When patients move through hospital units—and eventually are discharged—their vital information doesn’t follow. But smarter solutions can track patient data across settings.

It seemed like a simple idea—but it signaled a revolution in health care . In 1958, an inventor named James L. Clark filed a successful application with the US Patent Office by drawing attention to a critical need. The application read, “Hospitals have found it desirable to provide some means, to be worn by all persons during their stay in a hospital, for identifying patients by name. It is desirable that the identifying device be light in weight, one that will not cause discomfort to a patient, and one that will not be unsightly.” His humble idea would go on to become the ubiquitous, barcoded, RFID-enabled hospital bracelet, which has saved countless lives by improving patient identification and flow through the nation’s hospitals.

The next leap ahead in patient-monitoring technology is long overdue.

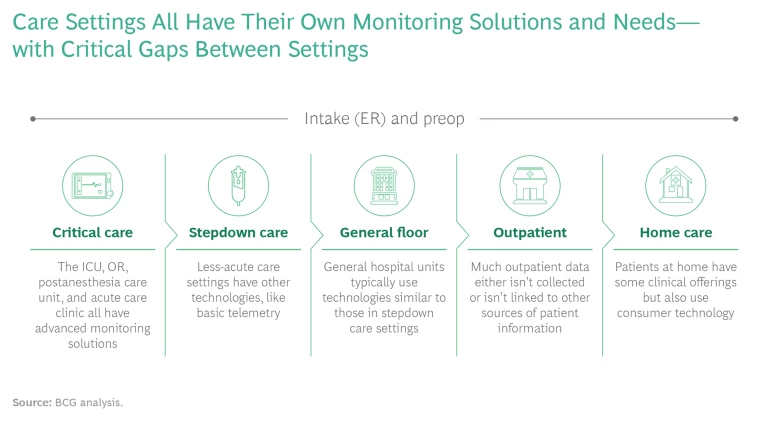

Today, the next leap ahead in patient-monitoring technology is long overdue. People receiving care in hospital settings—particularly acute care settings like the ICU—have their vital information closely monitored and recorded via highly advanced technologies. But when they move from the ICU to another unit, they are typically switched to a different device that tracks their information in other ways. When they head home for post-hospital care, they get a third device (or no device at all). The recent flood of health care apps and wearable devices has only compounded the problem. For patients and physicians alike, the result is information gaps, inefficiencies, and suboptimal care.

So there is a next frontier in patient monitoring— medical devices and technology that track the patient journey through the hospital and beyond, following them across settings, specialists, and circumstances. We recently surveyed nearly 500 health care providers , who work in a variety of clinical specialties and care settings, to determine the state of patient monitoring. The results show clear pain points, along with critical areas to focus on in developing new solutions and technologies. Medtech companies and investors that understand these key elements will find better success as they shape the future of patient monitoring.

MONITORING TECHNOLOGY IS DUE FOR AN UPGRADE

The patient-monitoring environment at most hospitals is highly siloed: a series of point solutions that function well within individual units and departments in a hospital—particularly in acute settings—but don’t transfer from one unit to the next. When a patient moves, the monitoring essentially starts all over again. (See the exhibit.) The downstream array of monitoring systems and the cacophony of individual alarms can present a grave danger to patients. The problem reaches its climax at patient discharge, when some patients are provided with monitoring tools while others receive instructions to call if they experience any problems.

All this inconsistency leads to persistent tradeoffs and compromises for both patients and providers:

- Gaps in monitoring capability among hospital units and especially at discharge, giving rise to fumbled handoffs and increased hospital readmissions

- Inconsistent integration with electronic medical record (EMR) and workflow systems, creating data silos and hindering both clinical and administrative patient follow-up

- Data overload and inadequate signal-to-noise ratio, resulting in confusion among clinicians and uneven patient care

- A proliferation of health-oriented consumer devices of uneven reliability, security, and granularity, even in lower-acuity settings

Incumbent medtech manufacturers are now trying to solve the patient-monitoring challenge. At the same time, greater bandwidth and the advent of low-cost sensors have lowered the barriers to entry, meaning that new entrants with innovative monitoring applications or hardware can increasingly compete against established players. Over the past five years, venture capital and private equity players have invested more than $600 million across roughly 1,000 financing rounds—all aimed at bringing innovative monitoring technologies to market.

THE IMPACT OF COVID-19

Patient monitoring was an issue before the pandemic, but COVID-19 has compounded the challenge. To free up ICU bed space, hospitals pushed many patients into lower-acuity settings—and often back to patients’ own homes. Among the providers we surveyed, 69% reported that they shifted patients to lower-acuity hospital settings, and 81% said they moved patients to remote or at-home care.

The pandemic also set off a cascade of regulatory and reimbursement changes to accommodate remote health and monitoring outside the hospital setting. In our sample of providers, only 27% used remote patient monitoring before COVID-19, but 65% made use of those technologies during the pandemic. Perhaps more significant, 75% anticipate using remote monitoring for more than 30% of patients in the next five years.

Finally, COVID-19 empowered more consumers to manage their own health using digital tools, including consumer wearables, to collect and share data with providers.

These changes are all significant and are

here to stay

.

THE MARKET RESPONSE—AND CLEAR PAIN POINTS TO ADDRESS

The need for an integrated patient-monitoring technology—with the capability to span all phases of care from higher-acuity units to at-home rehabilitation—is growing. In response, both established medtech players and nontraditional competitors are vying to develop new monitoring solutions. (See “Seven Competitor Archetypes.”)

SEVEN COMPETITOR ARCHETYPES

Capital Equipment. Traditional medtech companies—such as Philips, GE Healthcare, and Masimo—manufacture large health care capital equipment for hospital settings.

Therapy-Oriented. These players are usually incumbents with a primary business in medical devices, including monitoring technology that is linked to specific surgeries or procedures. This group includes Medtronic, Stryker, and Boston Scientific.

Pure-Play Monitoring. Newer players—including iRhythm Technologies and Spry Health—offer medical-grade technology that enables the collection of data parameters.

Telehealth. In this group, established companies like Teladoc Health seek synergies across their core business of remote care and at-home monitoring.

Health Care IT and Reporting. Clinical-systems companies—such as Epic Systems and Oracle (which recently acquired Cerner)—concentrate on the traditional reporting processes.

Health Care IT and Data Analysis. New entrants in this space, such as Vivify Health and Biofourmis, focus on the burgeoning field of health care data analytics.

Consumer Technology. Finally, there are consumer technology companies whose capabilities and expertise run the gamut from wearables (such as Apple) to consumer data analytics (Google, for instance) to the core sensors that enable monitoring (including Rockley Photonics).

Regardless of companies’ starting point or area of expertise, they must understand the pain points that our research identified. Specifically, providers ranked the following five as their biggest complaints with current monitoring technology. All five were cited by more than 50% of respondents in our survey as highly important.

The systems are overly complex. At many facilities, the current suite of monitoring solutions is not integrated into workflows; rather than removing steps from the process through automation or smart design, monitoring solutions require an extra step to manage the information presented. That is particularly true for EMR integration. In lower-acuity settings, more than a third of providers reported no linkage between monitoring technologies and EMR; all data has to be transferred manually. Even in higher-acuity settings, 39% of survey respondents said monitoring solutions require “occasional” action to integrate monitoring technology with the EMR system, and another 30% indicated a need for ongoing action.

Companies vying to develop new monitoring solutions need to understand the pain points our research identified.

Too many alarms are leading to data overload. A variety of monitoring systems means a corresponding variety of alarms, which can quickly degenerate into background noise to clinicians. As one cardiologist told us, “We have an excessive number of alarms from medical devices.” Another respondent, a cardiac surgeon, made a similar point: “There is so much data coming from patient monitors. I only want to be alerted when there’s a potential cardiac event and then I want to be able to view the data immediately to make the call.”

Budget constraints limit the ability to upgrade. Just about all health care facilities are under some kind of financial pressure; expensive monitoring systems may not be realistic options—no matter how well they work. At the same time, evolving technology means that new designs quickly surpass existing solutions, rendering them obsolete.

Data is not aggregated quickly (or sometimes isn’t aggregated at all). Providers may be wowed by the capabilities of a particular solution, but if it does not present data in a digestible, actionable form, it doesn’t add value. With hardware such as sensors becoming increasingly commoditized and some patients presenting physicians with data gleaned from their own consumer-grade wearables, clinicians report being overwhelmed by patient data. As one respondent said, “What makes these companies different isn’t the parameters they measure—it’s what they do with the data.”

Devices aren’t patient-friendly. Most devices are challenging to operate and require clinical expertise. Given that any future monitoring solution will need to move with patients from higher-acuity to lower-acuity settings, and ultimately to patients’ own homes, it needs to be something that average people can operate on their own, without any training and with minimal effort. Consumer technology is increasingly good at user-oriented design, but most medical-grade monitoring devices are not there yet.

FIVE CRITICAL PRINCIPLES FOR MEDTECH COMPANIES AND INVESTORS

Who will win the emerging showdown in the patient-monitoring space? Any company aggressively pursuing R&D in patient monitoring—along with any investor looking to fund new ideas—should heed these five strategic principles.

Follow the patient journey. New monitoring solutions must support the transition from higher- to lower-acuity settings, including remote monitoring. Of the providers we surveyed, 95% said they want a monitoring solution that offers longitudinal patient data, and 88% would be willing to pay more for it. A highly advanced point solution may not win against an adequate but more comprehensive patient-monitoring offer.

Prioritize solutions for lower-acuity and remote monitoring. Higher-acuity care settings are already well served by existing point solutions. But as recovering patients step down to lower-acuity settings, the ability to track patient information drops off precipitously. Accordingly, this is the largest unmet need in the market—and the biggest white-space opportunity.

Integrate with the EMR and clinical workflow. Our research suggests that the clearest patient management shortcoming is the lack of information sharing among various systems. Surveyed providers said that they place high value on a solution that is integrated with their EMR and could provide real-time workflow alerts.

Focus more on data analytics and less on hardware. Point solutions should be able to translate data into insights that can be used for triage and decision support. This is particularly true for more comprehensive patient-monitoring systems that combine data streams from multiple sources (such as different care settings) into a single integrated view. Ideally, the analytics-driven solution will capitalize on large data repositories that can be used to train artificial intelligence (AI) algorithms—even if clinicians do not wholly trust such decision aids today. As one cardiologist told us, “I need data analytics that turn all that data into something that I can act on, something that actually results in positive clinical outcomes.”

Consider making multiple bets across the care ecosystem. The danger in all early market investments is that it’s very easy to be generally right and specifically wrong. Investors have proved time and again that a good solution in such cases requires a portfolio approach, in which OEMs and investors alike hedge their bets across multiple possible technologies and solutions.

Sixty years ago, a simple inspiration saved countless lives by improving patient identification and flow through the nation’s hospitals. Today, the medtech industry and its investors are ushering in a new era of advanced patient-monitoring solutions that follow patients through their entire health care journey, from hospital to home. To capture this potential, medtech players—along with the venture capital and private equity firms looking to fund them—need to understand the shortcomings of current solutions as well as the main priorities and unmet needs of providers. In doing so, the industry can design a smarter solution that capitalizes on an emerging business opportunity and, more important, improves patient outcomes.