Industrial companies must quickly strengthen their ability to cope with crises and uncertainty affecting the availability of crucial supplies.

Leaders of industrial companies must prepare for a harsh reality: the recent volatility affecting raw-material supplies will not abate anytime soon. Although the severe conditions of recent years may be easing, companies need to learn from the experience and fortify themselves for future swings. In a business environment defined by uncertainty, preparing a company to manage supply volatility is a cross-functional concern that should be a top priority on the C-suite agenda.

As an initial step, companies should assess key risk indicators relating to their most critical raw materials. For those materials, they can take tactical measures to ease near-term pressures as well as strategic moves to manage longer-term exposure to volatility and the risks of scarcity. Building capabilities to enable this response is essential to coping with persistent uncertainty. Indeed, we view these as core operational capabilities that are table stakes for survival.

A Spectrum of Responses to Uncertainty

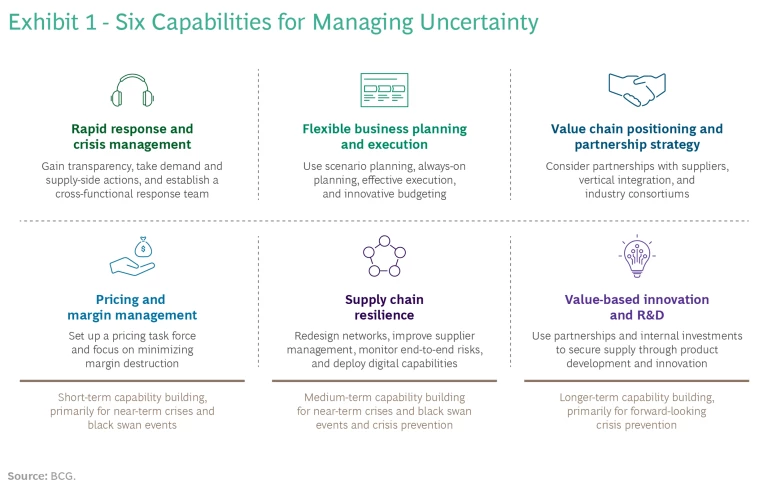

Managing uncertainty requires capabilities that enable a spectrum of responses across the short, medium, and long terms. To react to sudden shortages and black swan events, companies need capabilities that enable a rapid crisis response. As the pandemic and the war in Ukraine have shown, some shocks are so unanticipated or extreme (for example, the inability to procure critical components) that companies must be able to quickly assemble a team to manage the crisis and mitigate the threats. Other capabilities help companies move fast during near-term disruptions and prepare for future uncertainty.

In studying responses to uncertainty in the automotive industry , we compiled a set of capabilities, shown in Exhibit 1 and discussed below, that apply across manufacturing industries. Companies should allocate investments among these capabilities on the basis of their risk tolerance, strategic priorities, and other factors.

Get Ready to Rapidly Manage Crises

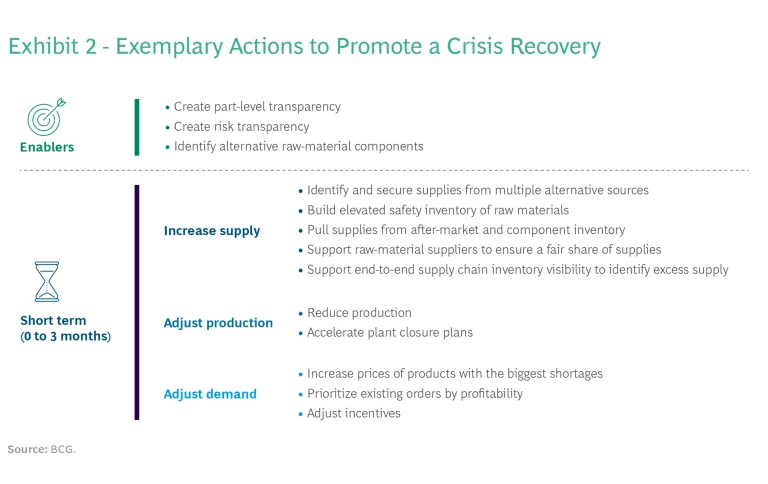

Decision making in supply crises requires building a strong fact base to gain transparency into the availability of materials and substitutes across suppliers and regions. Companies can then take measures to increase supply, such as by placing premium orders, identifying suppliers in lower-risk locations, and mixing and matching materials across business units. They can also take steps to adjust demand—for example, by increasing prices, prioritizing existing orders for fulfillment, changing in-progress orders, or adjusting product features. (See Exhibit 2.)

To achieve these objectives when a crisis hits, companies need to set up a cross-functional rapid-response team. There are several important design considerations:

- People and Governance. To ensure that decisions are made and acted upon, involve the right cross-functional and executive-level stakeholders. Establish closed-loop governance to ensure that people take the agreed-upon actions and are held accountable. Optimize the cadence of meetings to support productivity and efficiency. Avoid meeting fatigue by minimizing unnecessary touchpoints.

- Data-Driven Decisions. Enable data-driven decision making, such as by implementing digital capabilities to improve visibility into inventory. Ensure that decision-focused forums are informed by data and analytics.

- Timing and Phases. Consider potential scenarios across different time horizons in order to assess a comprehensive set of paths forward. Create options in the phasing of initiatives to safeguard against undetected blind spots.

- Creativity. Foster opportunities for creativity by allotting time to develop and discuss ideas for nontraditional solutions that enable disruptive changes. Emphasize the importance of using the crisis as an opportunity to consider innovations to the company’s business model.

Prepare to Proactively Manage Uncertainty

Looking beyond sudden crises, companies need to manage uncertainty as an ongoing business challenge. By taking a variety of tactical and strategic actions, they can soften the impact of volatility, improve the effectiveness of their planning, and expand their options for responding to disruptions. Ultimately, they can take steps to protect their operations from the effects of uncertainty.

Pricing and Margin Management

Pricing and margin management are critical to gaining stability in the aftermath of crises and black swan events. As a first step, set up a pricing task force to implement clear and agile governance, including guidelines, contract terms, and escalation and delegation rules. The task force should be led by a cross-functional steering committee with representatives from the pricing, commercial, product, and distribution departments. Its mandate is to align pricing with the company’s global strategy, tighten price monitoring to avoid leakages, and bring discipline to the pricing process. The task force also communicates internally about new pricing guidelines and procedures, especially to sales teams.

It is critical to minimize margin destruction. This requires closely controlling price discounts, such as by assessing their effectiveness and using digital marketing tools to enable personalization. Managing stock reductions is also essential—for example, by providing financial support to distributors to help them limit discounts on existing inventory. In addition, monitor market information—such as volume, discounting trends, and customer sentiment—to enable dynamic allocation of products and incentives. On the supplier side, use contract terms to minimize inflation in input prices and limit exposure to pricing fluctuations.

Flexible Business Planning and Execution

To insulate the business from volatility, shift from reactive to proactive responses to uncertainty. Build the foundation through scenario planning and advanced approaches to planning, process execution, and budgeting.

Decision making in supply crises requires building a strong fact base to gain transparency into the availability of materials and substitutes across suppliers and regions.

Scenario planning entails evaluating potential changes in supply and demand and understanding the impact of different scenarios on business plans. You can then prioritize actions to address the impact.

Complement the traditional annual strategy-setting process with “always on” strategic planning . Leading companies use this approach to systematically scan for signs of disruption and explore unexpected changes to the strategic environment. This helps them identify the most pressing strategic issues and regularly engage senior leaders in formulating a response. To increase the speed and impact of execution, they carefully monitor the progress of strategic initiatives. They use real-time data to reset their baseline assumptions and reevaluate their planning approach.

Always-on planning enables more effective sales and operations planning (S&OP) and sales and operations execution (S&OE). S&OP teams develop medium-term plans for the next 4 to 18 months. They need new ways of working to engage more frequently and unify stakeholders across functions (such as transport and procurement). S&OE focuses on the near term (up to three months) and adjusts execution in response to unexpected changes. The goal is to maximize supply chain effectiveness through rapid decisions at the product level and alignment of stakeholders from production, supply, and logistics functions. The process is supported by advanced forecasting algorithms that analyze regional data at the product level and run scenarios to determine the best responses.

Another innovative approach is called Beyond Budgeting . The traditional budgeting process leads to many problems and challenges, including the significant cost and effort required to create the budget, unrealistic targets, and year-end spending fever. Beyond Budgeting seeks to help companies achieve the three objectives of budgeting—target setting, forecasting, and resource allocation—separately and in new ways. In essence, managers shift from central planning and command-and-control decision making to directional guidance, delegation, and trust. This approach gives leaders greater visibility into market dynamics and more flexibility in decision making, which facilitates rapid responses to ever-changing conditions.

Supply Chain Resilience

Supply chain resilience

is essential for effective planning and execution. To promote resilience and enable faster responses to shortages, align strategic functions and institute end-to-end visibility across the supply chain. Approaches include:

- Redesigning Global and Local Networks. Enhance flexibility through selective redundancy, such as multiple sourcing options across regions for critical materials and components. Consider near-shoring to reduce dependence on complex global logistics, as well as vertical integration to bring manufacturing for critical components (including those that are IT-related) in-house.

- Changing the Parameters of Supply Chain Buffers. Evaluate resetting capacity utilization targets and identify triggers that signal when to add capacity or activate ready-to-use capacity based on utilization trends. Align order fulfillment strategies (whether make to order or make to stock) to customer needs.

- Proactively Managing Suppliers. Assess the criticality of suppliers and adjust supplier relationships to ensure resource availability. Gain transparency into multiple tiers of suppliers to fully assess upstream risks. To assess suppliers’ reliability, monitor traditional KPIs, such as on time, in full, and other risk KPIs, such as credit ratings and geographic concentration. Require suppliers to share relevant information periodically.

- Orchestrating Multienterprise Supply Chains. Establish a control tower to promote end-to-end transparency and enable rapid collaboration across multiple supply tiers, logistics providers, and distribution channels. Apply insights from analytic engines powered by artificial intelligence to support adaptive decision making. Deploy S&OE practices across the end-to-end supply chain to adapt to changes in supply and demand.

- Actively Managing End-to-End Risks. Comprehensively monitor risks relating to suppliers, regions, finances, and cyber security to gain an early-warning system. Use the intelligence generated to get a head start on designing and prioritizing mitigation actions. Create risk committees to oversee mitigation and develop business continuity plans to prepare for disruptions.

- Deploying Scenario Prediction and Simulation. Adopt advanced digital capabilities to perform analytics across multiple demand and supply scenarios and identify bottlenecks and risks. For example, digital twins simulate the performance of the entire supply chain system weeks in advance and use smart alerts to pinpoint which customers and consumers are likely to be affected by disruptions. Apply scenario-based planning to understand the impact of multiple potential risks.

Companies can combine actions to capture significant benefits. For example, a global pharmaceutical company developed an easy-to-use digital dashboard to give supply chain specialists real-time updates on material flow disruptions. It also used the predictive power of smart analytics enabled by machine learning and big data to identify the root causes of disruptions. The impact included a 2% to 5% improvement in customer service levels, a 3% to 5% cost reduction, a 5% to 7% working capital reduction, and cost avoidance of 10% to 15%.

Value Chain Positioning and Partnership Strategy

Establish partnerships across the value chain to further strengthen resilience by mitigating the risk of supply scarcity . Partnerships with raw-material producers and component suppliers help to secure priority access in the event of shortages. For example, Tesla is partnering with BHP to secure the long-term supply of nickel for battery production, while Ford has launched a joint venture with SK Innovation to localize battery supply in the US and produce 60 GWh annually.

Looking beyond sudden crises, companies need to manage uncertainty as an ongoing business challenge.

Also consider vertical integration with specific players in the value chain to secure supply, limit exposure to price volatility, and expand strategic core competencies for future product innovation. For example, Toyota acquired Lyft’s self-driving technology unit to bolster its autonomous technology capability.

Forming a consortium with peers is another option. These collaborations can help to diversify shared exposure to structural market risks, minimize risk exposure to development costs for product innovation, and expedite the advancement of technology and core competencies. For example, Volkswagen and Daimler are collaborating on sustainable lithium mining in Chile.

Value-based Innovation and R&D

Companies can fend off the impact of external crises through innovations that reduce dependence on specific materials or increase options for materials and sourcing. Examples include partnerships or investments in recycling or secondary markets to develop products that require less raw material.

To get started, assess the maturity of the organization’s innovation processes, behaviors, and tools, as well as the flexibility of the current product portfolio. The maturity assessment pinpoints gaps in capabilities or technologies so that you can identify where you need additional resources or attention.

To advance beyond traditional R&D levers, hone skills to take customer-centric and data-driven approaches. Use data to anticipate customer needs and market-dynamic shifts, and then apply an agile methodology to test products quickly and pivot to new designs as required. Wherever possible, use agile enabling technologies, such as virtual reality and simulations, to enhance speed and minimize risk.

The increasing uncertainty of market dynamics is forcing leaders to change how they prepare for crises and pursue future opportunities. Managing raw-material volatility is an especially daunting challenge. Industrial companies must conduct a risk assessment that considers the dynamics of their most critical raw materials as well as their risk tolerance and strategic focus. At the same time, they should start building capabilities across functions to enhance their ability to cope with uncertainty. By moving quickly to strengthen their “uncertainty fitness,” companies can build superior resilience.

This is the second of two articles on managing raw-material scarcity and volatility. The first article explained how companies can assess risk indicators to prepare for shocks.