndrome that often handicaps digital transformations and help turn IT service providers into trusted innovation partners.

To understand how companies manage these emergent VIEs, we surveyed the leaders of roughly 200 organizations in 2021. (See “Our Methodology.”)

Our Methodology

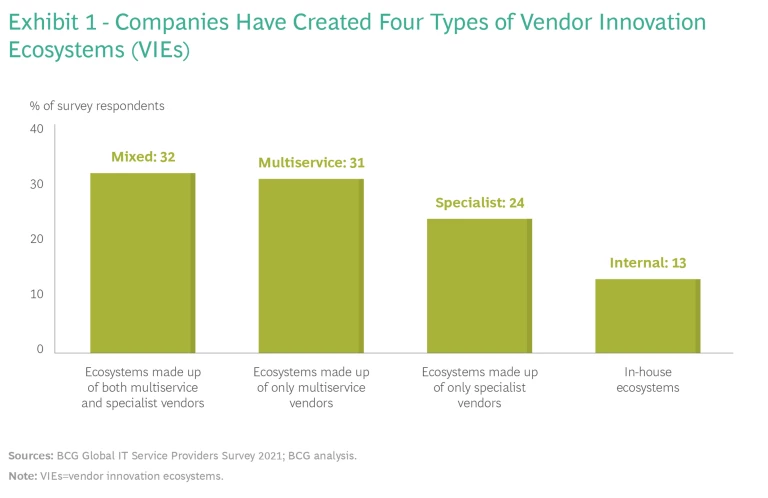

Our analysis suggests that companies create four different types of innovation ecosystems: mixed, multiservice, specialist, and internal. (See Exhibit 1.)

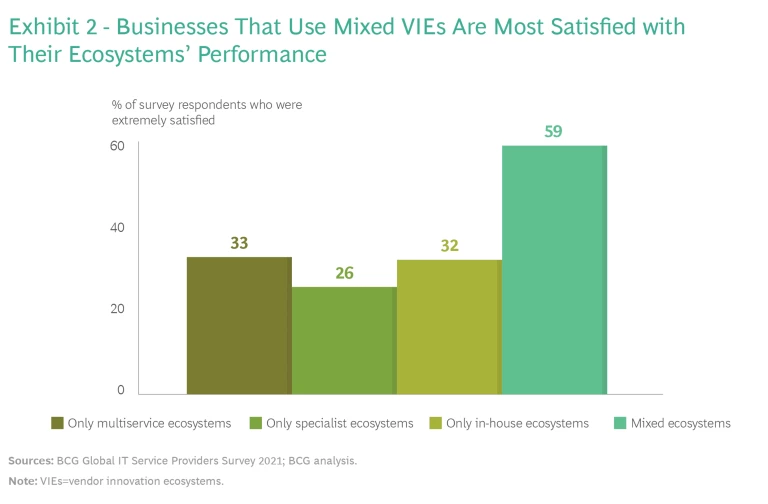

Each type delivers its own level of satisfaction, but companies were most happy with mixed ecosystems, which consist of both multiservice and specialized service providers. (See Exhibit 2.) However, we found that the more multiservice providers in an ecosystem, the less happy companies were with their performance. In this article, we focus on the lessons that can be learned from this first-ever global survey of VIEs.

The Four Types of VIEs

Most companies, especially large corporations, usually work with several IT service providers and systems integrators at the same time, establishing direct connections with each of them. Some have created VIEs around their service providers , connecting them with one another as well as with in-house capabilities. These ecosystems are built around large multiservice providers and smaller specialized providers, as well as IT consultancy firms. The four types of VIEs companies create include the following:

Mixed Ecosystems. Many companies (32%) had deployed innovation ecosystems that consist of both multiservice and specialized service providers. Explains the head of one US financial institution: “We depend on three multiservice providers, with one of them serving as the main partner for innovation along with our internal resources. We also surround ourselves with niche providers that help us accelerate innovation efforts. The niche firms drive innovation around specific pieces of work, while we think of the multiservice provider as the ‘factory’ that drives results.”

Multiservice Ecosystems. Some companies (31%) had developed ecosystems made up of only multipurpose service providers. Most organizations use multiservice vendors for outsourcing business processes, so they have found it natural to turn to those vendors for innovation as well.

Specialist Ecosystems. Some companies (24%) had orchestrated innovation ecosystems using only specialized service providers, with each focusing on a different problem or different aspects of the same problem. “Niche firms drive innovation,” the IT head of an Australian telecommunications company told us. “We prefer to work directly with them rather than with multiservice providers”

Internal Ecosystems. A minority of companies (14%) chose not to depend on IT service providers, preferring instead to use only internal ecosystems to drive innovation efforts.

While the specialist service providers tend to concentrate on innovation, the multiservice ones offer more (or only) standard services and focus less on innovation. For instance, the survey shows that 22% of specialist service providers offer only innovation-related services. By contrast, 14% of the multiservice providers offer only innovation services. In any case, by combining multiservice providers with specialists, companies are able to foster greater innovation.

Three Key Capabilities

Companies should create innovation ecosystems made up of service providers with diverse kinds of capabilities, so they can gain access to a range of competencies. According to our survey, CDOs and CIOs felt that there are three main skill sets to look for in service providers when creating VIEs. First, providers should be able to productize solutions and platforms (82.5% of executives felt this was the most important capability). Second, they should have a track record of delivering successful innovation (this was the priority for 80.5% of executives). Third, they should have business and sectoral expertise (80% felt this was most important).

To identify the service providers they need, the CDO’s starting point should be an understanding of their own organization’s technological abilities. Next, the CDO should consider what technologies and capabilities the company needs to acquire or outsource for innovation and the costs of doing so. Before making choices, companies must also gauge a service provider’s ability to deliver technological applications and how well the vendor is likely to work with other providers to develop new products or processes.

The Ecosystems That Work Best

Most companies said they use VIEs to create new products or processes related to cloud-based applications, digital solutions (applications), and cybersecurity . However, they benefit differently from different ecosystems. For instance, the biggest benefit to companies that use mixed ecosystems was better-performing business processes. Those that deployed multiservice or specialist ecosystems, meanwhile, benefitted from being able to introduce new products, but not better-performing processes.

The biggest risk to any ecosystem is that service providers will try to push their products and services even if they don’t fit customer needs.

That leads to the critical issue of performance: Which kinds of VIEs work best? According to our survey, most of the companies that were extremely satisfied with their service providers’ innovation prowess (59%) had created ecosystems with both multiservice and specialized service providers. In other words, heterogeneity is more critical for success than specialization, with mixed ecosystems providing access to more skill sets and diverse thinking.

There’s a relationship between the number of service providers in an innovation ecosystem and companies’ satisfaction with overall performance: companies with the highest level of satisfaction used between six and ten service providers. However, our survey data shows that the trend diverges in the case of multiservice providers: the more multiservice providers a company used, the lower its level of satisfaction. With specialized service providers, though, a company’s satisfaction didn’t change as the number of vendors in an ecosystem rose or fell.

Managing Ecosystems

The biggest risk to any ecosystem is that service providers will try to push their products and services even if they don’t fit customer needs. The survey confirms that this is a concern for companies. That’s why it’s important for them to use their ecosystems to understand what they’re buying as well as the limitations of those purchases; a diverse ecosystem will diffuse the risk that companies end up buying brochureware.

Managing VIEs composed of both large and small service providers, some with generic offerings and others with specialized solutions, can be challenging. It requires the ability to manage relationships, products, and processes, capabilities that often extend beyond IT functions’ normal strengths. Companies have no choice but to cultivate fresh capabilities if they wish to be successful. (See “5 Ways to Win with VIEs.”) When asked, they chose three organizational capabilities that, in their experience, are essential to get the most out of VIEs:

• A higher-than-average level of maturity in terms of deploying digital solutions

• Strong IT service provider management abilities

• The ability to build close relationships with multiple service providers

5 Ways to Win with VIEs

1. Management. CDOs and CIOs should figure out the specific roles that their internal functions and external service providers will play in the innovation process and identify who will manage their VIEs.

2. Mix. Leaders must determine how many IT service providers, and what kind, they will need for innovation.

3. Means. Companies must identify the technological capabilities, or the means, their service providers possess to achieve their objectives, especially for innovation.

4. Measures of Risk. Business leaders must gauge the risks of outsourcing innovation. A good service relationship may not lead to great innovations.

5. Metrics. CIOs must develop real-time metrics to measure their VIEs’ performance.

Companies have figured out how to find the right service providers for IT outsourcing, but they haven’t developed a similar capability for identifying partners for innovation—yet. As a result, many use multiservice providers to scout for possible innovation partners and speed up the process of creating VIEs. They also use multiservice providers to manage their innovation ecosystems; as many as 26.5% of the companies we surveyed said they preferred that to doing it themselves.

Companies need to create ecosystems in which the roles of the players and the rewards for innovation are both transparent.

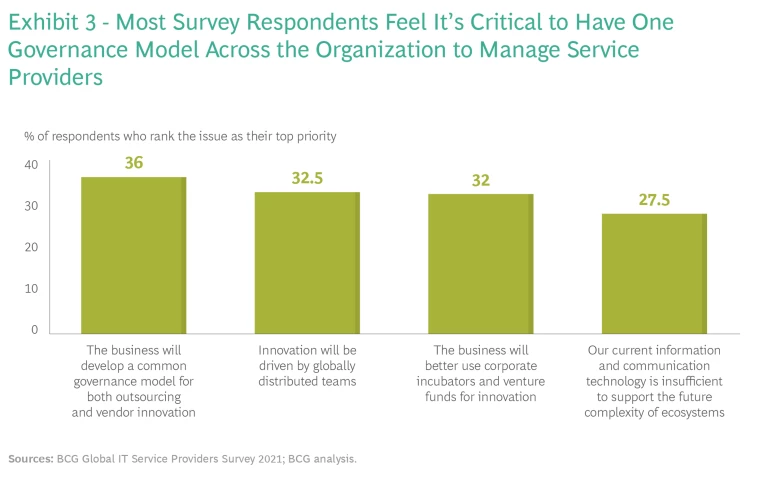

Companies were clear-eyed about how they would make their VIEs perform better over time. Many (38%) agreed that they would use more-specialized service providers to drive innovation, although globally distributed teams would drive the process. Companies also recognized the need for a single governance structure across the organization to manage service providers and felt that their current technology infrastructures were insufficient to tackle the rising complexity of innovation ecosystems. (See Exhibit 3.)

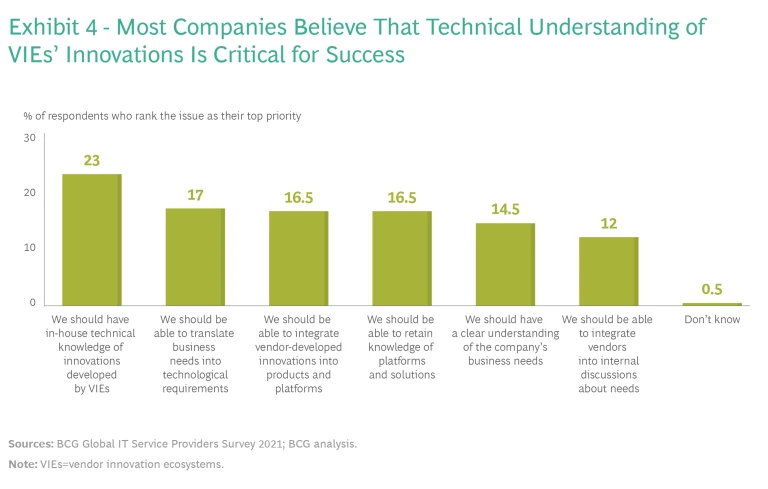

At the same time, companies admitted that soft capabilities wouldn’t be enough to ensure the success of the innovations that ecosystems produce. Nearly a quarter of the respondents (23%) felt that they would have to reinforce those capabilities with in-house technological knowledge of the solutions, areas, and businesses that service providers focus on. (See Exhibit 4.) In addition, executives felt their organizations needed to hone their own capabilities to translate business needs into technological requirements (17%) to get the best from their service providers. They also needed to integrate knowledge and solutions from service providers into their products or platforms (16.5%) to successfully take innovations developed by their VIEs to market.

It’s important to understand why innovation ecosystems, which are a relatively novel governance model, have become critical when using service providers. Many companies have found it difficult to use them for innovation in the past because it’s tough to design the right incentives. Service providers can increase margins by innovating, but many innovations tend to generate efficiencies that could reduce the revenue they earn. That’s why companies need to create ecosystems in which the roles of the players and the rewards for innovation are both transparent. Organizations must ensure that their innovation ecosystems create value while also managing the risks and optimizing the distribution of value in an equitable manner among their partners to sustain their ecosystems. If companies want to use IT service providers for innovation, they have no choice but to organize and orchestrate them into VIEs.