The world we live in is shaped by megatrends: high-impact, measurable shifts predicted to have a profound impact on the way we live and do business over the next decade(s). Navigating uncertainty has always been critical for top management – so what has changed?

- Uncertainty comes from new sources. Countries and organisations now need to track environmental, geopolitical, and cyber risk – in addition to traditional economic, competitive, and technology risk.

- Uncertainty moves faster. Accelerants (e.g., new technologies, climate change, high levels of debt, social media) have increased the pace of uncertainty. Being prepared is more important than ever, as the interconnected nature of risks can lead to spirals.

- The stakes are higher. Uncertainty causes environments in which organisations thrive or fail. Stakeholders expect management and boards to be proactive around a broader set of risks, to make quick decisions that have implications for the long term.

To turn uncertainty to advantage , organisations need to better detect signals of megatrends, be more decisive in acting on them, and more proactively build practices that foster resilience.

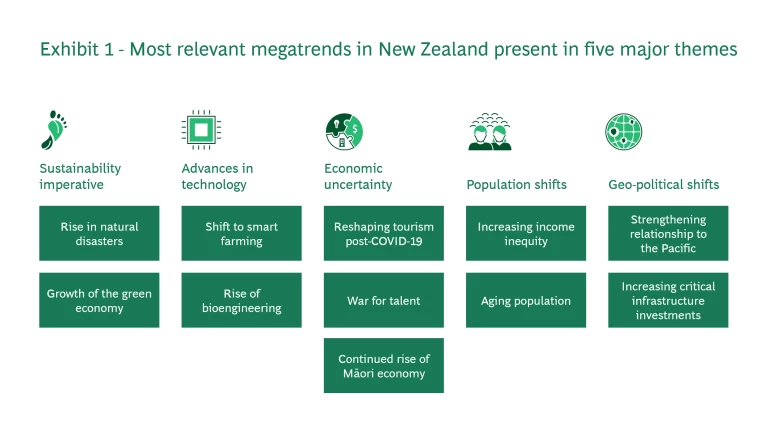

By definition, megatrends are global – spanning shifts in technology, sustainability, the economy, geo-politics, consumer trends and more. However, some are of specific interest to New Zealand – manifesting uniquely in New Zealand’s context - or having a disproportionate impact on New Zealand compared to other countries. Additionally, the interconnectivity of today’s world means that megatrends collide and intersect – they don’t exist in isolation.

This article introduces the most prominent megatrends in New Zealand and the main ways we believe they are presenting on our shores. In later articles, we will explore the threats and opportunities these megatrends pose, and what it takes for government and organisations to succeed in the possible future scenarios shaped by these megatrends.

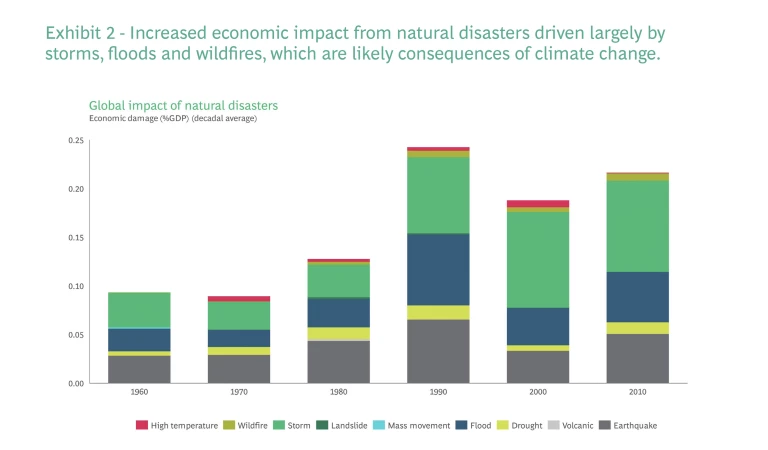

Rise in natural disasters. New Zealand is the second most susceptible country to a rise in natural disasters due to its location and geography.

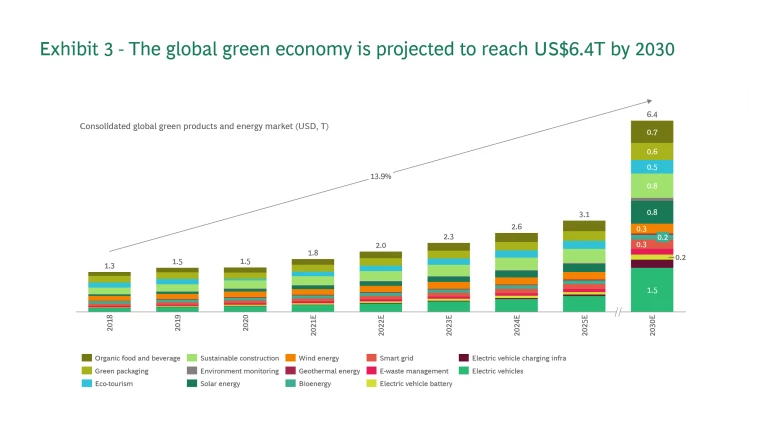

Growth of the green economy. The

green economy

is projected to reach US $6.4 trillion by 2030 (Exhibit 3).

- Organic food and beverage: New Zealand’s organic export and domestic market is currently worth NZ $720 million and shows potential for growth, projected to grow at 13.9% CAGR by 2030.

4 4 New Zealand Organic Sector Market Report, 2020/21, Time for Action - Eco-tourism: As consumers become more eco-conscious, to stay competitive with other nations, New Zealand has set a goal of net-zero emissions by 2050 to preserve the country’s clean, green image and reputation. The government estimates the 100% Pure New Zealand brand to be worth at least US $13.6 billion.

5 5 Kaefer F. Credibility at stake? News representations and discursive constructions of national environment reputation and place brand image: the case of clean, green New Zealand, 2014. - Sustainable construction: The number of green homes in New Zealand is increasing. The Green Building Council awarded 29 Green Stars in 2019/2020, exceeding its target of 23 and NabersNZ (government-backed energy efficiency rating system) has over 2,600 rated homes with 25,000 in the construction pipeline.

6 6 NZ Green Building Council, 2021, NZGBC Annual Review 2020 7 7 NZ Herald, 2021, Green Buildings: The NZGBC's hope – Zero carbon buildings by 2030

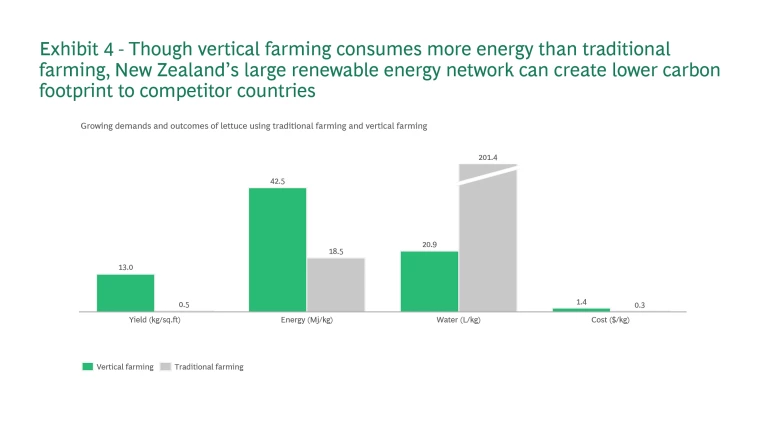

Shift to smart farming. As the world struggles with higher food demand, increasing climate change related drought, and decreasing arable land, smart farming, particularly vertical farming is growing.

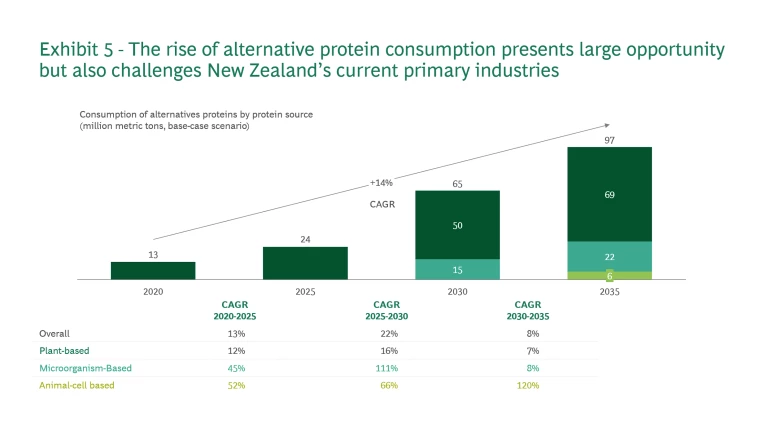

Rise of bioengineering. Global protein consumption is changing. People are relying less on animal proteins and turning to alternative sources , which are projected to grow by 14% CAGR by 2035 (Exhibit 5). With animal and dairy products being New Zealand’s largest export (and source of emissions), it will be important for New Zealand to diversify and capitalise on growing alternative protein consumption.

Reshaping tourism post-COVID-19. Prior to COVID-19, tourism was one of New Zealand's largest exports, contributing 20.1% of total exports.

War for talent. Since March 2021, net migration has fallen – now sitting at -8,668. Kiwis could be moving for several reasons: excited by the prospect of overseas experiences after border closures, or incentivised by the higher salaries, career opportunities, or more affordable housing offered in other countries also facing labour shortages. New Zealand employers who want to avoid the consequences of the country’s ‘brain drain’ will need to consider their flexible work arrangements, value alignment, development opportunities and salaries to attract and retain top Kiwi talent .

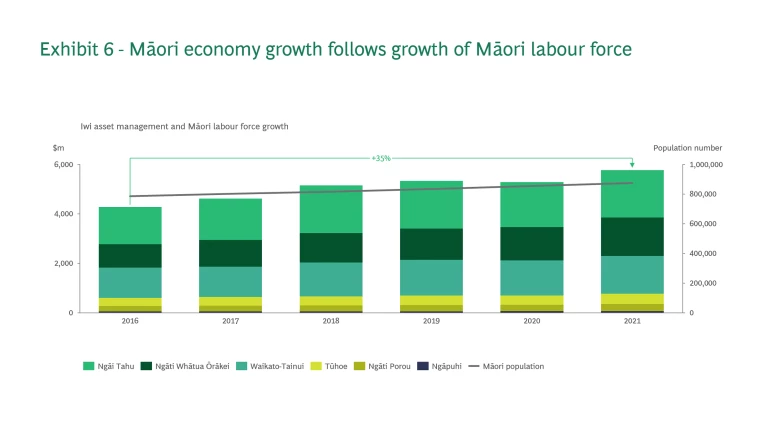

Continued rise of Māori economy. The asset value of the Māori economy has grown in the last 20 years from NZ $16 billion to $70 billion at a CAGR of 10% (compared to 2.9% for the NZ economy overall).

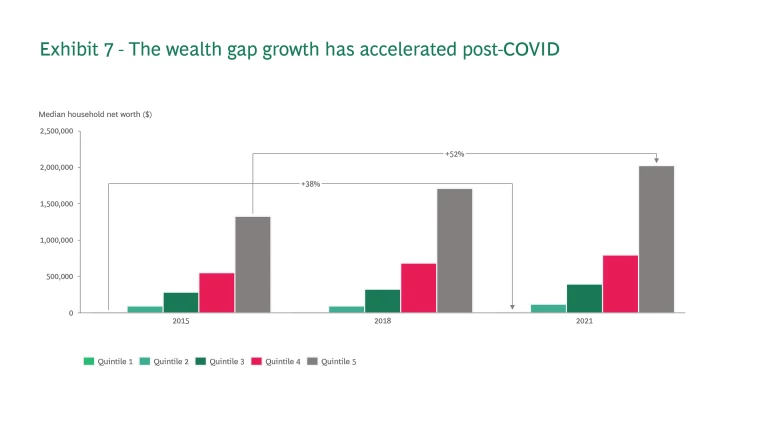

Increasing income inequity. New Zealand’s growing wealth gap presents a challenge to the physical, mental and financial health and cohesion of the nation. Since 2015, the top quintile of households has seen an increase of 52% in median net worth, while the bottom quintile has only seen a rise of 38% (Exhibit 7). The wealthiest 20% of households now own 69% of total household net worth.

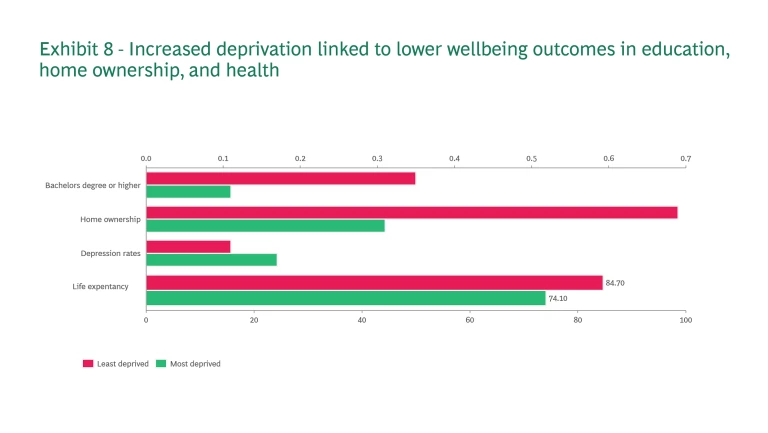

Increased deprivation is linked with lower education rates, home ownership and worse health outcomes – which all have far-reaching effects for the wellbeing of New Zealand and its economy (Exhibit 8).

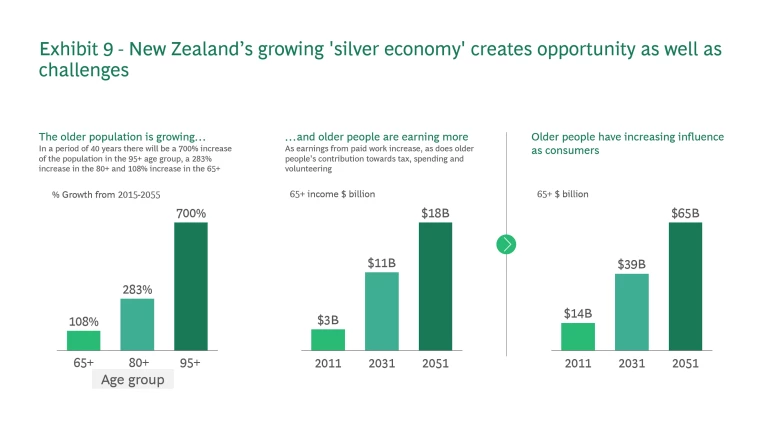

Aging population. New Zealand, like most OECD countries, has an aging population – where Kiwis over 65 are predicted to outnumber those under 15 by 2025.

Strengthening relationship to the Pacific. New Zealand is linked to other Pacific nations through shared Polynesian culture, history, people, and interests. As development in the Pacific grows along with increasing risk from climate-related sea level rise, so will the impact of New Zealand’s relationship. Projects in Pacific have traditionally been supported by New Zealand and Australia, with growing interest from China. On New Zealand shores, the Pasifika population is the youngest and fastest growing population, which is also growing through labour migration.

Increasing critical infrastructure investments. Critical infrastructure are the essential services that improve living standards for all New Zealanders. The 2022 New Zealand budget focused on health, education and transport infrastructure.

Imperatives for governments and businesses in New Zealand

To navigate these megatrends and the ways they present in New Zealand, governments and businesses need to adhere to three imperatives:

- Strategy is as important as ever, which includes making choices. As we anticipate the effects of these megatrends, it is crucial to devise a strategy for how to address the opportunities and threats they present. This includes choosing which opportunities to seize and which threats to tackle. While megatrends impact everyone globally, they don’t impact everyone equally. This article provides insight into the megatrends that impact New Zealand disproportionately or where New Zealand has a right to win – these are the ones government and businesses should focus on.

- Build on New Zealand’s strengths of innovation and collaboration, but don't be afraid to lift and shift. Two key strengths distinguish New Zealand: its nimble innovative power and its pragmatic collaboration. Both were demonstrated by the rapid implementation of business support, including the wage subsidy, during COVID-19 lockdowns. Policy decisions were made quickly and showed New Zealand’s ‘number 8 wire’ mentality to getting work done during a crisis. To make the most of these two strengths, governments and businesses need to build trust and collaboration between public and private industry. The flipside to these strengths is New Zealand’s preference for bespoke solutions. With a plethora of challenges on the horizon, it is important for New Zealand to leverage overseas models, such as from similarly-sized countries in Scandinavia and adapt to a New Zealand context.

- Understand the uncertainty or possible futures New Zealand is facing. Often, strategy only performs well in the expected future. We look at trends to inform our ‘best guess’ of what the future will look like, but in reality, trends are highly variable and the future is uncertain. Using these megatrends to shape scenarios can develop a more resilient and robust strategy to better prepare for a wide range of outcomes, including shocks from ‘black swan’ events.

As COVID-19 hit, leaders globally and in New Zealand shifted their focus to short-term issues, but the long-term megatrends did not pause – they accelerated. Leaders need to refocus on the long term and address these imperatives to adapt and thrive amidst uncertainty.

This the first of a new thought-leadership series by BCG – stay tuned for further insights on these megatrends and their implications for New Zealand over the coming months.

The authors are grateful to a number of colleagues for their support and assistance. They include Paul Sutherland and Chris Wheeler for marketing, and Debbie Spears, Rebecca Diepenheim and Matt Santos for design.