This article is the seventh in a series of publications offering practical guidance on business ecosystems.

Shift your mindset and operating model. It’s better to grow the pie together as an ecosystem than to fight alone for a larger piece.

The traditional principles of business strategy are rooted in concepts of competition—winning matches and snatching points from competitors. The language of business, too, reflects this: companies vie against other companies and exploit their foes’ weaknesses to capture market share or confront rivals to defend a position.

These principles served many firms well. Those that mastered them developed a sustained competitive advantage and dominated their industries; they were rewarded with outsize financial returns. These firms understood that success in business was all about beating the competition or—as former General Electric CEO Jack Welch neatly summarized it in the title of the book on his management philosophy—“winning.”

In the past two decades, however, these incumbents saw a new breed of competitors gaining top spots in the rankings of the largest and most successful companies. Rather than just being hypercompetitive, these new players have developed a novel way to compete: adding collaboration as a source of competitive advantage. This allows them to reduce asset ownership and instead use the resources of others and to address new customer value propositions that individual competitors cannot match.

These admired companies—among them Airbnb, DoorDash, Spotify, Alibaba, and Grab—have reinvented the rules of strategy by deploying a new model: the business ecosystem , which we define as a dynamic group of largely independent economic players that create products or services that together constitute a coherent solution.

Incumbents quickly realized that something had changed. In 2011, Nokia’s CEO, Stephen Elop, rightly asserted: “Our competitors aren’t taking our market share with devices; they are taking our market share with an entire

Traditional companies have started to understand the threat, embrace the opportunity, and launch their own business ecosystems:

- Agriculture machinery manufacturer John Deere, founded in 1837, is leading the race to build the most comprehensive smart-farming ecosystem.

- Retail giant Walmart has become a serious competitor of Amazon with its Walmart Marketplace.

- Maersk, the 118-year-old market leader in container shipping, is disrupting its own industry with digital platform solutions .

And they are not rare examples—we found that more than half of the largest companies in 2021 have seriously engaged in ecosystem business models.

However, many incumbents increasingly realize that it is hard to become an ecosystem player. According to our research, only 15% of business ecosystems thrive in the long

In our research and our work with these firms, we found that they need to rethink their management principles, question deeply held beliefs, and build new capabilities. (See the sidebar, “About Our Research.”)

About Our Research

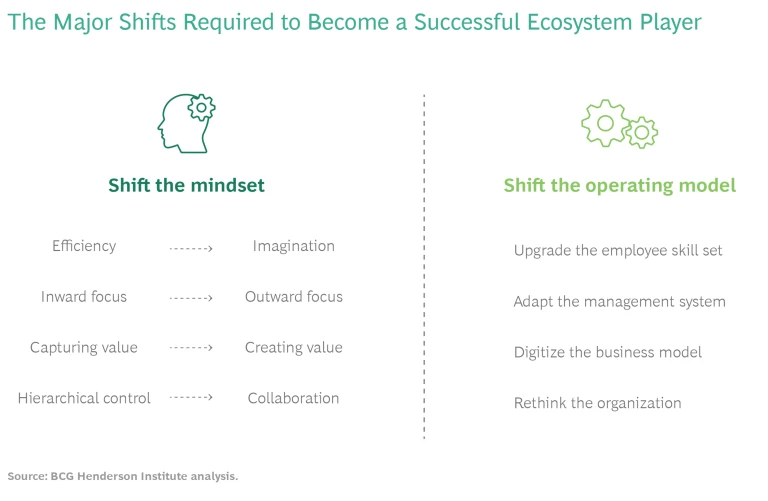

We identified eight major shifts (four shifts in mindset and four shifts in operating model) that traditional companies must make to become successful ecosystem players. (See the exhibit.)

Shift the Mindset

Ecosystem business models present new opportunities and challenges that require companies to change their mindset regarding how to approach strategy and competition. Incumbents must move from perceiving business as beating the competition to recognizing the prospects of joint value creation. This involves four major mindset shifts.

From Efficiency to Imagination. To identify opportunities for ecosystem business models, companies must concentrate less on optimizing current operations, exploiting existing capabilities, and expanding present positions and more on uncovering unmet customer needs and imagining new solutions, beyond the scope of their current activities. One of the strengths of a business ecosystem is that it can address challenges and enable value propositions that no individual company could achieve alone. Finding such opportunities requires counterfactual thinking and imagination, “the ability to create a mental model of something that doesn’t exist

Haier, for example, now the largest appliance manufacturer in the world, was in a crisis in the 1980s. The factory was rundown and in debt. Instead of following a strict and traditional restructuring approach, the new chairman, Zhang Ruimin, thought that the company and its managers needed to change how they thought about their core product (refrigerators). He pulled 76 fridges off the production line—any that had even minor faults—and asked employees to smash them. It was a symbolic act to shift thinking from factual to counterfactual that later paved the way for Haier’s rebirth as an ecosystem

From an Inward to an Outward Focus. Most traditional companies have a strong inward focus when developing strategies. They typically start from their own positions of strength, consider how best to deploy existing resources and capabilities, invest in building new assets, and measure success in terms of the additional revenues and profits they accrue.

As the locus of value creation and innovation moves from the company to the ecosystem, firms must look beyond their own boundaries to explore business opportunities and secure the required resources and capabilities. They must be more receptive to ideas and impulses from the outside world and beyond their own industry. They must reconsider which activities should be core to the firm and which should be left to partners, a process that requires questioning the scope and identity of the company. They must open up and be ready to share resources, data, strategies, and plans with external partners. And when they think about partnerships, they must move beyond bilateral contracts toward building multilateral relationships and nurturing communities.

For example, when John Deere, the global leader in agricultural equipment, ventured into precision farming, the company initially focused on internal innovation, developing, for instance, its GreenStar yield-mapping system and its JDLink telematics solution.

However, John Deere quickly realized that to develop an effective precision-farming solution, it needed to collaborate with a range of external partners that offered advanced sensors; software; location, weather, and agronomic data; and more. It built MyJohnDeere.com, a cloud-based platform to access, manage, and share data with outside partners. It initially focused on third-party applications in areas where John Deere did not compete, but it eventually opened the platform to farming equipment from direct competitors.

In this way, John Deere moved from being an equipment manufacturer to an orchestrator of a smart-farming

From Capturing to Creating Value. The traditional goal of strategy is to capture value by claiming profit pools, increasing market share, and outperforming competitors. By contrast, the most effective way to benefit from a business ecosystem is to grow the pie together rather than fighting for a larger piece. In an ecosystem in which all participants focus on their own advantage, it will be hard to establish the level of cooperation required to create sufficient value to distribute in the first place.

Don’t ask, “How can we make money?”

Instead, successful ecosystem builders start with a different question: “How can we create value together?”

They understand that if they collaborate effectively, every partner will be better off. This may involve co-investing in the ecosystem beyond the boundaries of the firm, supporting partners to improve the overall customer value proposition, and removing bottlenecks at the system level even if they are not related to their own activities.

For example, Alibaba invested heavily to support the many small sellers on its B2B marketplace with tools and data to run their online stores, partner with manufacturers, coordinate with logistics partners, and arrange online payments. Similarly, Airbnb focused early on providing professional support for hosts on its platform, such as photography and cleaning services, linen delivery, and tools to simplify property listing and guest check-in.

Sometimes, orchestrators need to squarely subsidize partners to remove a bottleneck in the ecosystem. For instance, digital cinema was established on a broad scale only after the film studios implemented a financing scheme in which they shouldered the initial outlay for the projectors and shared the benefits with the cinemas by paying a virtual print fee per digital film

The orchestrator of an ecosystem needs to accept the role of residual claim holder. While it has a big influence on the distribution of the value created, it must also make sure that all players earn enough to remain on board. In return, the orchestrator can retain the residual profit, which may eventually be very high but for an extended period can be negative. In this way, it took even the most successful ecosystem builders many years to turn their strong market positions into profits.

But some orchestrators that focused too early on value capture failed because they never made their ecosystem flourish. For example, eBay failed in China because it charged sellers to list products and services, whereas Taobao offered a cost-free service. Similarly, Rdio flopped in music streaming because users had to pay a subscription fee while competing platforms offered free ad-based services at the entry level.

From Hierarchical Control to Collaboration. Most traditional relationships within and between companies are based on some kind of hierarchical control. Between employer and employee, parent company and subsidiary, purchaser and supplier, or acquirer and target, it is clear who calls the shots and who depends on whom. By contrast, business ecosystems are based on voluntary collaboration between largely independent partners.

Incumbents that want to become ecosystem players must accept that they will not be in full control. As Haier’s chairman, Zhang Ruimin, put it, a business ecosystem is more akin to a rainforest than a walled garden. Ecosystem builders cannot dictate the rules; rather, they must persuade partners to join and collaborate. They cannot rely on detailed contracts. Instead, because dealings in ecosystems are complex and permanently evolving, they must exert influence by establishing effective and robust relationships and fostering alignment.

To get there, incumbents must invest in building trust in their ecosystems. In a recent study, we found that trust issues were culpable in the failure of more than half of the 110 unsuccessful ecosystems that we analyzed. Building trust requires consistently demonstrating competence (the ability to deliver on promise), fairness (in the way all stakeholders of the ecosystem are treated), and transparency (providing true, reliable, and unambiguous information that enables stakeholders to monitor behavior and results).

Ceding control may be the most challenging mindset shift for incumbents—and a key advantage for startups, which are less accustomed to hierarchies and positions of power.

Microsoft is a great example of an incumbent that managed this mindset shift well. For many years, Microsoft had a reputation for playing hardball, commoditizing the other players in the computer ecosystem, and squeezing its software partners by, for example, bundling their products into Microsoft’s core platforms. Now, under the leadership of Satya Nadella, Microsoft operates with a different mindset. As he told us at a global BCG partner meeting, the company now pursues a much more collaborative approach, opens its interfaces for integration with other platforms, and no longer tries to dominate its ecosystems, leaving room for others to lead. In this way, Microsoft has become a preferred partner in many cloud applications and IoT

Achieving the Four Mindset Shifts. How can incumbents learn from the above examples and achieve the four mindset shifts that are required to succeed in an ecosystem world? For starters, it is important to acknowledge that the mindset of an

organization

and the behavior of its employees are rational responses to the context they operate in, the constraints they face, and the resources at their disposal. So, if you want to change the mindset, you need to change the context, constraints, and

At this point, leadership comes into play. Most examples of successful incumbent transformations from individual performer to ecosystem player have been led by strong and visionary CEOs. Think of Sam Allen at John Deere, Zhang Ruimin at Haier, Satya Nadella at Microsoft, Ma Mingzhe at Ping An, and Piyush Gupta at DBS.

We observed that many leaders of successful ecosystem companies seem to contradict the popular image of an omnipotent leader. Successful ecosystem leaders tend to be more curious than determined, more humble than assertive, better at listening than presenting. They exhibit more empathy than persuasive power, have a stronger customer than competitor focus, and put more emphasis on long-term value creation than quarterly EPS. They are willing to admit mistakes and make compromises. In this way, such leaders can credibly represent the ecosystem mentality and spearhead the required mindset shifts in their company.

Shift the Operating Model

In addition to shifting their mindset, incumbent firms that want to successfully build business ecosystems have to rethink their operating models. Existing operating models are typically optimized to efficiently run hierarchical supply chains with clearly defined roles and interfaces. Our analysis of successful and failed incumbent ecosystem ventures, and a comparison with their big tech and startup peers, revealed that four major operating model shifts are required.

Skill Set. Incumbent firms that want to engage in business ecosystems often realize that their workforce is lacking some essential skills. The most obvious skill gap involves digital competencies related, for example, to the design and construction of digital infrastructure, cloud computing, blockchain, the human-machine interface, virtual or augmented reality, data analytics, machine learning, and data and cybersecurity. However, firms can’t just hire digital experts to develop the tools, processes, and algorithms. They must also develop the digital skills of the broader workforce , which relies on digital tools for communication, collaboration, and productivity improvement to function effectively.

Beyond technical skills, incumbents need to build competencies in ecosystem management. Incumbent firms are increasingly seeking “ecosystem professionals”; the number of postings for new positions such as platform strategist, ecosystem manager, and platform regulation and compliance officer has grown substantially in recent

Such professionals must be able to collect and analyze business intelligence through an ecosystem lens; build fact-based use cases for ecosystem business models; create, incubate, and launch new ventures; lead cross-functional teams; and collaborate with external partners. They require a deep understanding of platforms and ecosystem business models, a combination of technical and business skills, end-to-end product management experience, and strong collaborative and communication skills.

A final, easily overlooked skill gap relates to domain expertise beyond an incumbent’s core business. Most business ecosystems span industry boundaries, so participants need to broaden their understanding of the underlying markets. For example, when IBM ventured into life sciences it hired computational chemists, genetic scientists, and pharmaceutical business experts on a grand scale. Similarly, several financial institutions use ecosystem models to expand into new fields, such as real estate, mobility, health care, and smart cities. To understand customer needs, partner expectations, competition, and regulation in these domains, firms must build substantial new capabilities. Otherwise, they risk costly failures.

How can incumbent firms close these skill gaps?

Many traditional firms find it hard to compete with big tech and startup firms for digital talent , so they need to rework their employee value propositions and improve their recruitment capabilities to tap the right talent pools and establish a robust talent pipeline over time. They should also invest in internal and external training programs to develop the required skills among the existing workforce.

Given the tight job market for digital and ecosystem talent, ambitious incumbents may go one step further and follow the approach of technology firms: a recent study found that 73% of the 748 acquisitions by large US ecosystem players since 2000 were—at least partially—aimed at acquiring

A final option for incumbents is to collaborate with other firms that provide the needed complementary capabilities. For example, Maersk partnered with IBM to set up TradeLens, a neutral industry platform for the global shipping

Management System. Successfully competing in an ecosystem world also requires changes to the management system of incumbent firms. This means adapting existing functions and processes and establishing new processes and tools.

For example, in strategy and corporate development, structured approaches to ecosystem design, partner search, and venture building and scaling are required. Traditional business cases—based on long-term projections of cash flows and the calculation of internal rates of return and payback time—rarely work in an ecosystem context because uncertainty is high—not only on the demand side but also regarding the behavior of partners in the ecosystem.

Instead, investment decisions should be based on a clear value proposition that addresses substantial market friction and on a deep and explicit analysis of the fundamental economics, including customers’ willingness to pay, partner economics, required investments, the strength of network effects, competitor reactions, and barriers to entry. Detailed multiyear financial plans are not very meaningful. They should be replaced by frequently adapted plans and milestones, with clear stopping rules for ecosystem activities and ventures whose prospects of success are limited.

The dynamic development of many ecosystems also calls for decision-making routines that are much faster and more pragmatic than most incumbents have experienced. Ecosystem-related decisions must be made under greater uncertainty and before all the information is available. Jeff Bezos used a 70–90 rule at Amazon and stated that “most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being

The lesson: it is important to quickly recognize and correct bad decisions and to establish effective feedback and learning loops. Incumbents can also learn from successful tech players to apply scientific methods to decision making and to base decisions on hard data and quantitative evidence rather than hierarchies, power, and fancy PowerPoint presentations. Companies such as Uber, Airbnb, and Amazon have a strong discipline in translating assumptions into testable hypotheses and decisions into options that can be rigorously assessed—for example, in A/B tests with customers.

Performance management routines may also need adaptation. Conventional financial metrics—such as revenue, cash burn rate, and profitability—are not very useful for assessing the prospects of an ecosystem because they are backward looking and don’t reflect the economics of ecosystems, with their network, learning, and scale effects. Metrics for evaluating the health of an ecosystem should reflect the success factors unique to each of the distinct phases of ecosystem development. Emphasis should be on measuring ecosystem engagement and interactions, the satisfaction of customers and partners, and the value and unit costs of transactions. Performance metrics should be complemented by early warning indicators that can help identify emerging issues and decide if and when to cut losses or reorient the

Becoming an ecosystem player may also mean instituting new functions. For example, a recent empirical study found that ecosystem contributors that established a dedicated partner management unit were more effective in collaborating with partners than their peers that used other functions (such as marketing) for this

Digital Operating Model. Most successful ecosystems today are built on digital platforms and rely on the efficient exchange and analysis of large amounts of data. This is also one of the reasons for the success of big tech players and tech-driven startups in this field. Incumbents that want to become ecosystem players need to catch up and rethink their digital operating models.

Virtually all successful incumbents that we investigated started their ecosystem journey with a profound digital transformation. On average, their digital transformation preceded their first substantial ecosystem activities by four years.

Incumbents need to strengthen their digital capabilities and lay the foundations for data- and software-based business models. Many of those that succeeded began by establishing a common data and analytics infrastructure as a backbone that enables the effective collection, analysis, and utilization of data and that ecosystem ventures can connect to. In this way, synergies among ventures and with the core business can be harnessed and data flywheels can get started.

For example, the global shipping giant Maersk started its journey to become a global end-to-end integrator of container logistics with the digital transformation of its transport and logistics activities. The initial focus was on its own operations—for instance, digitizing formerly paper-based transactions, establishing remote container management, and optimizing the entire value chain using IoT. The internal digital transformation became the basis for subsequent broader ecosystem plays, such as the blockchain-technology-based TradeLens platform. TradeLens connects all parties in the shipping supply chain: traders, freight forwarders, inland transportation, ports and terminals, ocean carriers, customs, and other government

Another key element of the digital operating model in ecosystem companies is the harmonization of internal and external interfaces. Effective interfaces enable the modularization and seamless coordination of activities. If such interfaces are open to external partners, they facilitate collaboration beyond the boundaries of the firm and foster the development of ecosystems. Jeff Bezos was one of the first to understand this. In his legendary 2002 memo, he stated “All teams will henceforth expose their data and functionality through service interfaces. […] All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exceptions.”

And Bezos meant it, ending the memo: “Anyone who doesn’t do this will be fired. Thank you; have a nice

The tools of choice for managing digital interfaces are application-programming interfaces (APIs). Empirical evidence shows that adopting APIs has a positive impact on company performance, which is driven not so much by increased internal productivity but more by enabling external complementors. Adopters of externally facing APIs increased their market capitalization by an additional 38% over 16 years relative to

Organization. A final challenge to an incumbent’s operating model relates to the scope and speed of the organizational transformation. How should the ecosystem activities be integrated into the existing organization, and to what extent will those activities affect the traditional core business? The three potential models depend on the firm’s ecosystem ambition, the size of the opportunities, and their linkages to the core.

Separate Venture Portfolio. Many incumbents that start to launch ecosystem plays decide to keep them—at least initially—as a separate venture portfolio. They pursue multiple ecosystem opportunities at the same time, bundle them in a business development or venture unit, and manage them as a portfolio—always ready to stop them if they don’t perform. This approach works well for companies that consider ecosystems as an interesting opportunity to expand their current business activities but not as a threat to their core business. They can experiment with ecosystem business models, create options, and learn.

Some car manufacturers approached mobility services in this way. BMW and Mercedes bundled their activities across a broad range of digital mobility solutions into a joint venture called YourNow, for instance. Many insurance companies manage their ecosystem activities in a separate investment vehicle. For example, Allianz X is a subsidiary of the German insurance giant Allianz Group that invests in digital front-runners and ecosystem players relevant to insurance and asset management , having built a portfolio of more than 25 companies, among them 9 unicorns, in just a few years.

By separating their ecosystem activities from the traditional business, these incumbents maintain focus, protect the ventures from corporate bureaucracy, nurture an ecosystem mindset, and limit the risk for the overall company. But the separate ventures may not have sufficient access to the company’s resources and capabilities, and fertilization of the core business is limited. To overcome these limitations, some companies, such as the German engineering and technology firm Bosch, allocate their ecosystem venture activities for scaling to individual business units that are closer to the market, rather than managing them at the corporate level.

Parallel Business Models. A second organization model can be observed if the incumbent decides to focus on only a few large ecosystem plays rather than pursuing a broader portfolio approach. This may be a good strategy if the individual ecosystem opportunities are big and require significant investments of capital and management capacity and if the company has a high probability of winning.

Even in this case, many incumbents keep their ecosystem businesses separate from the core and run them as parallel business models—particularly if the core business continues to be viable and linkages between core and ecosystem plays are limited or easy to manage. For example, when Best Buy, the multinational consumer electronics retailer, built its care delivery platform, Best Buy Health, it decided to manage it as a separate business unit in its otherwise functional organization.

If done well, this model combines the autonomy of a startup with access to the resources of a mature business. The Chinese insurance company Ping An implemented such a model by centralizing all IT-related back-office operations in its subsidiary Ping An Technology to provide the necessary IT infrastructure and govern all data flows within the group. Ping An Technology was instrumental in creating and supporting four large ecosystem businesses in financial services, health care, automobile services, and smart

However, the model poses challenges if conflicts arise between the new and established business models. GE Digital, for example, was charged with building the software business for General Electric and establishing the company as the orchestrator of a large industrial IoT ecosystem. GE Digital was managed as an autonomous business unit while retaining access to key assets in the core business. However, the new unit was dependent on the established business units. For instance, no revenues were directly attributed to GE Digital, it just reported the sum of software sales of the other business units. After some initial success, pressures to generate short-term profits mounted, at the expense of long-term investments to build the business, contributing to GE Digital’s inability to meet the high

Ecosystem Transformation. In the third organizational model, the traditional core business is integrated into the ecosystem business, leading to a full ecosystem transformation. For example, when Amazon’s marketplace launched, in November 2000, it was combined with Amazon’s original reseller e-commerce business model. This approach works well if the emerging ecosystem play is strategic for the future of the firm because it presents an enormous opportunity and is expected to become the dominant business model, and if there are important core assets to leverage (such as, in the case of Amazon, payment and fulfillment services).

Ecosystem transformation requires the incumbent firm to adapt major processes to the ecosystem business model and to fundamentally rethink its culture and way of working. DBS Bank in Singapore, for example, transformed itself from a bank to a platform company and technology integrator. Its CEO, Piyush Gupta, was convinced that cross-industry ecosystems would be the business model of the future and that organization structures needed to evolve because data and interdepartmental collaborations would be pivotal to succeed. The company embarked on a major digital transformation of its core banking processes, insourced most technology services, established a data-first culture, formed platform teams of business and technology functions, and launched the world’s largest banking API platform. DBS Bank won Global Finance’s Best Bank in the World award for three years in a

We are still in the early days of the ecosystem revolution. Many incumbent firms have been caught off-guard by technology players and startup firms venturing into their markets based on ecosystem business models. But traditional firms are catching up fast. It may well be that they will dominate the next wave of ecosystem plays, in particular as ecosystems become more prevalent in B2B markets.

Incumbent firms that want to become ecosystem players should learn from big tech and startup firms, but they should not blindly copy their models. They need to adapt their mindset and operating models to achieve the eight major shifts described in this article. However, they should also harness the existing resources and capabilities that technology competitors may not have, such as a deep understanding of an established customer base, a strong infrastructure and sales force, intellectual property, and effective support functions.

The required degree of transformation should be guided by a clear ecosystem strategy that is shaped by the size of the opportunity and the threat to the core business. Incumbents should avoid overstretching the organization; it takes substantial time and investment to build the skill set, management system, digital foundation, organization model, and culture to succeed in an ecosystem world. They must be prepared to run an ambidextrous organization, building new business models while nurturing the core business to fund the journey.